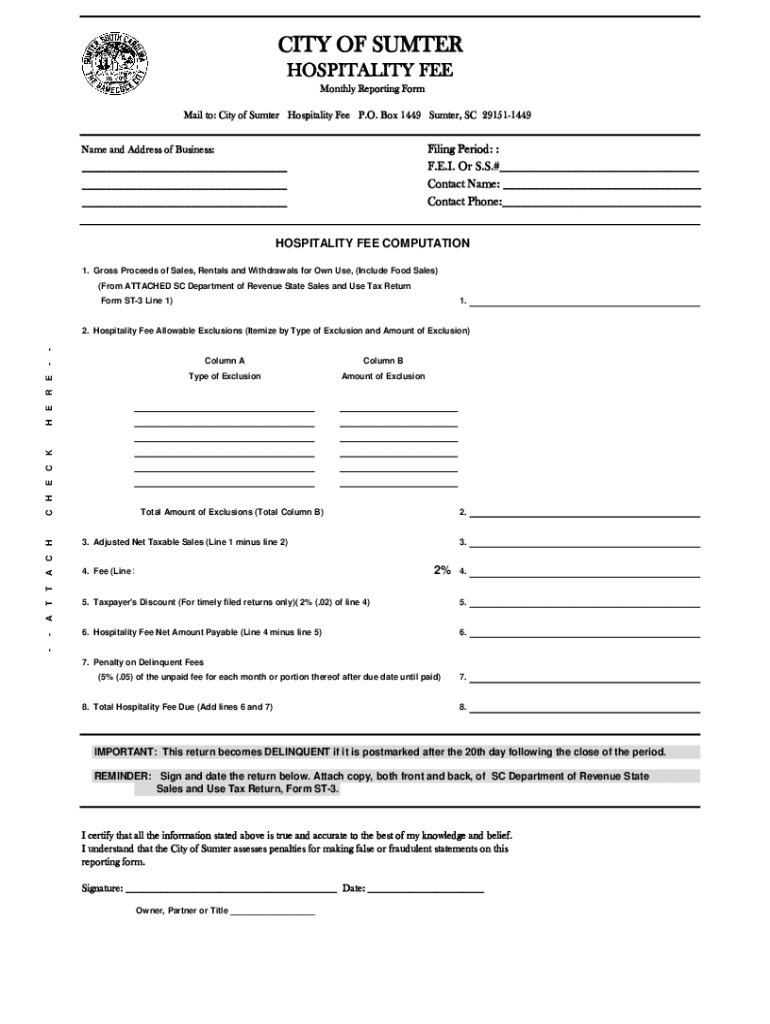

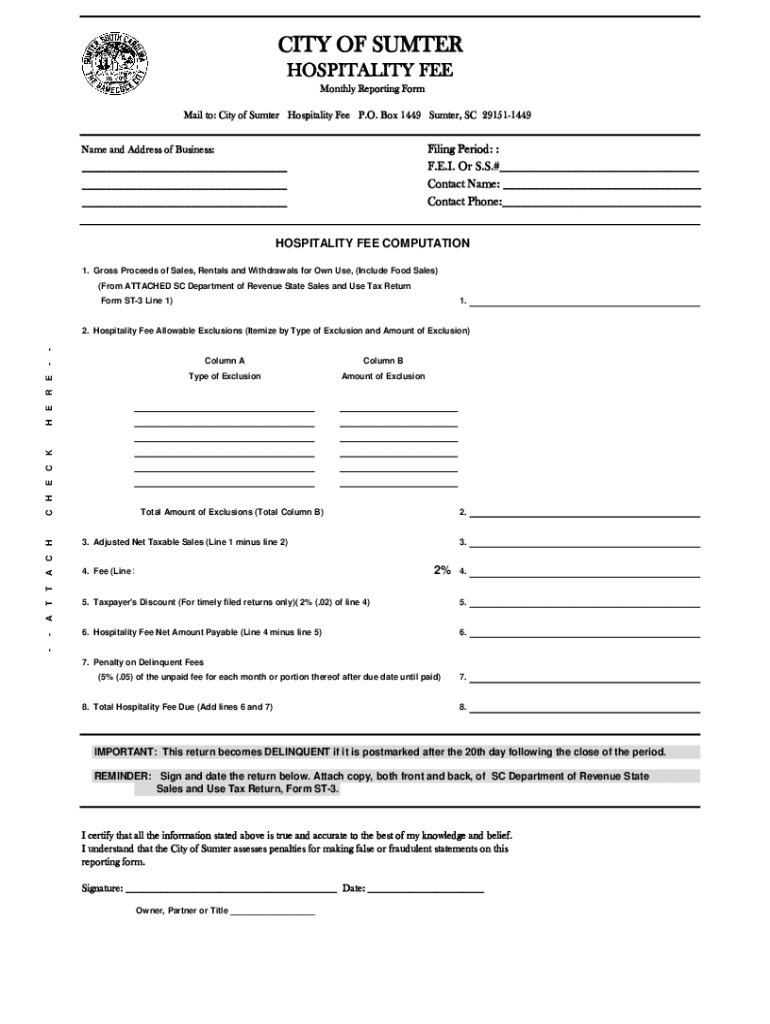

Get the free Hospitality Fee Monthly Reporting Form

Get, Create, Make and Sign hospitality fee monthly reporting

How to edit hospitality fee monthly reporting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospitality fee monthly reporting

How to fill out hospitality fee monthly reporting

Who needs hospitality fee monthly reporting?

Your Guide to the Hospitality Fee Monthly Reporting Form

Understanding the hospitality fee

The hospitality fee is a charge applied to accommodations within certain regions, often aimed at enhancing services and funding local tourism initiatives. This fee varies by location, but serves a critical purpose in supporting the hospitality industry and ensuring that areas can thrive for both visitors and residents.

The importance of the hospitality fee cannot be overstated; it provides essential funding for attractions, infrastructure improvements, and promotional efforts that benefit local businesses. Understanding key terms related to hospitality fees, such as exemptions and calculation methods, is critical for compliant reporting.

Setting up your hospitality fee monthly reporting account

Setting up an account for the hospitality fee reporting is the first step towards compliance. Eligibility generally requires that your business operates within designated locales that impose this fee. It’s essential to ensure your entity qualifies before proceeding.

To establish a new account, follow these streamlined steps:

Completing the hospitality fee monthly reporting form

Once your account is established, the next step is completing the hospitality fee monthly reporting form. The form is designed to capture comprehensive details relevant to the fees collected over the reporting period.

The form consists of several key sections, each designed to simplify the reporting process:

Reporting timeframes and deadlines

Timeliness is crucial in the reporting process. Businesses are generally expected to submit their hospitality fee monthly reporting form by a specific date each month. This deadline typically varies, so knowing your exact reporting schedule is imperative.

For example, many jurisdictions require that forms be submitted by the 15th of each month. Late submissions can result in penalties, ranging from fines to increased scrutiny during audits.

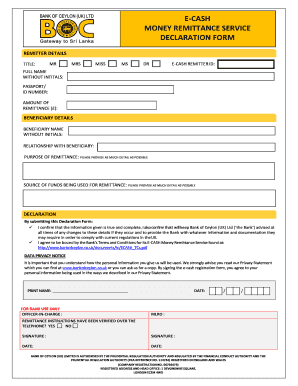

Remitting collected hospitality fees

After completing the reporting form, remitting the collected hospitality fees is the next step. Different payment methods are available to facilitate this process, ensuring ease of compliance for all businesses.

Most jurisdictions offer various payment methods such as direct bank transfers, credit card payments, or online portal submissions. It is vital to follow instructions carefully to ensure correct submission.

Audit and inspection information

Audits may occur to ensure compliance with hospitality fee regulations. Understanding the audit process will prepare you for any inspections that might take place, providing clarity on what is required.

Typically, audits will review not just the completeness of the reporting forms but also the accuracy of the figures reported. Be ready to provide supporting documentation, such as sales records and invoices.

Making changes to your hospitality fee account

Life in business requires adaptability, and changes in your hospitality fee account are a reasonable occurrence. However, notifying your local authority of any changes is essential to maintain accurate records.

This includes updating account information such as a change of address, new contact details, or reporting changes in your business operations, such as opening a new location.

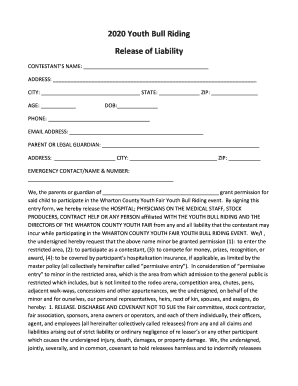

Board of fee appeals: understanding your rights

If you believe that your fee assessment is inaccurate, your business has rights under the appeals process. Knowing when and how to appeal a fee assessment is crucial for protecting your interests.

The appeal process typically requires submitting specific documentation backing your case. Timelines for decision-making may vary, so ensure to familiarize yourself with the specific requirements.

Common questions and troubleshooting

Common questions often arise regarding the hospitality fee monthly reporting process. It’s beneficial to familiarize yourself with FAQs to mitigate potential issues.

Some common issues reported include difficulties in completing the form or submitting incorrect payment amounts. Knowing how to troubleshoot these concerns contributes to a smoother reporting experience.

Utilizing pdfFiller for your reporting needs

pdfFiller stands out as a premier platform for managing your hospitality fee monthly reporting form. The tool provides an array of features crucial for efficient document handling.

With pdfFiller, you can easily edit PDFs, collaborate with team members, and secure documents with e-signatures. The cloud-based solution ensures that you can manage your reporting process anytime, anywhere.

Success stories: real users of the hospitality fee reporting form

Numerous hospitality businesses have benefited from utilizing the hospitality fee monthly reporting form. Various case studies highlight the positive impact of effective reporting on business performance.

From increased compliance rates to better financial forecasting, businesses that engage actively with the reporting process tend to perform better overall. Learning from these cases can provide valuable insights.

Stay informed: upcoming changes to hospitality fees and regulations

The landscape for hospitality fees is always evolving. Keeping abreast of anticipated changes in legislation will assist in ensuring ongoing compliance.

By utilizing resources such as newsletters, official government websites, and local business forums, you can stay updated on compliance requirements, helping your business stay ahead of potential changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find hospitality fee monthly reporting?

How do I complete hospitality fee monthly reporting online?

How do I edit hospitality fee monthly reporting online?

What is hospitality fee monthly reporting?

Who is required to file hospitality fee monthly reporting?

How to fill out hospitality fee monthly reporting?

What is the purpose of hospitality fee monthly reporting?

What information must be reported on hospitality fee monthly reporting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.