A complete guide to merger notification template forms

Overview of merger notification forms

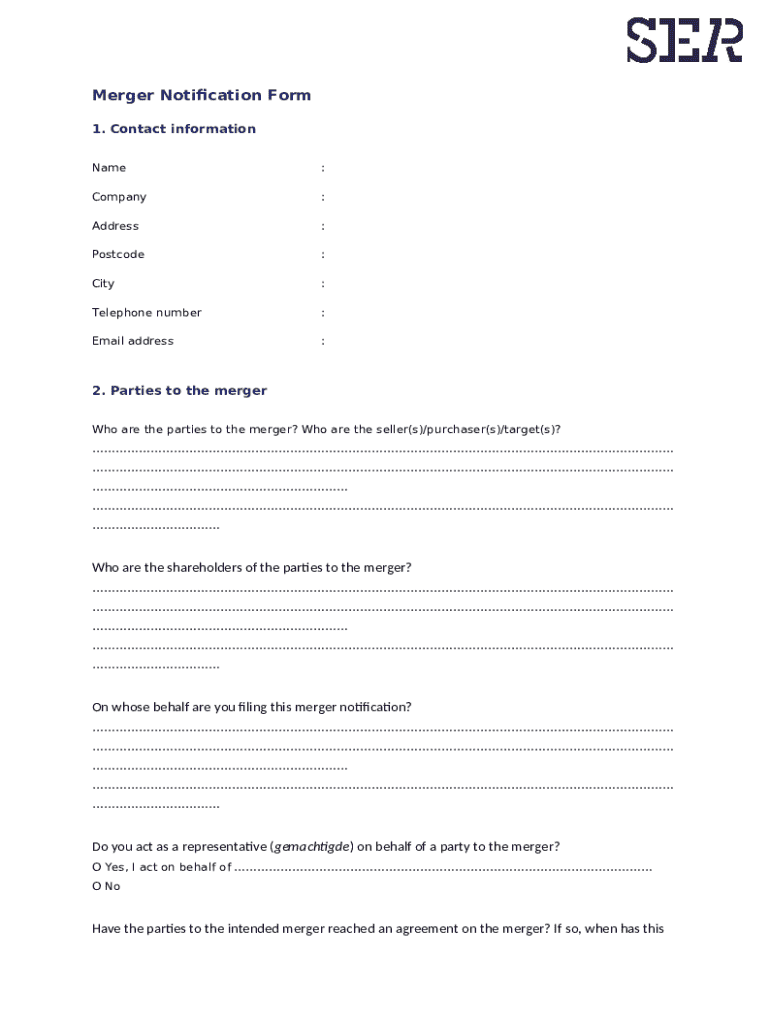

A merger notification template form serves as a formal document required by regulatory authorities when companies propose to engage in mergers or acquisitions. This template ensures that all relevant information regarding the transaction is disclosed transparently, providing regulators with the necessary data to assess potential impacts on competition and market dynamics.

Understanding its importance in both legal and business contexts is crucial. The form not only fulfills a legal obligation but also helps businesses strategize and articulate the benefits and implications of the merger effectively. Key components of this form include detailed information about the parties involved, financial data, and an analysis of how the merger will influence market competition.

Understanding regulatory requirements

Merger notifications are governed by laws that vary by jurisdiction, making it essential to understand the regulatory environment. Each country has its own set of regulations, administered by specific agencies responsible for antitrust compliance. For instance, in the United States, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) oversee the process.

The necessity for careful preparation and timely submission cannot be overstated. Often, there are strict timelines for notification, and delays can lead to significant legal ramifications. Once submitted, the regulatory body will review the notification, which can take several weeks to months, depending on the complexity of the transaction.

Step-by-step guide to completing the merger notification template form

Completing a merger notification template form involves several key steps. First, it is essential to gather preliminary information. You should compile company details, including the name, address, and registration information, as well as identifying key individuals involved in the merger.

Preliminary information to gather

Name, address, registration information.

Names and roles of key executives involved.

Next, detailed financial information is required. Companies should present current and projected financial statements and justify the valuation methodologies used in the merger.

Detailed financial information required

Last 3 years’ income statements, balance sheets, and cash flow statements.

Future financial performance expectations.

Methods for determining the merger value and related assumptions.

The form also requires a disclosure of market share and competition analysis. Companies need to define their target market and evaluate the competitive effects of the merger on that market.

Disclosure of market share and competition analysis

Clear definition of the relevant product and geographical markets.

Assessment of how the merger will affect competition within the identified markets.

Finally, the template requires filling out specific sections detailing transaction information, parties involved, financial information, and competition assessment. This section-by-section breakdown is crucial for clarity and compliance.

Best practices for filling out the merger notification template form

Accuracy and completeness are paramount when completing the merger notification template form. Each entry must be cross-checked to avoid common mistakes such as providing outdated or incorrect financial figures, misrepresenting market definitions, or neglecting details about the parties involved.

Clarity and transparency in communication will strengthen your submission. Avoid using jargon and ensure that all terms are defined, as regulatory bodies can be reluctant to interpret ambiguous language. By adhering to these best practices, companies can increase the likelihood of a smooth review process.

Editing and collaborating on the merger notification form

Using tools like pdfFiller can significantly enhance the editing and collaboration process when completing a merger notification template form. pdfFiller offers features that allow users to edit the document directly online, making it easy to update financial information or adjust details as necessary.

Collaboration is streamlined through the platform, which allows you to invite team members for feedback. This collaborative aspect ensures that all relevant perspectives are incorporated, particularly in sensitive areas of financial and legal implications.

Ensuring compliance of document version control

By using pdfFiller's document version control features, you can easily track changes and ensure compliance with regulatory requirements. Maintaining a clear record of revisions is essential, especially if the form undergoes multiple drafts before submission.

Signing and submitting your merger notification

Legal requirements for electronic signatures can vary by jurisdiction, so it’s crucial to understand the specific laws applicable to your merger situation. Most agencies accept electronic signatures, facilitated through platforms like pdfFiller, which ensures a more efficient submission process.

After eSigning the merger notification template, you should complete a final checklist to confirm that all required information has been accurately filled and verified before formally submitting it to the relevant regulatory authority.

Managing post-submission activities

After the submission, tracking your submission status becomes important, as regulatory bodies might require follow-up questions or additional information. It's essential to be prepared to provide prompt responses that offer clarity and further details.

Additionally, it's wise to consider potential outcomes of the notification process. Companies should strategize for different scenarios, including approval, conditional approval, or rejection, and understand how to manage communications with stakeholders effectively.

Creating a digital archive of your merger documentation

Establishing a robust document management system is vital for future reference after your merger notification process is complete. A digital archive keeps all merger-related documents accessible and organized.

Using pdfFiller facilitates this document storage and retrieval process, enabling seamless access to previous versions and related documents as needed. This archival process also serves well in compliance audits or if future reference is required.

Real-life examples and case studies

Examining successful merger notifications can provide valuable insights. For instance, companies like Disney and Pixar successfully navigated the merger notification process by meticulously preparing their submissions, which ultimately led to a smooth regulatory review. Lessons learned from their experience include the importance of comprehensive market analysis and transparent communication.

Conversely, some companies faced challenges due to inadequate information provided during the notification process. Understanding these common pitfalls can guide new submissions, helping companies leverage tools like pdfFiller effectively to avoid past mistakes.

FAQs regarding the merger notification template form

As with any complex legal document, questions frequently arise about the merger notification template form. Common concerns include understanding specific technical terms and the best practices for ensuring compliance with regulatory requirements.

Users can also seek further assistance through regulatory body resources or professional consultants versed in merger regulations, who can provide clarity on both procedural and technical aspects of the filing process.