Get the free Financial Disclosure Statement for Public Employees

Get, Create, Make and Sign financial disclosure statement for

Editing financial disclosure statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement for

How to fill out financial disclosure statement for

Who needs financial disclosure statement for?

Financial Disclosure Statement for Form: A Comprehensive Guide

Understanding financial disclosure statements

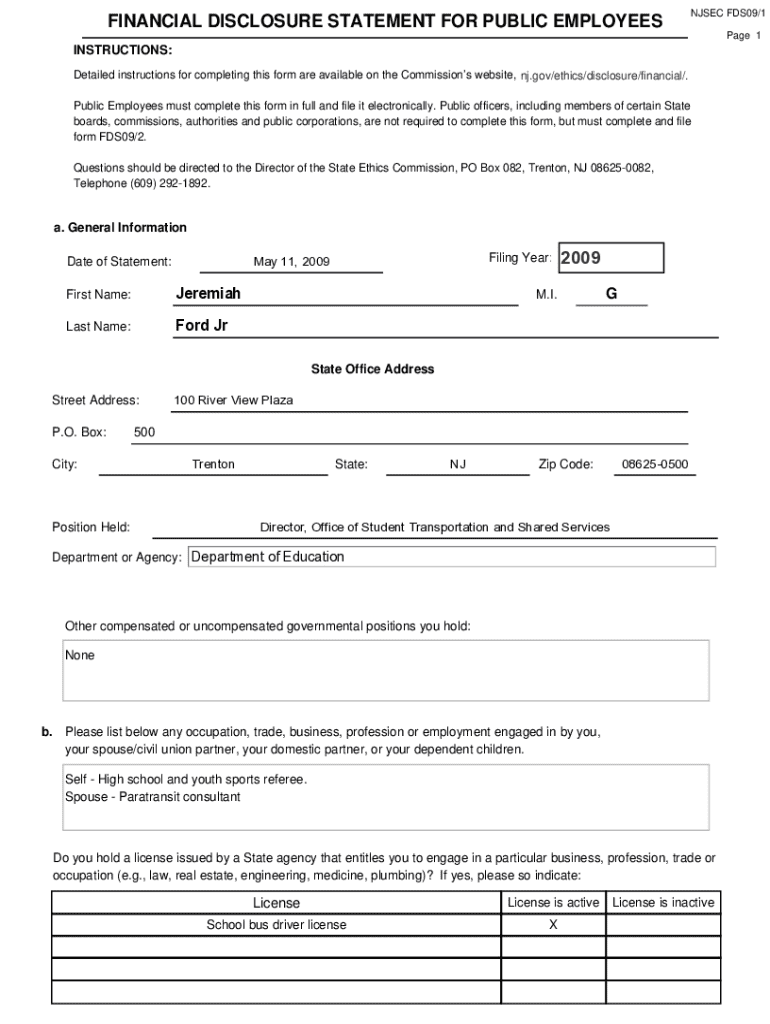

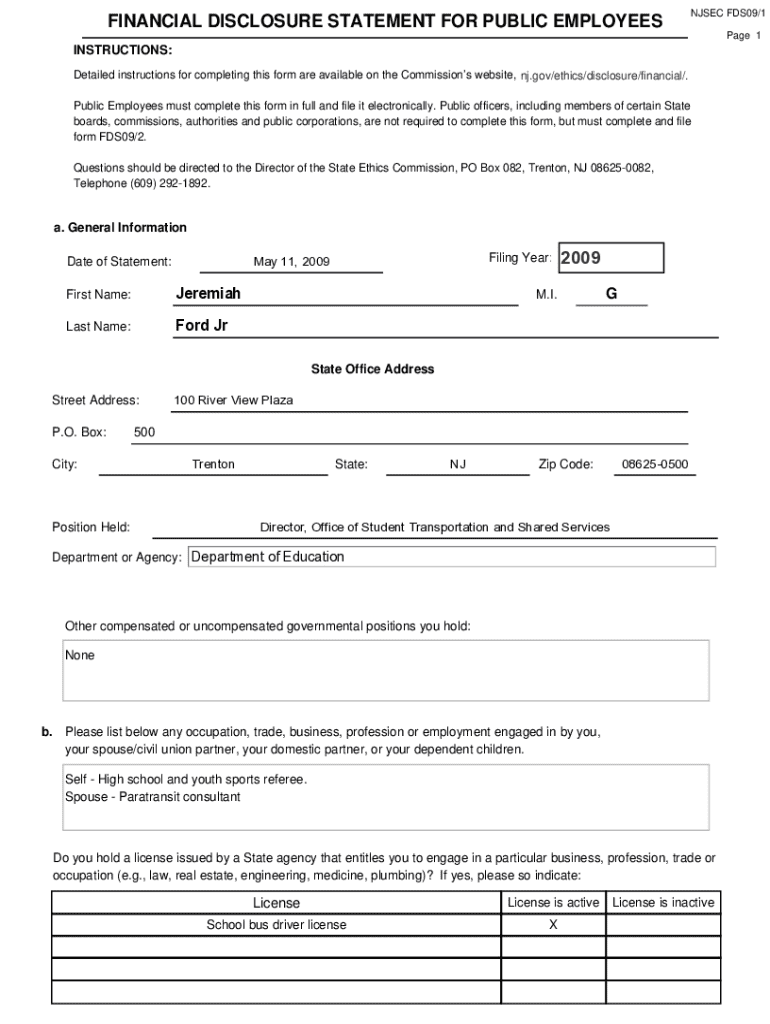

A financial disclosure statement for form is a crucial document that outlines an individual's financial status, including assets, liabilities, income sources, and other financial interests. These statements are typically a requirement for various sectors, such as government officials, corporate executives, and certain nonprofit organizations, to ensure transparency and accountability in financial dealings.

The importance of financial disclosures cannot be overstated; they help prevent conflicts of interest, maintain public trust, and promote ethical standards. These statements are especially vital in government and public service positions where decisions can have significant financial implications for the public.

Typically, individuals required to submit these statements include elected officials, federal employees, and certain contractors and grantees. Understanding the requirements associated with these disclosures is critical for compliance.

Types of financial disclosure statements

Financial disclosure statements can broadly be categorized into public financial disclosures and confidential financial disclosures. Public disclosures are available for public scrutiny, while confidential disclosures are protected from public access but are still subject to oversight by regulatory agencies.

Different agencies may have specific forms tailored to their requirements. For example, the U.S. Office of Government Ethics (OGE) provides forms such as OGE Form 278, a comprehensive public disclosure form required for certain federal employees, and OGE Form 450, which is a confidential financial disclosure form used by employees who do not occupy policy-making positions.

Key components of a financial disclosure statement

A financial disclosure statement for form must include several critical elements. The required information generally covers a range of financial details, such as assets and liabilities, income sources, as well as any gifts and reimbursements received during the reporting period.

Assets may include anything from real estate holdings to stocks, while liabilities encompass loans and debts. It's essential to disclose all income sources, whether from employment, investments, or other ventures, along with any gifts or reimbursements exceeding a predefined threshold.

Using accurate terminology is essential for clarity. Terms like 'fair market value' must be understood to ensure that all financial entries are recorded correctly. Providing complete and truthful information is not only a regulatory requirement but also an ethical obligation.

Step-by-step guide to completing the financial disclosure statement

Completing the financial disclosure statement can seem daunting, but by following a structured approach, you can ensure that you've accurately reported all necessary information. This process can typically be broken down into several phases.

First, in the preparation phase, gather all relevant financial documents and information, such as bank statements, investment account summaries, and debt obligations. Before filling out the form, familiarize yourself with your agency's specific requirements and any pertinent deadlines.

Next, start filling out the form with detailed attention to each section. When reporting assets, include all items of value and ensure they are properly valued. Disclosing income requires careful consideration of all sources, and documenting gifts and reportable reimbursements is equally important for compliance.

Finally, thoroughly review your completed statement to verify accuracy, and if possible, have a peer review it as well. Once you're confident in the information provided, submit the form according to your agency's guidelines, whether through electronic submission or paper submission methods.

Managing your financial disclosure statement

Managing your financial disclosure statement is an ongoing responsibility. Best practices include maintaining organized financial records and regularly updating your disclosure whenever your financial circumstances change. Ensure you document all assets, liabilities, and income accurately and retain copies of the submitted statements for future reference.

Updating your disclosure typically occurs during specific reporting periods or when significant financial changes happen, such as a primary stock investment or property sale. You'll also need to adhere to any retention schedules dictated by your agency for documentation-related to financial disclosures.

Common errors and how to avoid them

Completing a financial disclosure statement can lead to common errors that may result in complications or potential penalties. Understanding these pitfalls can help you avoid making mistakes in your financial disclosures.

One frequent mistake is the omission of required information, such as forgetting to report specific assets or income sources. Another common misstep is inaccurately valuing assets or not disclosing gifts appropriately. It's vital to take time to double-check information and ensure that all aspects of the statement are complete.

To mitigate these risks, develop a consistent process for financial record-keeping. Schedule regular reviews of your financial situation, and remain proactive about understanding your agency’s requirements to prevent omissions or inaccuracies in your disclosures.

Resources for assistance

When navigating the complexities of financial disclosure statements, having access to the right resources can simplify the process. One excellent tool for form management is pdfFiller, which allows users to create, edit, and manage forms easily from any device, ensuring that you can maintain compliance regardless of location.

Additionally, utilize support options available through pdfFiller, including FAQs, a Help Center, and responsive customer service. Networking with peers or seeking mentorship can also provide valuable insights and assistance in completing financial disclosure statements.

Legal and ethical considerations

Financial disclosure statements are governed by specific legal frameworks that aim to uphold transparency and ethical behavior in financial dealings. Agencies such as the U.S. Office of Government Ethics (OGE) establish regulations to ensure compliance among employees, highlighting the importance of ethical standards.

The principles behind financial transparency not only help in preventing corruption but also foster public trust by demonstrating accountability. Designated Agency Ethics Officials (DAEOs) are responsible for guiding employees through the disclosure process and ensuring compliance with ethical standards.

Keeping updated on changes in regulations

Regulatory changes can occur frequently, directly impacting the requirements surrounding financial disclosures. Staying informed on these updates is crucial for maintaining compliance and ensuring that your disclosures remain accurate.

Various resources, such as agency newsletters, legal bulletins, and professional ethics associations, can provide necessary updates on changes in policies related to financial disclosure statements. Engaging with community forums or attending workshops hosted by authorities may also offer insights into new regulations.

Frequently asked questions (FAQs)

Financial disclosure statements can raise many questions among those required to submit them. Common queries often include general inquiries regarding what constitutes a disclosure, the differences between various form types, and specifics about completing and submitting forms.

Understanding the nuances of agency policies can also be a concern. Therefore, having access to FAQs that address typical issues can provide clarity and ease the submission process. Carefully reviewing agency guidance can help dispel uncertainties and facilitate compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in financial disclosure statement for?

Can I create an electronic signature for signing my financial disclosure statement for in Gmail?

How do I edit financial disclosure statement for straight from my smartphone?

What is financial disclosure statement for?

Who is required to file financial disclosure statement for?

How to fill out financial disclosure statement for?

What is the purpose of financial disclosure statement for?

What information must be reported on financial disclosure statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.