Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form: A comprehensive how-to guide

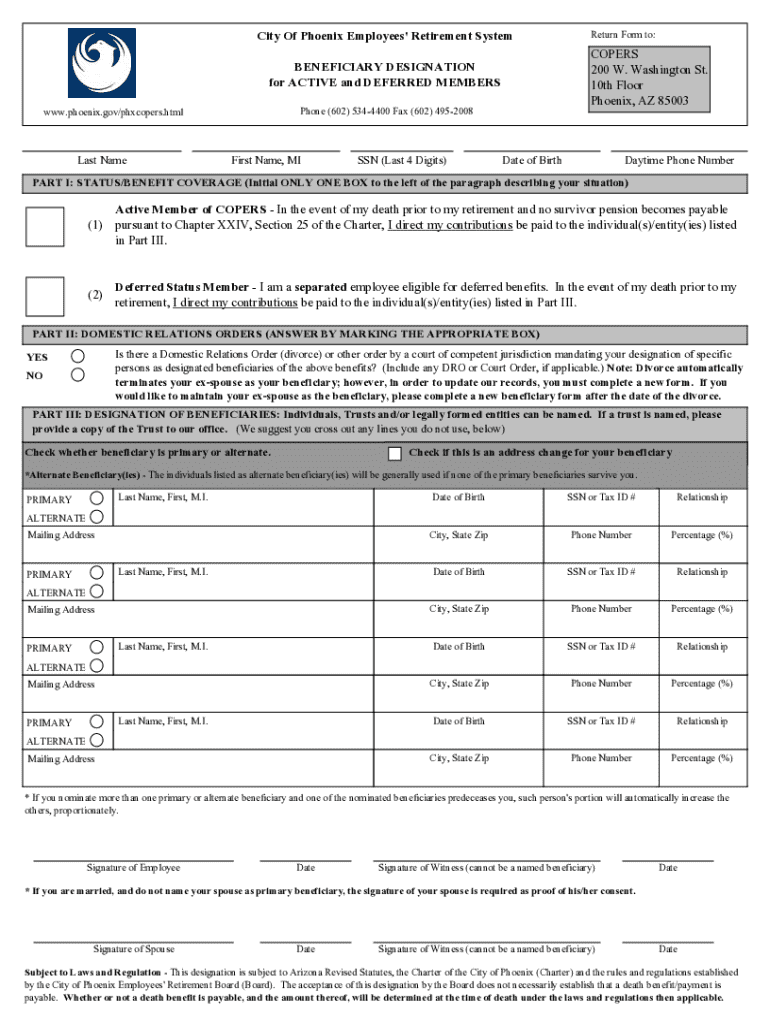

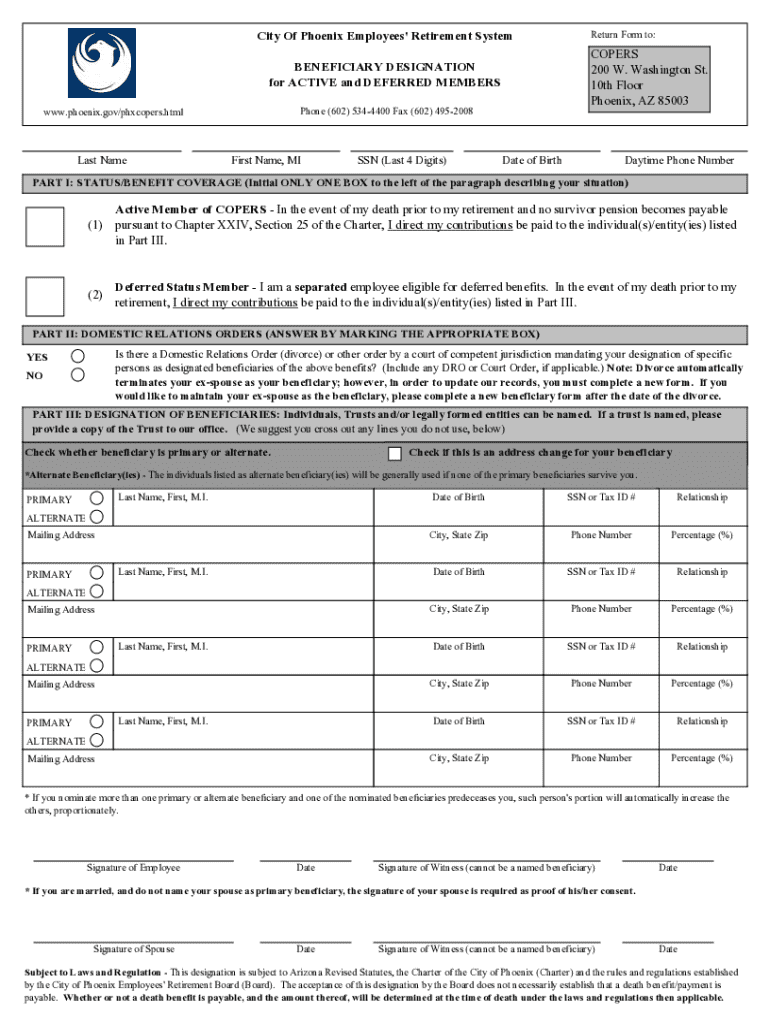

Understanding beneficiary designation forms

A beneficiary designation form is a legal document that allows account holders to designate who will receive their assets upon their death. This form is crucial for various accounts, including life insurance policies, retirement accounts, and bank accounts. The primary purpose of such forms is to ensure that assets are distributed according to the account holder's wishes, minimizing potential disputes and ensuring a streamlined transfer process.

Understanding the importance of a beneficiary designation form cannot be overstated. Without it, state laws may dictate asset distribution, which might not align with the account holder's preferences. Moreover, this form is pivotal in minimizing the time and costs associated with probate, effectively bypassing the lengthy court process for the named beneficiaries.

Types of beneficiary designation forms

There are several types of beneficiary designation forms, each serving different purposes based on individual circumstances. Understanding these types can help account holders make more informed decisions when filling out their forms.

Individual beneficiary designation forms are the most common type, allowing for straightforward designation of one or more individuals as beneficiaries. On the other hand, joint beneficiary designation forms enable multiple individuals to share assets, which can be a useful strategy for couples or business partners. Lastly, contingent beneficiary designation forms act as a safety net, providing a backup beneficiary should the primary beneficiary be unable to inherit.

How to fill out a beneficiary designation form

Filling out a beneficiary designation form may seem daunting, but it can be managed with a systematic approach. Here are the essential steps to ensure the form is completed accurately.

Editing and managing your beneficiary designation form

After filling out the beneficiary designation form, managing changes and edits is equally important to reflect life dynamics such as marriages, divorces, or the birth of children. One of the most user-friendly platforms for making these updates is pdfFiller.

Using pdfFiller, you can upload existing documents easily. The platform offers intuitive editing features that allow you to modify beneficiary details quickly without needing to fill out an entirely new form.

Signing and submitting your beneficiary designation form

Once the beneficiary designation form is filled out and reviewed, the next step is signing and submitting it. pdfFiller provides electronic signature options that make this process streamlined and effortless.

When deciding on how to submit your form, consider whether electronic or paper submissions work best for you. Electronic submissions often have faster processing times, but ensuring that you follow institutional guidelines is vital for successful submission.

Understanding the filing process

After signing your completed beneficiary designation form, it is essential to know where to send it. Different institutions may have specific submission guidelines, so it’s important to check these before mailing or uploading your document.

Confirming receipt is crucial. Following up after submission can help you verify that your changes have been documented and updated in the institution's records.

Common issues and troubleshooting

Despite careful preparation, issues can still arise during the submission of beneficiary designation forms. Common problems include failed submissions or missing information. Being aware of these potential difficulties can aid in effective troubleshooting.

If a submission fails or you encounter discrepancies, it is advisable to contact the relevant institution directly for clarification. In more complex situations, especially those involving legal interests or challenges, seeking legal advice may be necessary.

Frequently asked questions (FAQ) on beneficiary designation forms

Navigating the complexities of beneficiary designation can lead to a host of questions. These frequently asked questions address common areas of confusion.

Resources and tools for beneficiary designation

pdfFiller offers numerous interactive tools to assist users in managing their beneficiary designation forms. From templates to customizable forms, resources are available to facilitate accurate documentation.

Additionally, legal advice and assistance resources can provide users with confidence in their plans. Downloadable templates often serve as valuable starting points for filling out your designation forms.

Testimonials and success stories

Hearing from others who have successfully navigated the beneficiary designation process can provide valuable insights. Case studies highlight the importance of proper designation and how pdfFiller has facilitated a smoother experience for users.

User experiences demonstrate the practical benefits of effective document management, shedding light on the variety of situations in which having a clear beneficiary designation has led to positive outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiary designation directly from Gmail?

How do I make changes in beneficiary designation?

Can I create an eSignature for the beneficiary designation in Gmail?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.