Articles of Incorporation Nonprofit Template Form: A Comprehensive Guide

Overview of nonprofit articles of incorporation

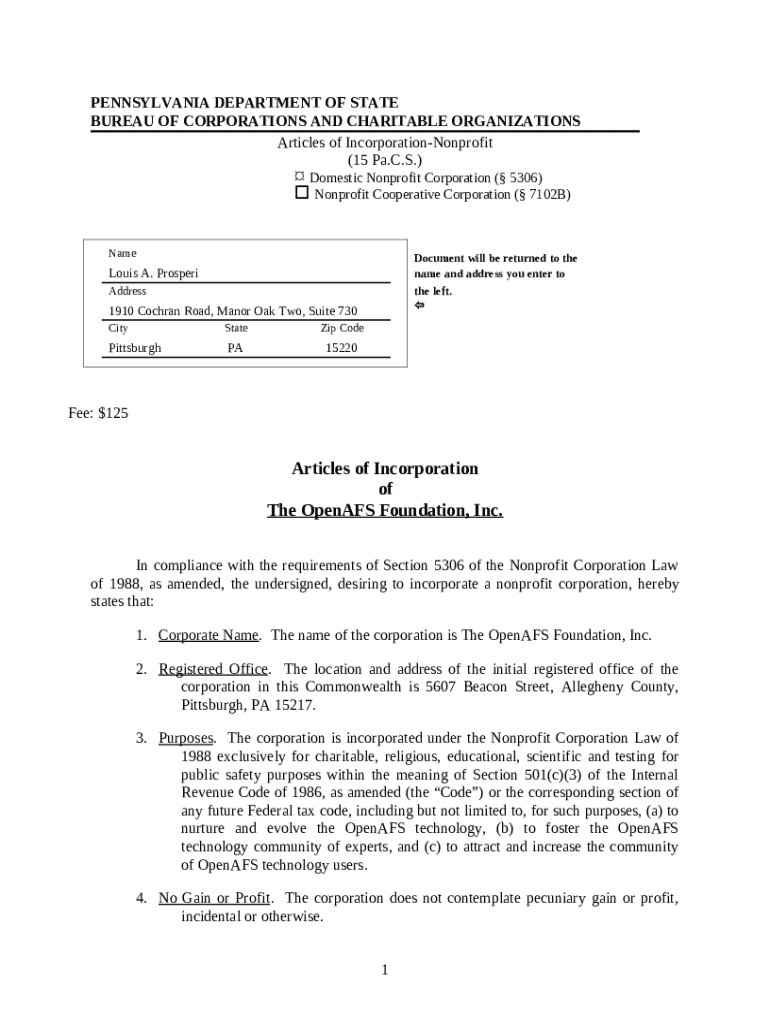

Articles of incorporation serve as a crucial document for establishing a nonprofit organization. Essentially, they are formal legal documents filed with a state government, serving to create a legal entity for your nonprofit. These articles outline essential elements including the organization's name, purpose, and structure, establishing its legitimacy in the eyes of the law.

Incorporating as a nonprofit is vital not only for the formal recognition of the organization but also because it fosters compliance with state and federal regulations, allowing the organization to operate lawfully while working towards charitable, educational, and other related purposes.

Incorporation has significant legal implications as well. It limits the personal liability of board members and ensures the organization can own property, enter into contracts, and engage in legal proceedings. Thus, preparing and filing articles of incorporation is the first crucial step in the journey of your nonprofit.

Why incorporate your nonprofit?

Incorporating your nonprofit organization has numerous advantages. Key among these is the legal protection it affords to board members against personal liability for the organization's debts or legal challenges. This security is paramount, especially as nonprofits engage in various activities that may invite scrutiny or risk.

Enhanced credibility is another notable benefit. Donors, grantmakers, and community members are more likely to support an incorporated nonprofit due to the formal structures in place, which signal reliability and permanence. Additionally, nonprofits that achieve incorporation often qualify for grants, creating opportunities for further funding and support, as well as tax exemptions which are not available to unincorporated entities.

Legal protection for board members against personal liability.

Increased credibility with donors and community stakeholders.

Eligibility for grants and tax exemptions that boost funding potential.

When weighing the options between incorporated and unincorporated nonprofits, it is critical to understand the long-term implications. While the initial process of incorporation may seem taxing, the comprehensive benefits in the operational realm far outweigh the burdens of managing legal compliance.

Key components of nonprofit articles of incorporation

Crafting your nonprofit's articles of incorporation involves including specific key components that ensure compliance with legal requirements and accurately represent your organization. Understanding these components is crucial as they define your operational structure and mission!

The name should be unique and clearly indicate it is a nonprofit.

Typically perpetual unless stated otherwise.

Include a mission statement defining your nonprofit's specific objectives.

A declaration that the organization will not operate for profit.

Outline board composition, including roles and term lengths.

State whether the organization will have members.

Specify how amendments can be made in the future.

Provide registered and principal office locations.

Identify the individual or entity who will receive legal documents.

Who is filing the articles on behalf of the organization.

Each article plays a pivotal role in not only establishing the organization legally but also in guiding its future operations and governance. Therefore, careful attention should be paid to ensure accuracy and clarity in these documents.

Step-by-step guide to drafting nonprofit articles of incorporation

Drafting and filing the articles of incorporation can feel overwhelming, but breaking it down into manageable steps can simplify the process. Here’s a step-by-step guide to get you started.

Prepare Basic Information Required: Prepare your organization’s name, purpose, duration, and structure.

Decide on the Nonprofit Name: Ensure it's unique and adheres to state regulations.

Draft the Purpose Statement: Your mission should align with activities and convey your goals clearly.

Identify Initial Directors and Members: Comply with state law by having a minimum number of directors.

Choose a Registered Agent: Designate someone who will receive legal correspondence on behalf of your nonprofit.

Review State-Specific Requirements: Each state has different requirements; do thorough research.

Finalize and File with Secretary of State: Submit your articles along with any required fees and documentation.

By following these steps systematically, you will streamline the incorporation process, assuring that you meet all necessary legal stipulations.

Interactive tools and resources for nonprofit articles of incorporation

Leveraging technology can significantly ease the process of drafting and managing your nonprofit articles of incorporation. pdfFiller offers several interactive tools that cater to the specific needs of nonprofit founders.

Easily edit your articles to ensure compliance with changing regulations.

Access customizable templates that cater to your specific nonprofit needs.

Work with your team to finalize documents quickly and efficiently.

Facilitates quick approvals from board members or stakeholders.

These resources not only help in crafting your documents but also ensure you save time and reduce errors, letting you focus on your nonprofit’s mission.

Common questions about nonprofit articles of incorporation

Navigating the incorporation process raises several questions for new founders. Here are some common queries concerning articles of incorporation that nonprofit groups frequently face.

Missing required information or failing to review state-specific guidelines.

Follow the specified amendment process outlined in the existing articles.

No, various states have unique regulations and fees for nonprofit incorporation.

Articles are foundational legal documents, while bylaws govern internal operations.

Filing fees, legal assistance, and additional registration costs can vary.

Addressing these concerns early can streamline organization establishment, ensuring compliance and enhancing operational readiness moving forward.

Tailoring your nonprofit articles of incorporation

Tailoring the articles of incorporation to align with your organization’s specific goals is a necessary process. Nonprofits have varying objectives, and the wording in these articles must reflect your unique mission.

Understand the specific language and provisions required for different nonprofit classifications.

Incorporate state-specific legal requirements and terminologies.

Clearly articulate mission statements to align with intended activities and funding opportunities.

Taking the time to ensure that your nonprofit articles of incorporation are tailored specifically to your organization’s nature and goals is essential. This not only clarifies your mission to others but also prepares your organization for future challenges and opportunities.

Sample templates for different nonprofit structures

Accessing sample templates can significantly reduce the complexity of drafting your articles of incorporation. These templates provide a foundation that can be easily customized to meet your organization’s needs.

Includes language reflecting the educational and charitable nature of the nonprofit.

Basic structure adaptable for various non-charitable purposes.

Templates tailored to comply with local legal frameworks.

Utilizing such templates not only helps ensure legal compliance but also saves time and effort in the document preparation process.

Next steps post-incorporation

Once your nonprofit has been successfully incorporated, several essential next steps follow to ensure proper functionality.

Establish governance and procedural rules for your nonprofit.

Open an account under your nonprofit's name to manage funds properly.

Apply for 501(c)(3) or other exemptions to benefit from tax-free status.

Ensure ongoing compliance with state and federal regulations post-incorporation.

Executing these steps will lay a solid foundation for your organization, enabling you to focus on achieving your mission effectively.

The importance of professional review

While many nonprofit founders are keen to self-manage their incorporation, there are pivotal moments when legal assistance becomes essential. Understanding when to seek help can save your organization from future complications.

Consider legal guidance if you're unsure about state requirements or special provisions.

Look for attorneys specializing in nonprofit law or certified public accountants familiar with tax regulations.

Having experts review your articles ensures that your documents are not only drafted correctly but also positioned to meet your organization’s future needs. This proactive approach minimizes potential future legal challenges.