Get the free Notary Public Bond

Get, Create, Make and Sign notary public bond

How to edit notary public bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notary public bond

How to fill out notary public bond

Who needs notary public bond?

Comprehensive Guide to Notary Public Bond Form

Understanding the notary public bond

A notary public bond is a financial guarantee that serves as a form of insurance for clients relying on the services of a notary. This bond is designed to protect the public from potential misconduct or negligence on the part of the notary. If the notary fails to adhere to the duties required or commits fraud, the bond allows affected individuals to claim compensation up to the bond's limit.

The importance of the notary public bond in the notary process cannot be overstated. It not only assures the public that the notary operates within the confines of the law but also emphasizes the commitment of the notary to practice ethically. Without a bond, a notary might lack credibility in their role.

Legal requirements

Each state has different regulations regarding the issuance and maintenance of notary public bonds. Understanding these legal requirements is crucial for notaries who want to operate legally and effectively. Most states mandate notaries to secure a bond in specific amounts, typically ranging from $5,000 to $25,000, depending on state law.

Compliance is vital for notaries since failing to maintain a valid bond can result in penalties, including the loss of their notary commission. Notaries should familiarize themselves with their state’s specific bonding laws to ensure full compliance.

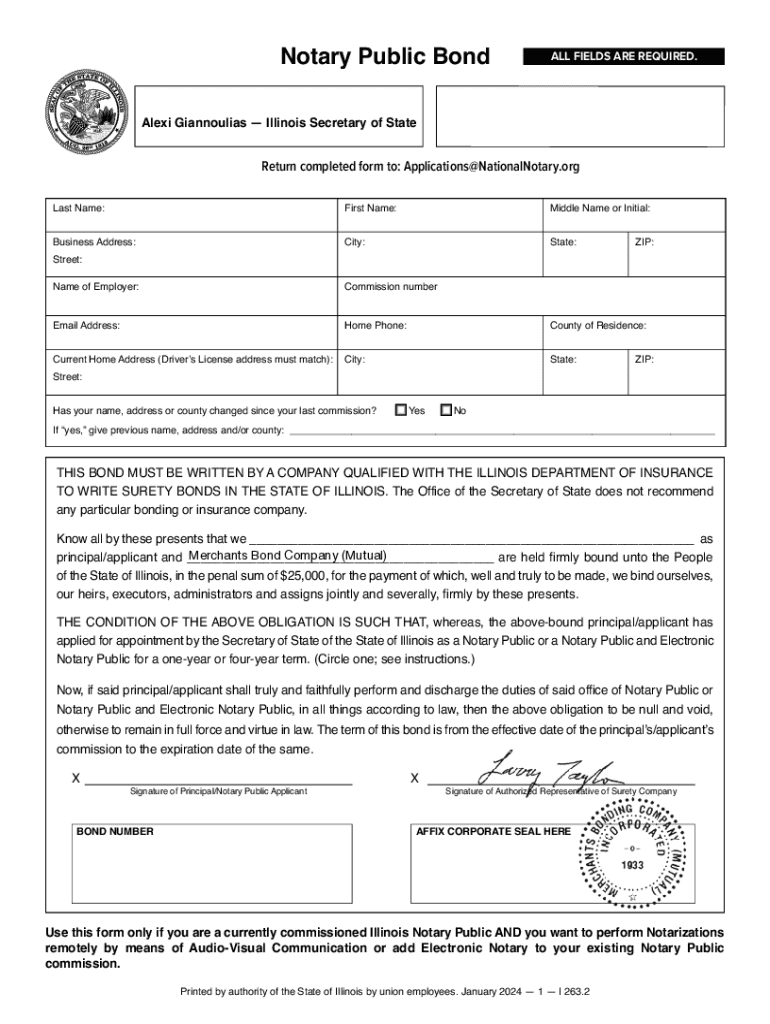

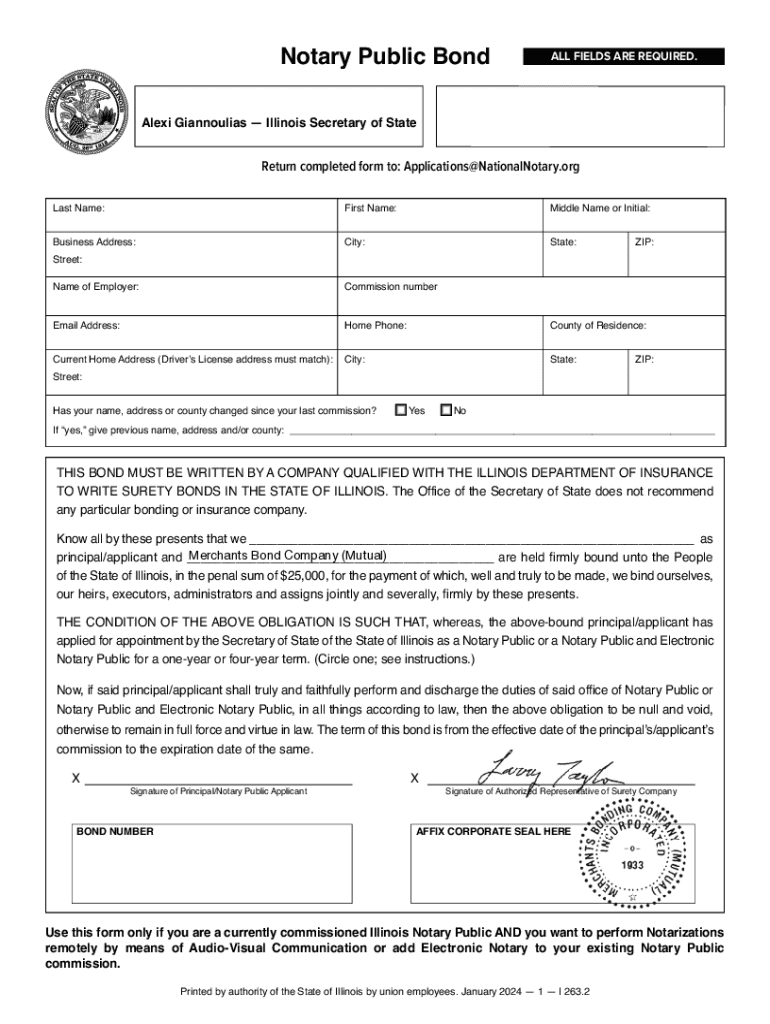

Notary public bond form overview

The notary public bond form is a crucial document that outlines the terms of the bond. It typically contains key components such as the name and address of the notary, the bond amount, the bonding company’s information, and a statement of the notary's commitment to adhere to state laws. This form is essential for establishing the notary's legal standing.

Each part of the notary public bond form needs to be filled out meticulously to avoid delays or issues in processing. The personal information required usually includes the notary’s full name, signature, and the county where they will operate as a notary.

Filling out the notary public bond form

Completing the notary public bond form can seem daunting, but with clear instructions, the process can be streamlined. The first step involves gathering all necessary documents, including identification and financial information. This preparation will make it easier to fill out the form accurately.

Next, it’s important to complete the form with precision. An inaccurate entry could lead to a rejection of the form, so double-checking the information is essential. Common mistakes to avoid include misspelled names and incorrect amounts.

Editing and managing the notary public bond form

In today's digital age, using PDF tools to edit your notary public bond form can save time and reduce the risk of errors. Cloud-based editing platforms like pdfFiller allow notaries to input information, make adjustments, and share documents with ease. These tools often come equipped with interactive features such as form-filling capabilities and digital signatures.

Storing your notary public bond form securely is equally important. Best practices include saving your documents in secure cloud storage where they can be easily accessed when needed yet protected from unauthorized access.

Signing the notary public bond form

An electronic signature can be a convenient and legally recognized method of signing your notary public bond form, streamlining the submission process. The legality of eSignatures is backed by laws like the ESIGN Act, which confirms their acceptance in many states. Platforms such as pdfFiller provide straightforward methods to eSign your documents securely and efficiently.

Depending on state law, you may need a witness to sign the bond form. It’s crucial to understand your state’s requirements regarding witness signatures, as some states do not require them while others do. If a witness is necessary, ensure they provide their signature in the designated area on the form.

Submitting your notary public bond form

Once your notary public bond form is completed and signed, the next step is submission. Typically, you’ll need to submit the form to your state’s notary public office or a similar regulatory agency. Each state has specific submission requirements, so it’s important to familiarize yourself with these procedures to avoid delays.

After submission, follow up on your application to confirm that the bond has been processed. This can usually be done either online or via contact with the relevant regulatory body. Being proactive can help address any issues that may arise.

Frequently asked questions (FAQs)

Common queries about notary public bonds typically include what to do if your bond is rejected and the duration of bond validity. If your bond is rejected, you should immediately contact the bonding company to understand the reason and resolve any issues. The validity of your bond varies by state but usually ranges between 1 to 5 years, requiring periodic renewal.

Moreover, state-specific FAQs can further clarify regulations unique to each area. For instance, Alabama requires notaries to renew their bonds every four years, while California mandates a $15,000 bond for notaries. Understanding these nuances is key for a successful notary career.

Key regulations and best practices

Maintaining compliance with state requirements for bond approval is essential for all notaries. Each state has its unique regulations, which can influence bond amounts, documentation, and renewal processes. A notary must keep abreast of such changes to maintain good standing.

Ongoing education for notaries, along with maintaining proper record-keeping, is vital. Attending state-sanctioned workshops or training can contribute substantially to a notary's professional growth and understanding of legal requirements.

Resources for notaries

For individuals seeking to navigate the complexities of becoming a notary, various resources are available. Organizations that cater to new notaries can offer guidance, support, and networking opportunities. Many states also publish educational materials that outline the duties of notaries, stringent compliance standards, and best practices.

Furthermore, remaining updated on legislative changes regarding notarial practices is essential. Subscribing to relevant newsletters or joining professional associations can help notaries stay informed and equipped to handle evolving regulations.

Success stories

Hearing from real-life experiences can illuminate common challenges faced by notaries and how they resolve them. For instance, many notaries share instances where thorough preparation and knowledge of state regulations made all the difference during complex transactions or issues related to bond applications.

Moreover, user testimonials regarding the use of platforms like pdfFiller can reflect on the efficiency and convenience offered in managing notary public bond forms. Such insights can inspire new notaries to leverage technology in their practice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notary public bond in Gmail?

How do I execute notary public bond online?

How do I make edits in notary public bond without leaving Chrome?

What is notary public bond?

Who is required to file notary public bond?

How to fill out notary public bond?

What is the purpose of notary public bond?

What information must be reported on notary public bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.