Get the free Mileage Reimbursement Form

Get, Create, Make and Sign mileage reimbursement form

Editing mileage reimbursement form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mileage reimbursement form

How to fill out mileage reimbursement form

Who needs mileage reimbursement form?

Mileage Reimbursement Form: A Comprehensive How-To Guide

Understanding mileage reimbursement

Mileage reimbursement is a financial practice that allows employees to get reimbursed for the money they spend when using their personal vehicles for business-related purposes. The intent behind mileage reimbursement is to ensure that employees are not financially burdened by travel costs incurred while performing their duties. For employers, it can also foster goodwill and ensure compliance with labor regulations.

The importance of mileage reimbursement is multifaceted. It helps retain employees by alleviating out-of-pocket expenses, promotes efficient travel for business, and adheres to IRS regulations regarding the tax-deductible nature of such expenses. The reimbursements cover a range of expenses, including fuel, wear and tear on the vehicle, and sometimes even parking or toll fees.

The mileage reimbursement process

The mileage reimbursement process typically involves several steps. First, the employee must track their business-related driving. Next, they fill out a mileage reimbursement form, providing necessary details about the trips they've taken. Finally, the completed form is submitted to the employer for approval and processing.

Employees who use their personal vehicles for work can request mileage reimbursement. This can range from sales staff meeting clients to employees attending off-site training sessions. Some key terms to understand when dealing with mileage reimbursement include reimbursable miles—defined as the distance driven for business purposes—and the IRS standard mileage rate, which fluctuates yearly based on the average costs of operating a vehicle.

Preparing to fill out the mileage reimbursement form

Before you can accurately fill out the mileage reimbursement form, gathering the necessary information is crucial. This might include maintaining a detailed log of your business trips, capturing the dates, miles driven, destinations, and purpose of each trip. You will also need to attach any necessary documentation, such as fuel receipts or toll tickets, to substantiate your claims.

Additionally, be mindful of the timeline for submissions, as companies often have specific deadlines for submitting these forms. Options for filling out mileage reimbursement forms can vary by organization, but common formats include digital forms provided by HR software or standard paper forms.

Step-by-step instructions for completing the mileage reimbursement form

Filling out the mileage reimbursement form correctly is vital to ensuring reimbursement. Follow these clearly defined sections:

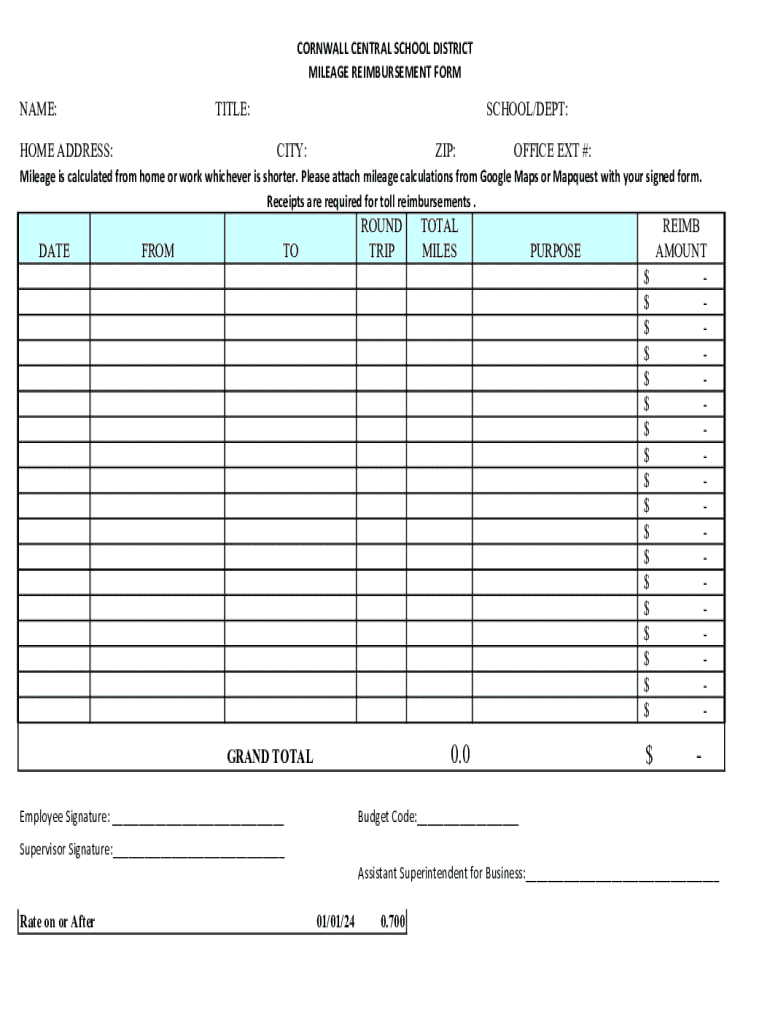

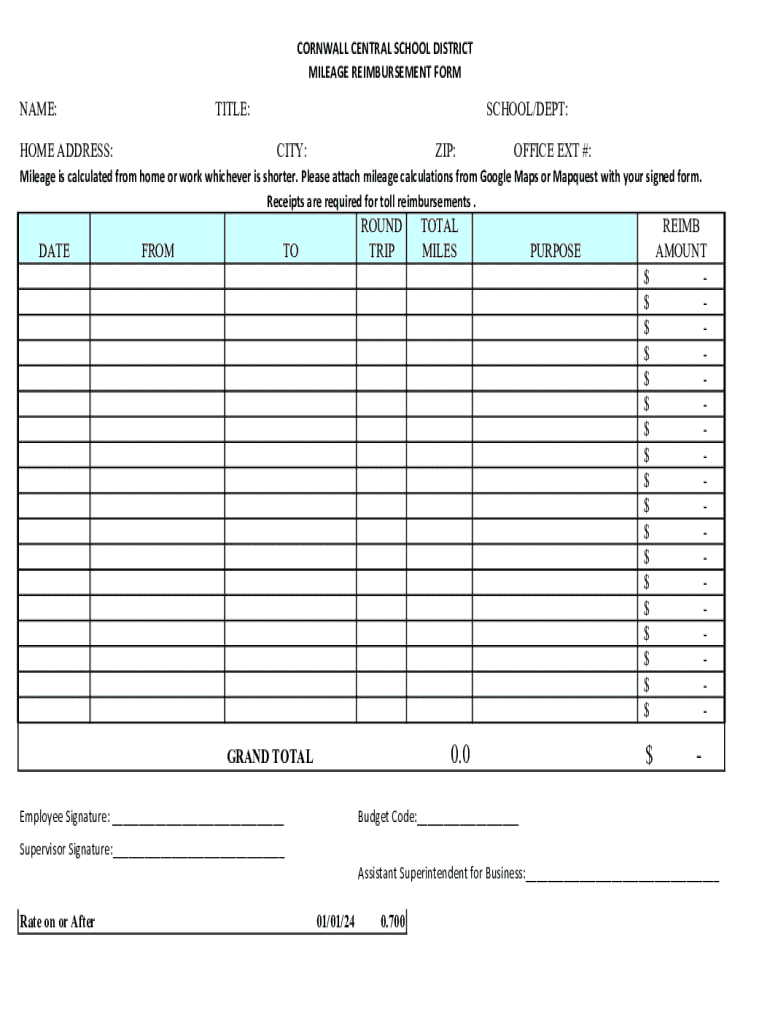

Section 1: Personal and Employment Information. This section requires you to provide your name, contact information, and possibly employee ID, along with your job title. Ensure that this information is accurate to avoid delays.

Section 2: Mileage Details. Here, you will record the dates of your trips, the destinations, the purpose of each trip, and the miles driven. It’s essential to maintain accuracy; incorrect mileage can result in denied claims.

Section 3: Expense Summary. This section is where you reference any allowable expenses such as fuel, and you should calculate your total reimbursement using the IRS Standard Mileage Rate. Be sure to stay updated on the current rate, which is published by the IRS annually.

Section 4: Signatures and Submissions. An important step is signing the form. Many organizations permit electronic signatures, making the submission process straightforward. Depending on your company's policy, you might submit the form electronically or hand it in physically.

Interactive tools and features for filling out forms

Turning to technology can greatly simplify the mileage reimbursement process. Tools like pdfFiller allow you to fill out forms digitally, offering a range of features that enhance productivity. With pdfFiller, you can input information directly into a fillable form, streamlining the completion process.

Adding digital signatures is a breeze with pdfFiller, making it easier to finalize and submit your form. Collaborating with team members is another feature; multiple users can work on the same document simultaneously, ensuring that everyone is on the same page. Once completed, you can save and export your mileage reimbursement form in various formats, or even directly upload it to cloud storage.

Common mistakes to avoid when submitting your mileage reimbursement form

Many individuals encounter issues when submitting their mileage reimbursement forms, often due to avoidable errors. One of the most frequent mistakes is providing incomplete or incorrect information. This could lead to delayed processing or outright denial of claims, frustrating both employees and employers alike.

Another common pitfall is miscalculating mileage. Failing to accurately log miles driven can result in significant losses. Additionally, many employees forget to include required documentation, like receipts or logs. Always double-check your form and ensure that all necessary documentation is attached before submission.

Frequently asked questions (FAQs) about mileage reimbursement

People often have questions about the mileage reimbursement process. For instance, it is common to wonder how long it typically takes to get reimbursed once the submission is made. While timelines can vary from company to company, most organizations aim to process claims within a few weeks.

If your request is denied, the first step should be to review the reason for the denial. In many cases, resubmitting with corrected information can facilitate the process. Finally, be aware there may be limits to reimbursement amounts set by your company or regulatory guidelines.

Tips for efficient mileage tracking

Effective mileage tracking is essential for ensuring accurate reimbursement. Best practices include maintaining a daily logbook of trips, noting the date, distance, destination, and purpose. Many find it helpful to use a spreadsheet or mobile app specifically designed for mileage tracking. These tools can automate calculations and provide an ongoing log of trips, thus reducing the effort at the end of the month or reimbursement period.

Utilizing mobile apps can modernize your mileage recording process. Many apps allow users to automatically track mileage through GPS, making it easier to collect accurate data without manual input. Furthermore, some applications can generate detailed reports that are beneficial when submitting your reimbursement form.

Regulatory considerations in mileage reimbursement

Understanding the regulatory framework that affects mileage reimbursement is vital for both employees and employers. The IRS provides guidelines that dictate the allowable rates for reimbursement and the tax implications of such payments. It is crucial to stay compliant to avoid any potential legal issues or tax penalties.

Additionally, each company may have unique policies dictating how reimbursement programs are implemented. These policies can determine what is reimbursable, the required documentation, and the method of submission. Familiarizing yourself with these regulations can ease potential misunderstandings and foster a positive reimbursement experience.

Case studies: Real-life applications of mileage reimbursement

To illustrate the mileage reimbursement process, consider a field sales representative who drives extensively to meet clients. For every meeting, they meticulously log their trip details, from dates and destinations to the purpose of the meeting. At the end of each month, they compile this information into a mileage reimbursement form and submit it, obtaining reimbursement based on the documented miles.

Another scenario might involve an employee attending a training seminar out of state. They rent a car and keep all receipts related to the trip. When filling out their reimbursement form, they ensure to include the rental charges along with their mileage logs to maximize their reimbursement claim. These examples highlight the practical application of mileage reimbursement and emphasize the importance of keeping detailed records.

Additional support and resources

If you encounter issues while navigating the mileage reimbursement form process, pdfFiller offers a variety of support options. The customer service team can assist with any questions you might have regarding the completion and submission of forms. Additionally, pdfFiller provides live support features ensuring immediate assistance when needed.

For those looking to manage documents efficiently, consider exploring the range of features offered by pdfFiller. The platform allows you to edit forms directly, utilize templates, and maintain thorough records, ensuring that your mileage reimbursement submissions are not only accurate but also well-organized.

Final notes

Using a mileage reimbursement form can streamline the refund process for employees using their vehicles for business purposes. The benefits of using pdfFiller in this context are numerous; the cloud-based platform supports users in editing PDFs, eSigning, and collaborating on documents seamlessly. Making use of these features can enhance productivity and ensure quick reimbursements, elevating the overall experience for employees and employers alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mileage reimbursement form?

How do I edit mileage reimbursement form online?

How do I make edits in mileage reimbursement form without leaving Chrome?

What is mileage reimbursement form?

Who is required to file mileage reimbursement form?

How to fill out mileage reimbursement form?

What is the purpose of mileage reimbursement form?

What information must be reported on mileage reimbursement form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.