Get the free Business and Financial Management Policies

Get, Create, Make and Sign business and financial management

How to edit business and financial management online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business and financial management

How to fill out business and financial management

Who needs business and financial management?

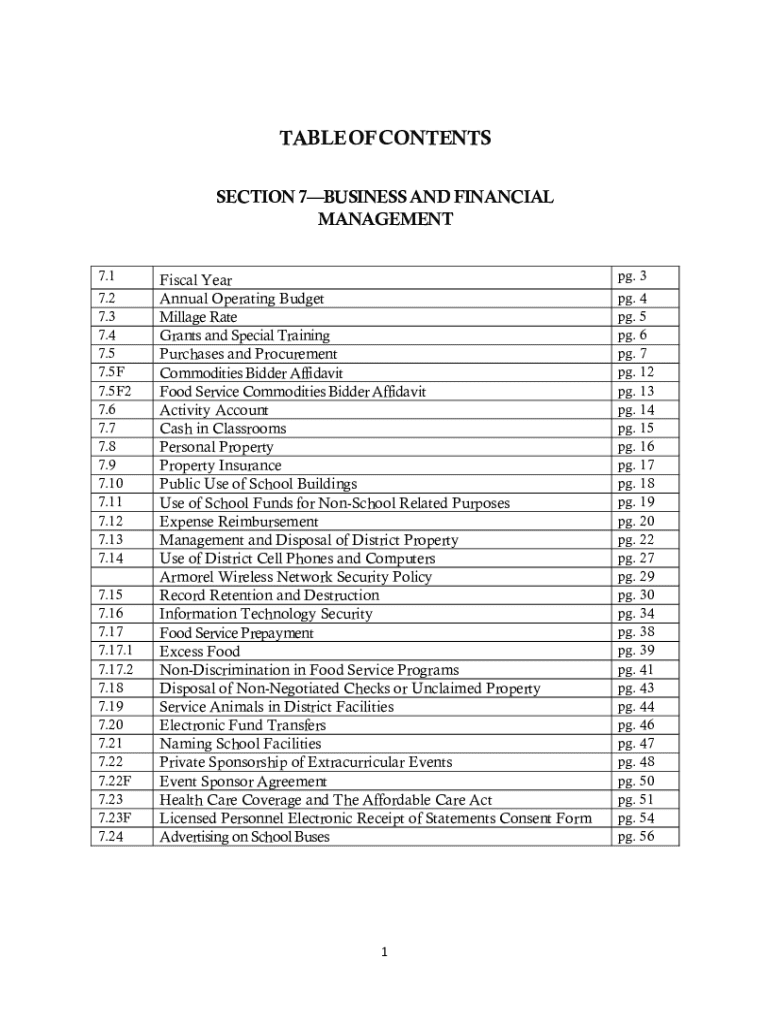

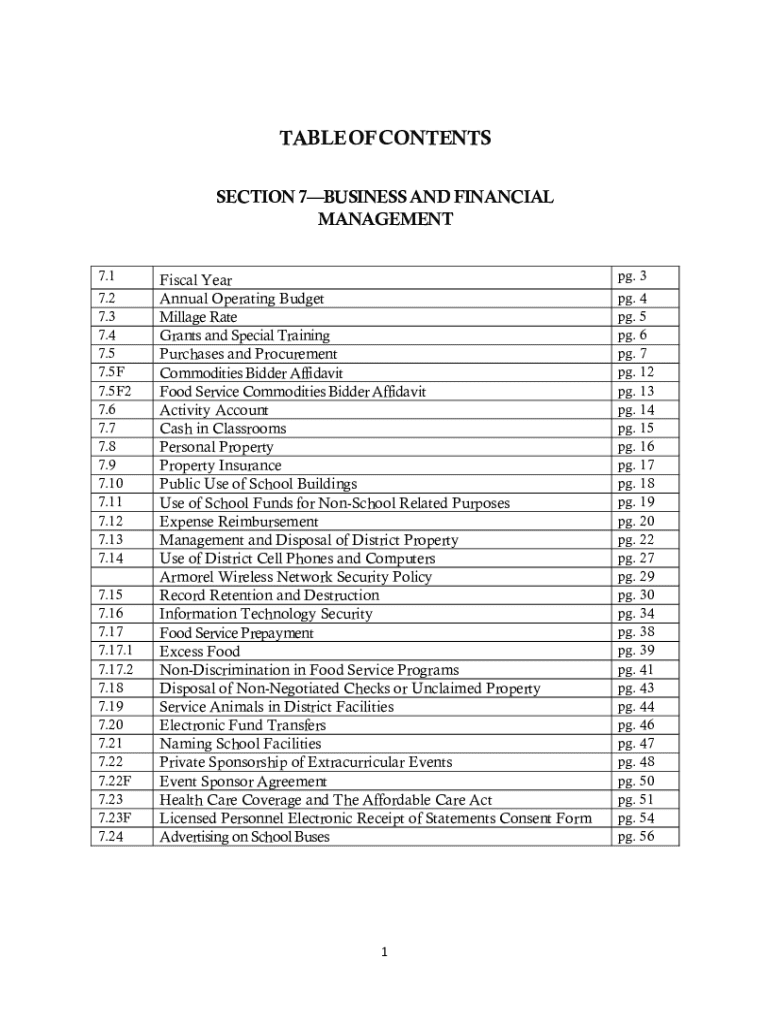

Comprehensive Guide to Business and Financial Management Forms

Understanding business and financial management forms

Business and financial management forms are essential tools that facilitate effective decision-making and planning in any organization. They provide a structured means to track financial activities, plan budgets, and document important processes. By using the right forms, businesses can improve transparency, accountability, and overall operational efficiency.

In terms of categories, business forms can be broadly categorized into operational, financial, and compliance forms. Operational forms help with daily tasks, financial forms manage fiscal activities, and compliance forms ensure adherence to regulations. Collectively, these forms aid in achieving business goals and maintaining healthy financial practices.

Frequently requested business forms

Every enterprise, regardless of size, relies on essential forms to manage day-to-day operations. One of the most critical types of forms is the business plan template, which serves as a roadmap for future growth. Additionally, financial projection worksheets can clarify expected revenues and expenses, while expense tracking sheets help monitor cash flow.

Collaboration within teams also necessitates specific forms. Project management templates organize tasks and timelines, while meeting minutes templates provide a record of discussions and decisions, enhancing accountability and follow-ups.

Specific business and financial management forms

A monthly cash flow plan is vital for any business, providing a clear view of incoming and outgoing funds. This plan not only helps ensure liquidity but also informs future business decisions. To create one, begin by listing all expected income sources followed by all anticipated expenses. Regular updates help refine this plan.

Budgeting templates, such as a quick-start budget and an allocated spending plan, are crucial for precise financial management. These tools help you allocate funds effectively based on priorities and historical spending patterns, making them indispensable in financial planning.

Specialized financial management tools

Debt management forms are essential for individuals and businesses managing multiple debts. Techniques like the debt snowball strategy can help users systematically pay off smaller debts first, thereby gaining momentum and motivation. Accompanying this, credit card history trackers monitor debt status and payment schedules.

Additionally, financial planning widgets such as an irregular income planning tool help users budget in months with variable income, while monthly retirement planning checklists lay the groundwork for future financial security.

Effective document management

Effective document management is key to optimizing operations and ensuring efficiency in managing business and financial management forms. Using PDF tools can significantly enhance this process. For instance, users can easily edit and customize templates to suit specific requirements. Best practices for eSigning include ensuring documents are signed by the appropriate stakeholders and keeping a streamlined record of signed contracts.

Furthermore, securely managing and storing financial documents is vital for safeguarding sensitive information. Cloud storage solutions offer excellent options for both security and accessibility, often featuring collaboration tools that increase team productivity.

Personalized financial management

Tailoring forms to fit the specific needs of your business is crucial. Personalization begins by assessing the unique requirements and processes of an organization and reflects in customized templates that optimize workflow. For example, when creating a comprehensive financial plan form, one should include sections for income sources, expenses, savings, and investment strategies.

When creating custom templates, focus on simplifying complex processes and ensuring that all necessary data points are included. This not only eases the process of filling out forms but also promotes consistency across documentation throughout the organization.

Overcoming common challenges in document management

Managing financial documents often comes with its set of challenges. Users frequently encounter issues with PDF editing, leading to frustrations during form completion. To mitigate these, utilize professional PDF editing tools that offer intuitive interfaces and comprehensive support. Common mistakes, such as omitting vital information or miscalculating data, can lead to compliance risks. Establishing a thorough review process before finalizing documents is essential.

Ensuring compliance and accuracy across all financial documents is of utmost importance, particularly in regulated industries. Creating checklists and employing automated tools can help maintain conformity and minimize errors, while also enhancing document quality.

Connecting with financial counseling services

When navigating complex financial challenges, seeking professional help can be invaluable. Financial counseling services provide expertise in budgeting, debt management, and business planning. Signs that indicate it’s time to seek help include overwhelming debt, poor cash flow management, or uncertainty about financial decisions.

To find support, consider accessing free business counseling resources available through local chambers of commerce or nonprofit organizations. Community support can also offer informal groups and workshops wherein individuals share strategies and solutions for effective financial management.

Innovations in business document solutions

Technological innovations in document management have transformed the way businesses handle paperwork. Solutions like pdfFiller enhance management practices by allowing users to quickly edit, collaborate on, and eSign documents from a centralized cloud platform. This streamlines operations and fosters better communication across teams.

Looking ahead, the future of financial document management will likely be influenced by advancements such as artificial intelligence and machine learning, promising even greater efficiencies through automation and predictive analytics in reporting and planning. As transparency and accuracy become paramount, innovative solutions will continue to define the landscape of document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business and financial management in Gmail?

How can I edit business and financial management from Google Drive?

How do I make changes in business and financial management?

What is business and financial management?

Who is required to file business and financial management?

How to fill out business and financial management?

What is the purpose of business and financial management?

What information must be reported on business and financial management?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.