Get the free iowa sales use excise tax exemption certificate

Get, Create, Make and Sign iowa sales use excise

How to edit iowa sales use excise online

Uncompromising security for your PDF editing and eSignature needs

How to fill out iowa sales use excise

How to fill out iowa salesuseexcise tax exemption

Who needs iowa salesuseexcise tax exemption?

Iowa Sales/Use/Excise Tax Exemption Form: A Comprehensive Guide

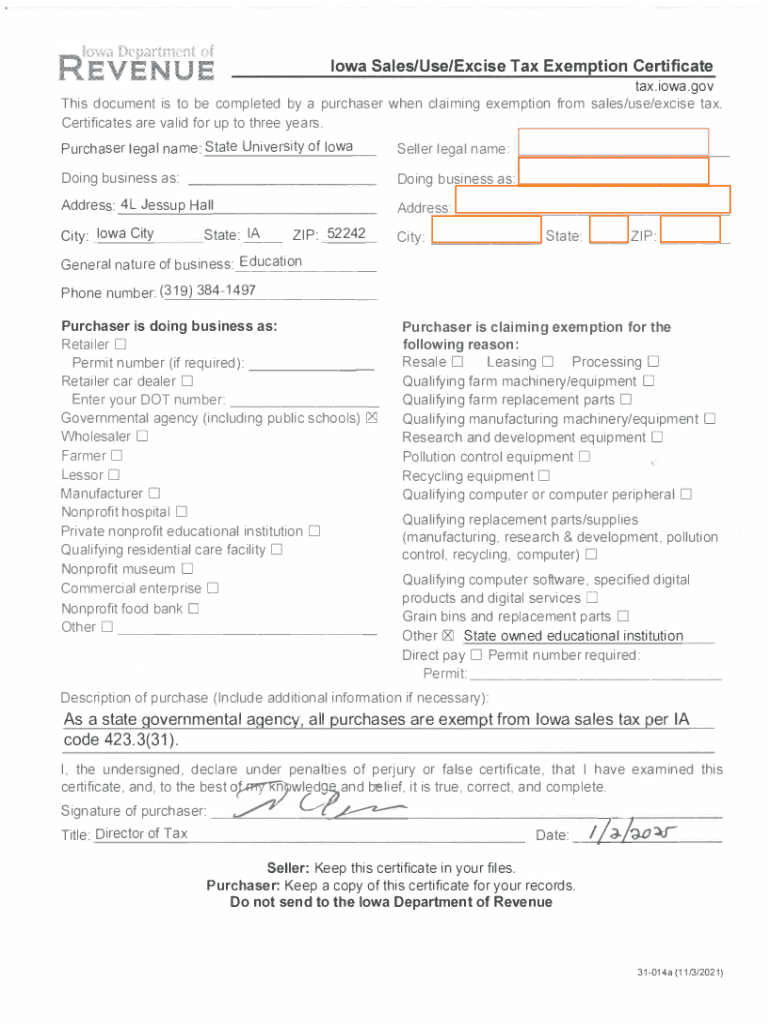

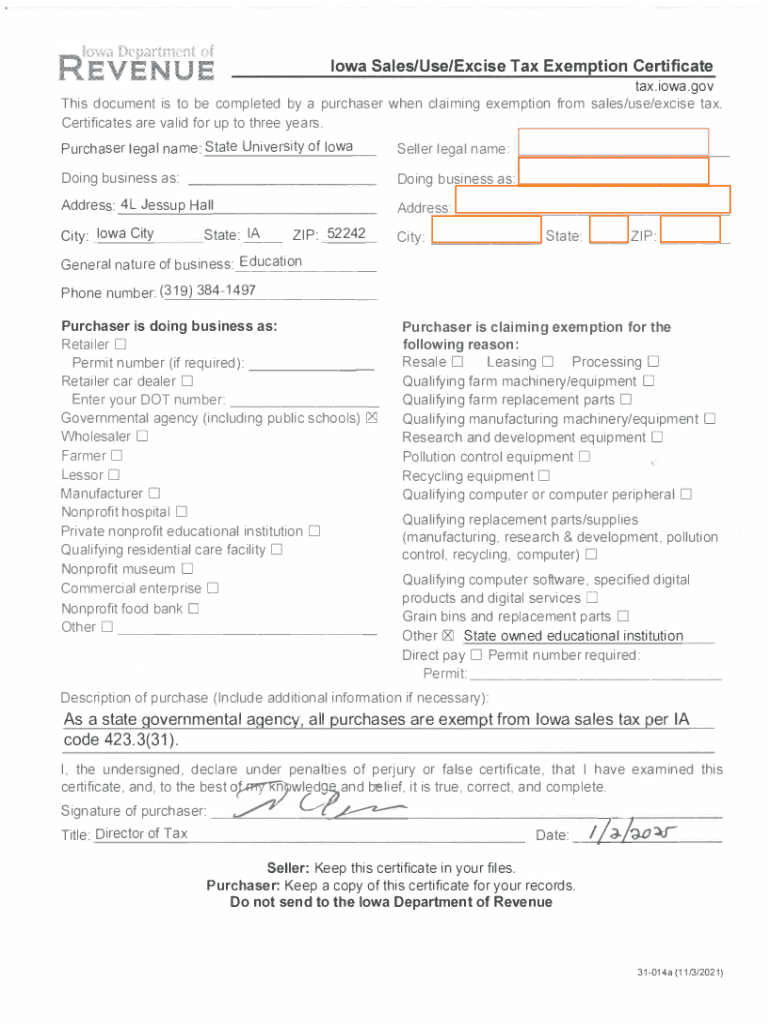

Understanding the Iowa Sales/Use/Excise Tax Exemption Form

The Iowa Sales/Use/Excise Tax Exemption Form plays a pivotal role in the state's tax framework, allowing eligible individuals and businesses to claim exemptions on certain purchases. This form is crucial for ensuring compliance while maximizing savings, especially for entities that frequently engage in tax-exempt transactions.

Primarily, the form serves to categorize specific cases where tax should not be applied. These can include purchases for manufacturing, nonprofit activities, or agricultural purposes, among others. Its importance cannot be overstated, as it enables economic efficiency and promotes certain sectors that the state wishes to nurture.

Key components of the Iowa Sales/Use/Excise Tax Exemption Form

The Iowa Sales/Use/Excise Tax Exemption Form consists of several essential sections that collect vital information needed to process the exemption. These include basic personal and business details such as names, addresses, and tax identification numbers, which establish the identity of the applicant.

Additionally, the form requires detailed descriptions of the goods and services intended to be covered under the exemption. For instance, if the exemption pertains to agricultural machinery or goods utilized in manufacturing, it's crucial to specify these clearly to avoid misinterpretation by tax authorities.

Step-by-step instructions for completing the form

Accurate completion of the Iowa Sales/Use/Excise Tax Exemption Form starts with gathering all necessary documentation. Ensure you have your tax ID, relevant business documentation, and a clear understanding of the exemptions you qualify for. This preparation will streamline the filling process and reduce the likelihood of errors.

When filling out the form, pay close attention to each section, starting with personal information. Next, articulate the reason for the exemption clearly; vague descriptions can lead to processing delays. Finally, remember to sign and date the form. Double-check your entries to minimize common mistakes, such as overlooking required fields or providing incomplete information.

Editing and managing the Iowa Sales/Use/Excise Tax Exemption Form with pdfFiller

Accessing the Iowa Sales/Use/Excise Tax Exemption Form has never been easier using pdfFiller. Begin by navigating to the template on the pdfFiller platform, where a user-friendly interface allows for seamless access and editing. This versatile platform gives you the tools needed to manage your documents efficiently.

Once accessed, pdfFiller provides functions like adding and removing information easily, and features like text boxes or highlights to emphasize key details. Utilizing the digital signature feature can also simplify the signing process. After editing, save the completed form in your preferred format, whether as a PDF or a document suitable for your needs, and consider utilizing cloud storage for easy retrieval.

Submitting your Iowa Sales/Use/Excise Tax Exemption Form

Once your form is thoroughly completed and reviewed, you have multiple options for submission. You can choose the online submission method through the Iowa Department of Revenue if you prefer a quicker, electronic route. Alternatively, traditional physical mailing is also acceptable, though it may take longer for processing.

For online submissions, visit the Iowa Department of Revenue’s website, while mailed forms should be sent to the designated address provided on the form itself. To track your submission status after submission, consistently check your application via the online portal or contact the department for updates.

Frequently asked questions (FAQs) about the Iowa Sales/Use/Excise Tax Exemption Form

A plethora of queries often surface surrounding the Iowa Sales/Use/Excise Tax Exemption Form. Notably, questions regarding eligibility are common, with numerous applicants seeking clarification on whether their purchases qualify for exemption. In Iowa, eligible parties typically include nonprofit organizations, certain types of businesses, and specific agricultural entities.

Moreover, confusion regarding particular exemptions can arise, such as those related to consumption versus resale. It’s crucial that applicants familiarize themselves with the specific language of the law, as the consequences of incorrect submissions can range from denied exemptions to potential penalties.

Helpful tips for using pdfFiller for your tax documents

Managing documents for tax purposes can be stress-free with pdfFiller's comprehensive features. For effective document management, consider organizing your tax forms within folders on the platform. This precaution makes it easier to retrieve necessary documentation during filing seasons.

Team collaboration is another benefit pdfFiller provides; sharing options allow team members to access the form securely. Utilize additional tools such as annotation features for collaborative comments or reviews, ensuring that every stakeholder is informed and involved in the process.

Contact support for further assistance

Should you require assistance navigating pdfFiller or addressing issues regarding the Iowa Sales/Use/Excise Tax Exemption Form, pdfFiller support is readily available. You can reach out via phone, email, or online chat to get the help you need.

Customer service representatives are accessible during regular business hours, providing timely responses to your inquiries. Whether you need guidance on the form itself or assistance with pdfFiller features, support is at hand to ensure a smooth document management experience.

Navigating related tax forms and templates

It's beneficial to be aware of other related tax forms that may apply to your business or individual tax situation in Iowa. Forms regarding contractor withholding or exemptions for specific industries often overlap with the Iowa Sales/Use/Excise Tax Exemption Form. Understanding these connections can save you time and confusion during tax season.

Accessing these forms is made easy via pdfFiller, where you can find links to related tax documentation, offering a consolidated approach to your tax preparation needs. Familiarizing yourself with these resources can enhance your efficiency in staying compliant with Iowa tax laws.

Feedback and improvements

User feedback plays a crucial role in the continued development of both the Iowa Sales/Use/Excise Tax Exemption Form and the pdfFiller platform. Engaging with users helps identify areas for improvement, ensuring that both the form and the software remain effective and user-friendly.

Encouraging users to provide feedback on their experiences fosters a more detailed understanding of user needs, helping to guide updates and features that enhance overall satisfaction. By actively participating in this feedback loop, users contribute to the evolution of their document management solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit iowa sales use excise in Chrome?

Can I create an electronic signature for signing my iowa sales use excise in Gmail?

How do I fill out iowa sales use excise using my mobile device?

What is iowa salesuseexcise tax exemption?

Who is required to file iowa salesuseexcise tax exemption?

How to fill out iowa salesuseexcise tax exemption?

What is the purpose of iowa salesuseexcise tax exemption?

What information must be reported on iowa salesuseexcise tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.