Get the free Beneficiary Nomination

Get, Create, Make and Sign beneficiary nomination

Editing beneficiary nomination online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary nomination

How to fill out beneficiary nomination

Who needs beneficiary nomination?

A Comprehensive Guide to Beneficiary Nomination Form

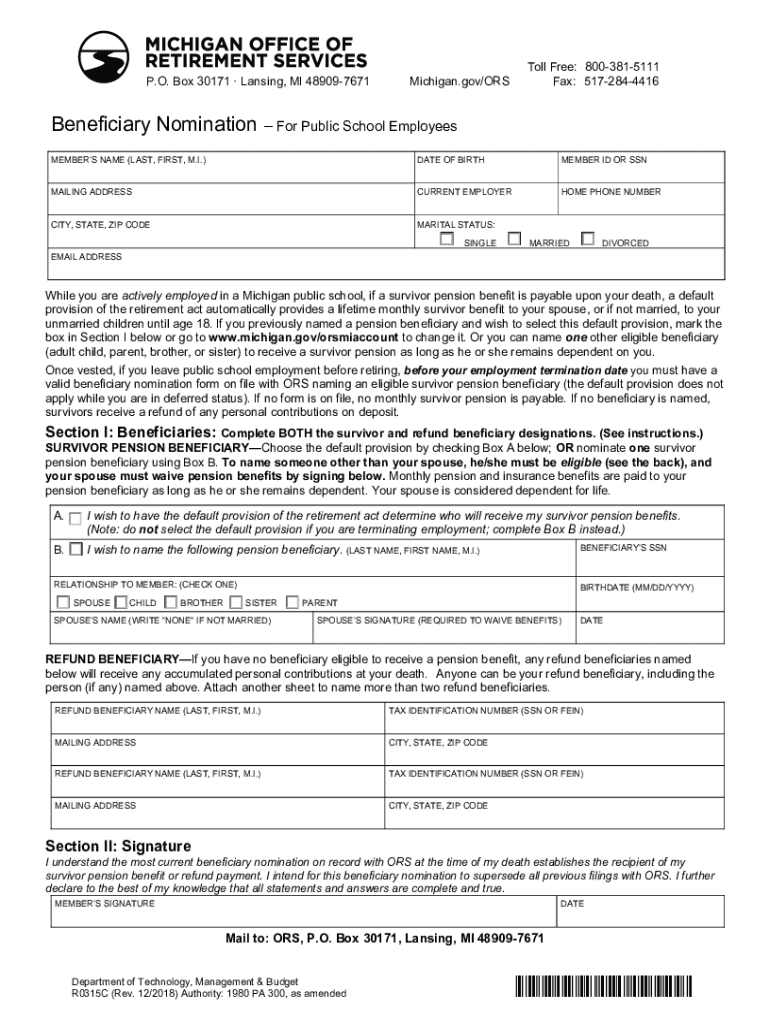

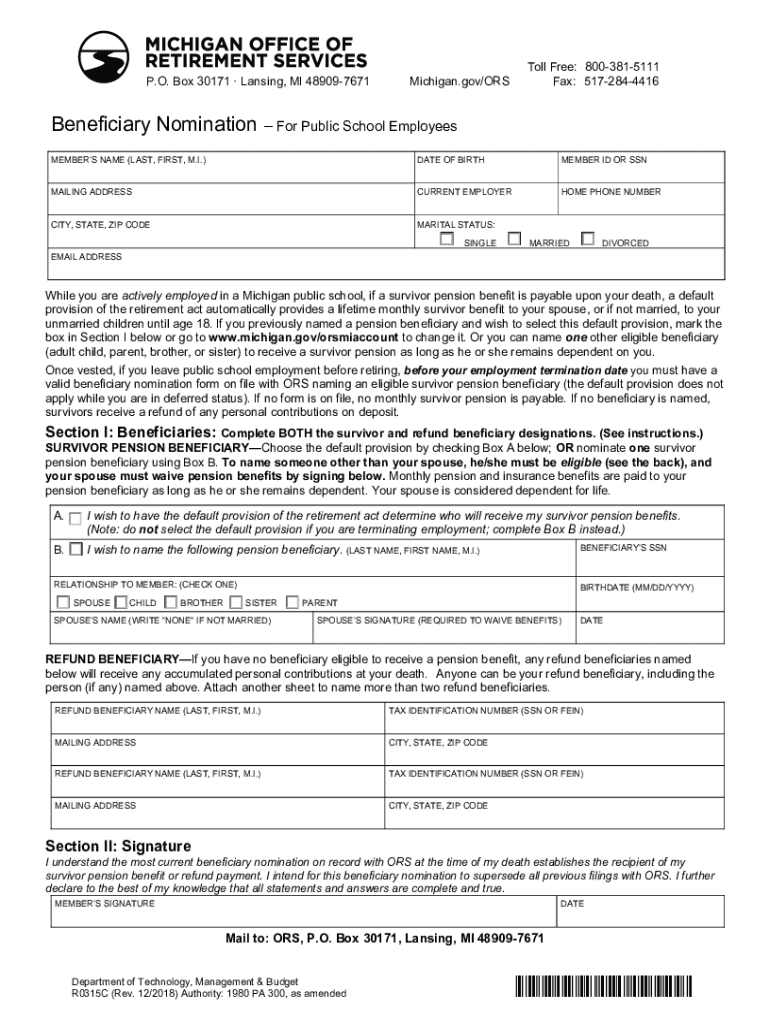

Understanding the beneficiary nomination form

A beneficiary nomination form is a crucial document used in estate planning to designate individuals or entities that will receive benefits from various accounts or investments after the account holder's death. This form helps ensure that your assets are distributed according to your wishes, avoiding potential disputes among family members or unintended heirs.

The importance of designating beneficiaries cannot be overstated. It streamlines the transfer of assets and can significantly lessen the emotional and financial burden on your loved ones during a difficult time. Without a beneficiary nomination, your assets may be subject to probate, a legal process that can be lengthy and costly.

Types of beneficiaries

There are generally two types of beneficiaries designated in a beneficiary nomination form: primary and secondary beneficiaries. Primary beneficiaries are the first in line to receive your assets, while secondary beneficiaries, or contingent beneficiaries, come into play only if the primary beneficiaries cannot inherit the assets.

When selecting primary beneficiaries, consider their current relationship with you, their financial stability, and their capacity to manage an inheritance responsibly. This careful selection is crucial as it directly impacts how your assets will be managed and used.

Navigating the beneficiary nomination form

Understanding the structure of your beneficiary nomination form is essential for accuracy and completeness. Typically, the form will contain several sections requiring essential personal information, details about your primary and secondary beneficiaries, and specific accounts or policies for designating benefits.

You can easily access the beneficiary nomination form on pdfFiller. The platform provides a user-friendly interface, allowing users to find and fill out the necessary forms efficiently, saving time and reducing frustration.

Step-by-step instructions for filling out the form

**Step 1:** Identifying Information. Start by filling in your full name, address, date of birth, and other essential personal details. This section establishes your identity and ensures the form is accurately processed.

**Step 2:** Designating Primary Beneficiaries. Carefully list the names of your primary beneficiaries along with their percentages of inheritance, ensuring totals add up to 100%.

**Step 3:** Designating Alternate Beneficiaries. Enter the names of secondary beneficiaries to ensure that your assets are governed even if a primary beneficiary passes away.

**Step 4:** Specifying Benefit Programs. Include any specific accounts or benefit programs such as life insurance, retirement accounts, or trusts that your beneficiary nominations pertain to.

**Step 5:** Signing the Form. Finally, ensure the form is signed. You may opt for a digital signature through pdfFiller or a handwritten signature, depending on your preference.

Tips for ensuring your form is accepted

To ensure your beneficiary nomination form is accepted, avoid common mistakes such as incorrect spellings, omissions of information, or designating more than one beneficiary without proper percentage distributions. Always check the legal requirements based on your state to ensure compliance.

It's also important to periodically review and update your nominations, especially after significant life changes such as marriage, divorce, or the birth of a child. Keeping your documents current helps prevent complications and misunderstandings.

Example scenarios for naming beneficiaries

When considering naming a minor child as a beneficiary, it’s crucial to appoint a guardian or representational mentor to manage that child’s assets until they come of age. This ensures the funds are used wisely and in the best interest of the child.

For trusts, acceptable designations might include testamentary trusts that are activated by your will or subtrusts designated for specific purposes. The impact of naming multiple beneficiaries should also be carefully calculated. Opting for a standard sequence may complicate matters unless all parties agree to percentage allocations.

Interacting with your document after submission

Once you've successfully submitted your beneficiary nomination form, managing the document is essential for future reference. pdfFiller provides document management tools that allow users to access, edit, and secure their nominated forms at any time.

Collaborating with family members or legal advisors becomes easier with shared access features. This openness ensures everyone involved is aware of your decisions, eliminating potential conflicts or confusion down the line.

FAQs about beneficiary nomination forms

Common questions about beneficiary nomination forms often include, 'What happens if a beneficiary passes away before you?'. Generally, the contingent beneficiary will inherit, but it’s wise to update your designations accordingly.

'Can you change your beneficiary designation?' Yes, you can update your designations at any time, which is why regularly reviewing your documents is so important.

Related resources

For further assistance in your estate planning efforts, pdfFiller offers a variety of other important documents and guides. Understanding estate laws and having the right forms in hand can significantly enhance your preparation and ensure that your wishes are honored efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my beneficiary nomination in Gmail?

How do I complete beneficiary nomination online?

How can I fill out beneficiary nomination on an iOS device?

What is beneficiary nomination?

Who is required to file beneficiary nomination?

How to fill out beneficiary nomination?

What is the purpose of beneficiary nomination?

What information must be reported on beneficiary nomination?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.