Get the free IPO Market Update

Get, Create, Make and Sign ipo market update

How to edit ipo market update online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ipo market update

How to fill out ipo market update

Who needs ipo market update?

IPO Market Update Form - How-to Guide Long-Read

Understanding IPOs: A foundation for success

An Initial Public Offering (IPO) offers private companies a path to publicly traded status, allowing them to raise capital by selling shares to the public. This transition can unlock significant growth opportunities and enhance visibility in the market. Companies primarily opt for IPOs for increased capital, enhanced corporate reputation, and the motivation to implement stricter governance practices.

The economic impact of IPOs extends beyond individual companies to influence the broader stock market. A successful IPO can signal healthy market conditions, attracting further investments, while contributing to improved liquidity and price discovery.

Preparing for your IPO journey

Determining if your company is ready for an IPO begins with establishing key indicators of IPO readiness. These may include consistent revenue growth, solid profit margins, and a mature organizational structure. Developing a strategic plan tailored for your IPO journey is critical for directing your efforts and resources effectively.

Organizational changes are often necessary as you transition into a public company. This includes enhancing financial reporting systems, refining corporate governance frameworks, and ensuring compliance with regulatory standards set forth by entities like the SEC.

The roles of key players in the IPO process

Selecting the right investment bank is vital to the success of your IPO. Consider experience in your industry, the guidance offered during the unintended challenges, and their existing investor relationships. Legal and financial advisors also play pivotal roles in ensuring compliance and proper structuring of your offering.

Moreover, the partnership with underwriters cannot be overstated, as they help set the offer price, market the shares, and provide insights into investor demand, which can determine the entire trajectory of your IPO.

The IPO process explained: step-by-step

The IPO process is intricate, composed of critical steps designed to ensure that companies present themselves properly to potential investors. The first step involves initial planning and due diligence. It's here that financial audits should be performed to guarantee compliance and mitigate risks—gathering the necessary documentation will form the backbone of your IPO.

The next important phase is preparing the S-1 Registration Statement. This document must include comprehensive financial performance data, clear risk factors, and a detailed use of proceeds. Understanding common pitfalls during this preparation, such as incomplete disclosures or vague risk assessments, can safeguard against complications down the line.

Market conditions: Navigating the IPO landscape

Analyzing market trends is essential for making informed decisions regarding your IPO. Current market sentiment driven by economic indicators greatly affects investors’ willingness to engage with new listings. Monitoring historical performance, especially of similar companies in your industry, can provide insights that guide expectations and strategies.

Timing your IPO is equally crucial. Analyzing broader economic trends can help you find the most advantageous moment to launch, aligning your offering with favorable market conditions.

Understanding valuation: how to price your IPO

Valuing your company accurately prior to the IPO is critical. There are various methods, including discounted cash flow and comparison with peer companies. Always remember that demand plays a significant role in how shares are ultimately priced, so gauging investor interest through pre-IPO marketing initiatives can align expectations with reality.

Additionally, consider the financing structures available to you, weighing the pros and cons of equity and debt, as both options present distinct implications for long-term growth and shareholder expectations.

Post-IPO transition: key considerations for newly public companies

Post-IPO, many companies find they need to make adjustments to meet market expectations. This includes maintaining open lines of communication with shareholders regarding performance and growth plans. Initial steps may involve organizing investor relations' departments to handle inquiries and manage expectations effectively.

Compliance is an ongoing commitment that newly public companies must uphold. Understanding and adapting to ongoing regulatory requirements, such as regular financial disclosures, is crucial in sustaining investor confidence and protecting your market position.

Common challenges in the IPO process

Market volatility can pose risks throughout the IPO process. Investors' sentiment can shift quickly, impacting your company's valuation and perceived stability. Managing public perception, via strong media relations strategies, is critical as it influences investor decisions.

Furthermore, companies often explore integration and growth opportunities after going public, which raises their visibility but presents challenges in maintaining operational focus and cohesion.

Expert insights and market updates

Obtaining insights from industry experts can provide valuable foresight as companies navigate the IPO landscape. Their tips can illuminate typical pitfalls and highlight successful strategies from previously executed offerings.

Staying informed on current trends through market updates is equally important. Regular analysis of market data can guide strategic decision-making, ensuring alignment with evolving investor expectations. Furthermore, predictions about the IPO market's future can inform planning efforts.

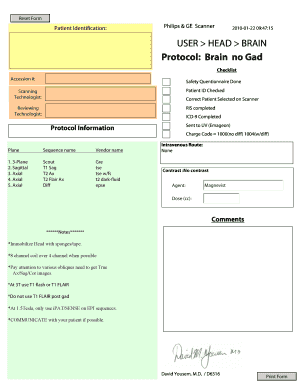

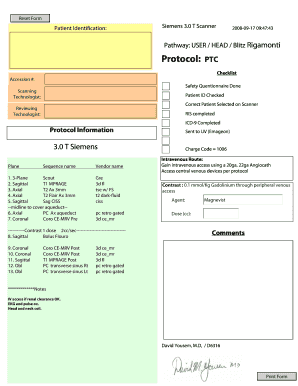

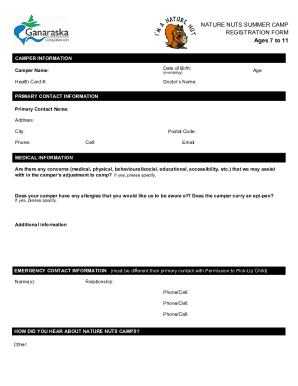

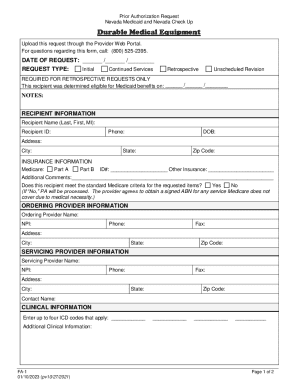

Tools for document management and collaboration through pdfFiller

Streamlining the IPO process is made simpler with document management tools like pdfFiller. By using pdfFiller’s features, companies can seamlessly edit PDFs, create vital forms, and collaborate effectively throughout the IPO journey.

Specifically, tools like eSigning documents and securing approvals can foster efficiency, helping teams stay organized while meeting critical deadlines associated with pre-IPO documentation.

Mastering the IPO documentation process with interactive tools

Utilizing templates and forms facilitates effective documentation processes and can make the task less daunting. Step-by-step instructions can provide clarity during filing, while adopting best practices for maintaining documentation accuracy ensures compliance and delivers a polished final product, reinforcing an image of reliability.

Training your team on the nuances of these interactive tools will empower them to manage documents more effectively and avoid unnecessary oversights.

Maximizing your IPO success: ongoing learning and resources

Continuous learning becomes essential when preparing for an IPO. Various resources such as webinars, articles, and market updates can equip your team with knowledge essential for navigating challenges and optimizing strategies.

Participating in industry events and workshops provides networking opportunities. Building connections with other IPO-ready companies offers a support system and strategic insights that can accelerate your path to a successful IPO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ipo market update in Chrome?

Can I create an electronic signature for the ipo market update in Chrome?

How do I complete ipo market update on an iOS device?

What is ipo market update?

Who is required to file ipo market update?

How to fill out ipo market update?

What is the purpose of ipo market update?

What information must be reported on ipo market update?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.