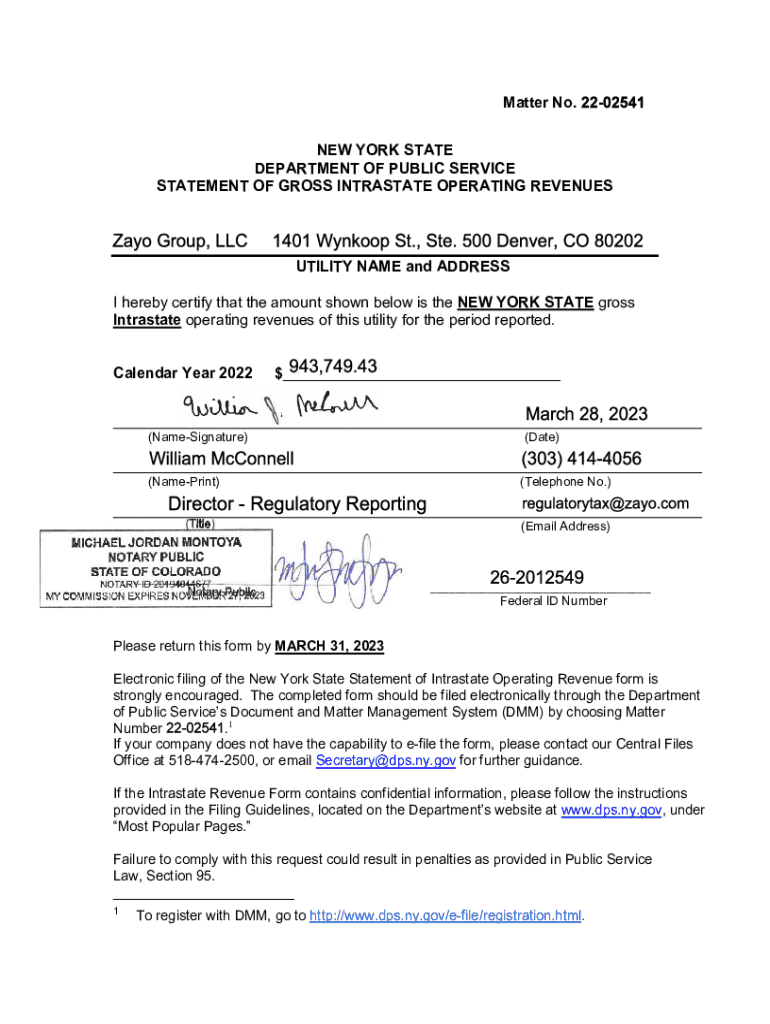

Get the free Statement of Gross Intrastate Operating Revenues

Get, Create, Make and Sign statement of gross intrastate

How to edit statement of gross intrastate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statement of gross intrastate

How to fill out statement of gross intrastate

Who needs statement of gross intrastate?

Understanding the Statement of Gross Intrastate Form: A Comprehensive Guide

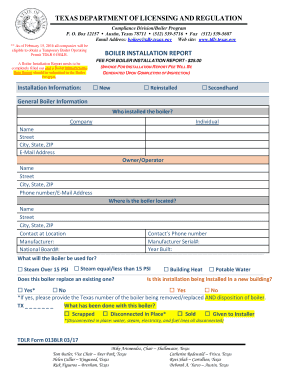

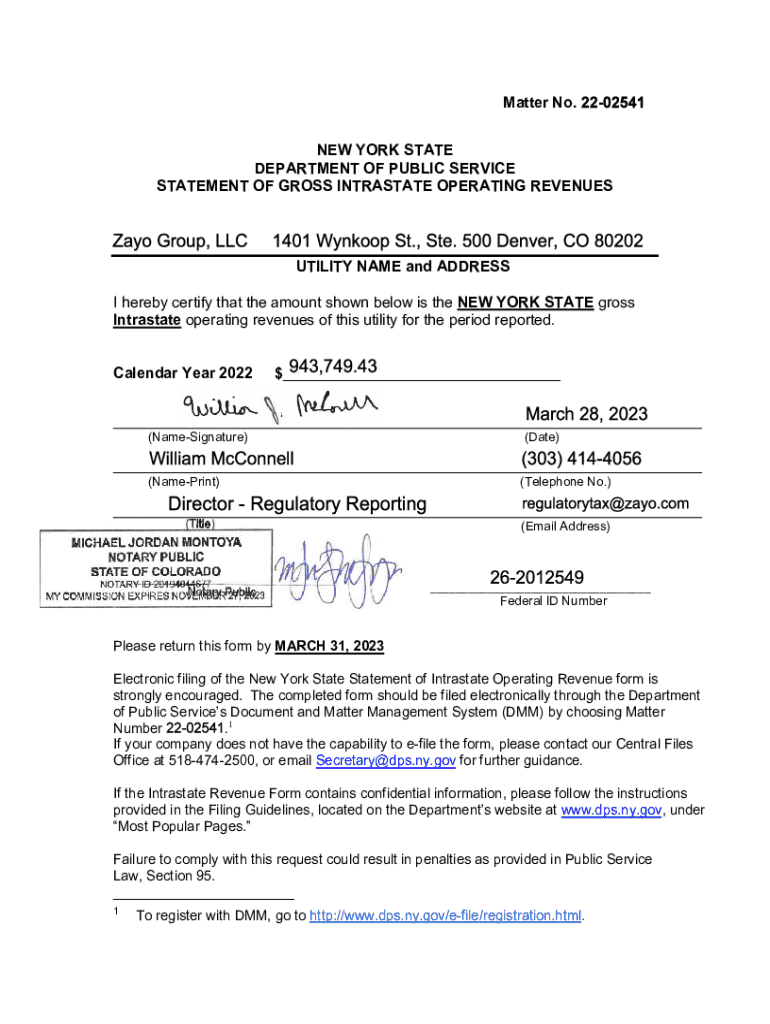

Understanding the statement of gross intrastate form

The Statement of Gross Intrastate Form serves as a crucial document for businesses operating within a specific state, providing a clear account of gross operating revenues generated intrastate—meaning within the state boundaries. Designed primarily for regulatory compliance, this form is essential for tax reporting purposes, ensuring that businesses meet both state and federal obligations.

Accurate reporting via the Statement of Gross Intrastate Form is critical not just for legal compliance but also for gaining a clear understanding of a business's financial health. Inaccuracies or omissions can lead to legal repercussions and unexpected audits. Each state may have its own set of regulations regarding this form, making it important for businesses to understand local compliance requirements thoroughly.

Overview of the form structure

Every form is structured to capture essential information systematically. The Statement of Gross Intrastate Form comprises various sections that require specific details, each facilitating the collection of relevant data about a business’s revenues.

Typically, the form starts with header information, including the business’s name, address, and identification numbers. Following this, businesses must report their gross operating revenues, detailing all revenue generated from intrastate operations. Deductions and exemptions applicable should also be listed to accurately reflect taxable income. Lastly, contact information ensures that the state can easily reach the business for follow-up or clarification.

Understanding common terminology can also make the form easier to navigate. Key terms such as 'gross revenues,' 'exemptions,' and 'deductions' can clarify the requirements significantly.

Step-by-step instructions for completing the form

Completing the Statement of Gross Intrastate Form may appear daunting, but by breaking it down into sections, the process becomes manageable. Following a systematic approach ensures all relevant fields are adequately filled out.

Section 1: Filling out your header information

Start with the header information. Enter your business name exactly as it appears on your legal documents. Include your physical and mailing addresses, as well as the correct state identification number. These details not only identify your business but also allow for efficient processing by state agencies.

Section 2: Reporting gross operating revenues

Next, report your gross operating revenues. This figure should include all revenues earned solely from intrastate transactions. To calculate accurately, consider all income streams within the state, excluding any revenue from outside states or jurisdictions. A common mistake is to include out-of-state revenues, which can skew the data.

Section 3: Identifying deductions and exemptions

In this section, identify any applicable deductions and exemptions. Types of deductions include expenses related directly to business operations within the state. It's crucial to provide documentation supporting these claims, such as invoices and financial statements, to ensure compliance and validity.

Section 4: Review and finalize your submission

Once all sections are completed, thoroughly review the form for accuracy. Double-check your calculations and ensure all required information is included. Following this, adhere to submission deadlines that are specific to your state to avoid penalties.

Interactive tools for completing the form

Leveraging technology can streamline the process of completing the Statement of Gross Intrastate Form. Tools available on pdfFiller facilitate editing and collaboration, making it easier to work as a team on your documents.

PDF editing and collaboration features available on pdfFiller

pdfFiller offers real-time editing tools that allow multiple users to input information simultaneously. This feature is particularly useful for teams where collaboration on financial data is essential. You can comment, underline, or highlight critical areas, ensuring everyone is on the same page.

eSigning capabilities

Once the form is complete, secure eSigning features on pdfFiller allow you to sign documents electronically. This modern approach not only simplifies the signing process but also enhances security, as it minimizes the risk of unauthorized access. Compared to traditional methods, eSigning is quicker and more efficient, helping to avoid delays.

Digital management of your documents

Managing documents digitally offers several advantages. With pdfFiller, you can easily store and organize completed forms, making retrieval straightforward when needed. This centralized approach is beneficial, especially during audits or when seeking historical financial data.

Moreover, pdfFiller facilitates easy sharing options with stakeholders. You can share forms directly via email or through secure cloud links, ensuring that your collaborators can access the necessary documents anytime, anywhere. This flexibility is critical for businesses that operate in multiple locations and require real-time access to forms.

Common FAQs about the statement of gross intrastate form

Understanding the nuances of the Statement of Gross Intrastate Form often leads to queries. Common questions typically revolve around submission deadlines, specific deductions allowed, and how to address discrepancies.

To troubleshoot common issues, ensure that all figures are accurate and that your forms are comprehensive. Resources are available through state agencies and pdfFiller support, where you can receive further assistance regarding your submissions or any problems encountered.

Related forms and resources

The Statement of Gross Intrastate Form may have analogous forms in different states or jurisdictions. Businesses should be aware of their specific state regulations as they may differ significantly from one place to another.

User testimonials and case studies

User experiences often highlight the efficiency gained through pdfFiller. Many businesses have reported significant improvements in their paperwork processes, from completing forms to secure signatures—all under the same platform.

One case study involved a mid-sized company that utilized pdfFiller to manage their intrastate revenue reporting. They noted a 30% reduction in time taken to prepare and submit the form due to seamless collaboration features and effective document management.

Stay updated: ongoing changes in regulations

Staying informed about the latest changes to regulations affecting the Statement of Gross Intrastate Form is crucial for compliance. Regulatory updates may change definitions, allowable deductions, or submission requirements.

Resources such as state government websites and pdfFiller newsletters provide ongoing updates, helping businesses maintain compliance effortlessly. Regularly reviewing changes ensures that your submissions are always accurate and timely.

Your support network: contacting pdfFiller

For any further assistance with the Statement of Gross Intrastate Form, pdfFiller offers various customer support options. Users can access tutorials to help guide them through the process or address specific inquiries.

Community forums and user groups are also excellent resources, where potential problems can be discussed with other users and solutions can be exchanged. pdfFiller not only empowers document management but also fosters a community focused on collaboration and knowledge-sharing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my statement of gross intrastate directly from Gmail?

Where do I find statement of gross intrastate?

Can I create an eSignature for the statement of gross intrastate in Gmail?

What is statement of gross intrastate?

Who is required to file statement of gross intrastate?

How to fill out statement of gross intrastate?

What is the purpose of statement of gross intrastate?

What information must be reported on statement of gross intrastate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.