Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

A Comprehensive Guide to Form 10-K

Overview of Form 10-K

Form 10-K is a comprehensive report filed annually by publicly traded companies with the U.S. Securities and Exchange Commission (SEC). This document provides a detailed overview of a company's financial performance, business operations, and risk factors. It is crucial for investors, analysts, and regulators seeking a thorough understanding of a company's financial condition and operational strategy.

Serving multiple purposes, the 10-K fosters transparency in corporate governance, helping to maintain investor trust and market integrity. Investors rely on the information provided in the Form 10-K to make informed decisions about purchasing, holding, or selling a company’s stock. Additionally, analysts utilize these reports to conduct more profound financial analyses and generate ratings and recommendations.

Structure of Form 10-K

Form 10-K is divided into four primary parts, each providing specific information that is critical for users assessing a company. This structured approach ensures that stakeholders can easily navigate through the report to find pertinent information.

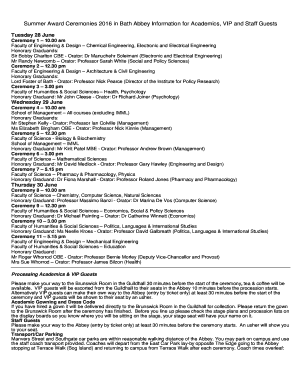

Filing deadlines for Form 10-K

Publicly traded companies are required to file their Form 10-K within a specific time frame following the end of their fiscal year. Generally, large accelerated filers must submit their filings within 60 days, while accelerated filers have 75 days, and smaller reporting companies have 90 days. Timely filings ensure that investors have access to up-to-date information, which is vital for making informed investment decisions.

Failure to file by the deadline can result in various consequences including potential fines and a loss of investor confidence. Companies may also face regulatory scrutiny, which can negatively impact their market reputation and share price.

How to prepare Form 10-K

Preparing a Form 10-K is no small task. It requires meticulous gathering of data and collaboration among various internal teams. Here’s a systematic guide to streamline this process.

Tips for filling out Form 10-K

Filling out Form 10-K can be daunting, but a focused approach can help in navigating common pitfalls. Key considerations include being thorough in disclosures and aligning language with SEC requirements.

Editing and reviewing Form 10-K

The editing phase is crucial for ensuring the accuracy and clarity of the Form 10-K. A collaborative review process can significantly enhance the quality of disclosures.

Utilizing pdfFiller, teams can seamlessly engage in review cycles by utilizing its eSignature and approval workflows. This ensures that feedback is efficiently addressed and revisions are made timely, allowing for a polished final submission.

Managing your Form 10-K post-filing

After filing, maintaining records and managing updates is essential for compliance and future reference. Companies should keep organized archives of their filings for easy retrieval.

Moreover, it’s important to track changes in the regulatory landscape and compare each annual filing. Being proactive allows companies to respond adeptly to any SEC inquiries or comments, thus maintaining a good standing with regulators.

Related forms and resources

In addition to Form 10-K, companies often file other forms with the SEC, such as 10-Q and 8-K. Each of these documents serves distinct purposes within the regulatory framework.

Interactive tools and resources on pdfFiller

pdfFiller stands out for its interactive tools designed for document customization. These tools facilitate the process of filling out important forms like Form 10-K, allowing users to streamline their workflows.

External links and further reading

For those looking to deepen their understanding of Form 10-K and related regulatory requirements, a variety of resources are available. The SEC website offers numerous forms and regulations relevant to corporate disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-k from Google Drive?

Can I create an electronic signature for the form 10-k in Chrome?

How do I edit form 10-k straight from my smartphone?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.