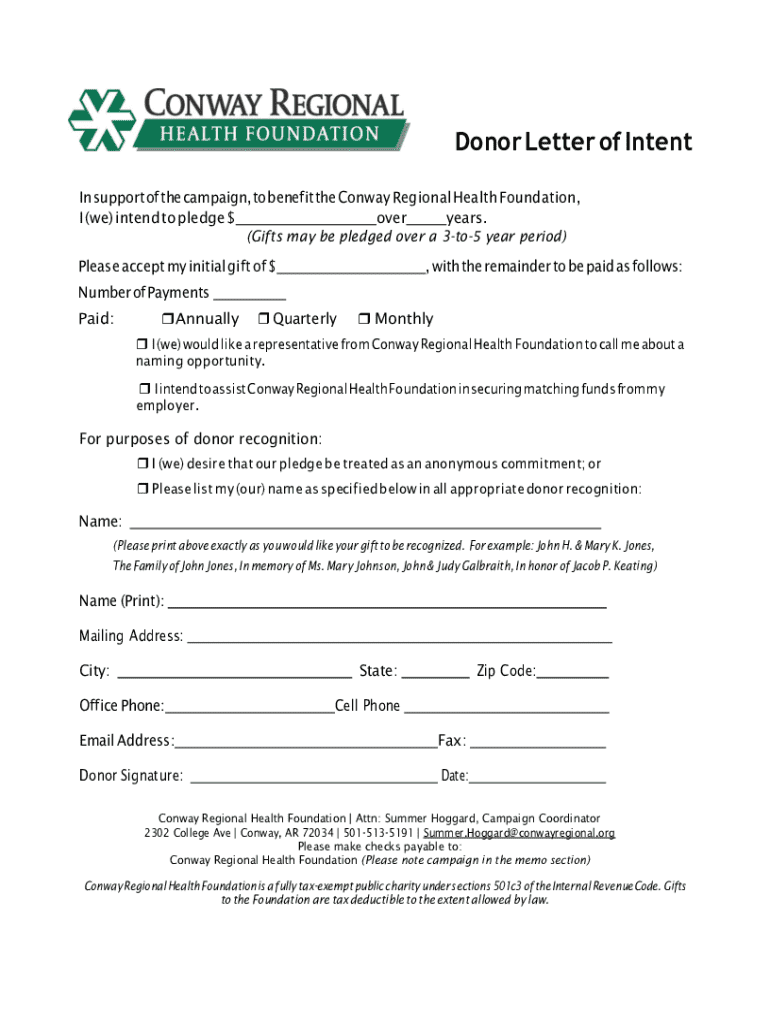

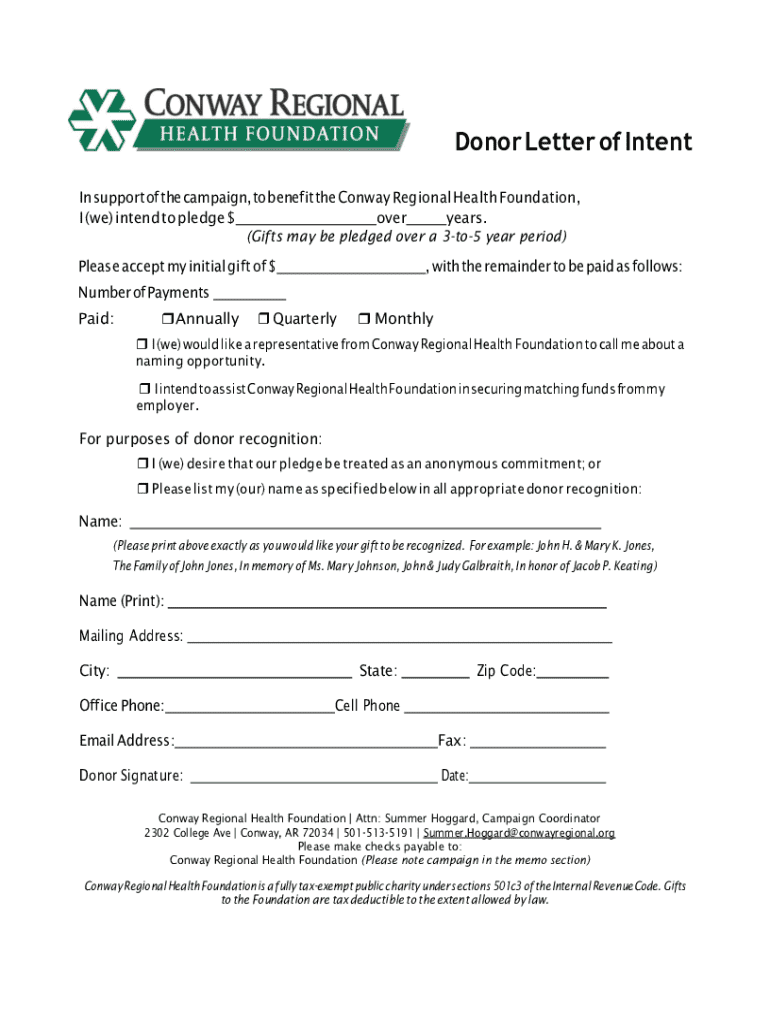

Get the free Donor Letter of Intent

Get, Create, Make and Sign donor letter of intent

How to edit donor letter of intent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out donor letter of intent

How to fill out donor letter of intent

Who needs donor letter of intent?

A comprehensive guide to the donor letter of intent form

Understanding the donor letter of intent

A donor letter of intent (LOI) serves as a critical document in philanthropic environments, expressing a donor's commitment to providing financial support or resources to a specific cause or organization. Unlike a formal donation agreement, an LOI outlines the donor's intentions clearly, paving the way for further discussions and formalities. It can be seen as a prelude to a more detailed contract involving legal obligations.

The importance of a letter of intent in philanthropic activities cannot be overstated. It helps both parties establish a mutual understanding of the donation, which is vital for ensuring that the funds are utilized as intended. Key differences between an LOI and other donation documents include its intent-focused nature rather than being purely transactional, thereby highlighting the donor’s values and objectives.

Purpose and significance of a donor letter of intent

The primary purpose of a donor letter of intent is to clarify the intended use of donations. By outlining how the funds or resources will be applied, the LOI sets clear expectations for the recipient organization. This enables them to align their activities with the donor’s goals, thereby enhancing the potential for impactful philanthropy.

Moreover, an LOI establishes ethical and legal foundations for donations. It indicates that the donor has carefully considered their contribution and wishes to ensure that it is used appropriately. By enhancing transparency between the donor and recipient, the LOI fosters trust and accountability, essential for ongoing relationships in the philanthropic space.

Essential components of a donor letter of intent

A donor letter of intent should include several pivotal components to be effective. Identification of the parties involved is crucial, ensuring that both the donor and the recipient are clearly defined. The letter should also explicitly state the purpose of the donation, detailing how the funds or resources will be utilized in alignment with the donor's mission.

Furthermore, it is important to detail the type of donation — be it monetary, property, or services. Including acceptance dates and deadlines is also vital for setting a timeline for the donation process. Beyond this, expectations for recognition and acknowledgment of the donation need to be addressed, alongside any legal and tax considerations pertinent to the donor.

Step-by-step guide to completing the donor letter of intent form

Completing a donor letter of intent form can seem daunting, but by following these steps, donors can create a comprehensive and effective document.

Common challenges and legal implications of a donor letter of intent

One of the common challenges associated with a donor letter of intent is addressing possible changes in donor intentions. Situations may arise where a donor's circumstances change, prompting them to alter or withdraw their commitment. It is crucial for both donors and recipients to recognize and address these potential changes proactively to minimize misunderstandings.

Dealing with non-compliance from recipients can pose another challenge. Recipients need to adhere strictly to the letter of intent, and any failure to comply can lead to conflicts and potential legal repercussions. Understanding the legal binding nature of the LOI is essential, as it can have significant implications should disputes arise.

Frequently asked questions about the donor letter of intent

Several questions often arise regarding donor letters of intent. For instance, what should be done if a donor's intent cannot be honored? Typically, open communication between both parties can lead to resolving such issues amicably. Donors frequently wonder if they can specify how their donation should be utilized, and the answer is typically yes, provided the details are clearly articulated in the letter.

Additionally, ensuring the tax-deductibility of a donation is a common concern. Donors should seek legal advice to confirm that their LOI aligns with tax laws. Lastly, what happens if the intended program or purpose changes? This emphasizes the need for flexibility within the LOI, allowing for necessary adjustments while still retaining the core intent behind the donation.

Benefits of utilizing a donor letter of intent

The utilization of a donor letter of intent offers numerous benefits. Firstly, it facilitates clear communication, enabling both parties to articulate their expectations and minimize the chances of misinterpretation. A well-structured LOI builds trust between donors and organizations, reinforcing relationships founded on transparency and mutual goals.

Moreover, establishing a framework for future contributions promotes ongoing engagement. It simplifies the process of donation management by delineating clear responsibilities and expectations, making it easier for both donors and recipients to manage their philanthropic endeavors effectively.

Sample donor letter of intent

A sample donor letter of intent provides a practical reference for those looking to create their own. A comprehensive LOI includes essential sections like donor and recipient information, the purpose of the donation, and details regarding acknowledgment. Each section should be tailored to fit the specific circumstances surrounding the donation. To customize, think about the specific intentions you have, the context of the donation, and how best to express this.

Annotations on important sections can guide users through why certain components hold significance. For instance, articulating the intended use of funds enables organizations to allocate resources effectively and remain accountable to the donor.

Automation and management of your donation documentation

Amidst the influx of digital tools, leveraging an automated platform like pdfFiller for managing your donor letter of intent comes with significant advantages. Users can easily edit, eSign, and collaborate on their documents within a cloud-based environment. This is especially valuable for groups working simultaneously on philanthropic projects, as it streamlines the process and reduces the chances of errors.

Interactive tools within pdfFiller also simplify the documentation of donation processes, allowing users to focus more on impactful giving and less on administrative tasks. Quick access to versatile functionalities aids in maintaining organized, paperless documentation.

Explore related forms and resources

Beyond the donor letter of intent, various other important documents enhance non-profit donations. These can include donation agreements, contracts, and financial accountability forms, each serving specific purposes within the broader framework of philanthropic giving. By understanding these documents, donors can navigate the complexities of giving with greater confidence.

Links to these forms provide clarity on the various components of the donation process. Additional use cases for LOIs can emerge in different donation contexts, ensuring that users remain adaptable and informed as they engage in their charitable endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find donor letter of intent?

Can I create an electronic signature for the donor letter of intent in Chrome?

How do I edit donor letter of intent on an Android device?

What is donor letter of intent?

Who is required to file donor letter of intent?

How to fill out donor letter of intent?

What is the purpose of donor letter of intent?

What information must be reported on donor letter of intent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.