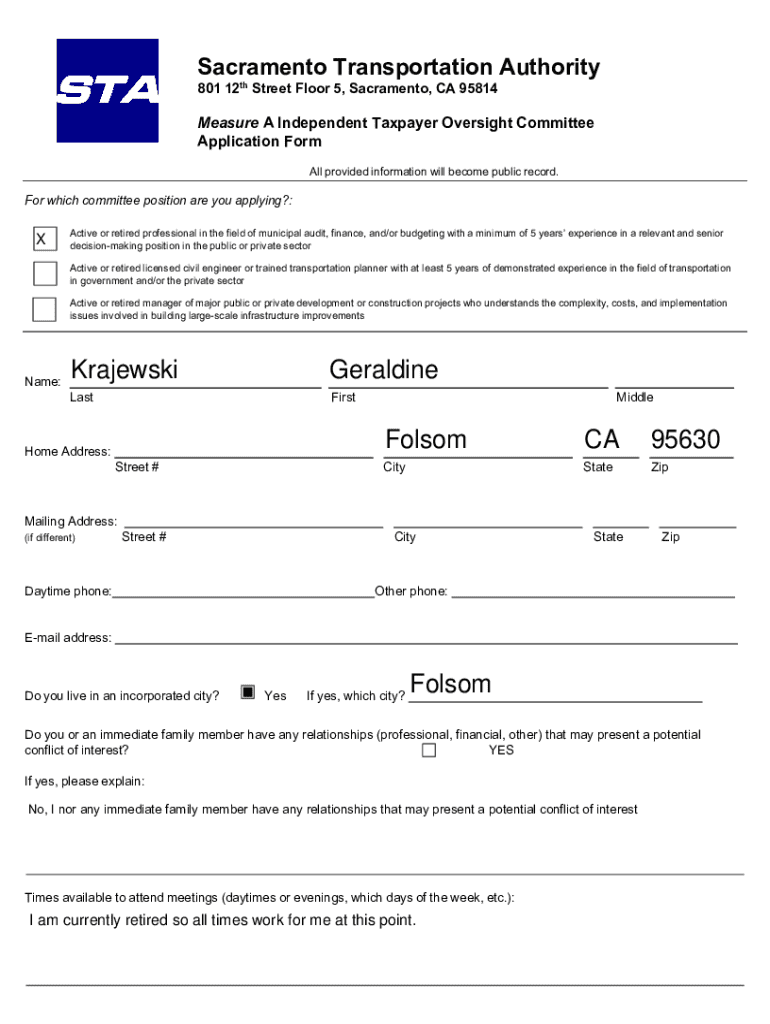

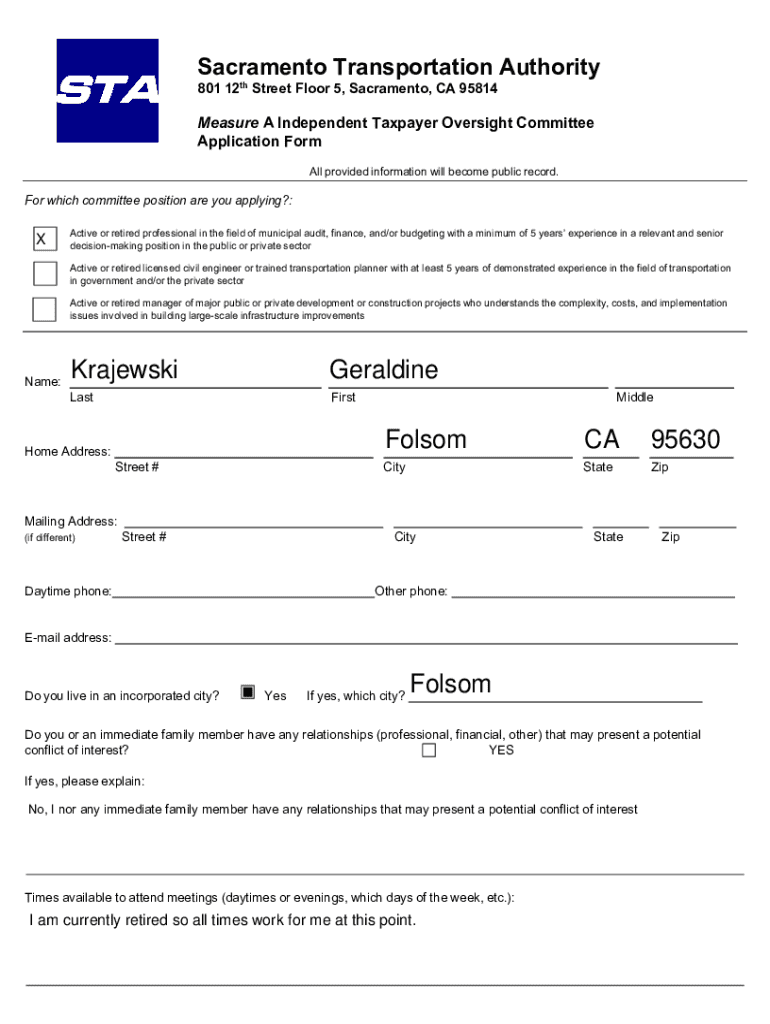

Get the free Measure a Independent Taxpayer Oversight Committee Application Form

Get, Create, Make and Sign measure a independent taxpayer

Editing measure a independent taxpayer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out measure a independent taxpayer

How to fill out measure a independent taxpayer

Who needs measure a independent taxpayer?

Measure an Independent Taxpayer Form - How-to Guide

Understanding the independent taxpayer form

An independent taxpayer form refers to a specific set of documents that self-employed individuals or independent contractors must fill out when filing their taxes. This form is essential for reporting income accurately and assessing any applicable deductions or credits. Unlike traditional employee tax forms, the independent taxpayer form allows individuals to detail various sources of income and claim deductions that are unique to self-employment.

Accurate measurement in tax submissions is crucial, as inaccuracies can lead to tax liabilities or penalties. Independent taxpayer forms differ significantly from traditional forms, such as W-2s, in terms of the information required, as independent candidates must account for variable income and a broader range of deductions often linked to business expenses or freelance work.

Key components of the independent taxpayer form

Filling out an independent taxpayer form correctly requires a comprehensive understanding of its key components. This form generally consists of personal identification information, financial details, and additional considerations tailored for independent workers. Accurate information is imperative as it directly influences tax calculations.

Steps to measure income and deductions accurately

Effectively measuring and calculating your income and deductions is a vital step in completing the independent taxpayer form. This process involves gathering the right documents, calculating your total income accurately, and identifying applicable deductions.

Completing the measurement of the independent taxpayer form

Once you have gathered all necessary income and deduction information, it's time to complete the independent taxpayer form. Using pdfFiller simplifies this process significantly. It provides an efficient interface for uploading, editing, and navigating your tax documents.

To ensure data accuracy, it's crucial to be meticulous in data entry. Review common pitfalls, such as incorrect figures or missing information, as they can lead to complications during the filing process.

Review and final submission

Before final submission, conduct a thorough review of your completed form. A checklist can help ensure that every section is correctly filled and no crucial information is absent. Accuracy is paramount here since errors can complicate the tax processing.

Once the review is complete, consider your submission options. With pdfFiller, you have the convenience of electronically submitting your independent taxpayer form, streamlining the process.

Frequently asked questions about independent taxpayer forms

It's common to have queries regarding the independent taxpayer form, particularly concerning amendments or errors. Addressing these concerns can ease the filing process.

Additional tips for independent taxpayers

Apart from ensuring accurate measurement on the independent taxpayer form, independent taxpayers can adopt additional strategies to optimize their tax filing process. Leveraging tools such as pdfFiller not only aids in form submissions but can also enhance long-term tax management.

Interactive tools and features within pdfFiller

pdfFiller offers various functionalities that are particularly advantageous for independent taxpayers. From editing tools to cloud storage options, these features streamline the process of managing important tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the measure a independent taxpayer electronically in Chrome?

Can I create an eSignature for the measure a independent taxpayer in Gmail?

Can I edit measure a independent taxpayer on an Android device?

What is measure a independent taxpayer?

Who is required to file measure a independent taxpayer?

How to fill out measure a independent taxpayer?

What is the purpose of measure a independent taxpayer?

What information must be reported on measure a independent taxpayer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.