Get the free Ca 71-18

Get, Create, Make and Sign ca 71-18

Editing ca 71-18 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ca 71-18

How to fill out ca 71-18

Who needs ca 71-18?

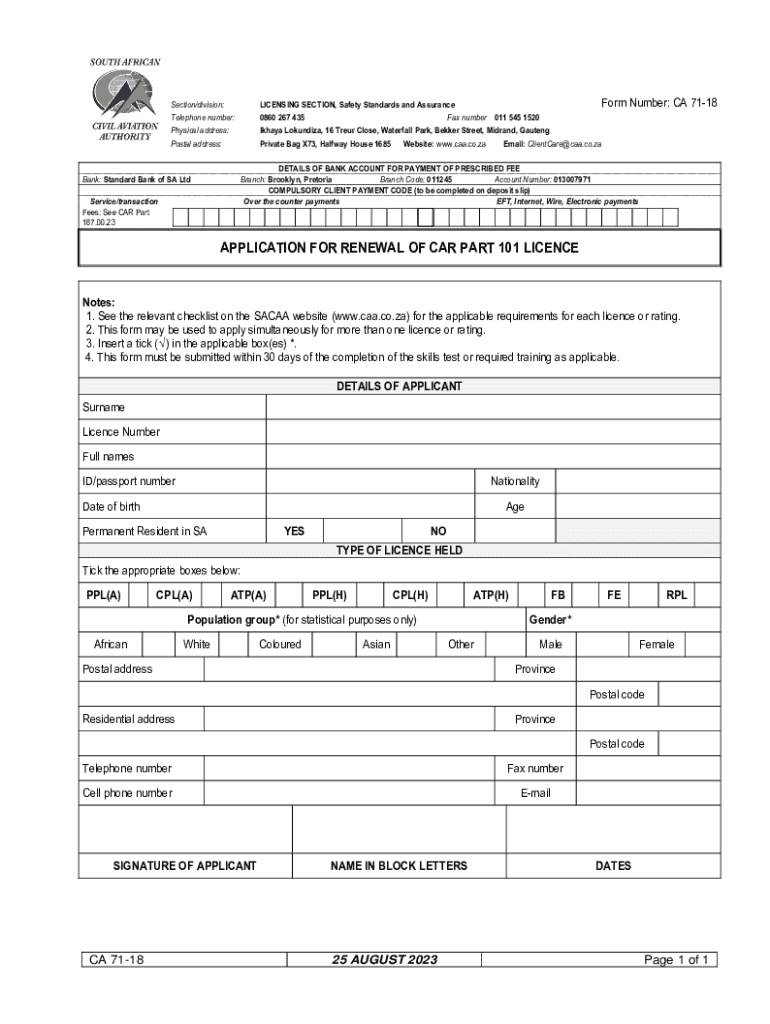

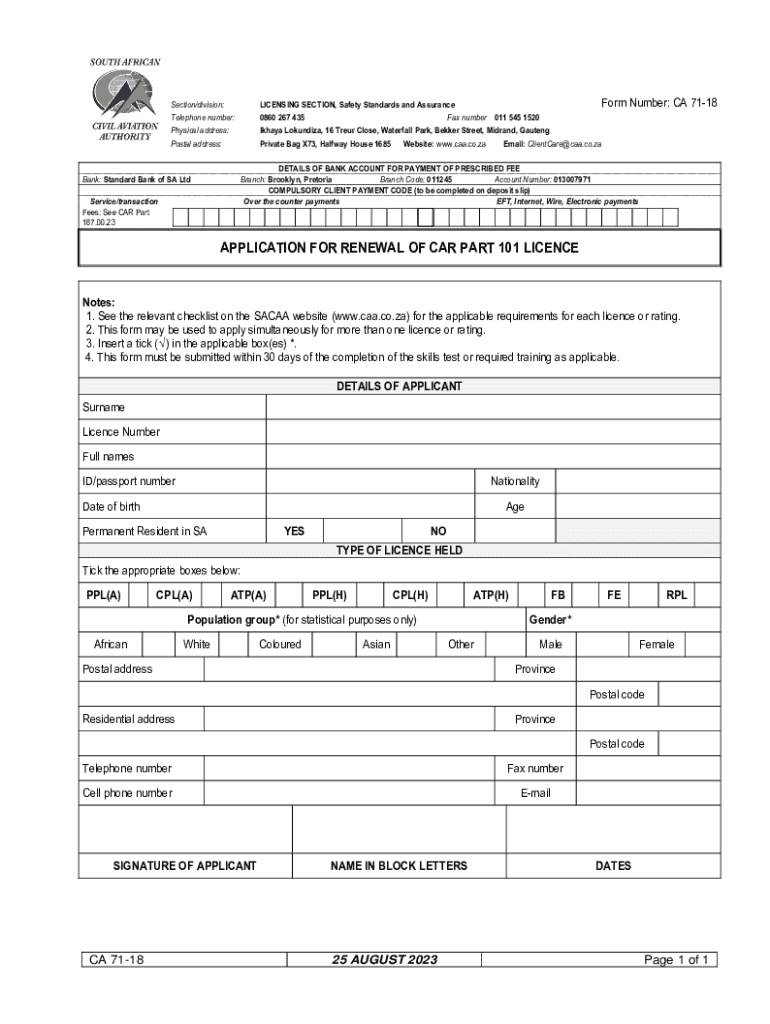

A comprehensive guide to the CA 71-18 form

Understanding the CA 71-18 form

The CA 71-18 form is a crucial document within the realm of California's employment and benefits processing. Specifically designed for reporting certain employee-related information, its primary purpose is to streamline the workflow associated with benefits eligibility and employment verification processes in California. By understanding the definition and purpose of the CA 71-18 form, individuals and teams can ensure that they fulfill their obligations while also adhering to state regulations.

Accurate completion of the CA 71-18 form is essential, as even minor errors can lead to significant processing delays, potential rejections, or reduced benefits eligibility. Many individuals hold common misconceptions about the form; for example, some believe that completing it inaccurately or late has no ramifications. However, submitted forms containing mistakes or incomplete sections could lead to complications that affect the overall benefits process.

Key components of the CA 71-18 form

The CA 71-18 form consists of several critical sections that need careful attention. Each section is designed to capture specific information, ensuring that the application process is comprehensive and includes all necessary details. Below is a detailed breakdown of each section.

Additionally, it is crucial to attach the required documentation that supports the information provided in the form. This could include pay stubs, tax documents, or proof of employment, depending on the specifics outlined in the application. Furthermore, mandatory signatures and initials play a vital role in verifying authenticity and consent.

Step-by-step guide to completing the CA 71-18 form

Before filling out the CA 71-18 form, preparation is key. Start by gathering all necessary information, such as your Social Security number, employment history, and any prior benefits details. Ensuring compliance with regulations is also vital as it helps to avoid pitfalls during the submission process.

Now, let's move to the detailed step-by-step guide on how to complete the form:

To avoid common errors, consider reviewing the form with a peer or seeking assistance from professionals who frequently handle such forms. Taking your time and ensuring clarity in each section can significantly reduce the risk of mistakes.

Editing and modifying the CA 71-18 form

Mistakes can happen, and knowing how to rectify them is essential. After submission, if you discover an error on your CA 71-18 form, it's crucial to follow the correct procedures for making corrections. Communicate promptly with the relevant department to address the issue.

To effectively edit the form, utilizing pdfFiller's editing features can be incredibly beneficial. This platform allows users to annotate sections easily, alter existing information, and add new details without hassle. Keeping a digital record of your documents is important for easy tracking and management of changes.

Signing and submitting your CA 71-18 form

Once you've accurately filled out the CA 71-18 form, the next step involves signing and submission. Utilizing e-signature options ensures that your submission is valid and legally compliant. E-signatures not only save time but also enhance security and reduce paperwork.

When it comes to submission methods, you have options: online or paper. Each method has its pros and cons depending on your preferences and organizational guidelines. After submission, keep track of your form by documenting whatever confirmation you receive; staying up-to-date is crucial to effective management.

Managing your CA 71-18 form using pdfFiller

Using pdfFiller for managing your CA 71-18 form can drastically simplify your workflow. Its cloud-based storage solutions ensure that you can access the form anytime, anywhere. Furthermore, collaboration tools allow teams to work together efficiently, providing inputs and making changes as needed.

Frequently asked questions about the CA 71-18 form

It's natural to have questions when dealing with the CA 71-18 form. Addressing common queries can ease concerns and provide clarity, so let's explore some of the most frequently asked questions.

For additional help, consider accessing resources that can provide further assistance, including official California benefit websites and online forums.

Advanced tips for individuals and teams

Efficiency in filling out and submitting the CA 71-18 form can greatly improve when teams employ advanced strategies. Best practices for collaboration include establishing clear communication channels and ensuring that all team members understand their roles during the completion process.

These advanced strategies can streamline processes and reduce the likelihood of errors, ultimately benefiting both individuals and teams.

User testimonials and case studies

Many individuals and teams have successfully navigated the CA 71-18 form with the help of pdfFiller. For instance, several users have reported improved turnaround times of their benefits applications after utilizing the platform’s editing and collaboration features.

Furthermore, teams have shared insights on how integrating pdfFiller improved their workflow efficiency, allowing for better tracking and less confusion during the submission process. These success stories showcase the potential impact of effective document management on benefits processing.

Legal considerations and responsibilities

Submitting the CA 71-18 form carries certain legal implications, especially if the information provided is inaccurate or misleading. Users must understand their rights and responsibilities when completing this document. Incorrect submissions could lead to penalties or loss of benefits, emphasizing the importance of diligence when filling out the form.

As a user, it’s essential to be aware of both the legal repercussions of submitting incorrect information and the importance of ensuring that every submission is accurate and complete. Resources and guidance available through pdfFiller can assist in maintaining compliance with these legal standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ca 71-18 without leaving Chrome?

How do I fill out ca 71-18 using my mobile device?

How do I edit ca 71-18 on an Android device?

What is ca 71-18?

Who is required to file ca 71-18?

How to fill out ca 71-18?

What is the purpose of ca 71-18?

What information must be reported on ca 71-18?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.