Get the free New Accounts Report

Get, Create, Make and Sign new accounts report

Editing new accounts report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new accounts report

How to fill out new accounts report

Who needs new accounts report?

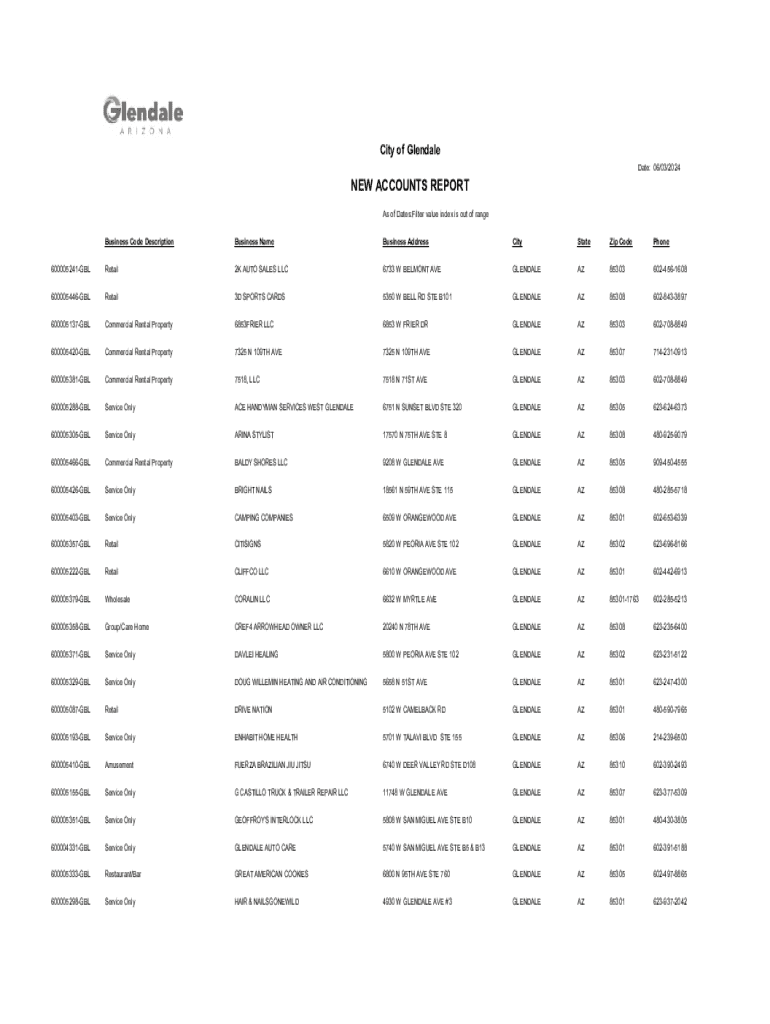

Comprehensive Guide to the New Accounts Report Form

Overview of the new accounts report form

The new accounts report form serves as a critical tool for individuals and businesses alike, facilitating the registration of new financial accounts within financial institutions. Its primary purpose is to provide a structured method for reporting essential account details, ensuring compliance with various regulatory standards. This is particularly crucial in industries heavily governed by financial regulations, such as banking and finance.

Understanding the importance of the new accounts report form helps stakeholders maintain financial accountability. Compliance is not just an organizational requirement; it plays a significant role in trust-building with customers. Financial institutions must ensure accurate reporting to adhere to legal standards, protecting both the institution and the consumer. Therefore, employees within banks, credit unions, and other financial entities should familiarize themselves with this form to facilitate smooth financial operations.

Understanding the components of the new accounts report form

The new accounts report form consists of various sections designed to gather all necessary data to ensure comprehensive account documentation. Each component plays a vital role in providing financial institutions with personal and account-specific information that aids in the establishment of new accounts.

The components can be broken down as follows:

In addition to these key sections, the form includes an OMB control number, which is essential for tracking and managing the document within federal regulations, as it denotes approval by the Office of Management and Budget.

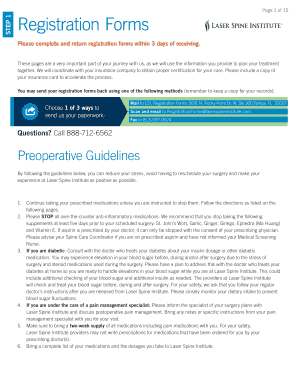

Step-by-step instructions for filling out the new accounts report form

Filling out the new accounts report form properly is crucial for timely processing. Here’s a step-by-step walkthrough to guide you through the process:

Interactive tools for completing the new accounts report form

To enhance the experience of completing the new accounts report form, many institutions leverage technology. Online fillable forms allow users to enter information directly into digital fields, minimizing the chances of errors.

Additionally, eSigning capabilities provided by platforms like pdfFiller streamline the process by enabling secure electronic signatures without the need to print or fax documents. Collaboration tools allow teams to easily work together on the form, share insights, and ensure accuracy.

Managing and tracking your new accounts report submission

Keeping records of your new accounts report submission is an essential practice to ensure accountability and facilitate future inquiries. Start by saving a copy of the submitted form either digitally or in a physical format.

Monitoring the status of your submission can often be done through your financial institution's online portal. Regular checks can help you quickly address any issues or additional requests that may arise during processing.

Frequently asked questions (FAQs) about the new accounts report form

As you navigate filling out the new accounts report form, you may encounter common questions or concerns. Understanding these can alleviate stress and clarify the process.

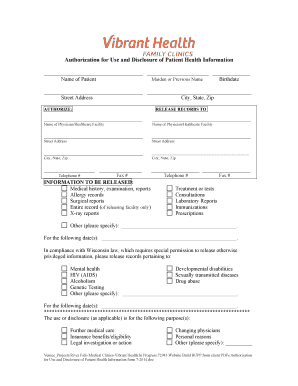

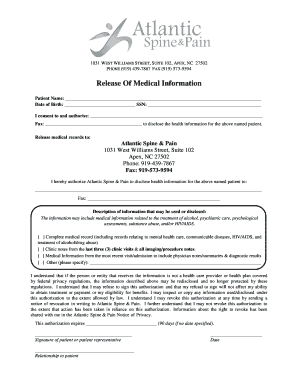

Security and privacy considerations

When filling out the new accounts report form, safeguarding your personal information is crucial. Avoid providing sensitive information through unsecured channels. Always utilize secure and encrypted platforms, like pdfFiller, to protect your data from unauthorized access.

pdfFiller prioritizes document security, ensuring that your information is kept confidential at all times while utilizing their feature-rich platform for managing and submitting forms.

Related forms and templates in financial reporting

Alongside the new accounts report form, there are various other documents that may be necessary for financial reporting. Understanding these related forms can streamline your overall financial management.

Legal and compliance measures

When utilizing the new accounts report form, adhering to legal and compliance measures is not just best practice; it's necessary for protecting both the institution and the consumer. Financial institutions are obligated to maintain precise records, and any inaccuracies in submissions can lead to regulatory penalties.

Understanding the potential impact of incorrect submissions helps both consumers and organizations mitigate risks associated with financial reporting.

Success stories: How pdfFiller improved reporting efficiency

Many users have experienced significant improvements in their workflows after adopting pdfFiller for managing the new accounts report form. User testimonials frequently highlight the platform's ease of use, which enables them to complete forms faster and with fewer errors.

Case studies reveal decreased processing times and enhanced team collaboration as a result of utilizing pdfFiller’s collaborative features and eSigning capabilities, leading to an overall boost in reporting efficiency.

Additional features of pdfFiller that enhance document management

pdfFiller offers sophisticated integrations with other tools and platforms, making it an excellent choice for comprehensive document management solutions. These integrations allow users to streamline their document workflows and enhance productivity in managing financial forms.

Additionally, users can access tutorials that demonstrate how to maximize pdfFiller features, allowing them to configure their account management practices effectively and efficiently.

Community and support resources

For additional help regarding the new accounts report form, users can access various support resources. pdfFiller provides a dedicated help section with articles and tutorials addressing common questions.

Moreover, community forums allow users to exchange advice and tips, transforming the platform experience into an interactive learning opportunity where individuals can gain insights from one another.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete new accounts report online?

How do I edit new accounts report online?

How do I fill out new accounts report using my mobile device?

What is new accounts report?

Who is required to file new accounts report?

How to fill out new accounts report?

What is the purpose of new accounts report?

What information must be reported on new accounts report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.