Get the free Schedule 13g

Get, Create, Make and Sign schedule 13g

How to edit schedule 13g online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 13g

How to fill out schedule 13g

Who needs schedule 13g?

A comprehensive guide to the Schedule 13G Form

Understanding the Schedule 13G Form

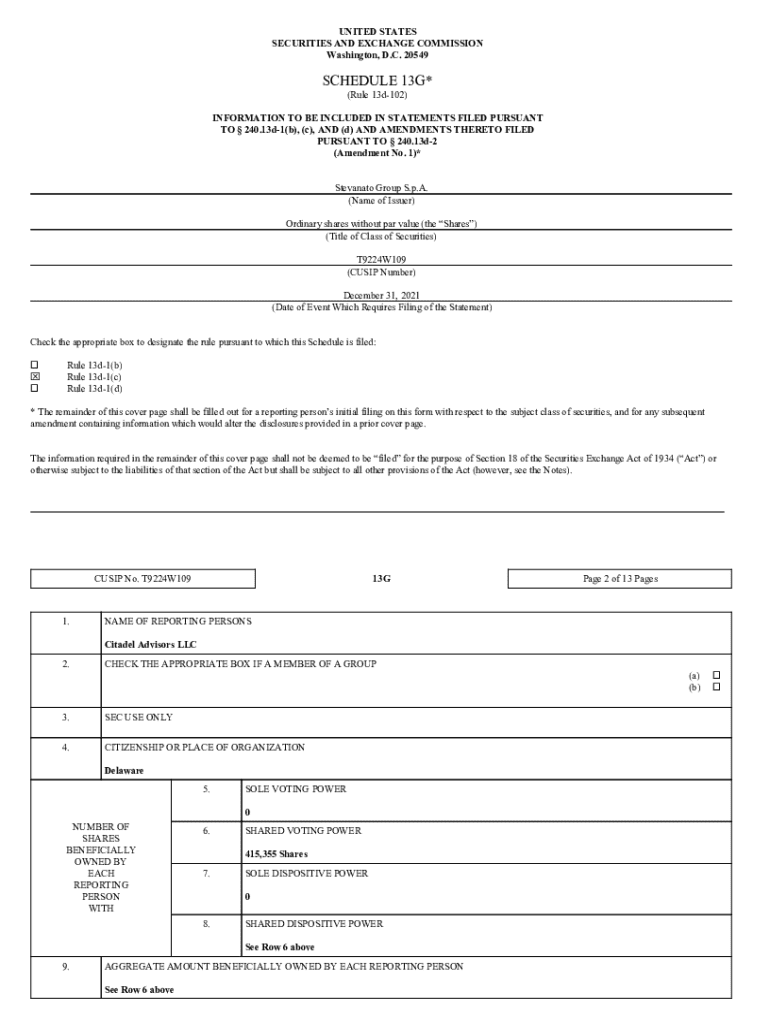

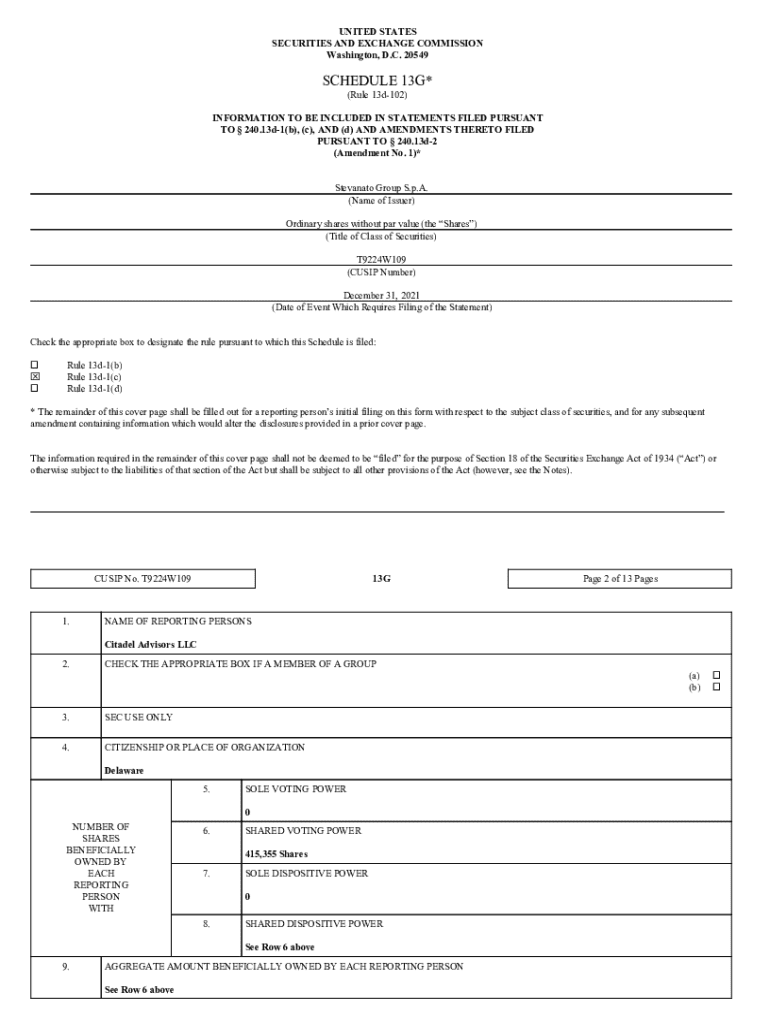

The Schedule 13G Form is a document required by the U.S. Securities and Exchange Commission (SEC) for certain individuals and entities that acquire more than 5% of a publicly traded company's shares but qualify as a passive investor. Unlike the Schedule 13D, which requires detailed disclosures and is intended for active investment strategies, Schedule 13G simplifies the reporting process for companies and investors that intend to hold their shares without active influence or control over the firm.

This distinction is essential; while both forms disclose ownership, Schedule 13D is more comprehensive and cumbersome, requiring additional intent and activity reporting. Schedule 13G is tailored for investors who do not aim to influence company policy or management, thereby easing the burden of compliance.

Who must file a Schedule 13G Form?

Eligible filers for the Schedule 13G Form typically include institutional investors such as mutual funds, pension funds, and insurance companies, as well as individual investors who are deemed passive in their investments. This classification allows these investors to report their holdings without being subjected to the intricate requirements otherwise outlined in Schedule 13D.

There are exemptions available to certain investors under varying circumstances. For instance, seasoned investors might not need to file if their ownership changes do not exceed specific thresholds, ensuring that the SEC's regulatory framework is efficient while maintaining investor information flow.

Key information included in a Schedule 13G filing

A Schedule 13G filing typically includes essential details that help the SEC and market participants gauge significant share ownership. Required disclosures entail information about the shareholder, including the identity of the investor, their ownership percentage, and relevant material facts that could impact investor behavior and company performance.

Accuracy in these disclosures is crucial. Misrepresentation or oversight can lead to compliance issues, penalties, and loss of trust among shareholders and investors, making meticulous reporting mandatory for all filers.

When is filing required?

Filing a Schedule 13G is mandated when an investor or group of investors acquires more than 5% of a class of a public company's shares. The timeline for filing is structured; filers must submit the initial Schedule 13G within 45 days of reaching ownership threshold and subsequently notify the SEC of any material changes or amendments—such as changes in ownership percentage or investor information—promptly.

Failing to file within the specified timeframe can result in significant repercussions, including fines and reputational damage. Additionally, it can undermine investor confidence, highlighting the importance of thorough documentation and timely submissions.

How to complete a Schedule 13G Form

Completing a Schedule 13G Form can be a straightforward process if the correct information is gathered in advance. To ensure accuracy, follow this step-by-step guide. The first step involves obtaining the specific form, which can be easily accessed through the SEC's website or platforms like pdfFiller, which allows users to fill out forms seamlessly.

Next, begin filling out the form section by section, where you will typically provide your identification details, ownership structure, and any relevant disclosures. Utilizing tools like pdfFiller can enhance this process through features such as eSignature and cloud storage, reducing compliance risk.

Managing the Schedule 13G filing process

For effective management of the Schedule 13G filing process, leveraging technology is indispensable. Document management tools, such as pdfFiller, offer integrated editing capabilities, eSigning, and team collaboration features that enhance compliance accuracy and administrative efficiency.

Moreover, establishing streamlined communication channels among team members can prevent miscommunication and ensure that all necessary stakeholders are kept in the loop about filing deadlines and updates—a vital aspect for maintaining compliance without last-minute stress.

Implications of Schedule 13G filings for public companies and shareholders

Schedule 13G filings play a significant role in shaping company operations and governance. When institutional and passive investors reveal substantial holdings, it can signal to the market the strength or weakness of the company's position. This transparency fosters open communication between management and shareholders, allowing management to engage constructively with significant stakeholders.

Furthermore, the dynamics influenced by these filings can alter shareholder perceptions and market strategies, thereby playing a crucial role in corporate governance and investor relations. Companies often tailor their strategies based on feedback or demands from these substantial investors.

Understanding Schedule 13D vs. Schedule 13G: When to choose which?

The choice between Schedule 13D and Schedule 13G primarily hinges on the investor's intentions and ownership strategy. If an investor aims to influence or exert control over a company, filing a Schedule 13D is imperative. However, if the objective is simply to hold shares without seeking governance changes, then Schedule 13G is the appropriate choice.

Incorrectly selecting the filing type can lead to regulatory scrutiny and possible penalties, underscoring the necessity for investors to accurately assess their goals and intentions prior to filing.

Recent changes and trends in Schedule 13G filings

Recent developments in the regulatory framework surrounding Schedule 13G filings have focused on enhancing transparency and ensuring compliance among institutional investors. The SEC has provided updated guidance to clarify existing requirements and streamline the filing process, especially in response to evolving market dynamics.

Moreover, fluctuating market conditions and increased scrutiny have prompted investors to adopt new best practices related to compliance. There’s a growing trend towards utilizing digital tools that not only simplify the filing process but also improve overall accuracy and reduce the risk of errors.

Case studies: Analyzing real-world Schedule 13G filings

Examining notable Schedule 13G filings can offer valuable insights into common practices and potential pitfalls. For example, the case of a well-known hedge fund acquiring a substantial ownership stake in a high-profile tech company highlights how such disclosures can shift market sentiment and influence executive decisions. Investors can learn from both successful filings and those that led to regulatory issues due to incorrect information.

By analyzing these cases, current and future investors can glean effective strategies for their own compliance and improve their understanding of market implications stemming from significant share ownership disclosures.

Conclusion to best practices in Schedule 13G management

Management of the Schedule 13G filing process encompasses understanding its intricacies, ensuring accurate reporting, and employing effective tools to facilitate compliance. Key takeaways include proper identification of eligibility criteria for filing, timely submission of information, and a commitment to accurate disclosures.

For anyone engaging in the financial marketplace, these best practices are not merely bureaucratic requirements but essential steps towards maintaining transparency, fostering trust, and achieving long-term success in shareholder engagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit schedule 13g from Google Drive?

How do I edit schedule 13g in Chrome?

Can I create an electronic signature for signing my schedule 13g in Gmail?

What is schedule 13g?

Who is required to file schedule 13g?

How to fill out schedule 13g?

What is the purpose of schedule 13g?

What information must be reported on schedule 13g?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.