Get the free Financial Assistance Application

Get, Create, Make and Sign financial assistance application

How to edit financial assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assistance application

How to fill out financial assistance application

Who needs financial assistance application?

Understanding and Navigating the Financial Assistance Application Form

Understanding financial assistance programs

Financial assistance programs are designed to support individuals and families facing unforeseen economic hardships, enabling them to access necessary services and healthcare. In today’s landscape, these options are vital, as medical expenses and basic living costs can often exceed what people can afford. For many, financial assistance is not just beneficial but essential for preserving health and well-being.

Programs typically include grants, discounts on medical bills, or payment plans tailored to accommodate varying income levels. Knowing the purpose of these programs helps applicants select the most appropriate options, ensuring that they can receive crucial services without the weight of financial burden.

Eligibility criteria

To qualify for financial assistance, applicants must meet specific eligibility criteria, which may vary by program. Typically, general requirements include demonstrating a financial need caused by unemployment, low income, or unexpected medical expenses. Understanding these criteria helps applicants gauge their chances of approval before immersing themselves in the application process.

Common eligibility criteria often involve detailed documentation of income, family size, and other financial burdens. Generally, applicants may need to provide earnings statements or tax forms that meet designated income thresholds. This documentation varies by program and is essential in determining the level of financial support offered.

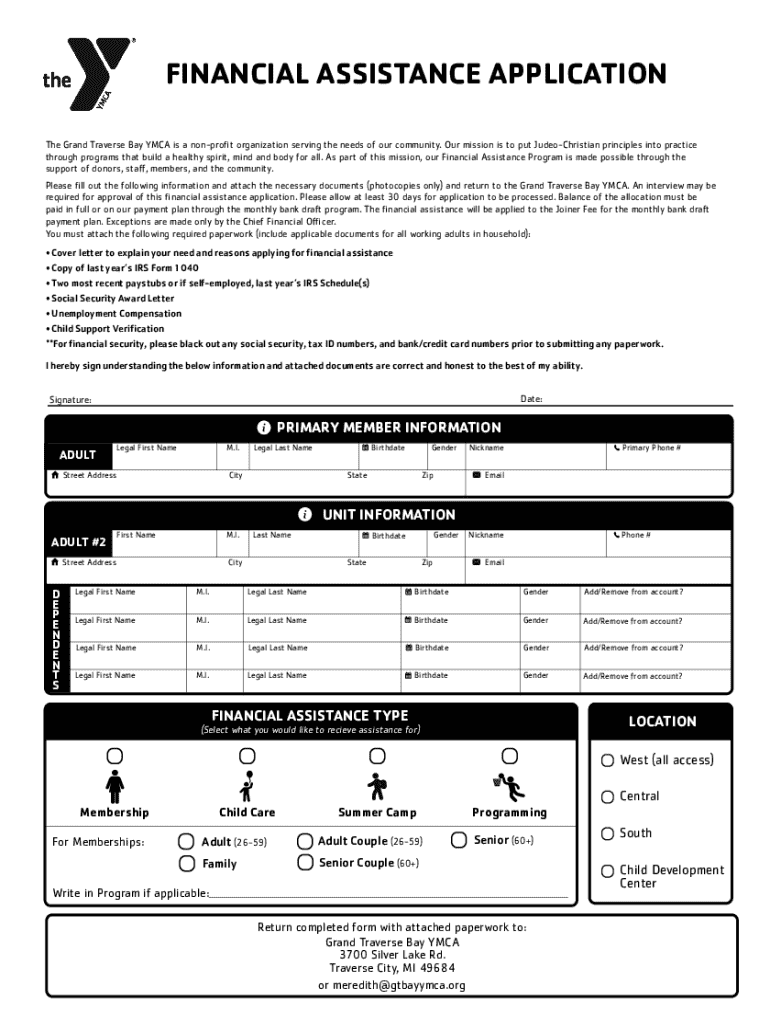

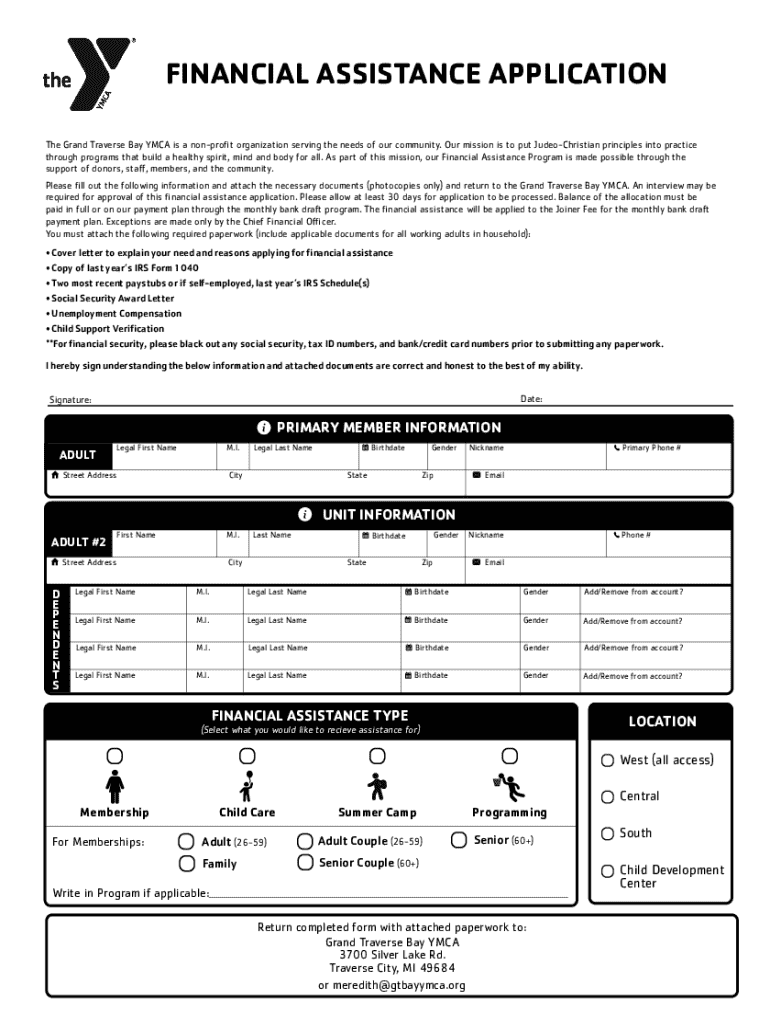

The financial assistance application form

The financial assistance application form serves as the gateway to accessing the support for which individuals and families might qualify. This structured form is crucial in compiling necessary information in a standardized manner, facilitating a smooth application process for both the applicant and the reviewing agency.

Navigating this application can be straightforward when armed with a clear understanding of its components and the significance of each section. Completing this form correctly, along with supplying additional documentation, strengthens the case for receiving aid and ensures smoother processing.

Components of the financial assistance application form

A complete financial assistance application comprises several key sections, including applicant information, patient details, financial details, and dependent information. Understanding what each part entails enhances the likelihood of a favorable outcome.

Each section gathers specific data critical for assessing the applicant’s eligibility. For instance, applicant information provides insight into who is seeking aid, while patient information applies specifically if the assistance is for medical support. Financial details demonstrate the need for assistance through an income verification process.

Applicant information

This section captures personal data necessary for processing the application. Fields typically include the applicant's name, address, contact information, and relationship to any patients involved in the application. Fostering clarity and detail in this section provides the groundwork for communication and follow-up.

Correctly filling out your information not only ensures that your application is linked to the right case but also helps establish a point of contact for future references, questions, or clarifications needed during the review process.

Patient information

Collecting necessary details about the patient receiving assistance is essential to verify eligibility. This portion requires specific information, including the patient’s name, date of birth, account numbers, and possibly medical facility information. Accurate patient data links the application to the correct medical services needing coverage.

Including comprehensive patient information aids in a thorough review of the application, ensuring that the individual’s needs are properly assessed and understood by the assistance team.

Financial details

This part of the application forms the backbone of financial need. Applicants will need to verify their income, often through documentation such as pay stubs, bank statements, or recent tax returns. It’s vital to accurately list all sources of income, including any side jobs or freelance contributions, to paint a complete financial picture.

Acceptable sources include both regular wages and alternative income streams, such as rental income, child support, or unemployment benefits. Transparency in reporting all financial information is paramount as it affects the determination of eligibility and the level of assistance provided.

Dependents and household information

This section requires listing all dependents living in the applicant's household, which is crucial for determining eligibility levels. Dependents typically include children or others who rely on the applicant's financial support. Households with larger sizes might qualify for greater assistance based on the greater financial needs associated with maintaining additional members.

Accurate data about household composition is pivotal, as it directly impacts both the assessment of financial need and the level of assistance granted. Misreporting can lead to complications in approval or unnecessary delays.

Specific policies and discounts

Many financial assistance programs also include specific policies aimed at alleviating costs for underserved populations. Understanding these policies can unlock additional support options that may not be immediately evident. Two key areas to explore are charity discounts and uninsured discounts.

Charity discount policies offer reduced costs based on financial need, while uninsured discounts provide pathways for those without coverage to access necessary medical services. Each policy will have its unique requirements and application processes, and comprehending these can maximize the benefits available to applicants.

Charity discount policy

Charity discount programs may offer substantial reductions in medical costs for those who can prove financial hardship. Eligibility requirements usually mirror those for broader financial assistance but can also include other considerations, such as exceptional medical circumstances. Understanding how to apply for these discounts involves specifying your financial situation clearly within the application while providing required documentation.

Additionally, these programs can vary significantly between institutions. It’s crucial to consult the specific guidelines of the facility providing assistance to ensure that one meets all necessary criteria before applying.

Uninsured discount policy

Uninsured discounts typically serve as financial relief for individuals without health coverage, allowing them to afford necessary treatments. These discounts can significantly lower costs, making healthcare more accessible to those who are uninsured. Applying for an uninsured discount usually requires self-reported information about employment status, income levels, and any recent significant changes to financial circumstances.

The process may also require a demonstration of the lack of coverage, which could then align the applicant with a particular set of benefits geared towards uninsured individuals.

Medical debt considerations

Existing medical debts can pose complex challenges during the financial assistance application process. It's crucial to disclose all outstanding debts as they can substantially influence an applicant’s overall financial eligibility and support level. Many assistance programs take into account current debt burdens when determining the urgency and level of assistance to provide.

Solutions for managing medical debt can include negotiation for lowered payments or restructuring repayment plans. Some programs may even include provisions for directly addressing these debts as a part of the financial assistance plan, demonstrating a comprehensive approach to financial relief.

Completing the financial assistance application form

Filling out the financial assistance application form accurately requires attention to detail. Each section must be completed meticulously to ensure clarity and compliance with application guidelines. Begin with personal information, ensuring all entries are current and correct. Move to patient information, detailing aspects like medical account numbers vital for processing.

Pay special attention to the financial section as any discrepancies in reported income or misreported financial details can lead to denial or extended processing times. It's worthwhile to double-check entries and, if possible, have someone else review the form for accuracy before submission.

Interactive tools and resources

In the effort to streamline the financial assistance application process, leveraging tools that facilitate document editing and signing can significantly reduce stress. Platforms like pdfFiller enhance the experience by enabling users to edit PDF forms, e-sign, collaborate, and manage documents all in one place.

Using interactive features available on pdfFiller not only aids in creating an error-free application but also empowers individuals to ensure they’ve gathered all necessary supporting documents efficiently. It can transform a daunting process into a more manageable task.

Submission and follow-up

Once the financial assistance application form is completed, applicants must follow established submission procedures. Most organizations offer various submission methods, including online submission, mail, or direct drop-off at designated locations. Choosing a method that allows for tracking can enhance transparency in the process.

Post-submission, applicants should be aware of typical timelines and review processes pertaining to financial assistance applications. It’s important to retain copies of submitted documents, as these can be invaluable when following up on the status of your application or rectifying any issues that may arise.

Managing your financial assistance

Managing financial assistance documentation wisely is crucial for ensuring ongoing success with the application process. Utilizing cloud-based platforms like pdfFiller allows users to keep organized records and easily access their documents from anywhere. This organization can reduce stress and improve response times for any follow-up actions or future applications.

Keeping track of deadlines related to re-applications or updates in personal circumstances is essential for maintaining eligibility. Over time, circumstances can change, and staying proactive will facilitate continuous access to needed assistance.

Future applications and re-evaluations

The need for financial assistance can vary over time, influenced by changes in income, household composition, or unexpected events. Consequently, understanding when and how to reapply or update an existing application becomes crucial. Many programs may require annual or semi-annual re-evaluations, ensuring that support remains relevant and responsive to the applicant’s needs.

Guidelines for ongoing eligibility should be followed closely. Preparing for these re-evaluations involves gathering updated documentation and reflecting changes in finances or household status clearly within applications. This procedure not only keeps applicants aligned with support but can also result in a smoother and more effective renewal process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial assistance application without leaving Google Drive?

How do I complete financial assistance application online?

How do I fill out financial assistance application on an Android device?

What is financial assistance application?

Who is required to file financial assistance application?

How to fill out financial assistance application?

What is the purpose of financial assistance application?

What information must be reported on financial assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.