Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

Editing return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

The Return of Organization Exempt Form: A Comprehensive Guide

Overview of the return of organization exempt form

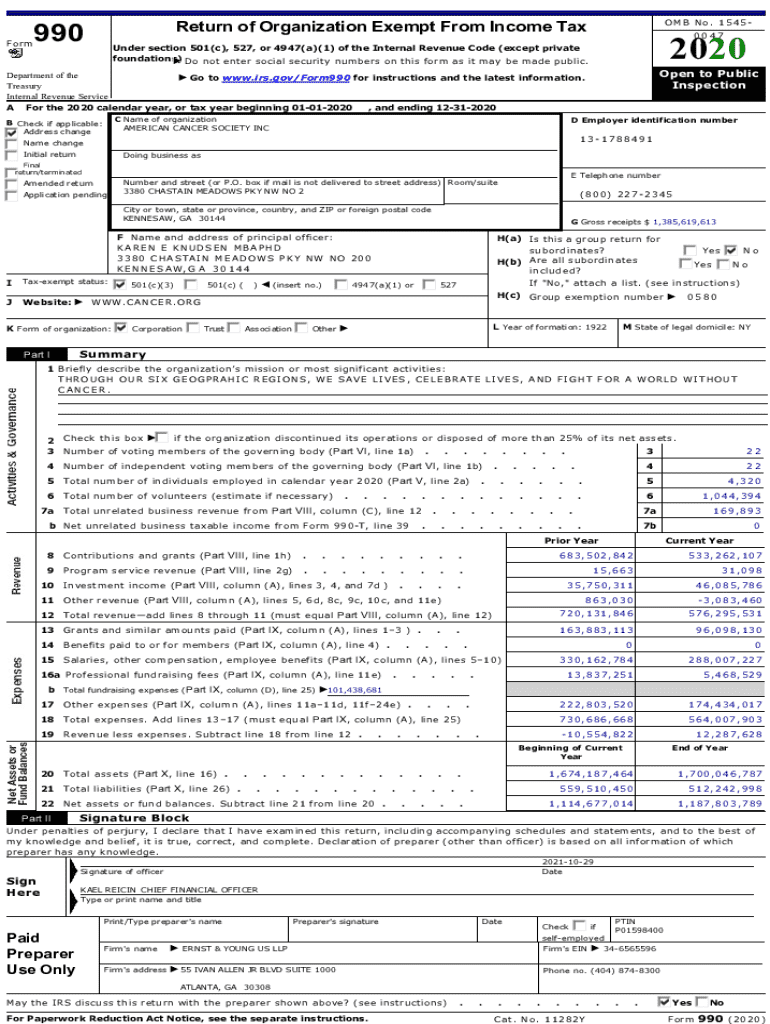

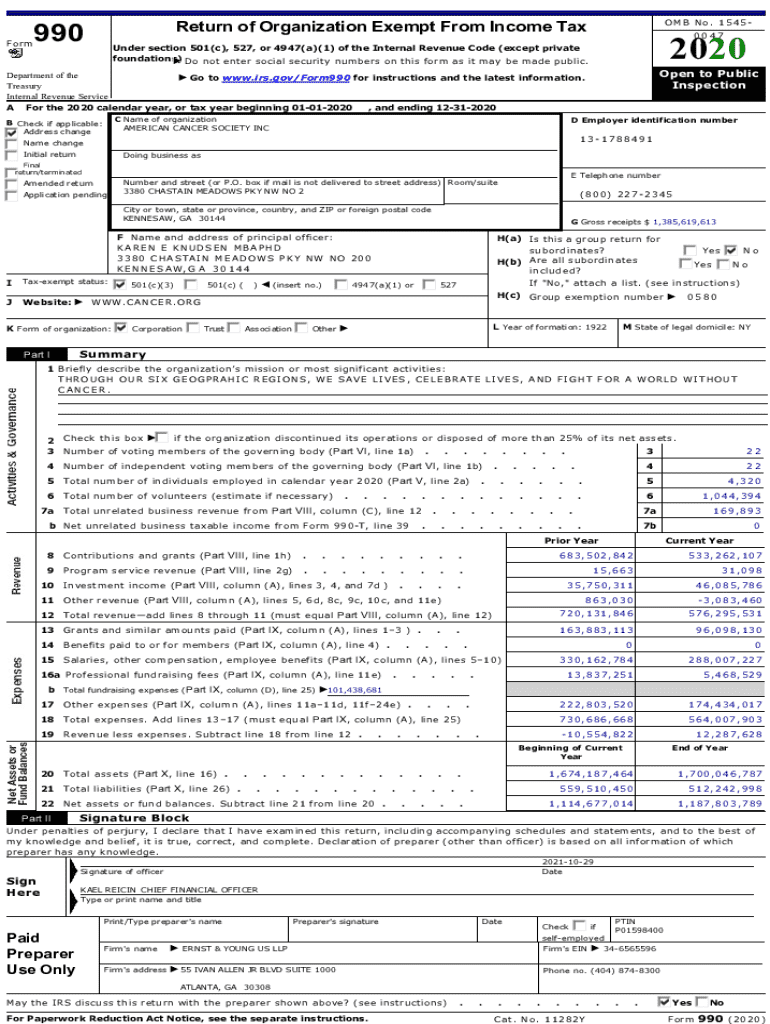

Form 990, known as the Return of Organization Exempt from Income Tax, serves as a vital tool for tax-exempt organizations to report their financial status and operational activities to the Internal Revenue Service (IRS) and the public. The importance of timely filing of Form 990 cannot be overstated, as it not only ensures compliance with federal regulations but also acts as a transparency and accountability mechanism for nonprofit organizations. Any tax-exempt organization operating under Section 501(c)(3) and various other categories must file this form, reinforcing the need for proper documentation and accurate reporting.

Key benefits of filing Form 990

Filing Form 990 is crucial for several reasons, as it offers a variety of benefits that can greatly enhance an organization's operations and reputation. First, it ensures transparency and public accountability, allowing donors, policymakers, and stakeholders to understand how funds are being utilized. Second, maintaining tax-exempt status hinges on filing this form—failure to do so may result in penalties or loss of exemption. Additionally, organizations that file Form 990 may have increased opportunities for funding, as many grant-making entities require submission of this form before awarding grants.

Who is required to file Form 990?

Eligibility for filing Form 990 encompasses various types of organizations. Primarily, 501(c)(3) organizations are required to submit this form annually. However, other organizations under different 501(c) classifications, like 501(c)(4) advocacy groups, must also adhere to these requirements. Filing requirements differ based on annual revenue; organizations with gross receipts exceeding $200,000 or total assets above $500,000 must file the standard Form 990, while those below these thresholds may qualify to file the simplified version, Form 990-EZ, or the smallest organizations may use Form 990-N, also known as the e-Postcard.

Step-by-step guide to completing Form 990

Completing Form 990 can be a meticulous process, but with a clear step-by-step approach, organizations can navigate through it seamlessly. Begin by gathering all necessary documents and information, including financial statements, board minutes, and any additional records that support your operational narrative. Determine the appropriate version of Form 990 based on your organization’s size and revenue. Proper preparation ultimately saves time and ensures accuracy when filling out the form.

Common mistakes to avoid when filing Form 990

When it comes to filing Form 990, certain pitfalls can lead to complications or penalties. Organizations often submit incomplete information or misreport financial data, leading to discrepancies that can trigger audits. Additionally, neglecting to sign the form or failing to include the appropriate schedules can lead to further issues. It is essential to fully review the form before submission to ensure accuracy and completeness.

Special considerations when filing Form 990

Organizations must remain vigilant about the potential penalties associated with late filing of Form 990. The IRS imposes fees based on the length of the delay, which can accumulate quickly and hurt the organization’s finances. Changes in IRS regulations can also affect how the form is completed and submitted, making it imperative for organizations to stay updated on any modifications. Being aware of these considerations can prevent costly misunderstandings or operational setbacks.

Support and assistance

pdfFiller offers a range of document management solutions that empower users to easily create, edit, sign, and collaborate on Form 990 and other forms. With features that facilitate real-time collaboration among team members, pdfFiller ensures that all stakeholders can access the document seamlessly from anywhere. Customer testimonials highlight the effectiveness of the platform in helping organizations navigate the complexities of filing Form 990 with confidence and efficiency.

Encouragement for continuous learning

For nonprofit professionals, ongoing education is vital for successful organizational management. Workshops, webinars, and courses tailored around nonprofit governance and reporting can enrich your understanding of compliance and best practices. Engaging with these resources not only enhances your knowledge but also ensures your organization remains compliant with regulations, ultimately fostering greater success and impact in your community.

Exploring related forms and filings

While Form 990 is essential for numerous organizations, there are other relevant forms that may be required in certain circumstances. For instance, Form 990-PF is specifically for private foundations, while Form 4506-A allows for the request of tax-exempt organization documents. Understanding these forms and their purposes can help organizations prepare more effectively and transition between filing requirements as needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send return of organization exempt to be eSigned by others?

Can I create an electronic signature for signing my return of organization exempt in Gmail?

How can I fill out return of organization exempt on an iOS device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.