Get the free Tuition Earned During Fiscal Year, Account 6940

Show details

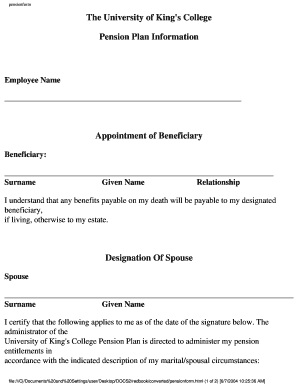

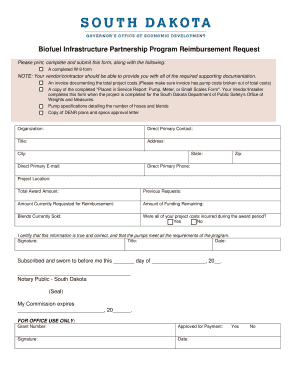

SUIT TUITION SCHEDULE JULY 1. 1994 THROUGH JUNE 30. 1995 I. Tuition Earned During Fiscal Year, Account 6940 AMOUNT 6941 Regular Day School Tuition 6942 Summer School Tuition 6943 Adult Education Tuition

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tuition earned during fiscal

Edit your tuition earned during fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tuition earned during fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tuition earned during fiscal online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tuition earned during fiscal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tuition earned during fiscal

How to fill out tuition earned during fiscal:

01

Begin by gathering all necessary financial documentation related to tuition earned during the fiscal year. This may include invoices or receipts from educational institutions, records of scholarships or grants received, and any relevant financial statements.

02

Review your organization's accounting system and policies to ensure that you understand how tuition revenue should be recorded and reported. This may involve consulting with the finance department or referring to specific guidelines or procedures.

03

Determine the period for which you are reporting tuition earned. This is typically the fiscal year, which may align with the calendar year or may vary depending on your organization's financial reporting cycle.

04

Calculate the total tuition earned during the fiscal year by summing up all the relevant revenue sources, such as student fees, tuition payments, or reimbursements from third-party organizations.

05

Assign appropriate account codes or categories to the tuition revenue based on your organization's chart of accounts. This will help ensure accurate tracking and reporting of the income.

06

Record the tuition earned in your organization's financial records. This may involve entering the revenue into an accounting software system, creating journal entries, or updating spreadsheets.

07

Reconcile the recorded tuition earned with the supporting documentation to ensure accuracy and completeness. This step is important for internal control purposes and may involve cross-checking figures, verifying calculations, and resolving any discrepancies.

08

Prepare financial reports or statements that include the tuition earned during the fiscal year. These reports may be required for internal purposes, such as management or board meetings, or for external stakeholders, such as auditors or regulatory authorities.

09

Maintain proper documentation of the tuition earned during the fiscal year for future reference and audit purposes. This includes storing invoices, receipts, financial statements, and any other relevant records in a secure and organized manner.

Who needs tuition earned during fiscal:

01

Educational institutions, such as schools, colleges, or universities, need to track and report tuition earned during the fiscal year for financial planning, budgeting, and accountability purposes.

02

Non-profit organizations or foundations that provide scholarships or grants based on tuition earned during the fiscal year may need this information to assess the impact of their educational funding programs.

03

Government agencies or regulatory bodies responsible for overseeing educational institutions or non-profit organizations may require tuition earned data as part of compliance or reporting requirements.

04

Internal stakeholders within an organization, such as finance departments, management teams, or board members, may need tuition earned information to evaluate financial performance, assess revenue trends, or make strategic decisions.

05

External stakeholders, like donors, investors, or creditors, may be interested in understanding the tuition earned by an educational institution or non-profit organization as part of their due diligence or investment evaluation process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tuition earned during fiscal without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing tuition earned during fiscal and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the tuition earned during fiscal in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your tuition earned during fiscal.

How do I edit tuition earned during fiscal straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tuition earned during fiscal.

What is tuition earned during fiscal?

Tuition earned during fiscal refers to the total amount of money received from students for educational services provided by an institution during a specific fiscal period.

Who is required to file tuition earned during fiscal?

Educational institutions or organizations that offer educational services and receive tuition payments from students are required to file tuition earned during fiscal.

How to fill out tuition earned during fiscal?

To fill out tuition earned during fiscal, institutions need to accurately record and report the total amount of tuition fees received from students during the specific fiscal period.

What is the purpose of tuition earned during fiscal?

The purpose of tuition earned during fiscal is to accurately report the revenue generated from tuition fees and provide transparency regarding the financial performance of an educational institution.

What information must be reported on tuition earned during fiscal?

The information that must be reported on tuition earned during fiscal includes the total amount of tuition fees received, breakdown of tuition fees by program or course, and any discounts or scholarships applied to tuition fees.

Fill out your tuition earned during fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tuition Earned During Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.