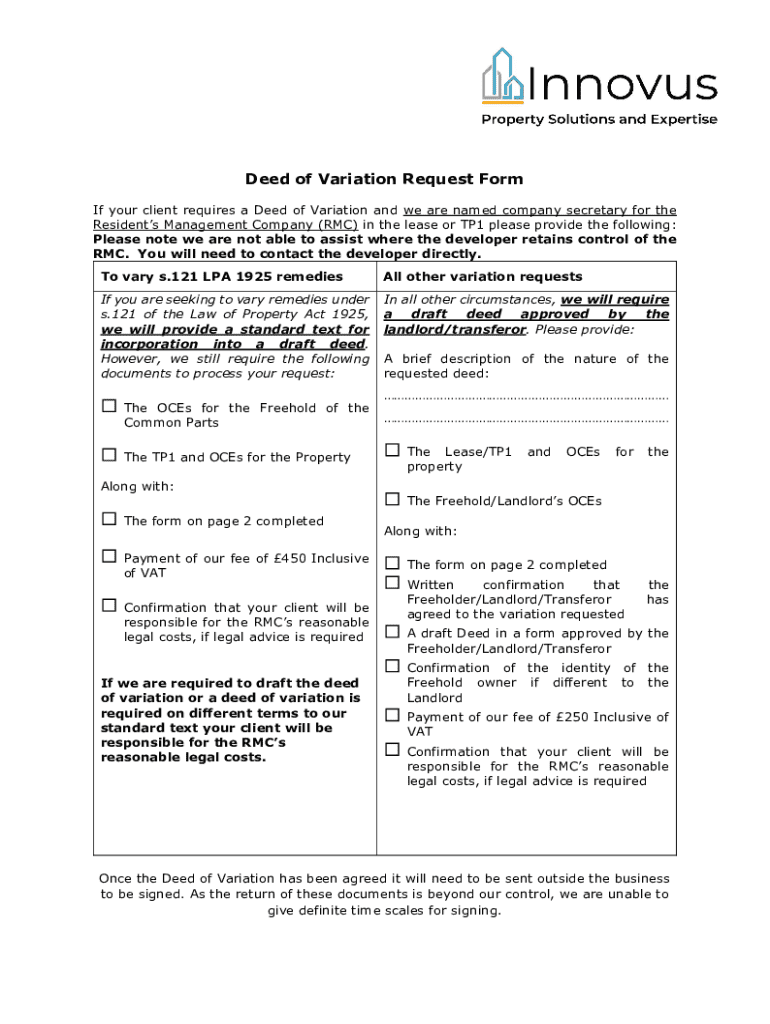

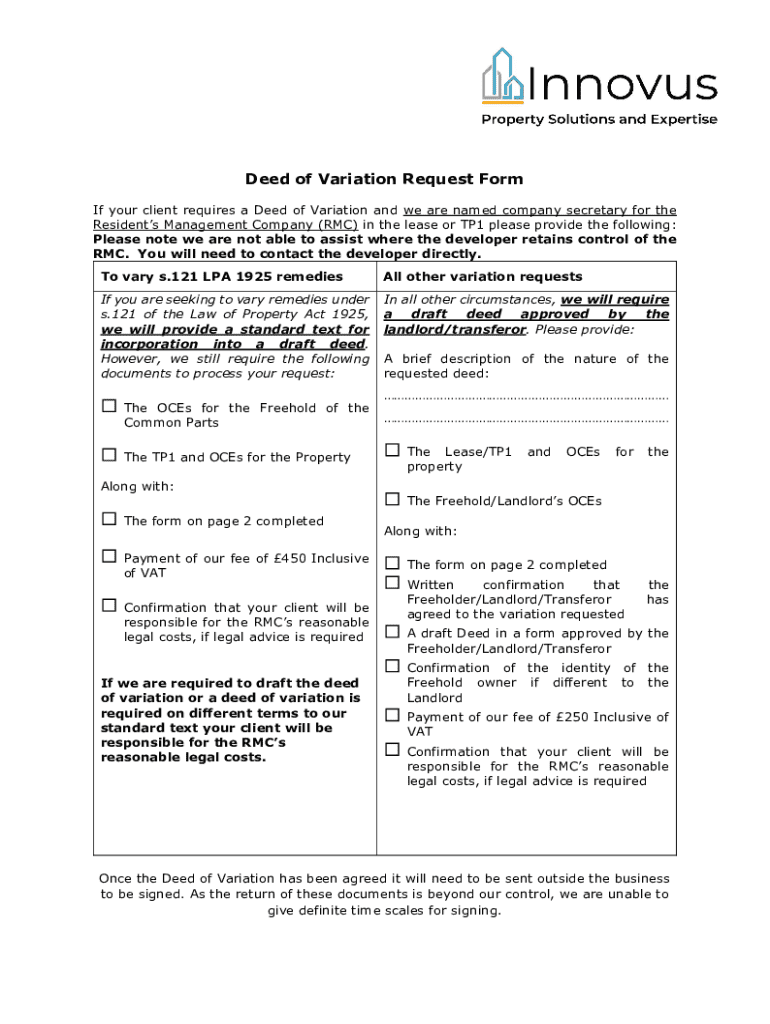

Get the free Deed of Variation Request Form

Get, Create, Make and Sign deed of variation request

How to edit deed of variation request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deed of variation request

How to fill out deed of variation request

Who needs deed of variation request?

Deed of variation request form - How-to guide

Understanding the deed of variation

A deed of variation is a legal document that allows beneficiaries of an estate to change the distribution of assets as stipulated in a deceased person's will. This adjustment typically occurs when all parties involved agree to modify the original terms, usually to either readjust individual beneficiaries' shares or to redirect assets to other individuals or charities.

The legal significance of a deed of variation extends beyond mere estate redistribution. It can affect inheritance tax liabilities and influence the overall financial arrangements tied to the deceased's estate. It enables beneficiaries to react to changing family dynamics or financial needs, providing flexibility where traditional wills may not.

By utilizing a deed of variation, beneficiaries can ensure that their individual interests are adequately protected and that the estate's distribution reflects the current wishes of those still living, rather than just the intentions of the deceased at the time the will was created.

Key terms and concepts

When discussing a deed of variation, it's crucial to familiarize yourself with several key legal terms that will frequently come up in discussions about estate management and modification. Understanding these terms can streamline the process and ensure effective communication among all parties involved.

Firstly, beneficiaries refer to those entitled to receive inheritances from the estate. The operative terms encapsulate the specific changes made to the will, specifying what is modified and how. Background information might consist of contextual details from the deceased’s life or previous agreements among beneficiaries.

In legal terms, a 'deed' refers to a written instrument that conveys an interest, rights, or obligations. Meanwhile, 'variation' indicates the action of modifying the original testamentary documents, which can ensure that none of the initial intents of the will are overlooked while accommodating current needs.

When to use a deed of variation

Deciding when to utilize a deed of variation can depend on several factors, mainly related to timing and circumstances. This document becomes particularly relevant after a will has been executed as long as it is enacted within two years following the death of the testator. Circumstances may also change the suitability of a will, necessitating a variation to reflect new family arrangements or financial situations.

Situations such as the birth of new family members, changes in beneficiaries' financial circumstances, or even disputes among survivors can prompt the usage of a deed of variation. On the other hand, failing to utilize a deed can lead to the existing will being enforced without adjustments, potentially resulting in misallocated assets and unwanted tax peaks due to the original stipulations.

The deed of variation process

Completing a deed of variation involves several essential steps to ensure that it is legally valid and fully executed. The first step is gathering all relevant information, which includes the original will, details on all beneficiaries, and the proposed changes to be made. This background information sets the stage for drafting the deed accurately.

The drafting of the document itself should be precise. Parties involved typically include all beneficiaries interested in the variation, and they must agree to the modifications. After drafting, all parties must sign the deed to confirm their acceptance of the changes outlined. This step validates the deed and ensures it holds up in legal settings.

A documentation checklist is vital before finalizing your deed of variation request form. Ensure that you possess the original will, details about the assets in question, the names and agreements of all beneficiaries, and the proposed adjustments maintain clear records for future reference.

Frequently asked questions

Understanding the tax implications associated with a deed of variation is critical. Variations may impact inheritance tax liabilities. In certain scenarios, redirecting inheritances to spouses or charities may offer significant tax advantages. Different regions, such as Scotland and Northern Ireland, may have specific variations in regulations, so it's essential to consult localized guidance.

The time it takes to process a deed of variation can vary significantly, depending largely on the complexity of the changes and the parties involved. Generally, when all beneficiaries are in agreement and documentation is correctly prepared, the process can be completed in a matter of weeks. While it's not legally required to hire a lawyer for this process, engaging legal counsel can provide peace of mind and avoid potential pitfalls, with associated costs varying widely based on complexity.

Making your deed of variation with pdfFiller

pdfFiller offers a robust solution for creating your deed of variation request form efficiently. With an all-in-one document solution, users benefit from accessibility to templates, making the drafting process streamlined. These templates guide you through the necessary elements to include, ensuring that important information isn't overlooked.

The platform simplifies the editing and signing process. Once you have selected the appropriate template, filling out the form is intuitive. You can easily input changes, e-sign the document, and manage it securely. This ensures a unified experience from creation to document management.

Ensuring compliance

Ensuring that your deed of variation is compliant and legally sound is paramount. Utilize a quality assurance checklist that provides guidance on the essential components needed for a valid deed. Steps include confirming the names of all beneficiaries, ensuring appropriate signatures, and verifying that the deed aligns with current estate laws.

The Make it Legal™ checklist is a valuable resource that outlines everything that needs to be reviewed before submitting your deed of variation request form. This ensures that no aspect of legality is overlooked, providing both parties with the necessary protections.

Legal considerations

A deed of variation is governed by the laws applicable in England and Wales. To be valid, certain prerequisites must be met. For instance, all beneficiaries must consent to the terms, and the deed itself must be executed properly with the correct legal wording. Legal profanity arises if not acknowledged, thus leading to possible disputes among beneficiaries post-death.

While deeds of variation can provide notable tax advantages, they come alongside legal requirements that must be fulfilled. Being aware of these can help you avoid common pitfalls that may arise during the process, such as disputes over the interpretation of the changes made.

Support and resources

If you find yourself in need of assistance concerning your deed of variation request form, consider accessing support services tailored to meet your needs. These services provide guidance through the legal intricacies surrounding variations and can connect you with professionals experienced in estate planning.

Customer service representatives are available to assist you via phone or email should you have queries regarding the process, costs, or document preparation. Additionally, exploring frequently asked questions can furnish you with insights relevant to your concerns and highlight how a deed of variation compares to other estate planning documents such as wills and trusts.

Start your deed of variation today

Initiating your deed of variation is straightforward with pdfFiller. The platform allows you the flexibility to create, edit, and sign your documents from anywhere. The seamless experience ensures users have access to vital tools for effective document management, enabling adaptability to any changing circumstances related to estate planning.

With options for a free trial, users have the perfect opportunity to familiarize themselves with the features without any initial commitment. Enjoy the benefits of efficient document management and the peace of mind that comes with effectively preparing for your family's future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deed of variation request without leaving Google Drive?

How can I fill out deed of variation request on an iOS device?

How do I complete deed of variation request on an Android device?

What is deed of variation request?

Who is required to file deed of variation request?

How to fill out deed of variation request?

What is the purpose of deed of variation request?

What information must be reported on deed of variation request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.