Get the free Line of Credit Agreements

Get, Create, Make and Sign line of credit agreements

Editing line of credit agreements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out line of credit agreements

How to fill out line of credit agreements

Who needs line of credit agreements?

Line of Credit Agreements Form: A Comprehensive Guide

Overview of line of credit agreements

A line of credit is a flexible loan option that allows borrowers to access funds up to a predetermined limit, giving them the ability to draw, repay, and borrow again as needed. This financial tool is not just a loan; rather, it provides a safety net, empowering users to meet various financial needs without having to reapply for new loans. For many, understanding the role of line of credit agreements is crucial to effectively managing personal finances.

The importance of a line of credit agreement lies in its capacity to offer immediate funding for expenses, smooth out fluctuations in cash flow, and allow for strategic financial planning. Common uses of this financial product include covering unexpected medical bills, financing home improvements, managing educational expenses, or even preparing for seasonal business shifts. By having a line of credit, individuals can maintain financial flexibility and respond quickly to opportunities or emergencies.

Types of line of credit agreements

Line of credit agreements can vary significantly based on how they're secured and whether they revolve or not. Understanding the differences between secured and unsecured lines of credit is vital for borrowers. A secured line of credit is backed by an asset, such as a home or savings account, thereby reducing risk for lenders and often resulting in lower interest rates. Conversely, unsecured lines do not require collateral, making them riskier for lenders, which can lead to higher interest rates.

Additionally, revolving and non-revolving lines of credit offer disparate usage patterns. A revolving line of credit allows borrowers to repeatedly draw up to a limit, repay, and borrow against the same credit. A non-revolving agreement, however, is more fixed; once the borrowed amount is repaid, the credit does not refresh. Borrowers should consider their financial habits and needs before deciding which type of agreement aligns best with their circumstances.

Key components of a line of credit agreement

When entering a line of credit agreement, several essential terms should be clearly understood to avoid confusion in the future. The credit limit is a crucial figure that denotes the maximum amount you can borrow. Interest rates, which may be variable or fixed, determine how much you'll owe in addition to the principal. Lastly, repayment terms outline the schedule for making payments, including minimum payments and when they are due.

Important clauses in any line of credit agreement typically cover potential penalties for defaulting, the specific purposes for which you can use the funds, and the governing laws that dictate the agreement. Including a clear dispute resolution clause can also help protect both parties in the event of misunderstandings or disagreements.

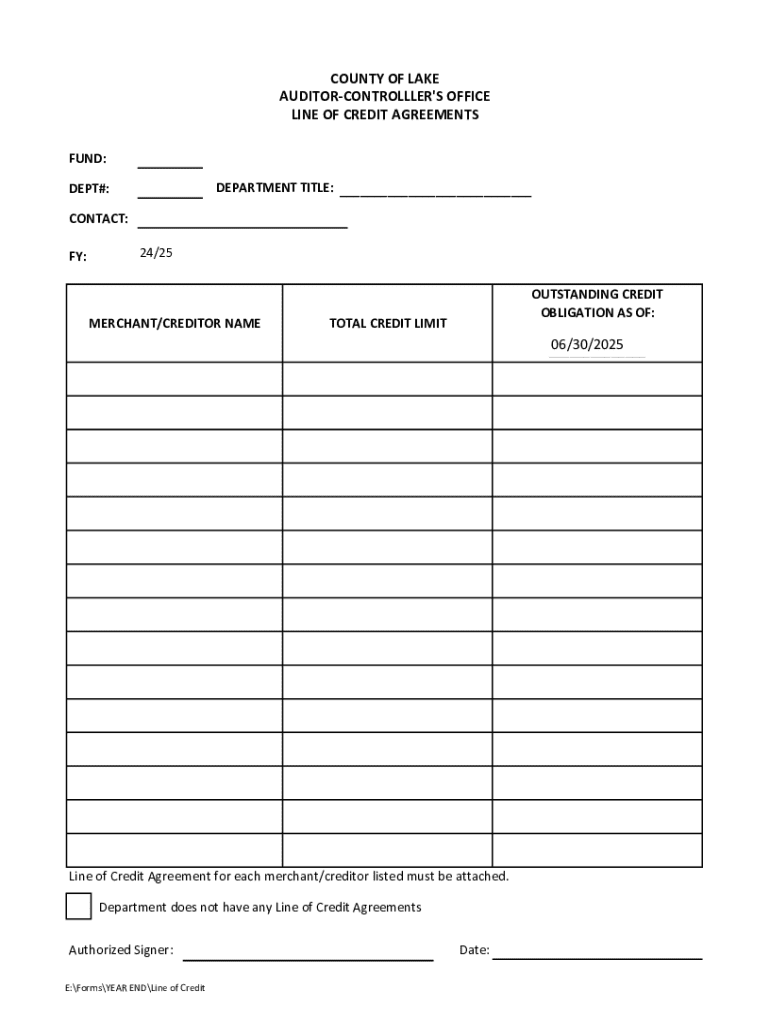

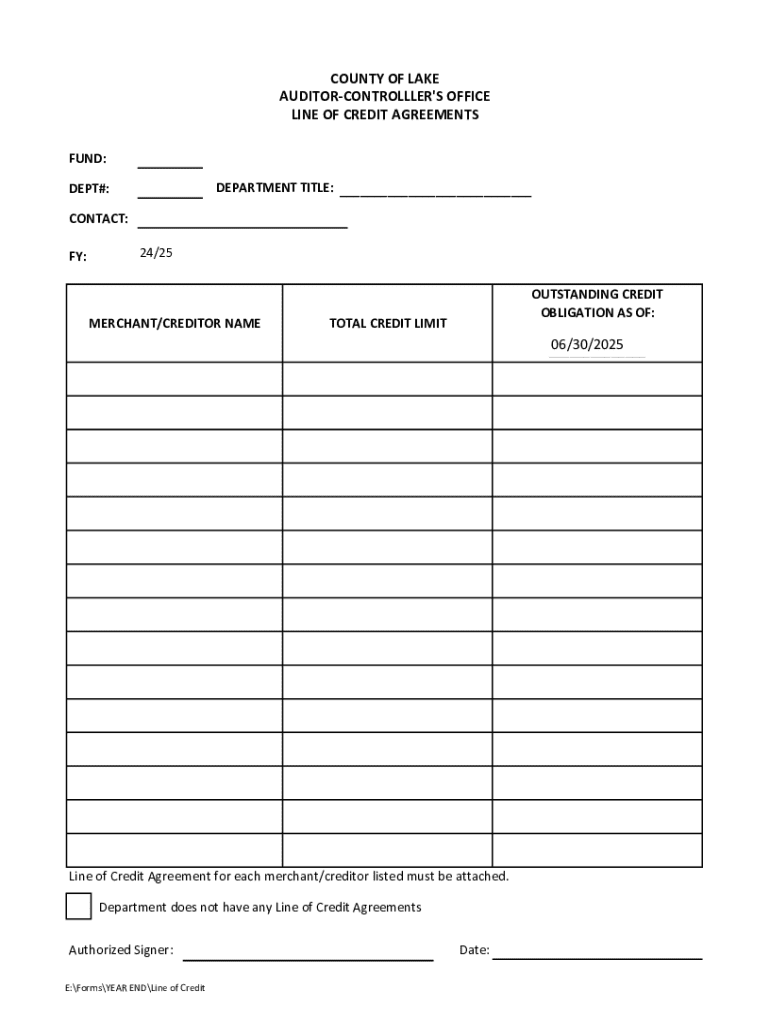

How to fill out a line of credit agreement form

Filling out a line of credit agreement form requires careful attention to ensure accuracy. Start by gathering necessary documents such as identification, income verification, and financial statements to provide clear insight into your financial position. Next, enter your personal and financial information accurately; this will include your name, address, income level, and employment details.

It’s essential to specify your desired credit limit and any specific terms that fit your repayment ability. Finally, review the agreement thoroughly to confirm all information is correct. A clear understanding of your responsibilities will culminate in signing the agreement confidently, knowing you have laid the groundwork for financial flexibility.

Editing and managing your line of credit agreement

Once a line of credit agreement has been signed, the need for amendments may arise. Whether due to changing financial conditions or adjustments in your borrowing needs, knowing how to make amendments is crucial. Changing terms, such as adjusting the credit limit or altering repayment schedules, should be approached through formal channels established in the agreement. Always consult with your lender to comprehend any potential implications of changes.

Using pdfFiller for document management allows for seamless editing of your agreement. Features such as cloud storage, easy document sharing, and eSigning facilitate timely adjustments without the hassle of printing or mailing. This cloud-based solution provides an intuitive interface for users, making alterations to your agreement straightforward and efficient.

eSigning your line of credit agreement

The electronic signature process has revolutionized how agreements are finalized, offering convenience and speed. When using pdfFiller, the eSigning process is straightforward. Users can upload their document, add their signature, and send it for signing without the traditional delays associated with paper documents. This method not only speeds up the transaction but also allows for secure data handling.

Importantly, eSignatures are legally recognized in many jurisdictions, which adds a layer of trust and validity to your agreement. However, it’s crucial to verify local laws and regulations regarding electronic signatures to ensure compliance.

FAQs about line of credit agreements

When utilizing a line of credit agreement, questions often arise regarding implications and functions. A critical inquiry is what happens if one defaults on the agreement. Defaulting can lead to severe penalties, increased interest rates, or even legal action from the lender. It’s paramount to maintain consistent payments to avoid these pitfalls.

Another prevalent question is whether one can cancel a line of credit agreement. While cancellation may be possible, it generally requires following specific procedures mandated by the lender. Additionally, the differences between a line of credit agreement and a personal loan agreement can be significant; the former typically offers flexibility in borrowing and repayment, while the latter is more a straightforward, fixed loan.

Useful tools and resources

Managing a line of credit successfully also involves utilizing various tools available to help track expenses and repayments. An interactive calculator designed for line of credit costs can provide insights into what you'll be paying over time, helping you make informed financial decisions. pdfFiller also hosts a range of related templates, making it easier to access financial agreement forms when needed.

Beyond simple document creation, tools for monitoring and managing your line of credit can streamline your finances significantly. Regular oversight helps to prevent potential pitfalls such as overspending or missed payments.

Real-life applications and case studies

Understanding the practical applications of a line of credit can solidify its value as a financial product. Consider a case study where an individual utilized a line of credit effectively to manage unexpected home repairs. The homeowner faced a sudden plumbing issue, which required immediate attention but didn’t have sufficient savings. By accessing funds from their line of credit, they were able to resolve the issue quickly without incurring high-interest debit or credit card charges.

However, it’s important to highlight common pitfalls as well. Some individuals may use their line of credit indiscriminately, leading to spiraling debt. Awareness of these risks and strategic use can help prevent costly mistakes and ensure that the line of credit serves its purpose as a financial tool.

Glossary of terms related to line of credit agreements

Navigating line of credit agreements involves understanding several financial and legal terms. Key financial terms include 'credit limit'—the maximum amount available for borrowing, and 'interest rate'—the percentage charged on borrowed amounts. Legal terminology, such as 'default', signifies failure to meet the contractual obligations of the agreement, which can have serious consequences.

Grasping these terms is essential for effectively engaging with creditors and ensuring compliance with the legal framework surrounding your agreement.

Additional considerations

The impact of line of credit agreements on your credit score is a crucial aspect to keep in mind. Responsible management can enhance one’s credit score, while defaults or missed payments can result in significant declines. It's essential to monitor how utilization ratios affect your overall credit profile.

Also, being aware of market trends in line of credit options can offer broader insights into the financial landscape. As lenders adapt to economic conditions, increased competition may drive better terms and rates for borrowers, making it essential to stay informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my line of credit agreements in Gmail?

How can I send line of credit agreements for eSignature?

How do I edit line of credit agreements straight from my smartphone?

What is line of credit agreements?

Who is required to file line of credit agreements?

How to fill out line of credit agreements?

What is the purpose of line of credit agreements?

What information must be reported on line of credit agreements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.