Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form - How-to guide

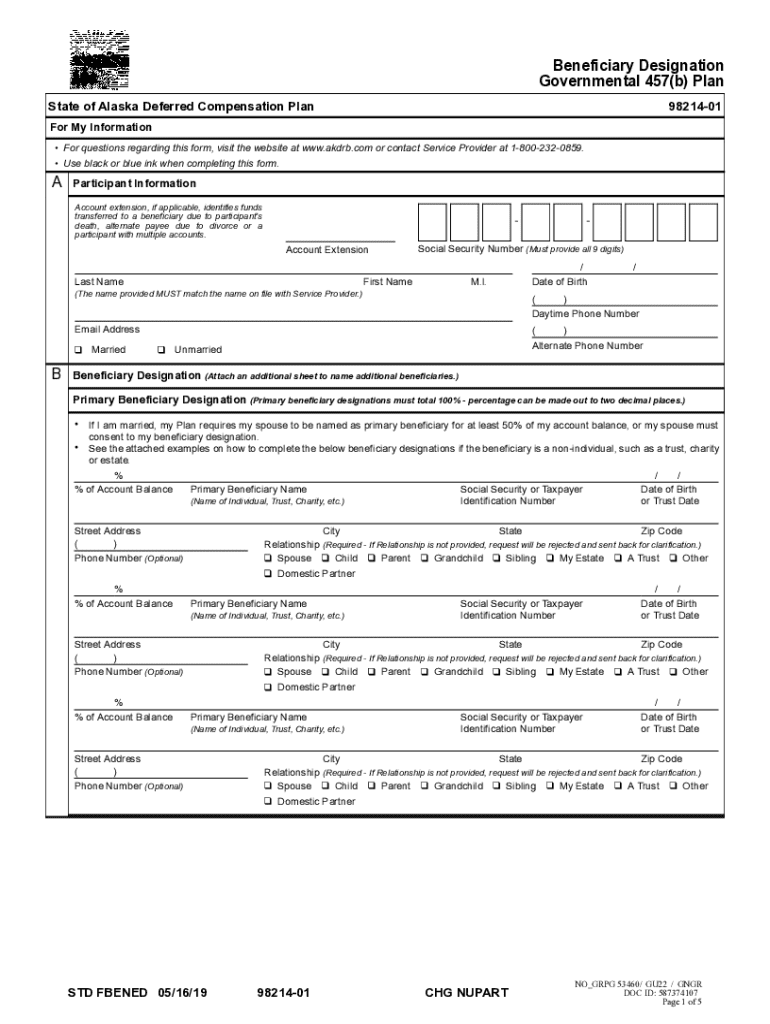

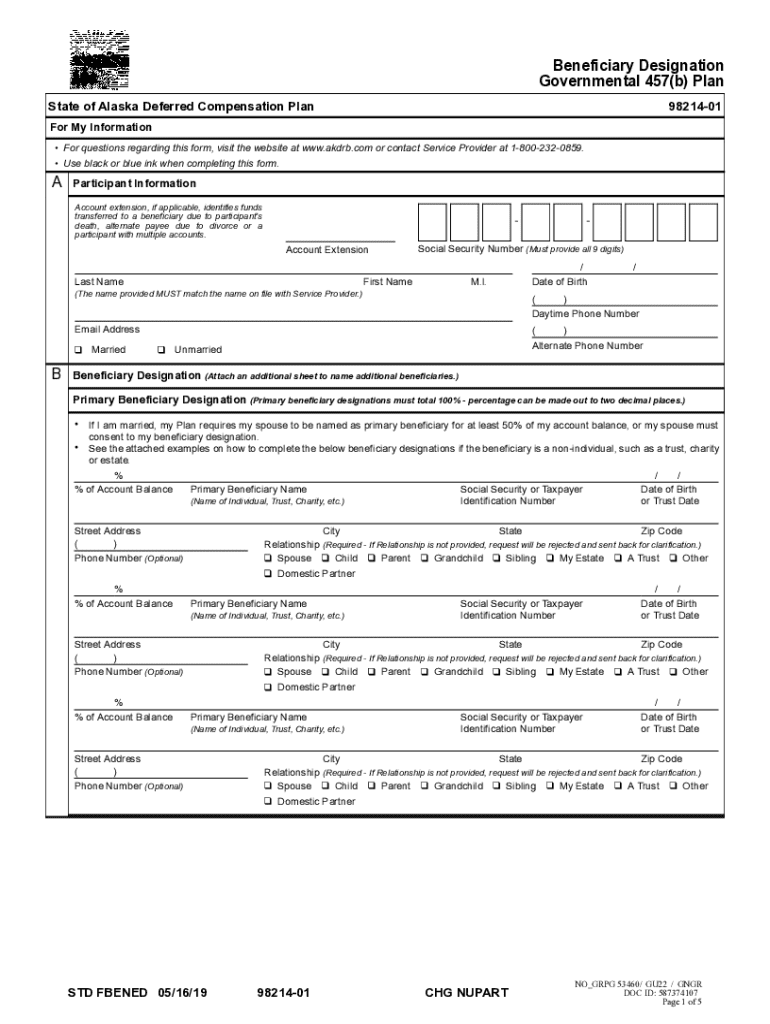

Understanding the beneficiary designation form

A beneficiary designation form is a vital document that outlines whom you wish to receive your assets upon your passing. This form not only clarifies your wishes but also helps in avoiding complications during the estate settlement process. By designating beneficiaries for specific accounts, such as life insurance policies or retirement accounts, you ensure that your assets are distributed according to your intentions.

The importance of beneficiary designations in estate planning cannot be overstated. Without a clear designation, your wishes may be disregarded, leading to potential disputes among heirs. This form acts as a legal instruction for financial institutions, making it critical for anyone wishing to manage their legacy effectively.

Who needs this form?

Various individuals and organizations should consider using a beneficiary designation form. Commonly, it is essential for individuals such as life insurance policyholders, retirement account holders, and individuals with investment accounts. Each of these groups must ensure that their intended heirs receive their assets without unnecessary legal hurdles.

Organizations, particularly employers offering benefit plans to employees, also need to implement this form to ensure their employees’ wishes are honored regarding benefits, pensions, and insurance payouts.

Key components of the beneficiary designation form

When filling out a beneficiary designation form, certain personal information is required. This includes the name, address, and contact information of the policyholder. Additionally, specific details about each beneficiary, such as their names, relationships to the policyholder, and dates of birth, should be included to prevent any ambiguity.

Moreover, the types of beneficiaries must be appropriately classified. Primary beneficiaries are first in line to receive assets, while contingent beneficiaries receive assets only if the primary beneficiaries are unable. Understanding the difference between individual beneficiaries versus charitable or organizational beneficiaries is also crucial for comprehensive estate planning.

Step-by-step guide to completing the beneficiary designation form

To successfully complete a beneficiary designation form, start by gathering all necessary information. Compile a comprehensive list of beneficiaries along with their details. Documentation for any trusts, as well as legal requirements specific to your state or situation, should also be collected ahead of time.

Next, fill out the form with clear and precise information. Each section should be carefully completed to avoid mistakes. Double-check that names are spelled correctly, and relationships are accurately described. Ensuring clarity and accuracy will minimize potential issues after submission.

Managing your beneficiary designation

After submitting your beneficiary designation form, it’s crucial to regularly review and manage your designations. Life events such as marriage, divorce, or the birth of a child can necessitate updates to your form. Staying aware of these changes and submitting necessary updates ensures that your assets will go to the intended beneficiaries.

Monitoring and confirming your beneficiary designations should not be overlooked. Periodic reviews are key to ensuring that your selections are up to date and accurately reflect your current wishes. This can prevent misunderstandings and disputes about your estate.

Interactive tools on pdfFiller for beneficiary designation form

pdfFiller offers a user-friendly platform for managing your beneficiary designation form. Through online editable templates, users can easily access and customize forms according to their needs. The process of filling out, editing, and signing documents becomes seamless, reducing the stress typically associated with paperwork.

In addition, the eSigning feature allows for legal signatures to be obtained digitally, ensuring that your documents are legally binding without the hassle of physical copies. Collaboration tools on the platform also enable users to share their forms with financial advisors or legal representatives efficiently.

Frequently asked questions (FAQs)

After completing and submitting your beneficiary designation form, it’s natural to have questions about the next steps. One common concern is what happens to the form following submission. Generally, the financial institution retains the document in its records as a formal notice of your wishes. It’s always beneficial to confirm receipt or any further requirements.

You may also wonder how to contest a beneficiary designation. This process typically requires legal consultation, especially if disputes arise among potential heirs. Furthermore, beneficiaries can be revoked or changed; however, it must be done through another formal submission to the relevant institution. It's important to stay informed about the tax implications for your designated beneficiaries, which may vary based on your region.

Case studies and real-life examples

Examining real-life scenarios can highlight the profound impact of correctly filling out a beneficiary designation form. For instance, in Example 1, an individual designated their spouse and children as beneficiaries on a life insurance policy. Upon the individual’s passing, the insurance payout went directly to the family, providing essential support without delay, as all forms were filled out correctly and updated regularly.

Conversely, in Example 2, a person chose to designate charitable organizations as beneficiaries in their will. This decision not only ensured that specific causes were supported after their passing but also provided tax benefits during their lifetime. Both cases underscore the importance of careful planning and proper documentation in alignment with one’s wishes.

Resources and support

For those seeking assistance while filling out their beneficiary designation form, numerous resources are available. Consulting with a financial advisor or an estate planning attorney can offer tailored guidance. Accessing community support forums on the nuances of estate planning can also provide valuable insights from shared experiences.

Additionally, pdfFiller serves as a comprehensive tool, offering templates and support for those looking to create or modify their beneficiary designation forms efficiently. Leveraging these resources can greatly enhance your peace of mind regarding your estate planning.

Conclusion: The importance of proper documentation

A properly filled out beneficiary designation form is essential for effective estate planning. It not only safeguards your assets but ensures they are distributed according to your wishes. In light of this knowledge, taking action to complete and submit your beneficiary designation form through pdfFiller empowers you to manage your documents and safeguard your legacy seamlessly.

With access to interactive tools and resources, pdfFiller stands out as an exceptional platform for drafting, editing, and managing essential documents, making it simpler for you to plan your future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit beneficiary designation online?

Can I create an eSignature for the beneficiary designation in Gmail?

Can I edit beneficiary designation on an iOS device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.