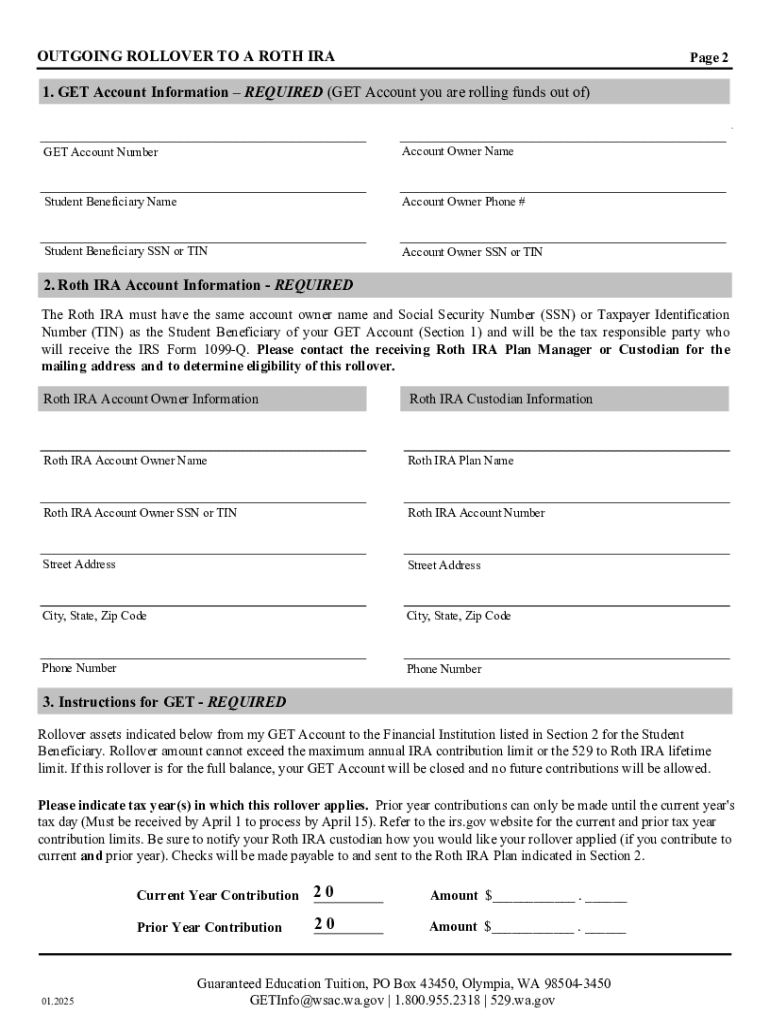

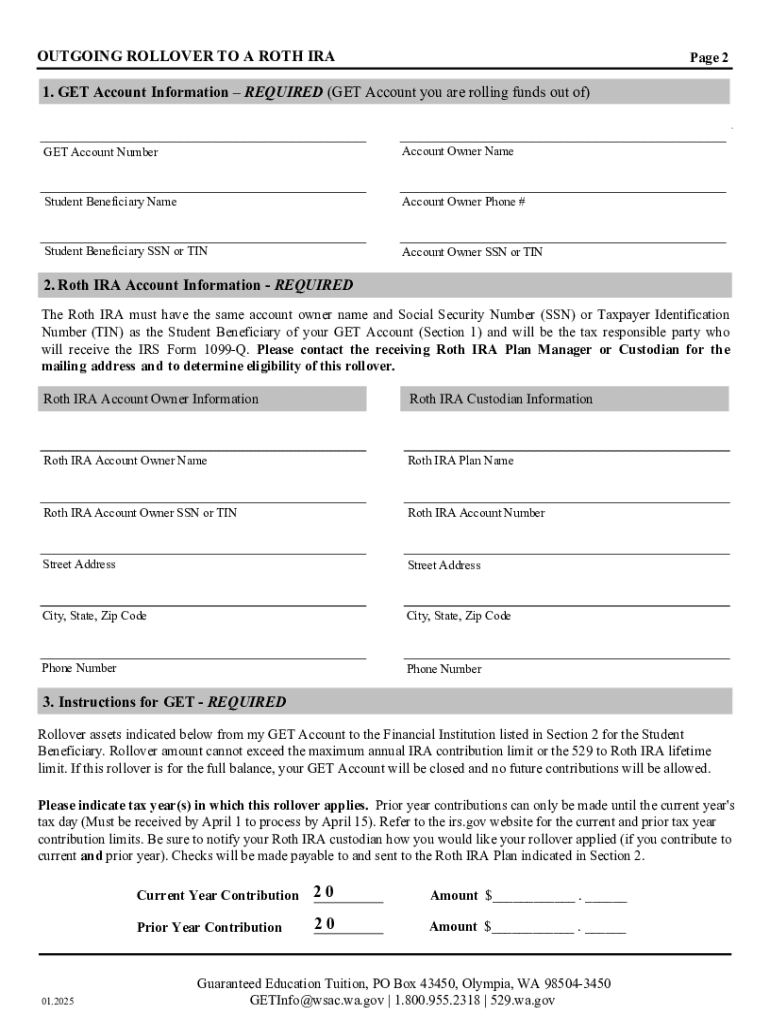

Get the free Outgoing Rollover to a Roth Ira

Get, Create, Make and Sign outgoing rollover to a

Editing outgoing rollover to a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out outgoing rollover to a

How to fill out outgoing rollover to a

Who needs outgoing rollover to a?

Outgoing rollover to a form: A comprehensive guide

Understanding outgoing rollovers: Overview

An outgoing rollover refers to the process of transferring funds from one account or a specific form to another. Commonly utilized in situations such as retirement accounts or insurance policies, outgoing rollovers are essential for individuals looking to maintain the tax-advantaged status of their investments. Understanding the nuances of outgoing rollovers can help you navigate your financial journeys more effectively.

In scenarios such as moving funds from a 401(k) to an IRA or transferring annuities, outgoing rollovers play a pivotal role. They allow you to consolidate your assets without incurring immediate tax penalties, making it a strategic financial move in various circumstances. It's important to note that outgoing rollovers differ significantly from other types, such as direct rollovers, where funds are transferred directly between accounts without the account holder's intervention.

The importance of outgoing rollovers

Considering an outgoing rollover is crucial when you need to streamline your finances or move assets into a more beneficial investment structure. One of the best platforms to facilitate this process is pdfFiller. By using pdfFiller for outgoing rollovers, you gain not only a way to manage documents efficiently but also access numerous features tailored to enhance your experience.

Step-by-step guide to initiating an outgoing rollover to a form

Initiating an outgoing rollover requires careful planning and execution. Start by determining your eligibility for a rollover, as you must meet specific criteria to proceed. Factors such as the type of account and the timing of the rollover can significantly impact your ability to complete this process!

Utilizing pdfFiller for your rollover process

pdfFiller provides an intuitive interface to fill out the necessary forms for your outgoing rollover efficiently. Start by selecting the appropriate template specific to the form you require. You can fill out the forms directly on the platform, eliminating the need for printing or scanning paper documents.

In addition to filling out forms, pdfFiller's interactive tools enable you to highlight essential sections, make notes, or attach supplementary documents. Moreover, the platform offers guidance to ensure compliance with required standards, which is vital for successful rollovers.

Managing your outgoing rollover

Once you have completed your forms, managing your outgoing rollover effectively becomes crucial. pdfFiller allows you to track the status of your submitted documents seamlessly. You will receive notifications regarding your rollover’s progress, ensuring you are always in the loop.

Moreover, you can organize and securely store all completed documents within pdfFiller, making retrieval easy whenever necessary. Collaboration features also enable sharing completed forms with your team or any relevant parties, simplifying communication and ensuring everyone involved is updated.

Common challenges and solutions in outgoing rollovers

Initiating an outgoing rollover can come with its set of challenges, including improper documentation that may lead to delays or, in worse cases, penalties. Understanding potential issues before starting the process is key to a smooth rollover experience. Many individuals face hurdles such as not understanding the forms or the timeframe for rollover completion.

Utilizing pdfFiller can help mitigate these issues. With its user-friendly interface and extensive support documentation, many past users have shared success stories about overcoming their challenges.

Frequently asked questions about outgoing rollovers

Several common questions arise concerning outgoing rollovers. Understanding these can help clarify the process and set expectations. Knowing your rights and responsibilities can prevent future complications.

Related topics for further exploration

As you navigate the world of outgoing rollovers, consider exploring related topics that can enhance your understanding. These topics can provide deeper insights into your options, enabling you to make informed decisions about your investments.

Maximizing your document management with pdfFiller

Integrating outgoing rollovers with other documents and forms is crucial for maintaining a streamlined and organized digital space. pdfFiller shines in this area, providing advanced tools that allow users to combine documents seamlessly.

For instance, utilizing pdfFiller's feature set enables quick adjustments to forms, the ability to share templates, and easy access for team collaboration. Numerous case studies reveal how organizations have transformed their processes by employing pdfFiller's solutions for outgoing rollovers, showing significant increases in efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit outgoing rollover to a straight from my smartphone?

How do I edit outgoing rollover to a on an iOS device?

Can I edit outgoing rollover to a on an Android device?

What is outgoing rollover to a?

Who is required to file outgoing rollover to a?

How to fill out outgoing rollover to a?

What is the purpose of outgoing rollover to a?

What information must be reported on outgoing rollover to a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.