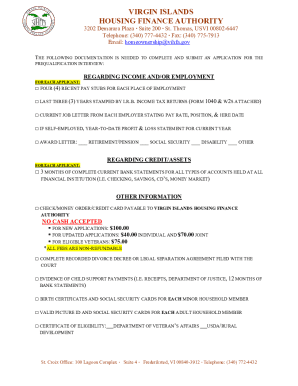

Get the free Form F-1

Get, Create, Make and Sign form f-1

How to edit form f-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form f-1

How to fill out form f-1

Who needs form f-1?

How to Complete Form F-1: A Comprehensive Guide

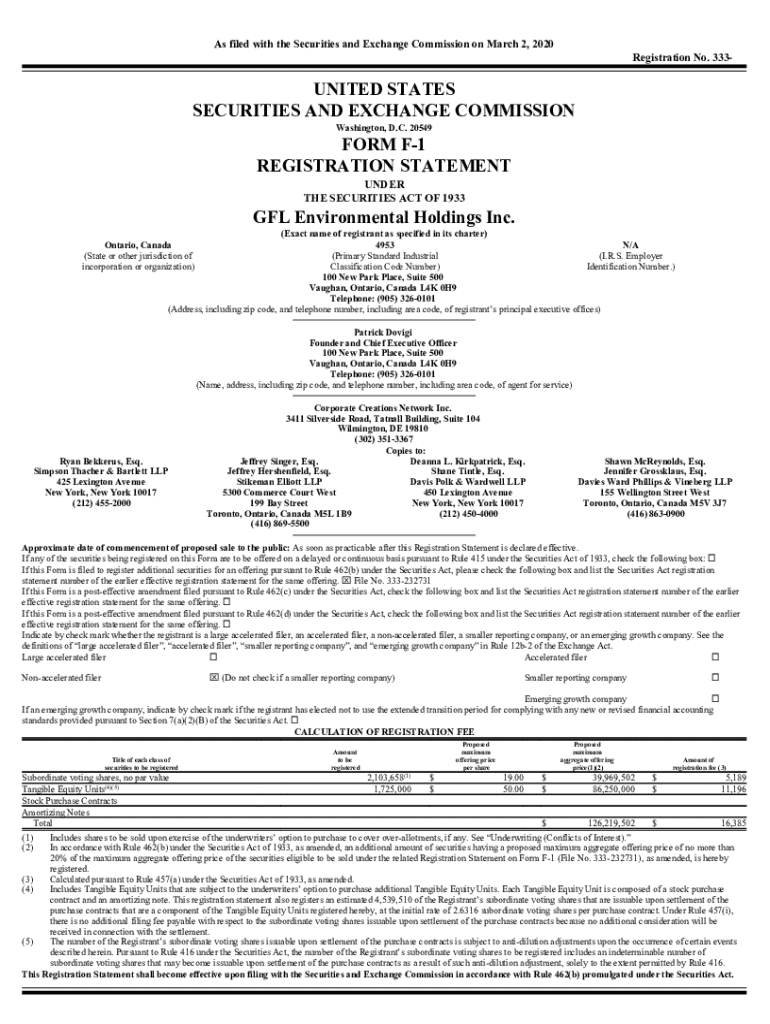

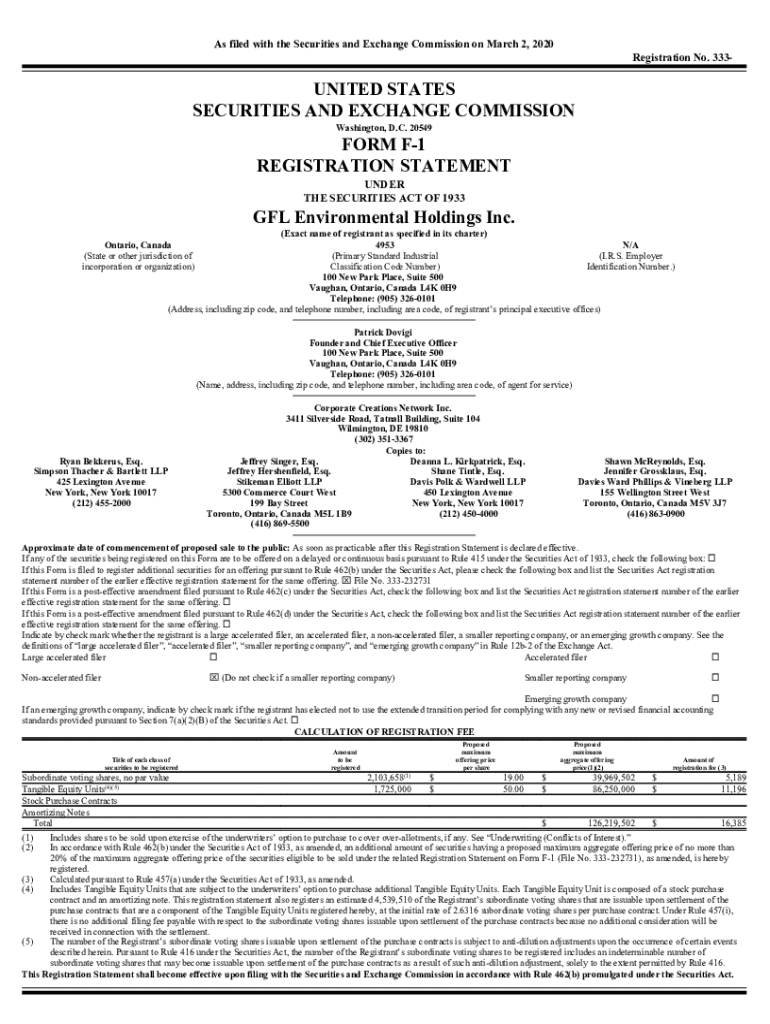

Overview of Form F-1

Form F-1 is a registration statement used by foreign private issuers to register securities with the U.S. Securities and Exchange Commission (SEC). This form is essential for companies based outside the United States that wish to offer securities to U.S. investors. The importance of Form F-1 lies in its role in ensuring transparency and accountability in the securities market.

Understanding who needs to file Form F-1 is crucial: primarily, it is aimed at entities self-identifying as foreign private issuers, meaning they are permitted to file this form instead of the more complex registration statements used by domestic companies. The primary purpose of Form F-1 is to enable these foreign entities to disclose necessary information about their business operations, financial position, and other pertinent details.

Understanding the filing requirements

Filing Form F-1 is not just about completing the form itself; there are specific eligibility criteria that entities must meet. A foreign issuer must ensure that less than 50% of its shareholder base is U.S. residents and that it actively pursues business outside the United States. Additionally, companies must adhere to various documentation requirements to support their claims as foreign private issuers.

Common misconceptions surrounding Form F-1 include the assumption that any foreign company can file this form. In reality, only those satisfying certain conditions can use this registration method. Ensuring clarity about these requirements will facilitate a smoother filing process.

Step-by-step instructions for completing Form F-1

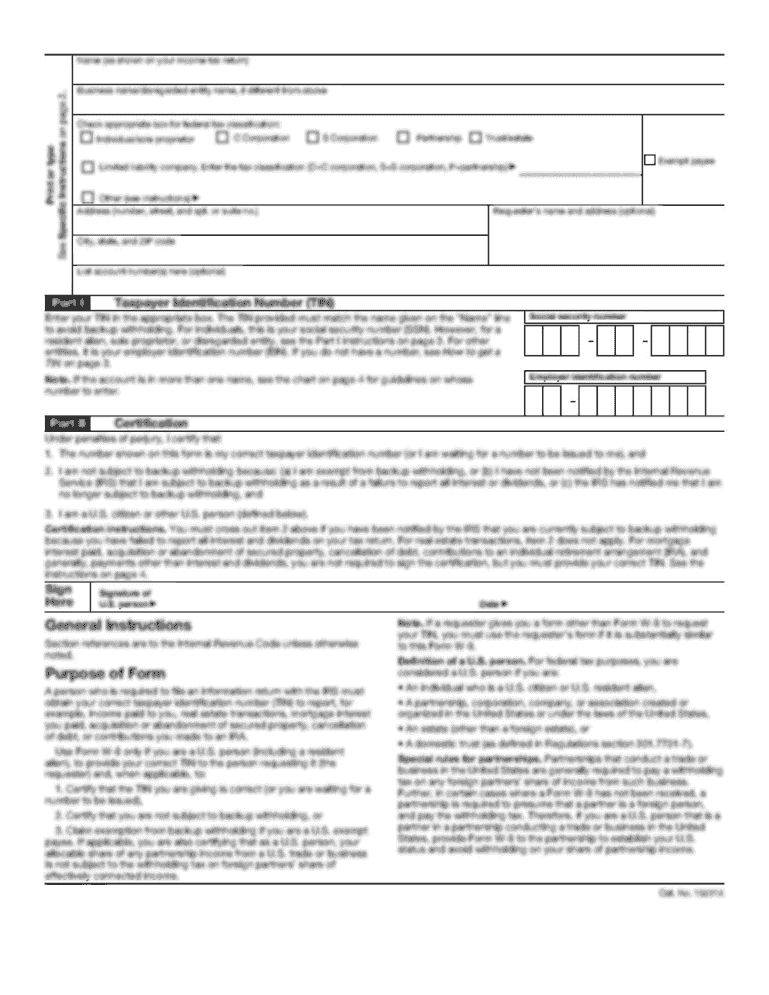

Completing Form F-1 requires precision and attention to detail. The form is generally broken down into several sections, each critical to providing a comprehensive view of your business. Start with the basic information section where you will furnish your company's name, address, and contact details, which serve as the foundation of your submission.

Next, delve into the business overview section. Describe your business activities clearly, highlighting key financial metrics and operational accomplishments that set your firm apart. This section sets the tone for investors, so it's essential to be articulate and direct.

Additionally, the financial statements section mandates the inclusion of key financial documents, like balance sheets and profit-and-loss statements, presented in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

Tips for filling out Form F-1

To enhance the accuracy of your Form F-1 submission, adhere to best practices. Begin with a thorough review of all instructions related to the form. Reviewers typically look for clarity, so avoid jargon and ensure that explanations are straightforward.

Common mistakes include neglecting to attach supplementary documentation or failing to adequately explain the information provided. Rely on resources that offer templates and guidance specifically for Form F-1 to streamline your process.

Editing and eSigning your Form F-1

The accuracy of documents like Form F-1 cannot be overstated. Even minor mistakes can lead to delays in processing. Utilizing tools available on pdfFiller enhances your ability to edit and prepare your form accurately. You can add comments, edit text, and even rearrange sections seamlessly.

Once the content is finalized, eSigning becomes crucial. The platform offers secure eSigning options, ensuring that the necessary individuals can sign the document from anywhere, which simplifies the process and enhances efficiency.

Submitting Form F-1

Submission methods for Form F-1 vary. Typically, the form can be submitted electronically through the SEC's EDGAR system, making it vital to understand how to navigate this platform. Additionally, you may incur submission fees based on the type of offerings made, and keeping this in mind will assist with budgeting.

Upon submission, you can expect a confirmation notice from the SEC informing you that your filings have been received. Accurate tracking of this submission is essential for compliance and future reference.

Managing and tracking your Form F-1

After submitting Form F-1, keeping track of your filing status is important. Utilizing tools available on pdfFiller can help manage your documents effectively and ensure that no deadlines are missed. Staying updated with the SEC’s communications concerning your filing will also aid in effective compliance management.

In cases where amendments are necessary post-submission, understanding the process for filing amendments is critical. Error corrections or updates to disclosures should follow the prescribed format to maintain compliance with SEC regulations.

Frequently asked questions about Form F-1

Navigating the intricacies of Form F-1 raises many questions. One common inquiry involves what to do if your Form F-1 is rejected. In such cases, carefully review the feedback provided by the SEC and make necessary corrections before resubmitting.

Timing is another frequent concern. Generally, the review process can take several weeks, and staying in communication with the SEC during this time is advisable for a smoother experience.

Interactive tools available on pdfFiller

Making the most of your experience with Form F-1 involves leveraging interactive tools available on pdfFiller. The platform allows for seamless editing of PDFs, along with collaboration features that enable teams to work on documents simultaneously, enhancing productivity.

Moreover, the cloud storage benefits offered by pdfFiller ensure your documents are securely stored and easily accessible, which is especially useful for retrieving past filings or amendments.

Related solutions for your document needs

Besides Form F-1, pdfFiller offers a range of other SEC forms and templates that can streamline your filing processes. Understanding the relation between various forms is critical for compliance and effective document management. The platform provides access to numerous templates tailored to meet company-specific needs.

Integrating Form F-1 into your business workflow involves aligning your financial disclosures with broader reporting standards. Also, leveraging resources provided by pdfFiller can enhance your documentation strategy, ensuring that you’re always prepared as regulatory landscapes evolve.

Connect with expert support

Navigating the complexities of Form F-1 can be daunting. pdfFiller provides expert support, ensuring you’re not alone in your document management journey. Contact options are readily available to assist with any inquiries regarding the form and enhance your filing experience.

For more personalized guidance, consider scheduling a consultation with our team of experts to address specific queries or concerns related to your filing.

Stay informed: Latest updates on SEC regulations

The regulatory landscape surrounding SEC filings is not static, making it vital to stay updated on changes that affect filing requirements. Engaging with timely updates and resources on pdfFiller ensures that you’re well-informed and capable of adapting to new regulations.

Being proactive about staying informed is crucial for your business. Regularly checking for updates can safeguard your company against compliance issues when preparing Forms like F-1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form f-1 without leaving Google Drive?

How do I edit form f-1 straight from my smartphone?

How can I fill out form f-1 on an iOS device?

What is form f-1?

Who is required to file form f-1?

How to fill out form f-1?

What is the purpose of form f-1?

What information must be reported on form f-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.