Get the free NEW SALES TAX ACCOUNTS 6/1-6/30 - Fort Collins

Get, Create, Make and Sign new sales tax accounts

Editing new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

Navigating the New Sales Tax Accounts Form: A Comprehensive How-To Guide

Understanding the new sales tax accounts form

Sales tax accounts are essential for businesses to manage their tax obligations to state and local governments. This form enables businesses to register and collect sales tax on taxable sales. The distinction between sales tax and use tax is crucial; sales tax is charged at the point of sale, while use tax applies to goods purchased out of state and brought into a state where sales tax is owed. Understanding these concepts is vital for compliance and accurate reporting.

The need for a new sales tax accounts form has arisen from recent legislative changes aimed at simplifying tax processes and enhancing compliance. This revised form is critical for both businesses and individuals, as non-compliance can lead to penalties and increased scrutiny from tax authorities.

Key features of the new sales tax accounts form

The new sales tax accounts form includes significant revisions compared to its predecessor. Notably, it offers a streamlined format that reduces redundancy and addresses clarity issues that previously puzzled users. Added fields now require specific business identification numbers and updated financial data to better assess tax liabilities.

Accessibility has also been enhanced through technology integration. The new form is compatible with both mobile and desktop platforms, allowing users to complete it anywhere, enhancing user experience across devices.

Preparing to fill out the new sales tax accounts form

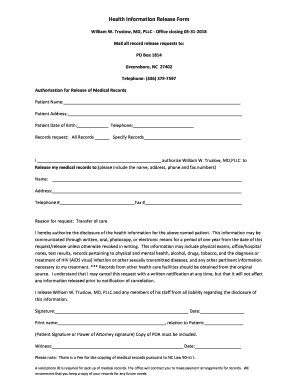

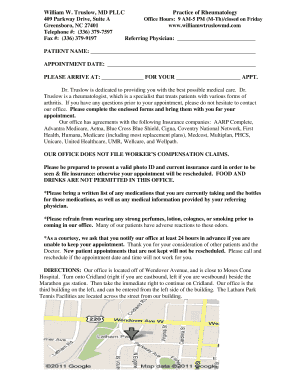

Before filling out the new sales tax accounts form, you should gather all necessary documentation. This typically includes a valid business license, federal Employer Identification Number (EIN), and personal identification such as a driver’s license or state ID. If you operate under a different name (DBA), it's essential to have that documentation ready as well.

It's important to note the qualifying criteria for those who need to fill out the new form. Generally, any business that sells tangible goods or taxable services in a state must complete the form, although specific requirements may vary across jurisdictions.

Step-by-step instructions for completing the new sales tax accounts form

Completing the new sales tax accounts form can be straightforward if you follow these detailed instructions. The form is divided into various sections, each addressing specific information.

Common mistakes include omitting required fields and mismatches in identification details. Regularly proofreading your entries can avoid these issues and expedite the approval process.

Interactive tools and resources

Utilizing online tools can significantly streamline the process of filling out the new sales tax accounts form. pdfFiller offers several features that enhance the user experience.

Submitting the new sales tax accounts form

After completing the new sales tax accounts form, submitting it accurately is crucial. There are several submission methods available.

Tracking your submission is essential. Keeping a copy of your form and any confirmation emails allows you to verify receipt and status updates efficiently.

Managing your sales tax account post-submission

Once submitted, monitoring your sales tax account becomes a priority. Regularly check for updates on your tax obligations to avoid surprises and stay compliant with state requirements.

Should you need to make amendments, keep abreast of any changes related to your business structure, as this may affect your sales tax account. Familiarity with potential appeal processes can also be crucial for disputes.

Frequently asked questions about the new sales tax accounts form

Several questions frequently arise concerning the new sales tax accounts form. Understanding these can save time and reduce confusion.

Navigating resources and support

Access to reliable resources is invaluable when navigating the new sales tax accounts form. pdfFiller offers a myriad of taxpayer resources to assist users.

Real-world applications and case studies

Real-world applications provide valuable insights into how various businesses have adapted to the new sales tax accounts form. Companies across diverse industries have reported successful experiences by effectively utilizing pdfFiller.

Learning from these examples emphasizes the importance of adapting swiftly to changes in forms and regulations, thereby ensuring compliance and operational efficiency.

Looking ahead: Future changes to sales tax regulations

As technology continues to evolve, ongoing changes to sales tax regulations are anticipated. Future modifications may revolve around digital sales and marketplace facilitators, which will require businesses to stay informed.

Preemptively preparing for such changes can ease transitions and mitigate compliance risks, fostering a smoother operation for businesses across all sectors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new sales tax accounts?

How do I make edits in new sales tax accounts without leaving Chrome?

Can I sign the new sales tax accounts electronically in Chrome?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.