Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Your Comprehensive Guide to Form 10-Q

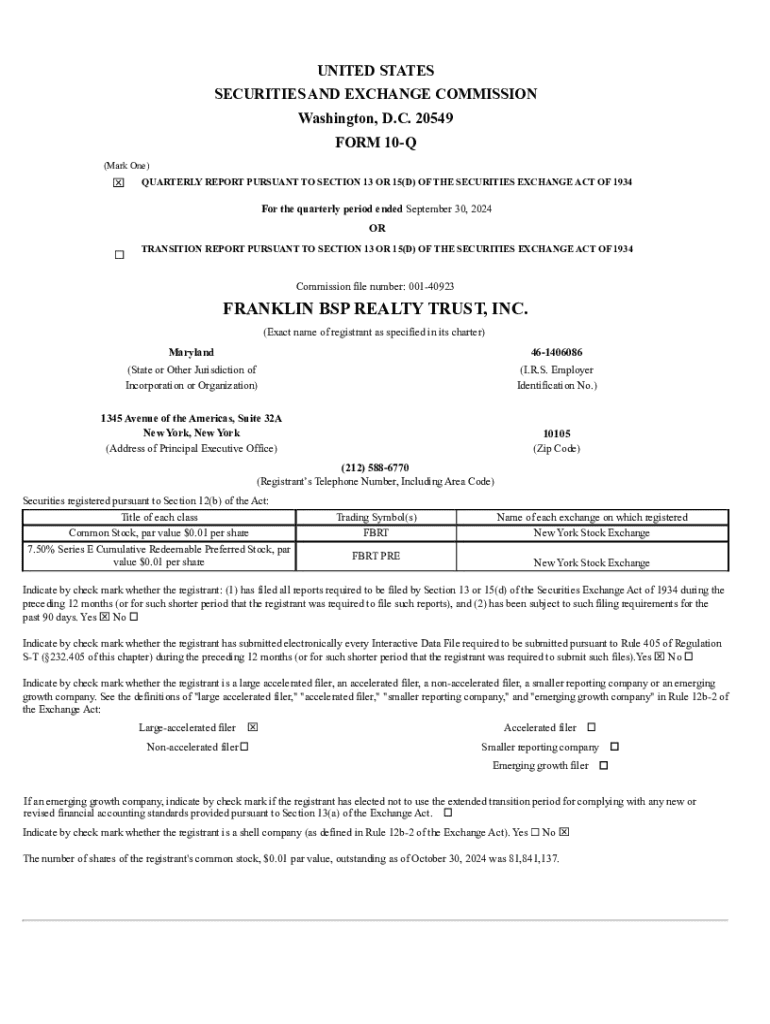

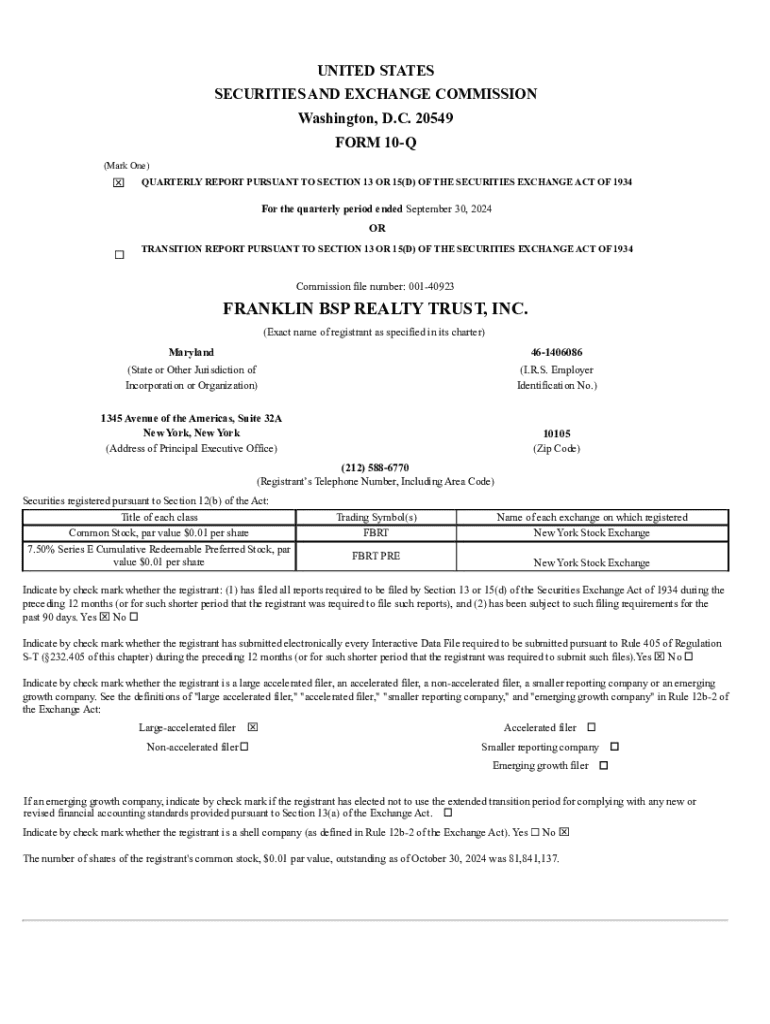

What is Form 10-Q?

Form 10-Q is a quarterly financial report that publicly traded companies in the United States are required to file with the Securities and Exchange Commission (SEC). This form provides a comprehensive overview of a company's financial performance and condition during the most recent quarterly period. Unlike the annual Form 10-K, which serves as a more in-depth overview of the company's annual financial health, the 10-Q offers a snapshot of the company's operations and financial results on a quarterly basis.

The 10-Q is critical for investors and financial analysts who need timely information to make informed decisions. This form distinguishes itself from other SEC filings, such as Form 8-K, which reports unscheduled material events or corporate changes. Understanding Form 10-Q is essential for recognizing a company's interim financial status and to gauge its trajectory throughout the fiscal year.

Purpose of the 10-Q filing

The primary purpose of the 10-Q filing is to ensure regular reporting of a public company's financial performance. This quarterly requirement fosters transparency and accountability, enabling investors to track a company’s financial health and operational efficiency in real time. By providing updates on critical financial metrics, the 10-Q helps investors to make informed decisions about buying, holding, or selling stock.

Additionally, public companies are mandated to comply with SEC regulations when filing their 10-Qs. This compliance not only serves to protect investors but also enhances overall market integrity. The availability of consistent financial data empowers stakeholders to assess past performance and predict future performance, facilitating better investment strategies.

Key components of a Form 10-Q

The Form 10-Q consists of various key components that provide a comprehensive view of the company's performance. Understanding these sections can equip investors and analysts with the information needed to evaluate the company's financial status.

Filing requirements for Form 10-Q

Understanding filing requirements for Form 10-Q is crucial for compliance. Most public companies are obligated to file this form, regardless of their size. Companies must submit their 10-Q filings on a set schedule, typically: 40 days after the end of each fiscal quarter for larger companies, and within 45 days for smaller reporting companies. This creates a consistent rhythm of financial reporting throughout the year.

For smaller reporting companies, while the overall framework remains the same, there may be some relaxed disclosure rules or less complex financial requirements. It's vital for all companies to be aware of their responsibilities to ensure compliance and maintain investor confidence.

What’s in a Form 10-Q?

A Form 10-Q includes several mandatory items that companies must report. Knowing these components can enhance the understanding of the document’s significance.

Filing deadlines for Form 10-Q

Filing deadlines for Form 10-Q depend on whether a company operates on a calendar year or a fiscal year basis. Calendar year companies must file within 40 days of the end of each quarter, while fiscal year companies will follow their respective schedules. It’s essential for companies to familiarize themselves with the specific deadlines applicable to their reporting periods.

Key dates to remember include: - First quarter: Due 40 days after the quarter ends. - Second quarter: Due 40 days after the next quarter ends. - Third quarter: Due 40 days after the next quarter ends. - Fourth quarter: No 10-Q, but must file a Form 10-K instead. The consequences of filing late can be severe, including penalties from the SEC and potential negative impacts on stock prices.

How to prepare a Form 10-Q

Preparing a Form 10-Q requires careful planning and organization. Collecting necessary financial documents early can help streamline the process. This typically includes the company's balance sheet, income statement, and cash flow statement from the quarter. It’s also essential to gather notes on any significant changes or events that occurred during the reporting period.

To ensure accuracy and compliance, companies should create a checklist that guides them through each required section of the form. Using templates can be extremely helpful, allowing companies to maintain consistency across quarterly reports. Collaboration with financial teams is critical, as different areas of the business may need to provide information that contributes to the report.

How to file Form 10-Q

Filing Form 10-Q can be accomplished through the SEC's EDGAR online filing system. After compiling all required documents and reviewing them for accuracy, companies will upload their completed form. This process involves creating an account on EDGAR, filling in required sections, and ensuring that electronic signatures are applied where necessary.

Common pitfalls to avoid include missing deadlines, insufficient internal review, and failure to address disclosure requirements. Timeliness and accuracy in filing are vital, as discrepancies can lead to scrutiny from the SEC and potential damage to corporate reputation.

How to find Form 10-Qs

Finding Form 10-Qs is simplified through the SEC's EDGAR database. Investors and analysts can access company filings by searching for the specific company and navigating through the report categories. In addition to EDGAR, various financial databases and platforms provide tools for tracking and managing these filings quickly and efficiently.

Key resources for locating Form 10-Qs include financial news websites, investment research platforms, and analytics tools that aggregate this information. Utilizing these resources empowers investors to stay updated on the latest filings and make informed decisions based on the most current financial data available.

Comparing 10-Q with other SEC filings

To fully understand Form 10-Q, it's beneficial to compare it with other SEC filings such as Form 10-K and Form 8-K. The Form 10-K is an annual report that provides more comprehensive insights than the 10-Q, including extensive disclosures concerning operations, financial performance summaries, and future outlooks over the entire fiscal year.

In contrast, Form 8-K is specifically designed to report unscheduled material events or corporate changes that require immediate reporting to investors. The differences lie in the content depth and frequency of the filings, with the 10-Q occurring quarterly and the others serving more specialized communication needs. Understanding these distinctions can enhance a reader's ability to evaluate a company's operational trajectory effectively.

Understanding the consequences of non-compliance

Non-compliance with filing requirements for Form 10-Q can have serious ramifications for companies. The SEC can impose penalties on firms that consistently fail to meet reporting deadlines, which can include fines or restrictions on trading their stock. More importantly, failure to comply can quickly erode investor trust, leading to decreased stock valuation.

In addition to SEC penalties, the negative fallout from non-compliance can manifest in public perception. Investors may rush to sell their shares, significantly impacting stock prices. Ultimately, maintaining compliance with Form 10-Q filing requirements is essential for safeguarding corporate credibility in the market.

Key insights and highlights from recent Form 10-Q filings

Reviewing recent Form 10-Q filings can reveal important trends in financial performance and management insights. For example, many companies have reported their responses to economic shifts and market uncertainties directly in their 10-Qs, showcasing either resilience or vulnerability to market changes. Investors should pay particular attention to MD&A sections for critical context around quantitative data.

Sector-specific observations are also valuable. For instance, tech firms may highlight changes in demand for products, while consumer goods companies might address shifts in consumer behavior. Analyzing these trends can provide a more comprehensive understanding of market conditions that could affect an investment’s long-term viability.

Interactive tools for document management

Utilizing interactive document management tools can significantly streamline the 10-Q preparation process. Platforms like pdfFiller enable seamless editing, e-signing, and collaborative work on documents from a single, cloud-based system. This enhances efficiency, allowing teams to focus on content accuracy and clarity instead of administrative details.

Electronic signing and cloud-based storage also facilitate easy access to documents and ensure that important files are securely stored and easily retrievable. These tools are particularly beneficial for teams working from different locations, promoting unified collaboration in creating and filing Form 10-Q and other essential documents.

Frequently asked questions (FAQs) about Form 10-Q

Several common questions arise regarding Form 10-Q, especially among new filers. Many individuals wonder about the differences between 10-Q and 10-K filings or seek guidance on filing procedures. Addressing these questions can alleviate confusion and ensure correct adherence to SEC regulations.

Explore related financial reporting forms

Understanding Form 10-Q is just one aspect of navigating the world of corporate financial reporting. Other forms, such as Form 10-K and Form 8-K, provide different insights into a company's financial health. While the 10-K offers a more comprehensive annual review, the 8-K delivers immediate updates about significant events — each playing a unique role in the financial reporting spectrum.

Companies must leverage best practices for corporate financial reporting to meet regulatory requirements and uphold transparency to investors. Familiarizing oneself with these forms ensures that stakeholders can make well-rounded assessments about a company’s overall standing in the marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 10-q online?

How do I edit form 10-q in Chrome?

Can I create an electronic signature for the form 10-q in Chrome?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.