Eligibility to Claim Reimbursement Form: A Comprehensive Guide

Understanding reimbursement claims

A reimbursement claim is a request submitted to an employer or organization to recover expenses incurred by an employee or contractor during the course of their work. These expenses might include travel, training, supplies, and other job-related costs. Understanding what constitutes a reimbursement claim is the first step in ensuring that expenses you have incurred are rightfully compensated.

Filing for reimbursement is crucial as it not only aids in financial well-being but encourages employees to take necessary actions without the fear of incurring personal costs. It places responsibility on organizations to adhere to fair practices and ensure that their employees are not financially burdened when fulfilling their tasks.

Expense verification - Confirm every claimed amount relates to valid company activities.

Employer communication - Maintain an open line to understand the company’s policies on reimbursements.

Documentation and record-keeping - Protect yourself by keeping receipts and records of all transactions.

Eligibility criteria for reimbursement claims

To successfully claim reimbursement, various eligibility criteria must be satisfied. Generally, the foundation of eligibility revolves around employment status, the type of expenses being claimed, and adherence to submission timeframes. Full-time employees usually have clear reimbursement policies laid out in their contracts, while part-time employees, freelancers, and contractors may have different guidelines.

An essential aspect of eligibility is ensuring that the expenses align with what the organization deems reimbursable. For example, traveling expenses are often covered, but personal expenses or entertainment may not be. Ensure you understand what your specific organization covers.

Employment status - Only active employees or approved contractors qualify.

Type of expenses - Must fall under categorized reimbursements as outlined by the company.

Timeliness - Claims should be submitted within a specific timeframe after the expense occurs, often ranging between 30 to 90 days.

Checklist: Are you eligible?

Before proceeding to file a reimbursement claim, it’s vital to confirm your eligibility by completing a quick checklist. This ensures that you have all necessary documentation prepared, thereby increasing your chances of approval.

Confirm your employment status - Are you currently employed or, in certain cases, authorized as a contractor?

Compile necessary documentation - Gather receipts, invoices, and any relevant communications.

Verify that your expenses align with eligibility guidelines - Have they been pre-approved or are they part of ongoing approved activities?

Avoid common pitfalls such as submitting incomplete documentation or missing deadlines as these can significantly slow your reimbursement process, putting undue strain on your financial obligations.

Preparing the reimbursement form

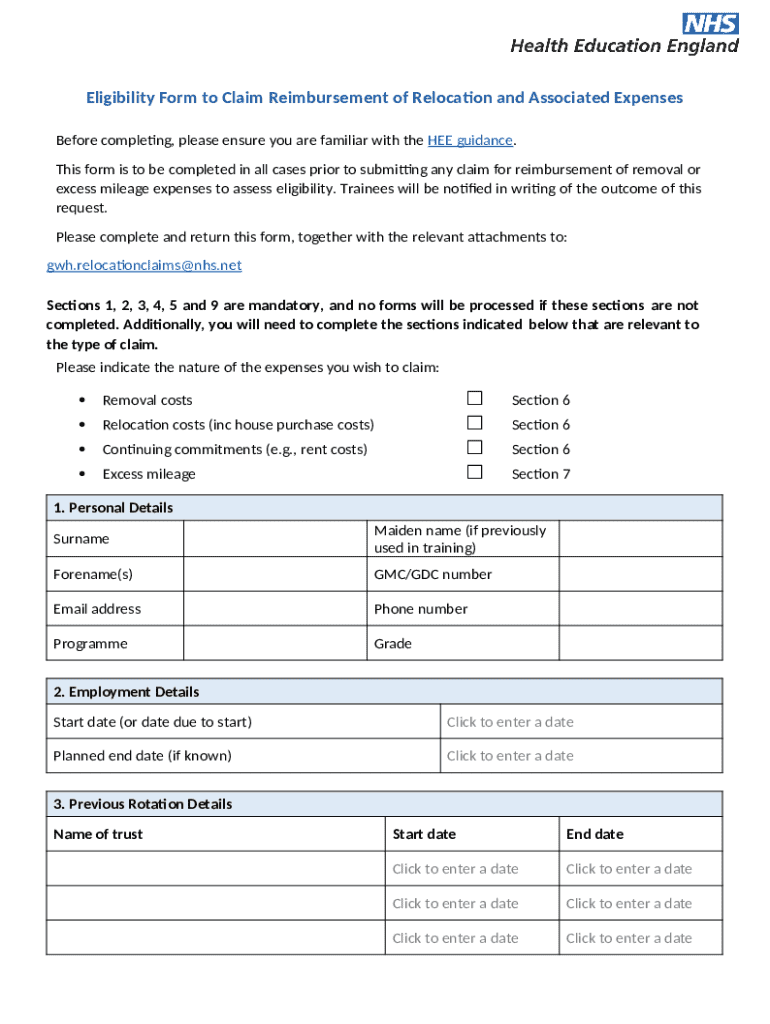

In preparing your reimbursement form, attention to detail is paramount. Each section typically requires thorough completion to ensure accuracy and relevance to your claim. The form generally includes a personal information section, where employees input details such as name, employee ID, and contact, followed by an expense breakdown section detailing each claimed expense.

Additionally, it is crucial to attach proof of expenditures in various formats such as receipts, invoices, or travel itineraries, providing transparent validation for claims made. Utilizing interactive tools available on platforms like pdfFiller can enhance this process by offering ready-to-use templates that streamline the needed sections making for an efficient and user-friendly experience.

Personal Information Section - Fill in your full name, position, and relevant contact details.

Expense Breakdown - List out each expense clearly, stating the amount and purpose.

Proof of Expenditure - Attach all required documents that substantiate your claims.

Filling out the reimbursement form

Filling out the reimbursement form accurately is crucial for a smooth claim process. Start by inputting all personal information; double-check each entry to prevent errors that could complicate your claim. Following that, in the expense reporting section, provide a detailed account of each claimed expense, specifying amounts, dates, and purposes.

Once the information is filled in, conduct a thorough review of your entries. It's advisable to pause before submission to ensure everything is accurate. You may also consider adding notes or comments to clarify any unique circumstances surrounding your claims.

Input personal information - Provide accurate contact details.

Report on expenses - Ensure clarity and transparency in all entries.

Review entries before submitting - Confirm all details are accurate and complete.

Submitting your reimbursement claim

Once your reimbursement form is complete, it's time to submit it. Depending on the organization, you might have multiple submission options — digital methods, such as sending the form via email or online portals, or traditional methods like mailing a physical copy. Always follow specified protocols to avoid misdirection or delays.

After submitting your claim, you need to track its status. Ensure to communicate with your finance department to confirm receipt and to understand their timelines on processing. Knowing average response times can help manage expectations.

Digital submission - Use organization’s designated email or online submission forms.

Traditional mail - Follow appropriate mailing procedures to ensure proper delivery.

Track submission status - Contact finance for updates on the processing timeline.

Common issues and resolutions

Despite thorough preparations, reimbursement claims can still face issues leading to rejection. Common reasons include insufficient documentation, ineligibility of claimed expenses, or submission errors. Each of these can be easily mitigated with careful attention to detail and understanding of your organization’s guidelines.

If a claim is rejected, don't lose hope. You should first review all feedback provided by the finance team and then consider appealing the decision. Most organizations have a clear process in place for this, including specific timelines for submitting appeals that you should be aware of.

Rejection due to lack of documentation - Ensure all supporting documents are submitted.

Ineligibility of claimed expenses - Familiarize yourself with what constitutes reimbursable expenses.

Appeal process - Follow outlined steps and keep track of submission timelines.

Utilizing pdfFiller for your reimbursement process

pdfFiller offers a robust solution for managing the reimbursement process efficiently. A significant advantage of this platform is its cloud-based nature, allowing users to access their documents from anywhere, thus promoting flexibility. Moreover, features designed for collaboration make it simple for teams to work together on reimbursement claims, ensuring all voices are heard and paperwork is accurate.

With pdfFiller, users can easily navigate through templates specifically designed for reimbursement forms, enabling faster document completion. Organizing and managing reimbursement claims is also streamlined through intuitive dashboard features that minimize confusion and maximize productivity.

Cloud-based access - Work on documents anywhere, anytime.

Collaboration capabilities - Simplify teamwork on expenses and approvals.

Organized document management - Streamline your reimbursement process efficiently.

Real-life case studies: successful reimbursement claims

Consider how different individuals have successfully navigated the reimbursement process. For example, one employee was able to submit a series of travel expenses that exceeded their expectations regarding approval time and amounts reimbursed. By following company guidelines meticulously, they set an example for their colleagues and showcased the importance of precise documentation.

Analyzing customer experiences, specific challenges often identified include lack of clarity in expense categories and confusion over document requirements. Tips shared by satisfied users highlighting proactive communication with finance teams have proven invaluable for others looking to avoid similar pitfalls.

Successful travel claims - Operating within guidelines resulted in seamless processes.

Challenges faced - Numerous users experienced difficulties due to lack of clarity on reimbursement policies.

Effective communication - Regular updates to finance helped in resolving concerns quickly.

Future of reimbursement claims: trends and innovations

The landscape of reimbursement claims continues to evolve, particularly with a focus on digital transformation. With technology advancing rapidly, organizations are increasingly adopting cloud-based solutions to facilitate and streamline claim processes. This includes automated submission systems that minimize errors and help employees track their submitted claims in real-time.

Looking ahead, trends suggest that organizations will further refine eligibility criteria and enhance filing practices through database-driven approaches that ensure higher accuracy levels and reduce workloads for finance teams. Embracing these innovations allows businesses to create a more efficient reimbursement landscape.

Rise of digital solutions - Enables automation and simpler tracking.

More refined eligibility criteria - Enhances clarity and accessibility.

Innovative tracking capabilities - Real-time updates to claims status.