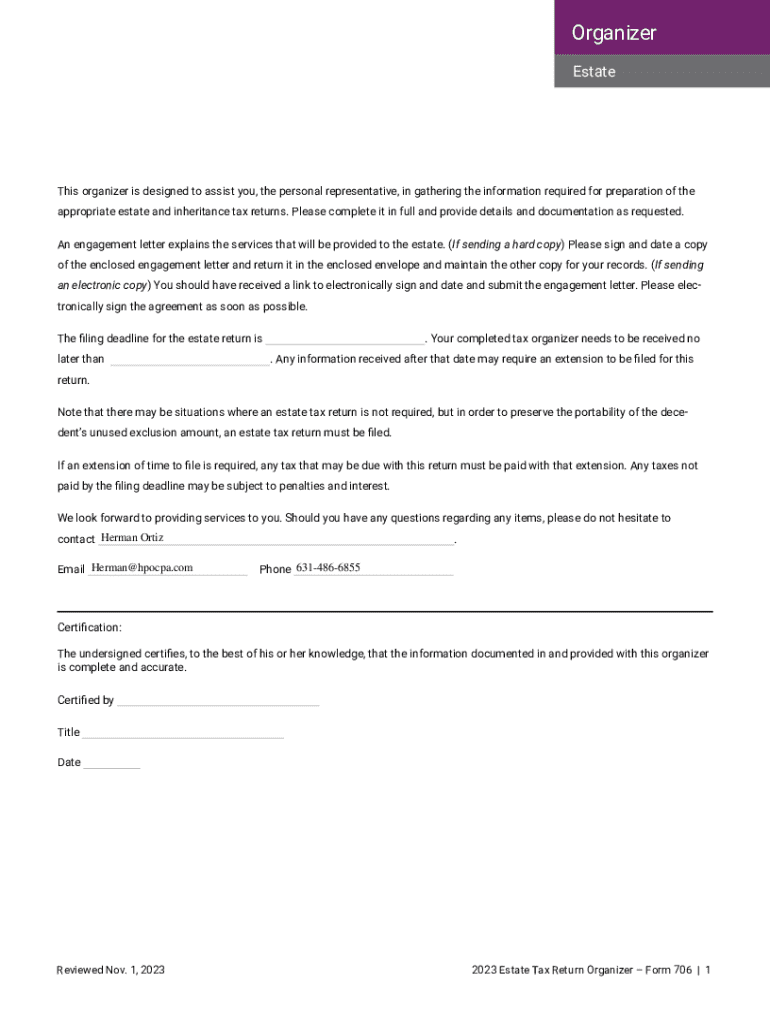

Get the free Estate Tax Organizer - Form 706

Get, Create, Make and Sign estate tax organizer

How to edit estate tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate tax organizer

How to fill out estate tax organizer

Who needs estate tax organizer?

Your Comprehensive Guide to the Estate Tax Organizer Form

Understanding the estate tax organizer form

The Estate Tax Organizer Form is a vital document designed to aid individuals and tax professionals in compiling necessary information to assess estate taxes accurately. It encompasses various aspects of a deceased individual’s financial situation, including assets, liabilities, and other pertinent details that influence tax obligations. Understanding the purpose of this form is critical for effective tax planning and compliance.

Utilizing an estate tax organizer not only simplifies the tax preparation process but also ensures that no vital information is overlooked. It serves both as a checklist for what needs to be documented and as a foundation for accurate and strategic tax planning.

Who should use the estate tax organizer form?

The estate tax organizer form is invaluable for multiple stakeholders engaged in estate management. Individuals tasked with managing estates will find this form essential to navigating the complexities of estate taxes comprehensively.

Tax professionals and financial advisors also benefit significantly by using this tool as it enables them to assist clients in identifying all necessary information to accurately file estate taxes. Furthermore, executors and administrators of estates must utilize this form to ensure that all relevant assets and debts are reported, while families with inheritance concerns can leverage the organizer to clarify their financial standing.

Key components of the estate tax organizer form

To effectively utilize the estate tax organizer form, it's crucial to understand its components. The personal information section collects vital details about the deceased, including their full name, Social Security number, and date of death. This information is foundational and impacts all subsequent details provided.

Next, the asset valuation section breaks down various categories such as real estate assets, financial accounts including bank and investment portfolios, and personal property like vehicles and collectibles. Identifying liabilities and debts is equally essential, as these can significantly influence the estate's overall tax obligations. Additionally, the form has provisions for special considerations regarding gifts and trusts, which must be accurately reported.

How to fill out the estate tax organizer form

Filling out the estate tax organizer form involves a systematic approach to ensure all necessary information is included. Start by gathering all required documents, such as previous tax returns and asset statements. This preparation helps streamline the process and ensures thoroughness.

Once you have everything, complete the personal information section by accurately providing all requested details. Focus on asset valuation by thoroughly recording the fair market value of all listed assets and noting any existing liabilities which might affect the taxes owed. Don’t forget to document any gifts or special bequests that may influence the tax calculations.

Ensuring accuracy is paramount. Be diligent to avoid pitfalls that could lead to erroneous filings or compliance issues.

Interactive tools for completing your organizer

pdfFiller enhances your experience when filling out the estate tax organizer form with various interactive tools. The document editor allows you to effortlessly edit your form while providing numerous options for customization to fit your unique needs.

eSigning capabilities are crucial for ensuring all signatures are easily gathered and securely attached. If collaborating with a team, pdfFiller offers features that allow multiple users to work on the form simultaneously, promoting efficiency and teamwork. Additionally, the cloud storage solution gives you easy access to your completed form anytime, anyplace, ensuring you are never without essential documents.

Common mistakes to avoid when filling out the estate tax organizer form

Filling out the estate tax organizer form can be complex, and there are numerous common pitfalls to beware of. One prevalent mistake is underreporting or overreporting the value of assets. Accurate reporting is vital to avoid discrepancies during the filing process.

Neglecting to include the deceased's debts is another significant error; this oversight can lead to inflated taxable estate calculations and complications later on. Additionally, misunderstanding gift tax rules can result in unnecessary liabilities, as failure to report certain gifts can complicate or disrupt future estate planning efforts.

Submitting your estate tax organizer form

Once the estate tax organizer form is complete, the next step involves submission to the IRS and other relevant tax authorities. Users have several options for submitting this information; electronically or via traditional mail, depending on what suits them best.

Timely filing is crucial to avoid penalties and to initiate the estate settlement process. Moreover, utilizing pdfFiller's secure portal for document submission ensures that sensitive information is transmitted safely, providing peace of mind throughout the process.

Post-submission: what to expect

After you submit the estate tax organizer form, it’s essential to understand the review process administered by tax authorities. This step ensures that all reported information is accurate and complete. Tax officials may reach out for clarification or further documentation if discrepancies are found.

Being prepared for potential queries or even audits related to your estate tax return can make a significant difference. It is recommended to keep meticulous records of all documentation submitted, as well as any correspondence with tax authorities, to facilitate a smoother resolution process.

Special considerations

Certain unique circumstances can affect the handling of estate tax, especially when multiple estates are involved. Each estate's tax implications can be distinctly different based on various factors, including the size of the estate and state-specific laws. Careful coordination is necessary to ensure that filings for each estate adhere to the respective regulations.

Additionally, proactive tax planning strategies are essential for minimizing future estate taxes. Consulting with estate planning professionals can provide valuable insight into effective methods for reducing tax liabilities, including utilizing trusts or gifting strategies. It is also vital to coordinate the estate tax organizer with other financial planning documents to ensure comprehensive coverage of all tax responsibilities.

Recent developments in estate tax laws

Staying informed about recent developments in estate tax laws is crucial for individuals and professionals alike. Changes to estate tax exemptions, for instance, can significantly alter the amount of tax owed by an estate. Keeping abreast of any modifications in tax legislation ensures that planning remains compliant and effective.

New filing procedures are also emerging, accompanied by evolving requirements that must be adhered to for successful submissions. The ongoing legislative trends can introduce further complexities in estate planning, requiring continuous vigilance to adapt and respond effectively.

Related tools and templates by pdfFiller

pdfFiller offers a number of related tools and templates that complement the estate tax organizer form. Users can explore other tax organizers and spreadsheets that facilitate various aspects of financial documentation. Additionally, customizable templates for broader estate planning needs provide a flexible strategy for managing complex financial situations.

Resources for legal document creation and management are also at users' fingertips, ensuring that any necessary documentation can be generated quickly and efficiently. These tools enhance the estate planning process, making it simpler and more effective.

User experiences with pdfFiller and the estate tax organizer

User feedback reflects the effectiveness and ease of use of the estate tax organizer available through pdfFiller. Individuals have shared positive testimonials regarding the form’s clarity and accessibility, stating that the platform streamlines their estate tax filing experience considerably.

Case studies highlight instances of successful estate tax filings that were made simpler following the implementation of this organizer form. The community engagement through frequent questions and supportive feedback further affirms the utility of pdfFiller's resources in providing a user-friendly document management solution.

Explore more forms and resources

Users looking for further assistance can explore additional tax forms available through pdfFiller. The variety of documents and tools designed for various needs makes it straightforward to find necessary forms, whether for tax purposes or other legal requirements.

Moreover, learning about other document management solutions can help users better streamline their financial tasks. Subscribing to updates on tax tips and guidelines from pdfFiller ensures individuals remain informed about best practices and legal changes that could impact their estate planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify estate tax organizer without leaving Google Drive?

Where do I find estate tax organizer?

How do I edit estate tax organizer online?

What is estate tax organizer?

Who is required to file estate tax organizer?

How to fill out estate tax organizer?

What is the purpose of estate tax organizer?

What information must be reported on estate tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.