Get the free Application for Agriculture Exemption Permit

Get, Create, Make and Sign application for agriculture exemption

How to edit application for agriculture exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for agriculture exemption

How to fill out application for agriculture exemption

Who needs application for agriculture exemption?

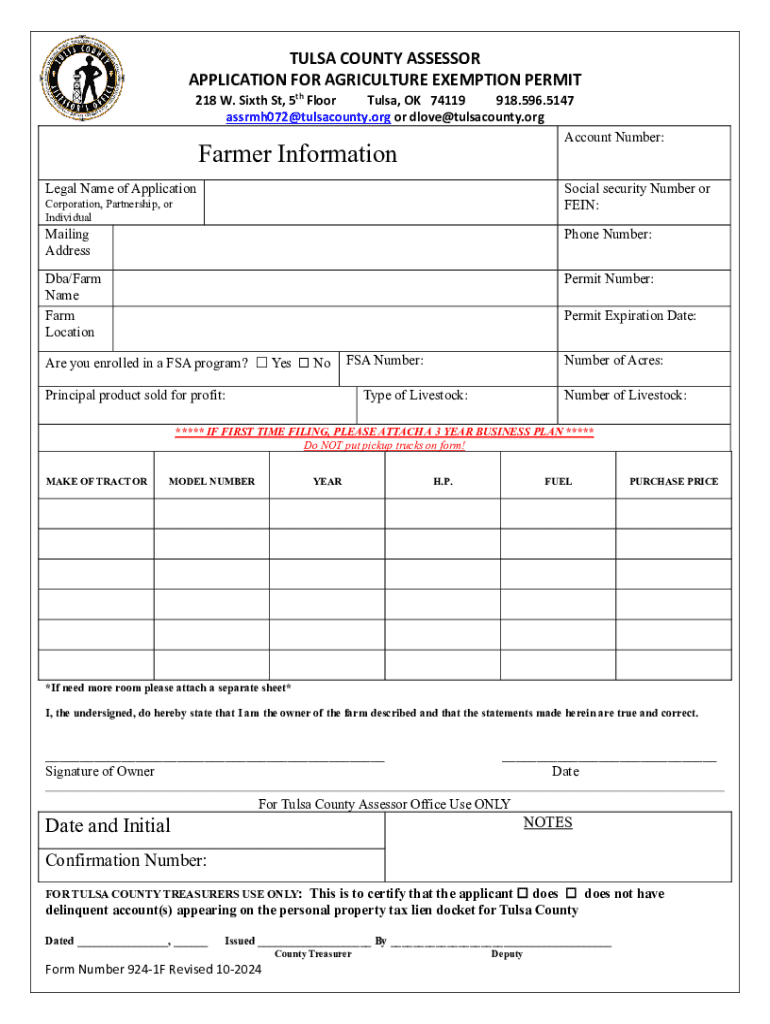

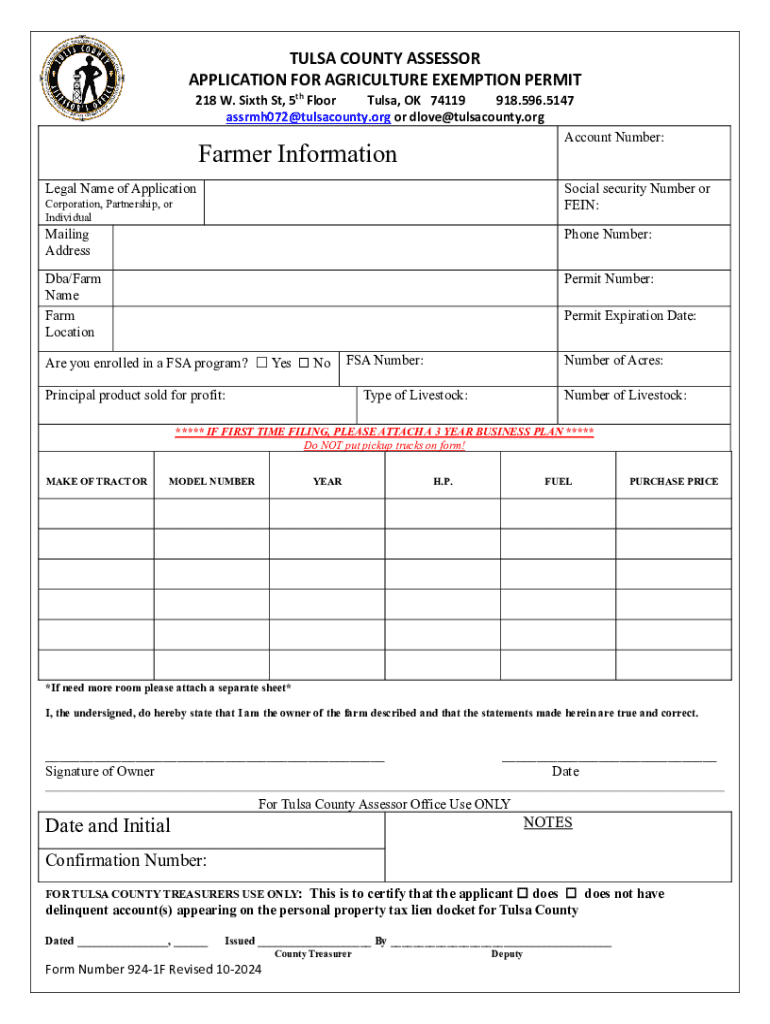

Comprehensive Guide to the Application for Agriculture Exemption Form

Overview of agriculture exemption

Agricultural exemption refers to a tax exemption designed to alleviate the financial burden on farmers and agricultural businesses. This exemption is vital as it enables farmers to reinvest in their operations, enhancing productivity and sustainability. Moreover, it supports the agricultural sector, which is crucial for food security and economic stability.

Applying for the agriculture exemption form carries several significant benefits. Farmers can save on sales taxes for equipment, seeds, and other essential goods, which directly contributes to maintaining profitability. Additionally, the exemption fortifies the agricultural community by helping small farms thrive alongside larger operations.

Understanding eligibility criteria

To qualify for an agricultural exemption, applicants must meet certain eligibility criteria. This typically includes owning or operating a business primarily engaged in agricultural production. Types of agricultural businesses that generally qualify include farms, nurseries, and aquaculture operations. Furthermore, certain products such as livestock, grains, fruits, and vegetables may also be eligible for tax exemption.

Applicants should prepare to provide specific documentation to verify their agricultural operations. This could include business licenses, proof of agricultural production, crop reports, and any relevant sales records. These documents serve to substantiate the claim for exemption and expedite the review process.

Detailed instructions for completing the agriculture exemption form

Completing the agriculture exemption form requires careful attention to detail to ensure clarity and accuracy. Below is a step-by-step guide to assist applicants in navigating the form effectively.

1. Personal information section

Accurate personal information is vital. Applicants should provide their full name, address, and contact details. It’s recommended to double-check spellings and ensure that all information aligns with official documents.

2. Business information section

In this part, applicants need to describe the nature of their agricultural operations. Detailed descriptions of the business type and its primary functions are essential to establish eligibility.

3. Exemption request section

In this section, clarify what specific exemptions are being requested. Applicants must detail the types of products or services that qualify for the exemption, ensuring that the descriptions are precise and thorough.

4. Supporting documentation section

Compiling the right documentation is not just beneficial but often necessary. Best practices include using organized checklists and ensuring that all documents are signed, if required, before submission.

Common mistakes to avoid when completing the form can include omissions, unclear descriptions, and submitting incomplete documentation. Taking the time to thoroughly review the application can save applicants from potential rejections.

Editing and managing the application with pdfFiller

Utilizing pdfFiller can streamline the process of filling and managing the application for agriculture exemption forms. With its robust set of editing tools, users can add notes and comments, ensuring that no detail goes unaddressed.

Additionally, using electronic signatures (eSignatures) simplifies the signing process, eliminating the need for printing, signing, and scanning. A step-by-step guide to using electronic signatures includes selecting the area to sign, entering your eSignature, and saving the document securely.

Collaboration features for team-based applications

For those working in teams, pdfFiller’s collaboration features allow for easy sharing of documents. Team members can provide input or review the application, enhancing the thoroughness of submissions. This collaborative environment helps ensure that the application is strong before submission.

Submitting your application

Once the form is completed, applicants must choose a suitable submission method. Online submission is often the fastest and most convenient, while physical mailing remains an option for those preferring to send a hard copy.

After submission, applicants should verify that their application has been properly submitted. This can often be done through confirmation emails or online application portals that update the application status.

Tracking your application status

Once submitted, it's important for applicants to track their application to ensure timely processing. Most states offer online portals where applicants can log in to view the status of their submissions. This transparency allows for proactive follow-ups if necessary.

Applicants should be prepared for standard processing times, which can vary by state and workload. Knowing what to expect can reduce anxiety and allow for better planning.

Frequently asked questions (FAQs)

As applicants navigate the application for agriculture exemption forms, they often encounter common questions and concerns. Addressing these can clarify the path ahead. For example, some applicants worry about rejections. Understanding the reasons behind a potential denial can help craft a more effective application in the future.

Additionally, many wonder about renewal processes for ongoing exemptions, which often require submissions made periodically, and the exact timeline for those renewals can be distinct from the initial application.

Additional support and resources

For further assistance in filling out the application for agriculture exemption forms, utilizing customer support via pdfFiller can be invaluable. Their team provides guidance on document processes and can help clarify specific questions related to submission.

Moreover, applicants can access state and federal resources specializing in agriculture exemptions. These platforms often provide detailed guidance, including FAQs and downloadable resources that can ease the application process.

Testimonials and user experiences

Many applicants have found success in obtaining agriculture exemptions with the help of pdfFiller. Users often share stories highlighting the efficiency improvements achieved through digital document solutions. These testimonials provide assurance to new users that the platform can significantly simplify the complex process of application.

Case studies reveal that users who utilized pdfFiller experienced shortened application timelines and reduced paperwork errors, affirming the platform's effectiveness in streamlining document management.

Next steps after receiving your exemption

Once an exemption has been granted, recipients must understand compliance requirements to maintain that status. This typically includes keeping detailed records of exempt purchases and ensuring continued eligibility by adhering to agricultural operational standards.

Additional forms or documents may be required post-approval, especially in the case of audits or reviews by agricultural departments. Staying organized and informed helps ensure long-term compliance and continued operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application for agriculture exemption directly from Gmail?

How do I edit application for agriculture exemption online?

How do I edit application for agriculture exemption in Chrome?

What is application for agriculture exemption?

Who is required to file application for agriculture exemption?

How to fill out application for agriculture exemption?

What is the purpose of application for agriculture exemption?

What information must be reported on application for agriculture exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.