Get the free Beneficiary Distribution Request

Get, Create, Make and Sign beneficiary distribution request

How to edit beneficiary distribution request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary distribution request

How to fill out beneficiary distribution request

Who needs beneficiary distribution request?

Beneficiary Distribution Request Form - How-to Guide Long-read

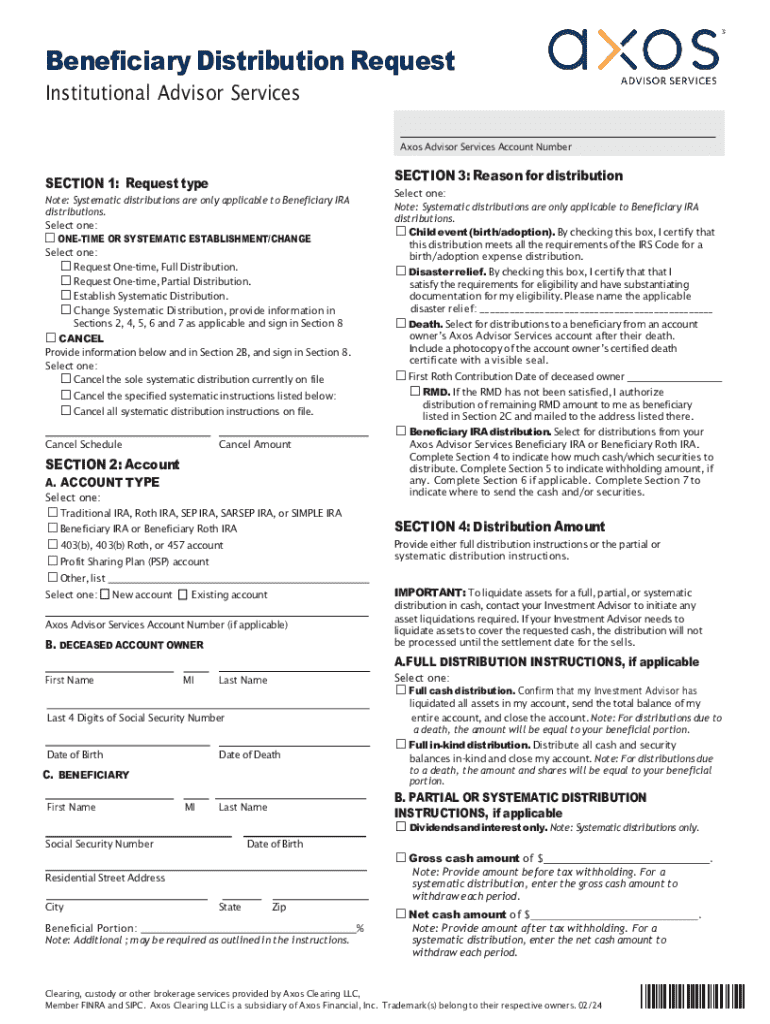

Understanding the Beneficiary Distribution Request Form

A beneficiary distribution request form is a formal document used to designate an individual or entity to receive assets upon the account holder's death. This form is essential in initiating the distribution process for various types of accounts, including retirement savings, life insurance, and estate settlement. Its primary purpose is to ensure clarity and legal compliance in the transfer of assets, safeguarding the rights of both the beneficiaries and the estate.

In financial and legal contexts, the importance of the beneficiary distribution request form cannot be overstated. It serves as a streamlined means of ensuring that beneficiaries receive their entitled assets promptly and fairly. Key stakeholders in this process include the account holders, the designated beneficiaries, executors of estates, and financial institutions holding the accounts.

When should you use a beneficiary distribution request form?

This form should be utilized in specific scenarios where asset distribution is necessary after an account holder's demise. Common situations include estate settlements where an executor is responsible for distributing assets according to a will, retirement account distributions that require evidence of a beneficiary's identity, and insurance claims where policy proceeds are to be disbursed. Each of these instances underscores the necessity of completing the form to facilitate timely distributions.

Despite its critical role, there are several misconceptions regarding this form. Some may believe it is only required for large estates, while others might think they can bypass it if a will exists. However, utilizing the beneficiary distribution request form ensures that all legal requirements are met and provides a clear record of beneficiary designations. The benefits are manifold, including faster processing, clearer communication between parties, and reduced potential for disputes.

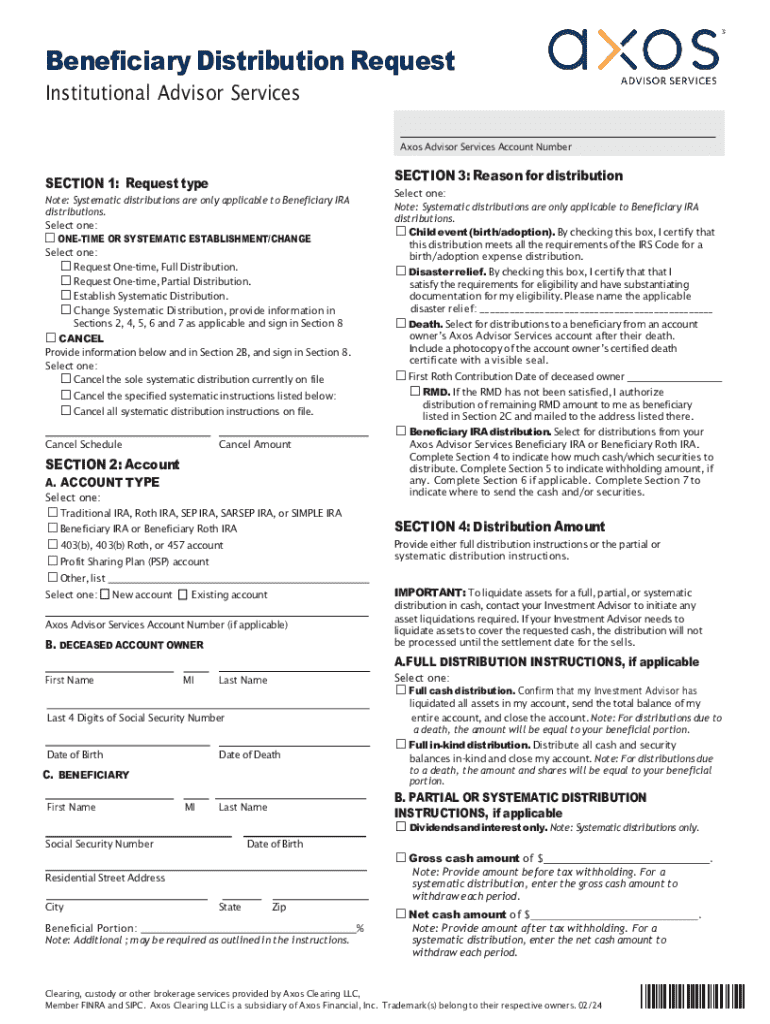

Components of the beneficiary distribution request form

Understanding the components of the beneficiary distribution request form is crucial for accurate completion. Typically, this form requires detailed information such as the applicant’s information, which includes full name, address, and contact details. Following that, beneficiaries' details need to be disclosed, including name, relationship to the deceased, and share of assets.

The form also includes distribution options, allowing beneficiaries to choose how they would like to receive their assets—whether as a lump sum, annuity, or other arrangements. It's essential to distinguish between optional and mandatory fields; inaccuracies in mandatory fields can lead to processing delays. In many cases, supporting documents such as death certificates or proof of identity may also need to be attached, ensuring compliance with institutional requirements.

Step-by-step instructions for filling out the beneficiary distribution request form

When preparing to complete the beneficiary distribution request form, start by gathering all necessary documents. This may include the deceased’s will, identification for all beneficiaries, and relevant financial statements. Understanding your rights and obligations under the law is also critical. This knowledge can prevent mistakes and expedite the process.

Filling out each section requires careful attention. In Section 1, you will input your personal information, ensuring accuracy in names and addresses. Section 2 focuses on beneficiary information, where you’ll list each beneficiary’s details, verifying their relationship to the deceased. Finally, Section 3 outlines distribution instructions; be clear about how you wish the assets to be shared. To avoid common errors, double-check all entries and use interactive tools such as pdfFiller to gain real-time assistance while completing the form.

Editing and customizing the beneficiary distribution request form

Editing and customizing the beneficiary distribution request form can enhance your accuracy and efficiency. Tools available on pdfFiller allow users to modify pre-existing forms, making it easier to include new beneficiaries or update existing information. Adding additional notes or attachments could provide more context to your requests, ensuring that all parties are informed.

Saving different versions of your form might also be useful, especially if changes occur over time. This can help in document management and ensure that the most current information is always available. Remember that clarity and precision in your submissions not only prevent errors but also create a smoother distribution process, ultimately benefiting all parties involved.

eSigning the beneficiary distribution request form

The eSigning process for the beneficiary distribution request form offers a convenient and secure way to finalize documentation. Understanding the steps for eSigning can streamline your submission significantly. When utilizing pdfFiller's eSigning feature, rest assured that robust security measures protect your information during the signing process.

The legal validity of e-signatures varies by jurisdiction, but many recognize them as equivalent to handwritten signatures under electronic signature laws. This means you can often sign forms remotely while ensuring they have legal standing. For scenarios requiring multiple signatures, pdfFiller provides tools to request signatures from various parties efficiently, simplifying collaboration in the signing phase.

Submitting your beneficiary distribution request form

After completing the beneficiary distribution request form and obtaining any necessary signatures, the next step is submission. Various submission methods are available, with online submissions through pdfFiller being the most efficient. This method not only enhances speed but also provides you with immediate confirmation of receipt.

For those opting for traditional methods, mailing options are available; however, ensure you use secure and traceable mailing services. Personal delivery remains another option, particularly if local institutions require in-person submission. Regardless of the chosen method, tracking your submission and maintaining meticulous records is critical for follow-up and verification should any questions arise later.

Managing your beneficiary distribution process

Once the beneficiary distribution request form is submitted, managing your application becomes paramount. Active monitoring of the status can alleviate anxieties and help you remain informed throughout the process. Keep in communication with the financial institutions and remain adaptable in case further information or clarification is required.

If your request is delayed or denied, knowing the right steps to take can be incredibly helpful. Reach out promptly to the institution to understand the reasons behind the hold-up and what actions may be required to resolve any issues. Additionally, familiarizing yourself with FAQs regarding common problems post-submission can empower you with knowledge to navigate these situations effectively.

Best practices for future beneficiary distribution requests

To simplify future beneficiary distribution requests, it's vital to keep your information updated regularly. Changes in relationships, personal circumstances, or assets can all necessitate revisions to beneficiary designations. Conducting periodic reviews of beneficiary designations helps ensure that your wishes are accurately reflected and minimizes the chances of disputes among potential claimants.

Additionally, organizing your documents efficiently can ease the burden during future requests. Implementing strategies such as creating a digital folder containing all essential documents, including updates and notices, can streamline the process and eliminate the scramble for information when the need arises. By adopting these best practices, you not only ensure that your interests are safeguarded but also enhance clarity for your beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit beneficiary distribution request in Chrome?

How do I fill out beneficiary distribution request using my mobile device?

How do I edit beneficiary distribution request on an iOS device?

What is beneficiary distribution request?

Who is required to file beneficiary distribution request?

How to fill out beneficiary distribution request?

What is the purpose of beneficiary distribution request?

What information must be reported on beneficiary distribution request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.