Get the free Form 1017

Get, Create, Make and Sign form 1017

How to edit form 1017 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1017

How to fill out form 1017

Who needs form 1017?

A Comprehensive Guide to Form 1017

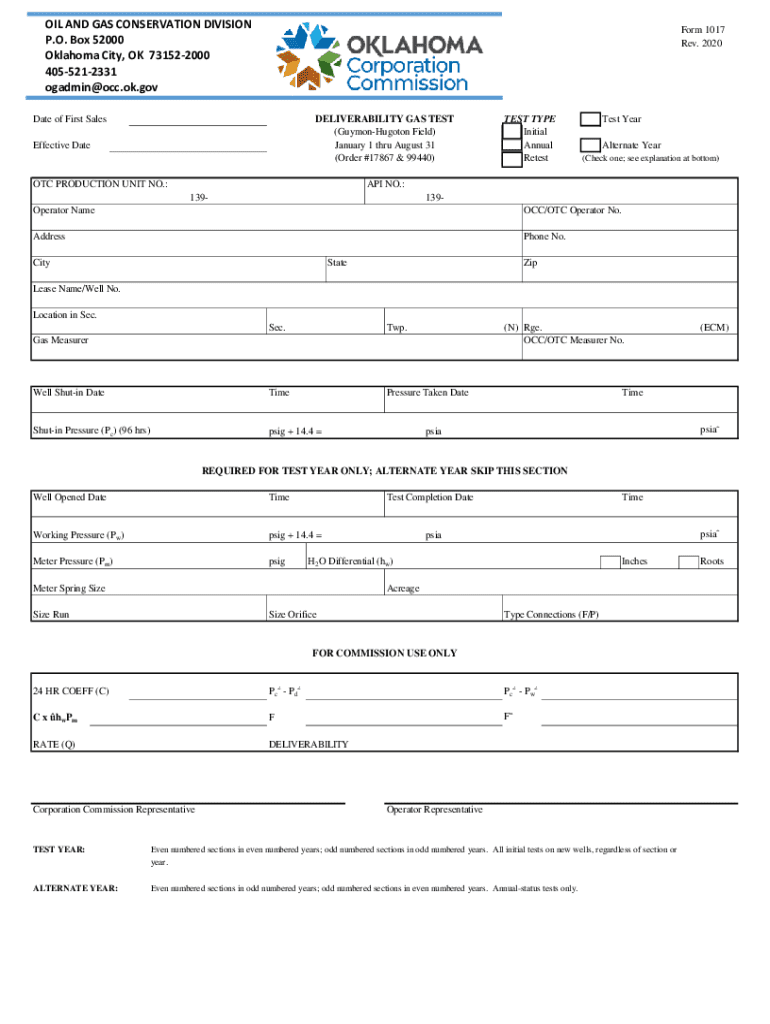

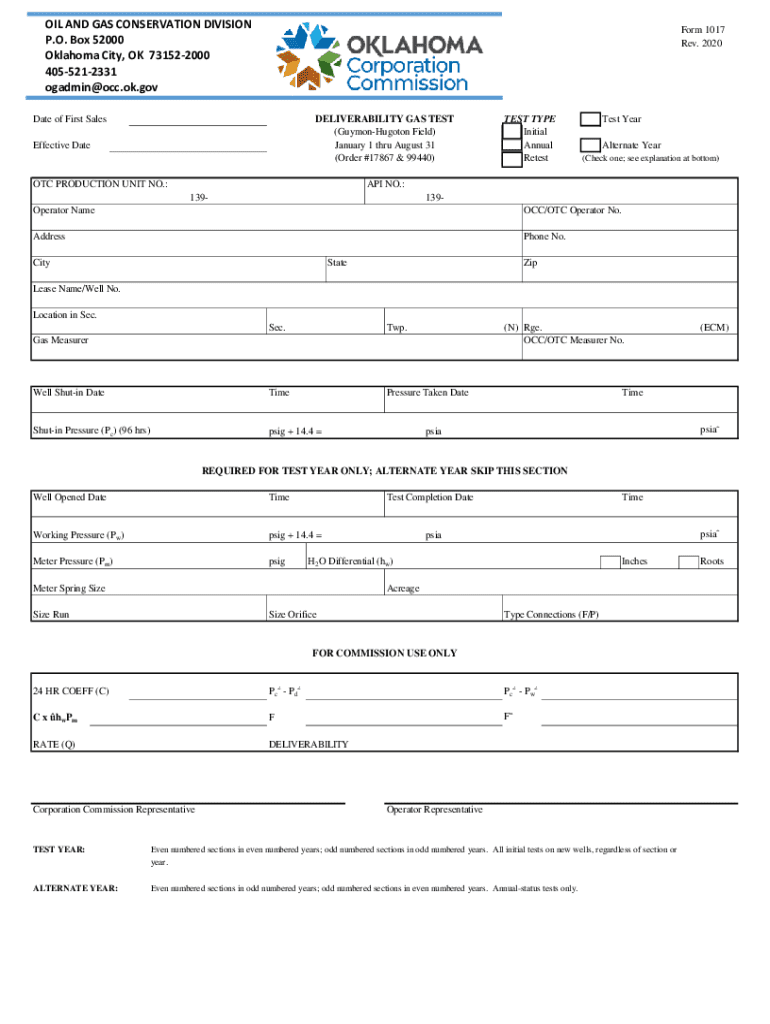

Overview of Form 1017

Form 1017 serves a specific purpose within various legal and financial contexts, particularly in tax documentation. This form is often utilized by taxpayers to convey important information regarding their income and tax liabilities. It essentially acts as a bridge between taxpayers and tax authorities, providing essential data that aids in accurate tax assessments.

The Form 1017 is critical when individuals or businesses seek to document certain tax-related criteria, thus ensuring compliance with federal regulations. It's commonly used during audit processes or when applying for various tax credits, illustrating the importance of precise information and timely submissions.

Importance of Form 1017 in document management

The Form 1017 plays an indispensable role in the overall landscape of document management, especially concerning tax and legal documentation. Proper completion and submission of this form ensure a smooth interaction with tax authorities, potentially impacting one’s financial liabilities and standing. If filled incorrectly, the consequences may span from delayed processing to severe financial penalties, thereby highlighting the need for attention to detail.

Furthermore, individuals or businesses that improperly complete Form 1017 might face auditing risks, resulting in added scrutiny from governing agencies. Effectively managing this form ensures that users can mitigate risks while maximizing potential benefits from available tax credits or deductions.

How to access Form 1017

Form 1017 is readily available for access through multiple channels. Individuals can visit official tax authority websites to obtain the form in its latest version. Additionally, pdfFiller serves as an excellent resource for acquiring this form, providing users with an intuitive platform for document handling.

For users with varying accessibility needs, pdfFiller ensures that form retrieval is optimized. The platform includes features that cater to diverse audiences, such as screen-reader compatibility and text resizing options to enhance usability.

Step-by-step instructions for filling out Form 1017

Filling out Form 1017 involves understanding its sections: Personal Information, Income Reporting, and Tax Deduction Claims. Each section carries significance, and accurate completion is vital. Begin with Personal Information where taxpayers should provide their name, address, and other identifying details.

Next, in the Income Reporting section, it’s crucial to disclose all income sources with specificity. The Tax Deduction Claims section requires taxpayers to accurately indicate applicable deductions, providing necessary documentation as support.

To ensure accuracy, avoid common mistakes such as neglecting to double-check the figures or omitting required supporting documents. Take time to review completed sections thoroughly, enhancing your likelihood of successful submission.

Editing Form 1017 using pdfFiller

Editing Form 1017 is straightforward with the editing tools offered by pdfFiller. Users can upload the form into the platform and utilize various functionalities like text editing, formatting, and annotation to make changes effectively. The platform’s user-friendly interface simplifies the process, allowing seamless modifications.

After making the necessary edits, pdfFiller provides multiple saving and exporting options. Users can choose to save directly to their pdfFiller account, download a copy for personal records, or share the updated form via email directly from the platform.

eSigning Form 1017

Utilizing eSigning capabilities through pdfFiller provides numerous benefits. eSigning is not only faster but also more secure than traditional signature methods. It ensures that documents are signed quickly while maintaining their legal validity under relevant binding agreements.

To eSign Form 1017 using pdfFiller, users simply click the eSign option within the document interface, select their signature style, and place it appropriately on the form. After signing, an automated validation process confirms the integrity of the signature, thus allowing for safe submission.

Collaboration on Form 1017

Collaborating on Form 1017 can significantly enhance the procedural efficiency of document management. pdfFiller allows users to share the form easily with team members or clients, promoting collaborative efforts to complete the document accurately. The ability to provide feedback directly on the form supports dynamic interactions among all parties involved.

Moreover, it’s essential to maintain document security during collaboration. pdfFiller employs encryption and access controls to ensure that sensitive information is protected while enabling collective input on the document.

Managing Form 1017 after submission

Once Form 1017 has been submitted, tracking its status is crucial. Users should establish a system for keeping records of all forms submitted, enabling easy retrieval when needed for future references or audits. Keeping digital copies stored in pdfFiller ensures documents are accessible and retrievable anytime.

If changes are required after submission, users must be aware of the processes involved in editing or retracting a submitted Form 1017. Understanding these procedures ensures that necessary corrections or updates can be managed swiftly, minimizing any potential disruptions.

FAQs about Form 1017

Users frequently express confusion about completing Form 1017, hence common FAQs can provide clarity on various aspects. Potential questions may revolve around filling out specific sections, the importance of provided documentation, and the implications of incorrectly submitted forms. Numerous testimonials reveal the ease of managing these inquiries through pdfFiller, thanks to its user-friendly interface and customer support.

Many users appreciate the clarity that comes from accessing simplified instructions and sample filled forms available through pdfFiller. These resources empower individuals and teams to handle their form management tasks competently.

Troubleshooting common issues

Encountering issues with Form 1017 is not uncommon, and knowing how to navigate these challenges can save time and stress. Some of the most frequent problems include difficulties in accessing the form or challenges in securely eSigning. Users should first ensure they are using the latest version of their browser and have a stable internet connection.

When it comes to eSigning issues, confirming that your signature meets the necessary format requirements can resolve many problems. If difficulties persist, contacting pdfFiller support for assistance provides users with pertinent guidance to address their concerns.

Additional features of pdfFiller

pdfFiller offers more than mere access to Form 1017; its integration capabilities with a multitude of applications streamline comprehensive document management solutions. Users benefit from seamless workflow integration with tools like Google Drive, Dropbox, and other essential platforms. This feature enhances collaboration and keeps all documents organized in one location.

The platform is committed to evolving, regularly updating its functionalities to meet user demands and improve the overall experience. Upcoming features will seek to further enhance utilization of Form 1017, ensuring that users have the latest tools for efficient form management.

Conclusion

With its multitude of features and user-friendly interface, pdfFiller stands out as an essential tool for efficient document management, particularly when it comes to navigating Form 1017. The platform empowers users to edit, eSign, collaborate, and manage their documents seamlessly. Taking proactive steps to familiarize yourself with Form 1017 and pdfFiller’s capabilities enhances efficiency and compliance in your document management endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 1017 online?

Can I create an electronic signature for signing my form 1017 in Gmail?

How do I fill out form 1017 using my mobile device?

What is form 1017?

Who is required to file form 1017?

How to fill out form 1017?

What is the purpose of form 1017?

What information must be reported on form 1017?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.