Get the free Financial Aid Fund Promissory Note

Get, Create, Make and Sign financial aid fund promissory

Editing financial aid fund promissory online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid fund promissory

How to fill out financial aid fund promissory

Who needs financial aid fund promissory?

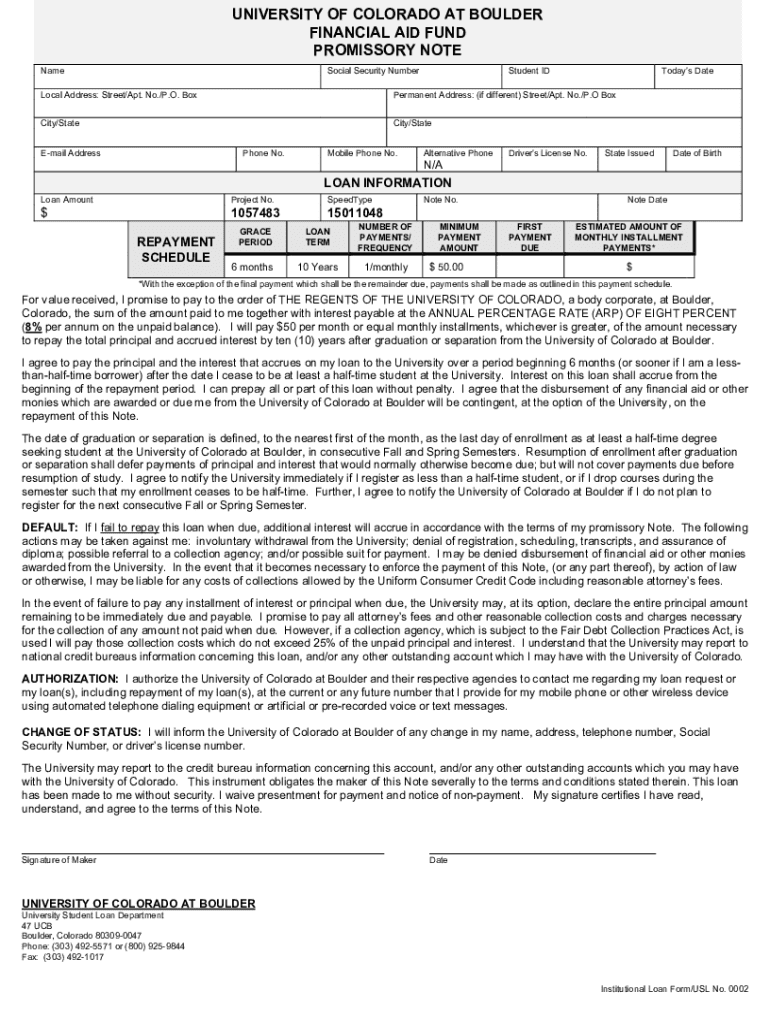

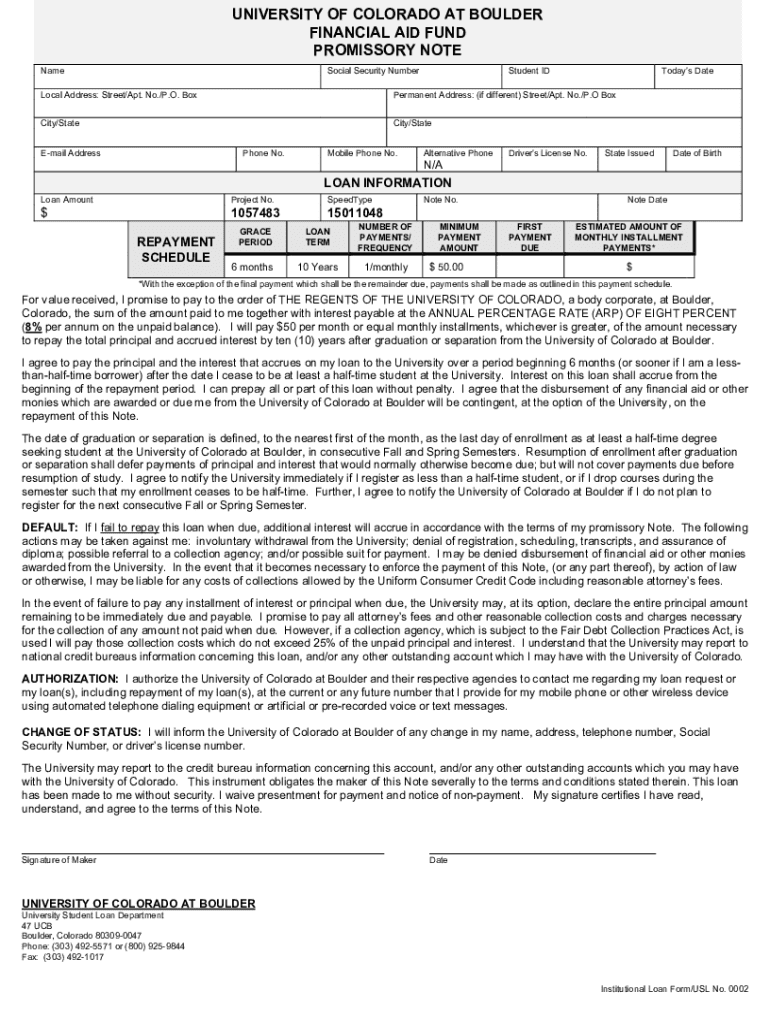

Understanding the Financial Aid Fund Promissory Form

Understanding financial aid and its importance

Financial aid serves as a crucial lifeline for students seeking higher education, making it financially accessible for many who might not otherwise have the opportunity. The importance of financial aid cannot be overstated; it significantly reduces the burden of education costs, so students can focus on their studies rather than worrying about their finances.

There are various types of financial aid available, including grants, scholarships, and loans. Grants and scholarships do not require repayment, making them the most desirable options. Loans, on the other hand, require borrowers to repay the borrowed amount with interest. This is where the financial aid fund promissory form comes into play, serving as the legal agreement that details the terms and conditions of the loan.

What is a financial aid fund promissory form?

A financial aid fund promissory form is a legally binding document that a borrower signs when accepting a student loan. This form outlines critical details regarding the loan, including repayment terms, interest rates, and borrower responsibilities. The primary purpose of this form is to ensure that borrowers understand their obligations and agree to the terms set forth by the lending institution.

This form is typically required when a student is awarded a federal or private loan. It's essential for both the student and the institution involved, as it safeguards the lender's investment while providing the borrower with clarity about their financial responsibilities. Key stakeholders in this process include the student, their educational institution, and the funding agency.

Overview of the financial aid application process

Navigating the financial aid application process can be daunting, but breaking it down into manageable steps makes it much more approachable. Below is a step-by-step guide to assist applicants in securing the financial aid they need.

Each step has specific timelines that vary by institution, so it's essential to stay organized and aware of deadlines to avoid missing out on needed aid.

Key components of the financial aid fund promissory form

The financial aid fund promissory form consists of several key components that collectively provide a complete overview of the loan agreement. Understanding each section is critical for both borrowers and institutions.

Providing accurate information and necessary documentation is crucial, as incorrect details could delay funding or complicate the borrowing process.

Filling out the form: a step-by-step guide

Before filling out the financial aid fund promissory form, proper preparations are essential. Gathering necessary documents such as identification, income statements, and tax returns can streamline the process.

It's important to fully understand the loan terms and conditions to make informed decisions. Here’s a detailed guide to help you fill out the form.

Common pitfalls include rushing through the process or neglecting to review terms, which can lead to significant issues down the line. Always take time to understand each aspect of your agreement.

To illustrate, a completed form example can highlight correct entries and offer clarity, helping others fill out the document with confidence.

Editing and managing your promissory form with pdfFiller

Once the financial aid fund promissory form is complete, editing and managing it efficiently becomes vital. pdfFiller provides several tools tailored for these needs.

Users can upload their forms and utilize pdfFiller's editing capabilities to make any necessary adjustments. The intuitive platform allows for easy navigation.

The eSign feature enables secure signing of documents, ensuring that your forms are officially validated. Collaboration tools allow users to work as a team when reviewing important financial aid documents.

Common FAQs about the financial aid fund promissory form

As many students navigate the financial aid landscape, questions about the promissory form frequently arise. It’s essential to address these queries to ease the process.

Collaborating on financial aid documents

Collaboration can enhance the financial aid application process, allowing for a more thorough approach to document management. When students work with advisors, families, or peers, they benefit from a wider range of insights and support.

pdfFiller supports teamwork through multi-user access, which is ideal for reviewing and finalizing important applications. Collaborative tools help track changes, which can streamline the completion of financial aid documents.

Tips for ensuring successful approval of your financial aid

To maximize the likelihood of approval for your financial aid application, several actionable strategies can prove beneficial. Meeting deadlines is of utmost importance; missing a date can delay or entirely derail your application.

Clear communication with financial aid offices is equally vital, as they can provide updates and guidance throughout the process.

Staying organized and proactive significantly enhances your chances of securing financial aid.

Legislative changes and their effects on financial aid

Recent changes in financial aid laws have major implications for students and their financial aid applications. Understanding these changes can empower students to take full advantage of available resources.

For instance, adjustments to interest rates or the qualification criteria for certain loans can affect both the amount students can borrow and the terms laid out in the financial aid fund promissory form.

Staying informed about legislative updates ensures that borrowers are fully aware of their rights and responsibilities.

Streamlining future applications and document management with pdfFiller

An efficient document management platform like pdfFiller can simplify not just the financial aid process but also other educational needs. By utilizing pdfFiller’s cloud-based services, users can centralize all their financial documents.

Future-proofing your financial aid documents is simple with saved templates, allowing you to easily fill out new applications with minimal effort.

Navigating unique situations

Certain circumstances may warrant special considerations during the financial aid application process. For international students or non-traditional borrowers, personalized guidelines often apply.

Furthermore, students dealing with changes in enrollment status must understand how it impacts their financial aid, including potential funding reductions or requiring reapplication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial aid fund promissory directly from Gmail?

How can I modify financial aid fund promissory without leaving Google Drive?

Can I create an eSignature for the financial aid fund promissory in Gmail?

What is financial aid fund promissory?

Who is required to file financial aid fund promissory?

How to fill out financial aid fund promissory?

What is the purpose of financial aid fund promissory?

What information must be reported on financial aid fund promissory?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.