Get the free Carrier’s Legal Liability Policy- Claim Form - uiic co

Get, Create, Make and Sign carriers legal liability policy

How to edit carriers legal liability policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out carriers legal liability policy

How to fill out carriers legal liability policy

Who needs carriers legal liability policy?

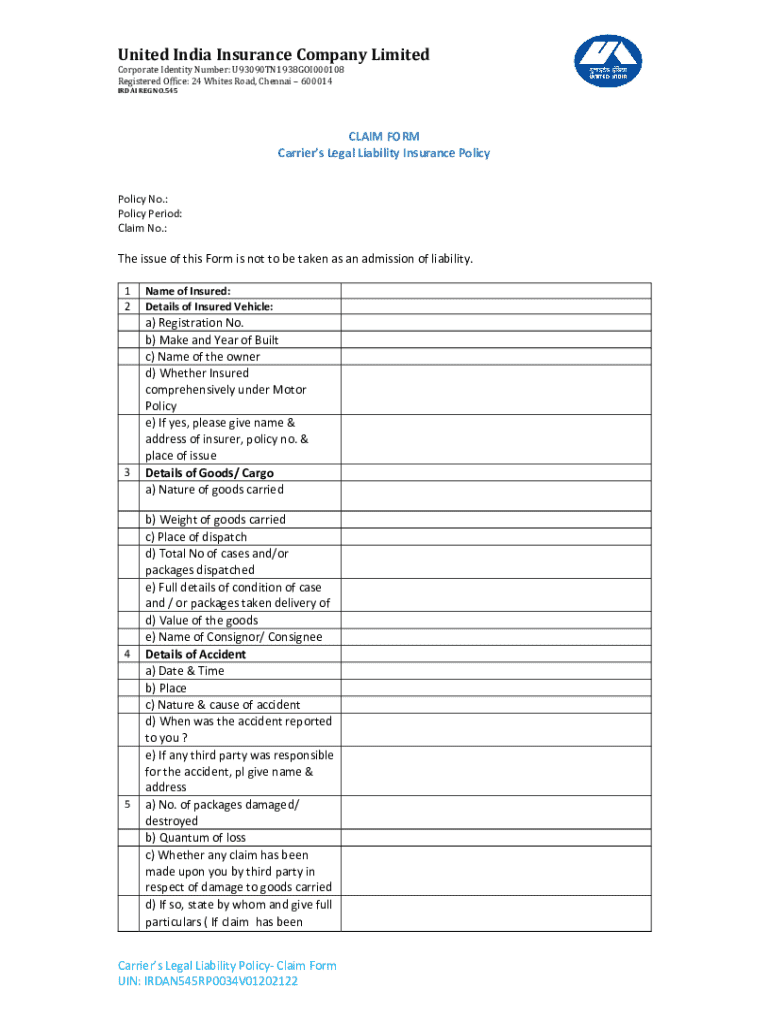

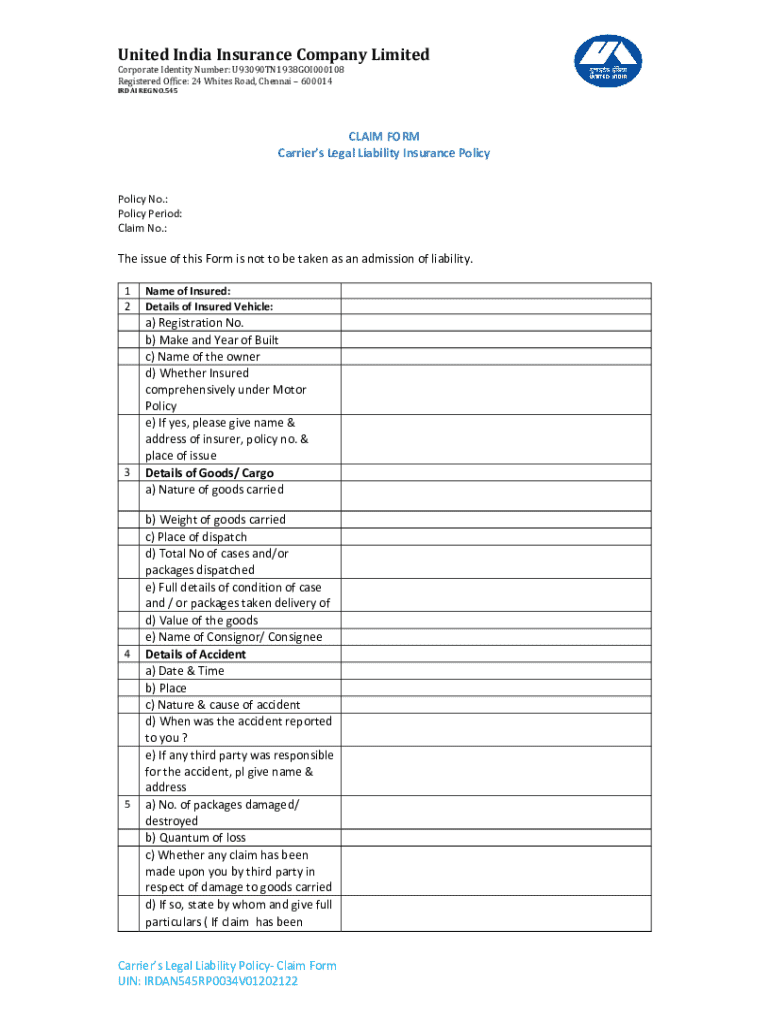

Understanding the Carriers Legal Liability Policy Form

Understanding carriers legal liability policies

Carriers legal liability policies are essential documents for businesses involved in transporting goods. They provide a safeguard against losses or damages incurred during the shipping process. These policies are crucial for transporters, also known as carriers, and help them offer a reliable service to their shippers.

The importance of these policies cannot be overstated, as they cover a variety of situations, including theft, accidental damage, and loss of cargo. Whether transporting perishable goods or high-value electronics, carriers need to have a comprehensive understanding of their policy coverage.

Essential components of carriers legal liability policy forms

When reviewing a carriers legal liability policy form, it’s crucial to understand its structure. Each policy typically contains several key sections that outline important aspects of coverage. Standard policy sections include coverage details, exclusions, and the conditions under which the policy operates.

Familiarizing yourself with critical terminology will also greatly enhance your understanding. Terms like liability, coverage limits, and deductibles play a significant role in determining the policy's effectiveness for your specific needs.

Step-by-step guide to filling out the carriers legal liability policy form

Before tackling the carriers legal liability policy form, ensure you have gathered all necessary documents. This may include previous policies and transport agreements that highlight your business’s unique needs. It's important to tailor the policy to fit your shipping operations accurately.

As you fill the form, each section requires careful attention. Starting with the policyholder information, you need to provide personal identification and details about your type of business. Follow this with coverage details, selecting the appropriate limits based on the risks involved in your operations.

After filling out the form, take time to verify all the information. The accuracy of details provided in the carriers legal liability policy form is crucial to avoid potential disputes or claims denials.

Interactive tools to facilitate form management

Managing documents has never been easier, thanks to innovative platforms like pdfFiller. This service offers features for real-time editing and collaboration on your carriers legal liability policy form. Users can easily implement feedback and make necessary adjustments to ensure compliance.

One of the standout features is the eSignature capability, allowing for seamless transactions without the need for physical signatures. Additionally, utilizing established templates can help streamline the process, making it easier to customize forms to meet your specific requirements.

Editing and modifying your form

Once you've filled out your carriers legal liability policy form, there may be a need for edits and modifications to ensure compliance. Document editing should focus on maintaining accuracy and relevance. Each change must reflect the latest information and remain aligned with your operational needs.

pdfFiller makes this process straightforward. You can save and organize your forms in the cloud, which allows for easy access and management of documents. Utilizing best practices in naming and filing your forms ensures you can quickly retrieve them when necessary.

Signing and sharing your completed policy form

The signing process has evolved with technology, making eSignatures a highly efficient option. Not only are they legally valid, but they also offer convenience for all parties involved. With pdfFiller, signing your carriers legal liability policy form becomes a seamless part of your workflow.

Sharing the completed form is likewise simplified. Users can send secured links or copies of the document while setting permissions for viewing or editing. This feature is particularly useful when collaborating with stakeholders to ensure everyone has the required access.

Managing your carrier's legal liability policy

Once you've established your carriers legal liability policy, regularly keeping it up-to-date is crucial. This involves reviewing the policy periodically to ensure it reflects your current operations accurately. Factors like expansion of services or regulatory changes can trigger the need to revisit your coverage.

Collaborating with your insurance agent also plays a vital role in policy management. Open communication and proactive discussions can help you adjust coverage, ensuring you remain adequately protected against potential risks.

Common questions and troubleshooting

Despite being a critical aspect of operations, carriers often encounter difficulties when submitting their legal liability policy forms. Common issues include providing incorrect information or misunderstanding the intricacies of policy terms. To address these challenges, clarifying frequently asked questions can help demystify the process.

Understanding how to correct inaccuracies and navigate changes within policies is essential in maintaining compliance with standards. Make sure to leverage the resources available to ensure thorough comprehension of your policy.

Final thoughts on utilizing the carriers legal liability policy form effectively

Integrating digital solutions into your document management processes can significantly enhance compliance, efficiency, and security. Tools like pdfFiller empower users to manage their carriers legal liability policy forms seamlessly. By embracing technology, you can reduce the hassle associated with traditional forms and ensure a more organized approach.

In conclusion, understanding and effectively using the carriers legal liability policy form is pivotal for any transport operation. With the right tools and knowledge, including pdfFiller’s features, managing your documentation becomes not just efficient but also a strategic advantage in ensuring your business's success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute carriers legal liability policy online?

How do I edit carriers legal liability policy online?

Can I create an eSignature for the carriers legal liability policy in Gmail?

What is carriers legal liability policy?

Who is required to file carriers legal liability policy?

How to fill out carriers legal liability policy?

What is the purpose of carriers legal liability policy?

What information must be reported on carriers legal liability policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.