Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

Editing beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary Designation Form - Comprehensive Guide

Understanding beneficiary designation forms

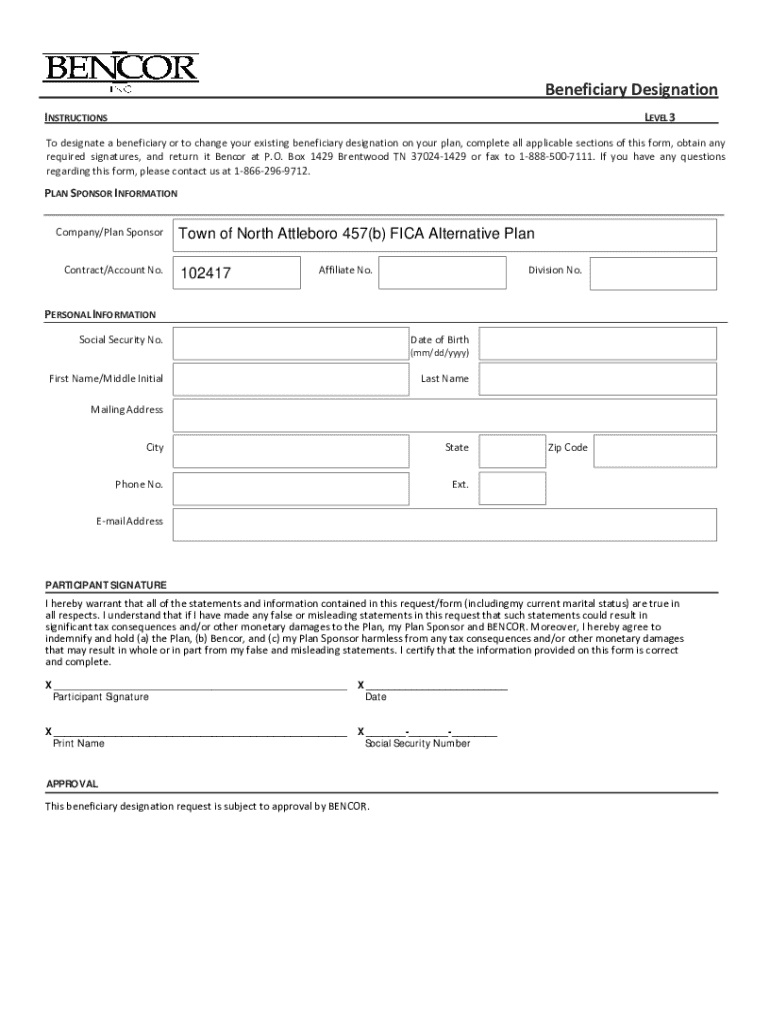

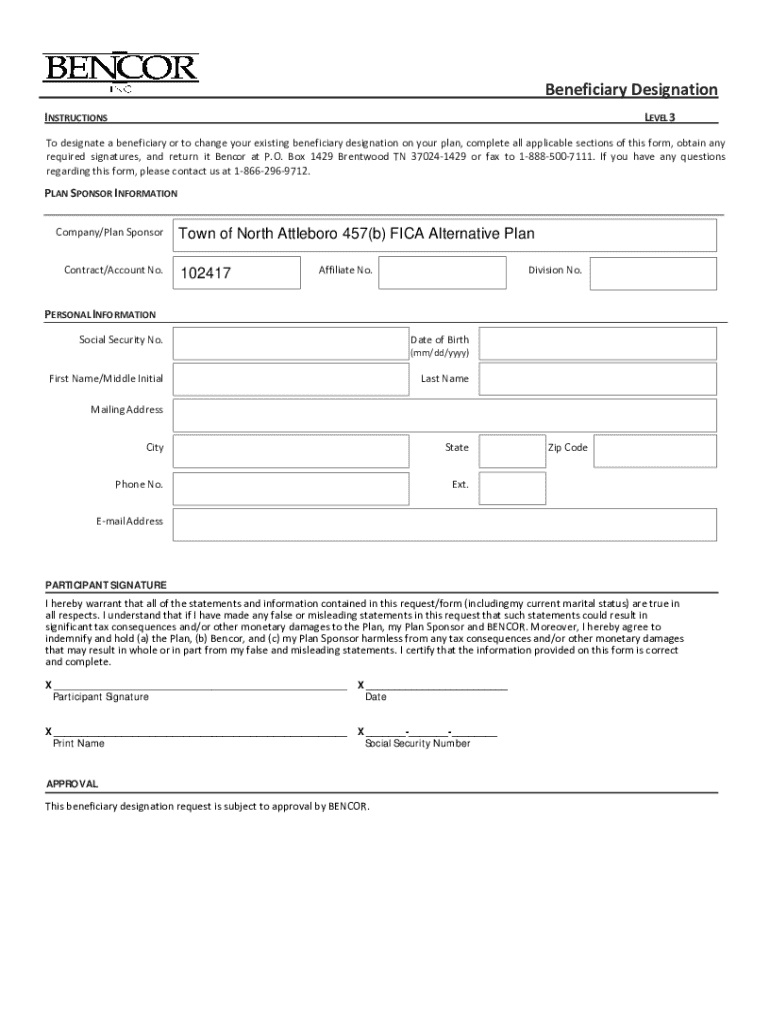

A beneficiary designation form is a crucial legal document that specifies who will receive assets from accounts such as life insurance, retirement plans, and bank accounts after your death. Its importance cannot be overstated; proper use of this form ensures that your assets are distributed according to your wishes, bypassing the often complicated probate process. In financial planning, these forms are as critical as drawing up a will, as they dictate the immediate distribution of your assets.

Understanding the key terminology associated with these forms is essential for effective document management. The term 'beneficiary' refers to the individual or entity designated to receive the assets. The 'designator' is the account holder who selects the beneficiaries. Beneficiaries can be primary, receiving the full benefit upon the account holder's passing, or contingent, stepping in if the primary beneficiary cannot inherit.

When should you use a beneficiary designation form?

Certain life events often necessitate updates to your beneficiary designation form. For instance, marriage or divorce can significantly affect your asset distribution plans, as the individuals you would have chosen previously may not reflect your current relationship status. Similarly, adding new family members such as children through birth or adoption means adjusting who will receive your assets in the future.

Changes in financial status can also trigger the need for updated designations. If you acquire significant assets or establish new accounts, it’s imperative to ensure that the designated beneficiaries are recorded. Several types of accounts require beneficiary designation forms, including retirement accounts like 401(k)s and IRAs, life insurance policies, as well as bank accounts and other financial assets.

How to fill out a beneficiary designation form

Filling out a beneficiary designation form accurately is essential for ensuring your wishes are fulfilled. First, gather all necessary personal information, including the full legal names and relationships to intended beneficiaries. Being meticulous here ensures there are no legal disputes later.

Next, carefully choose your beneficiaries. Tips for this include considering who you wish to benefit most from your assets and ensuring that the percentages allocated add up to 100%. Once you have chosen your beneficiaries, complete the form accurately, paying special attention to common mistakes such as misspellings, incorrect dates, or omitting a signature.

After filling out the form, take the time to review and confirm your designations. Confirming this information can save your beneficiaries from uncertainty or challenges in the future.

Editing and updating your beneficiary designation

It’s advisable to review your beneficiary designation form regularly, particularly following significant life changes. Changes such as marriage, divorce, or the birth of a child invariably impact your choices. Besides, it's wise to revisit your designations if your asset portfolio shifts, which can often happen after purchasing a new property or transferring accounts.

Accessing and modifying existing forms can be simplified through digital solutions like pdfFiller. This platform allows users to store important documents securely and make adjustments with ease. Utilizing such a digital tool not only helps keep your documentation organized but also enables you to manage all your forms from one cloud-based location.

Best practices for managing beneficiary designations

To ensure your wishes are honored, it’s crucial to communicate your intentions to your beneficiaries. Discussing your selections helps to avoid confusion and potential disputes among heirs. Additionally, secure storage of your beneficiary designation forms is vital. Keep them in a safe place and consider using a digital platform like pdfFiller for added accessibility and security.

Consulting with legal advisers, such as financial planners or estate attorneys, can provide valuable insights tailored to your unique situation. When your financial picture is complex, professional guidance can ensure that your beneficiary designations are legally sound and aligned with your overall estate planning objectives.

Interactive tools and features on pdfFiller

pdfFiller offers robust document editing capabilities that allow users to fill out, modify, and save beneficiary designation forms directly in a user-friendly environment. Seamless PDF editing tools let you easily input necessary information, while annotation options facilitate note-taking or reminders directly on the form.

The platform also features eSigning and collaboration tools, enabling secure signing of documents and sharing with financial advisors or family members without the hassle of physical paperwork. Organizing your beneficiary designation forms for easy access and management becomes effortless, which means you can focus more on your financial planning rather than document management.

Frequently asked questions (FAQs) about beneficiary designation forms

Many individuals have common queries regarding beneficiary designation forms. For example, you can name multiple beneficiaries on a form; just ensure that the percentages total 100%. Another frequent question is, 'What happens if a beneficiary predeceases you?' Typically, this will lead to the contingent beneficiary taking over, or if none exist, it will revert to the estate.

Additionally, some people wonder how a beneficiary designation intersects with a will. It's important to know that the assets designated via beneficiary forms will pass directly to the beneficiaries specified, regardless of what your will states. This can sometimes cause conflict if not managed correctly but reflects the power these forms hold in asset distribution.

Real-life scenarios and case studies

To illustrate the importance of correctly managing beneficiary designation forms, consider a family navigating changes after the unexpected death of a parent. They had updated the form to include their children just after the birth of their first child, ensuring his financial protection. This foresight avoided significant turmoil during an emotionally taxing time.

In another scenario, an individual focused on retirement planning needed an updated designation due to changing relationships. After a divorce, they consulted a financial advisor who helped property management and revised the beneficiary designations promptly, safeguarding their assets for intended family members.

Conclusion and additional insights

In summary, the beneficiary designation form is a pivotal tool in ensuring that your financial assets are transferred according to your precise wishes. Regular updates and proper maintenance can save your beneficiaries a great deal of anxiety and confusion during difficult times.

Utilizing a platform like pdfFiller enhances the management of your beneficiary designation forms, offering seamless document handling from anywhere, ensuring your desired outcomes are met efficiently and securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation to be eSigned by others?

How can I get beneficiary designation?

Can I edit beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.