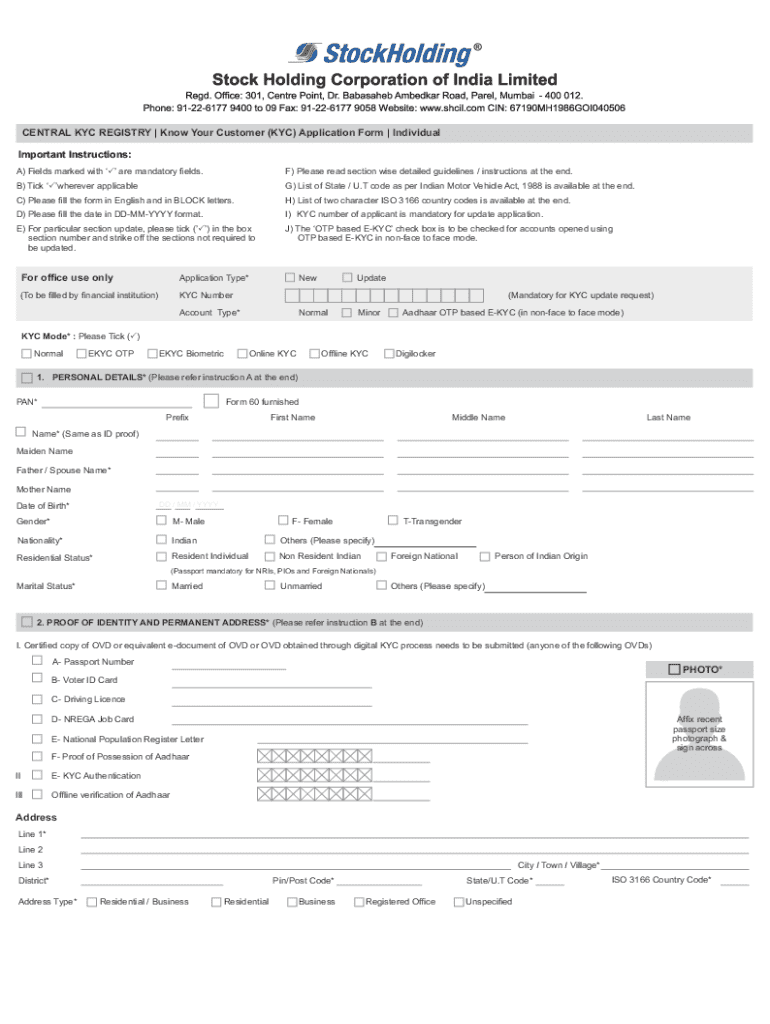

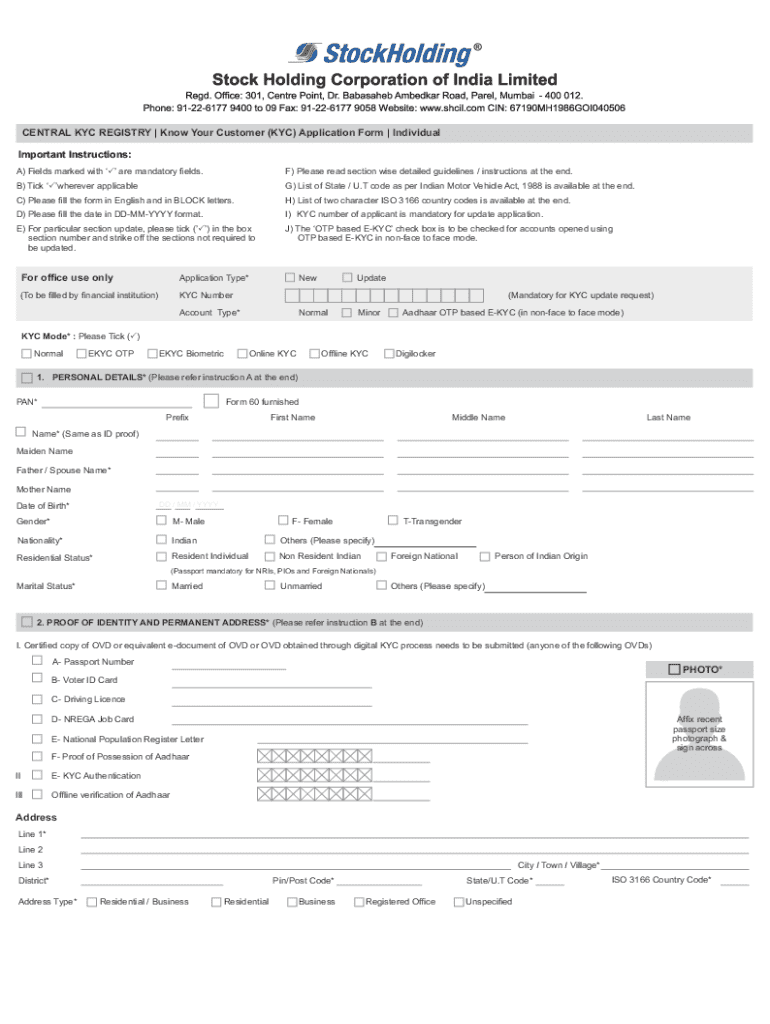

Get the free Central Kyc Registry | Know Your Customer (kyc) Application Form | Individual

Get, Create, Make and Sign central kyc registry know

How to edit central kyc registry know online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central kyc registry know

How to fill out central kyc registry know

Who needs central kyc registry know?

Central KYC Registry Know Form: A Detailed Guide

Understanding the Central KYC Registry

The Central KYC Registry (CKYCR) serves as a central repository for Know Your Customer (KYC) documents submitted by customers seeking banking and financial services. Its primary purpose is to simplify the process of verifying a customer's identity across the vast financial landscape, thus ensuring compliance with anti-money laundering regulations. This centralized approach not only improves access but significantly reduces duplication of documentation, benefiting both financial institutions and customers.

KYC plays a crucial role in the financial services sector, as it establishes the identity of clients, mitigating the risks associated with fraud and money laundering. By gathering vital personal information and supporting documentation, financial entities can better assess each customer's risk profile and ensure ongoing due diligence. The ability to access a centralized registry streamlines these processes considerably.

Access to the Central KYC Registry is granted primarily to banks, financial institutions, and other entities regulated by governing authorities. This ensures that sensitive personal information is safeguarded while still being available for legitimate financial service applications.

Steps to access the Central KYC Registry form

To initiate the process of accessing your Central KYC Registry form, the first step is navigating to the dedicated KYC portal. This user-friendly online resource is designed to guide you through the necessary steps, rendering the process straightforward.

The registration process involves several critical components:

Occasionally, you might need to reset your password for easier access. This process is typically straightforward, requiring you to follow prompts sent to your registered email address, ensuring the security of your account.

How to fill out the Central KYC Registry form

The Central KYC Registry form is structured to facilitate a clear and organized submission of your KYC information. It comprises two main sections—personal information and identification documents—which are essential for identity verification.

When filling out the personal information section, it is vital to ensure accuracy. This includes:

In the identification documents section, you'll need to submit certain documents. Understand the formats and guidelines to avoid common mistakes such as submitting blurry images or incorrect document types. This can delay your application.

Editing and updating your KYC information

Keeping your KYC information up to date is critical for continued compliance and service efficiency. Changes in personal details, such as a new address or updated identification documents, necessitate an update of your KYC profile.

Follow these steps to edit your KYC form:

Electronic signature options for the KYC form

An electronic signature is increasingly vital for signing KYC forms, as it streamlines the verification process. By signing digitally, you save time while ensuring your consent is documented.

Using pdfFiller, here’s how to eSign your KYC form:

Collaborating on the KYC form

Collaborating on your KYC form can enhance efficiency, especially when working with financial institutions or advisors. Sharing options are available to facilitate this process.

Utilize pdfFiller’s collaboration tools for seamless teamwork:

Managing your KYC documents with pdfFiller

Managing your KYC-related documents effectively contributes to organization and compliance. With pdfFiller, you can store and retrieve your forms easily, enabling quick access whenever needed.

Take advantage of the following pdfFiller features to enhance document management:

Troubleshooting common issues with the KYC form

While navigating the KYC process, you might encounter several common issues related to form submission. Staying informed about these can make your experience smoother.

Common issues include uploading the wrong document type or misconfigured personal information. To avoid these pitfalls, ensure careful review before submission. If you encounter problems, contacting support can help resolve your concerns quickly.

Real-life applications of the Central KYC Registry

The efficacy of the Central KYC Registry can be highlighted through various case studies showcasing successful implementations. Organizations have witnessed significant improvements in customer onboarding experiences and compliance adherence since utilizing the CKYCR.

User testimonials frequently emphasize the efficiency gained through a centralized approach, reducing their KYC processing times substantially. Financial institutions report drastic decreases in repeated documentation, illustrating the transformative effect of adhering to the Central KYC Registry guidelines.

As the financial industry continuously evolves, the Central KYC Registry stands at the forefront, revolutionizing practices through better transparency and compliance solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the central kyc registry know electronically in Chrome?

How do I edit central kyc registry know on an iOS device?

How do I fill out central kyc registry know on an Android device?

What is central kyc registry know?

Who is required to file central kyc registry know?

How to fill out central kyc registry know?

What is the purpose of central kyc registry know?

What information must be reported on central kyc registry know?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.