Get the free Beneficiary Designation—form 42

Get, Create, Make and Sign beneficiary designationform 42

Editing beneficiary designationform 42 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designationform 42

How to fill out beneficiary designationform 42

Who needs beneficiary designationform 42?

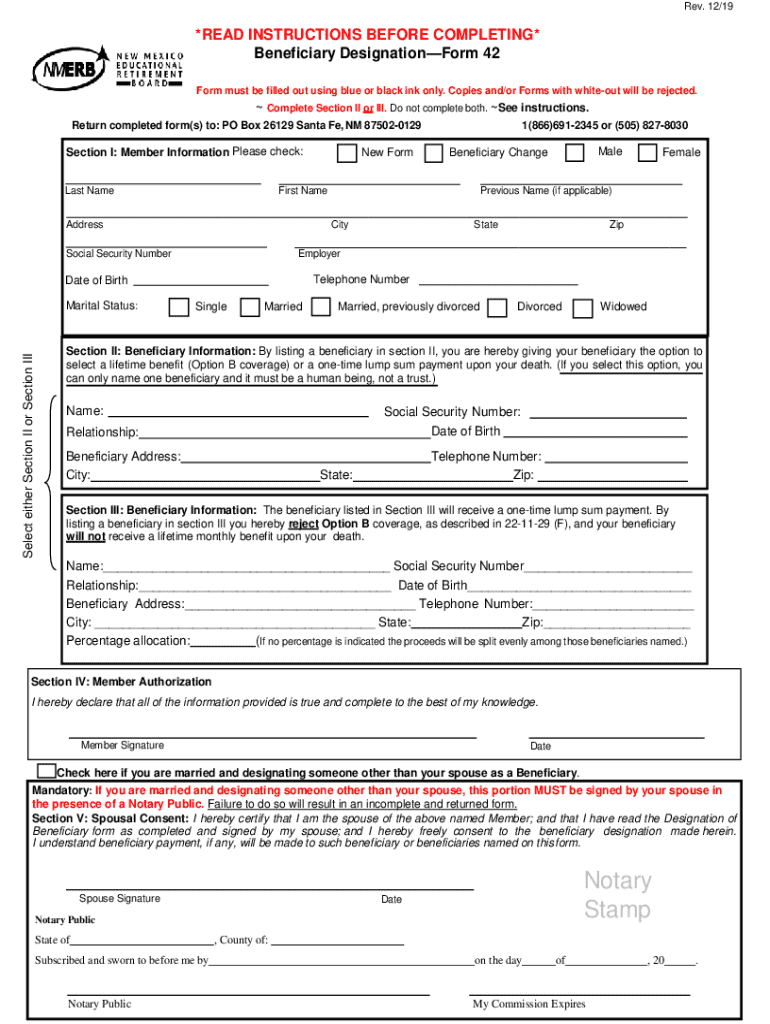

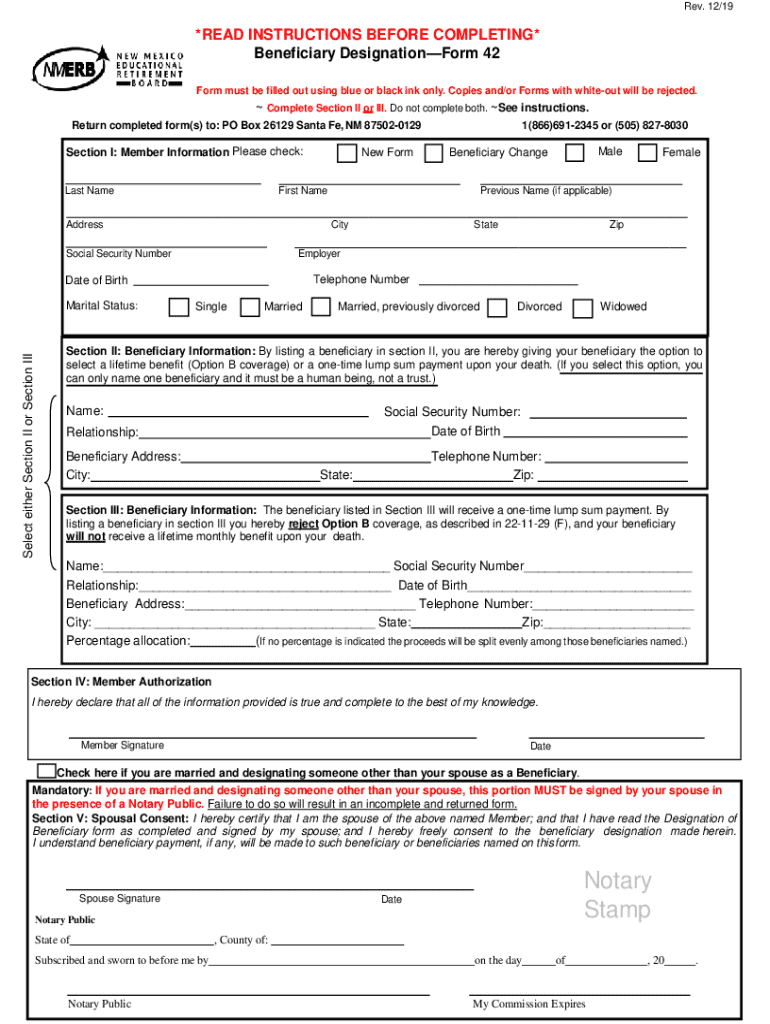

Understanding the Beneficiary Designation Form (42 Form)

Overview of beneficiary designation

Beneficiary designation is a critical element of financial planning that allows individuals to name someone who will receive specific benefits upon their death. This process is particularly relevant for life insurance policies, retirement accounts, and various financial instruments. By designating a beneficiary, individuals ensure that their assets are distributed according to their wishes, offering peace of mind and clarity to their families during challenging times.

Understanding the importance of beneficiary designation is vital. It simplifies the estate planning process, making it less burdensome for loved ones. Without a designated beneficiary, assets may be subject to probate, potentially delaying distribution and incurring unnecessary costs.

The beneficiary designation form (42 form)

The beneficiary designation form, commonly referred to as the 42 form, is a document used to officially name a beneficiary for specific accounts and policies. This form is crucial in situations such as life insurance, retirement plans, and various financial products. It serves to indicate the party entitled to receive benefits, facilitating a seamless transfer of assets upon the policyholder's death.

The purpose of the 42 form is not just to designate who receives funds but to ensure that assets are handled according to the individual’s wishes. It helps avoid complications that may arise from probate challenges, disputes over assets, and potential family conflicts.

Who should use the beneficiary designation form?

The beneficiary designation form is relevant for a broad audience. Individuals of all ages who have financial assets or policies should consider using the 42 form to ensure their beneficiaries are clearly defined. It's not just for wealth owners; young adults beginning their first jobs with benefits can also benefit from naming a beneficiary.

Additionally, teams and organizations managing group insurance plans or pensions often need to utilize the 42 form. This ensures that within corporate structures, employees' wishes are respected and maintained even after their passing. Understanding the target audience becomes crucial as it helps tailor financial discussions and services appropriately.

Step-by-step instructions for completing the 42 form

Completing the beneficiary designation form requires careful preparation. Begin by gathering necessary information, which includes required personal details such as the full name, date of birth, and relationship of the beneficiary. Additionally, know the types of beneficiaries you want to designate - primary and contingent.

For effective completion, follow this detailed guide section-by-section:

Common mistakes to avoid include failing to sign the form, forgetting to date it, and not clearly identifying beneficiaries which could lead to disputes.

How to edit and sign your beneficiary designation form

Utilizing pdfFiller’s online editing tools can simplify the process of completing the beneficiary designation form. To get started, upload your form onto the platform and access tools that enable you to edit easily for clarity and accuracy.

Follow these steps to edit your form:

When ready to sign, you can eSign the form, which is as legally valid as a handwritten signature. Simply follow these electronic signature steps: select 'eSign', create your signature, and place it on the designated line.

Managing your beneficiary designation

Once you’ve completed your beneficiary designation form, it’s essential to keep your designations up-to-date. Life changes such as marriage, divorce, or the birth of a child may affect your beneficiary choices.

To effectively manage your beneficiary designation, consider the following:

Best practices for beneficiary designation

To ensure your beneficiary designations are accurate and reflect your current wishes, follow these best practices:

Incorporating these tips can prevent common scenarios such as unintended consequences or disputes among heirs.

Frequently asked questions about beneficiary designation

Many individuals have questions regarding the beneficiary designation process. Here are some common queries addressed:

Real-life examples and scenarios

Utilizing case studies can illuminate the importance of properly managing beneficiary designations. For instance, consider a case where an individual named their sibling as a primary beneficiary. After a family dispute, the individual updated their form to designate their child instead, avoiding conflicts tied to the sibling's inheritance.

Conversely, failing to update a beneficiary designation can lead to problematic outcomes, such as when a divorced individual neglected to revise their form, resulting in the ex-spouse inheriting assets they were no longer entitled to. Being proactive in these instances can save significant emotional and financial turmoil.

Supporting tools and resources

pdfFiller provides a host of interactive tools designed to enhance the experience of completing and managing beneficiary designation forms. Utilizing their platform allows users to edit and sign documents seamlessly and enables secure document storage. Additionally, you can access templates and guidelines to ensure accurate and efficient form completion.

If you encounter challenges or require assistance, contact benefits services through pdfFiller for expert guidance tailored to your needs.

Next steps

Upon completing your beneficiary designation form, it’s prudent to set reminders for future reviews. Financial situations can change rapidly, and regular assessments can ensure your designations remain in line with your current wishes. Furthermore, maintaining consistent communication with your beneficiaries about your decisions can help alleviate any potential confusion or conflict.

Utilize the features available on pdfFiller to keep your documents organized, as this will enable you to manage your beneficiary designations efficiently over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find beneficiary designationform 42?

Can I create an eSignature for the beneficiary designationform 42 in Gmail?

How do I complete beneficiary designationform 42 on an iOS device?

What is beneficiary designation form 42?

Who is required to file beneficiary designation form 42?

How to fill out beneficiary designation form 42?

What is the purpose of beneficiary designation form 42?

What information must be reported on beneficiary designation form 42?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.