Get the free New Mexico Business Personal Property Report 2022

Get, Create, Make and Sign new mexico business personal

How to edit new mexico business personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mexico business personal

How to fill out new mexico business personal

Who needs new mexico business personal?

New Mexico Business Personal Form - How-to Guide

Overview of the New Mexico Business Personal Form

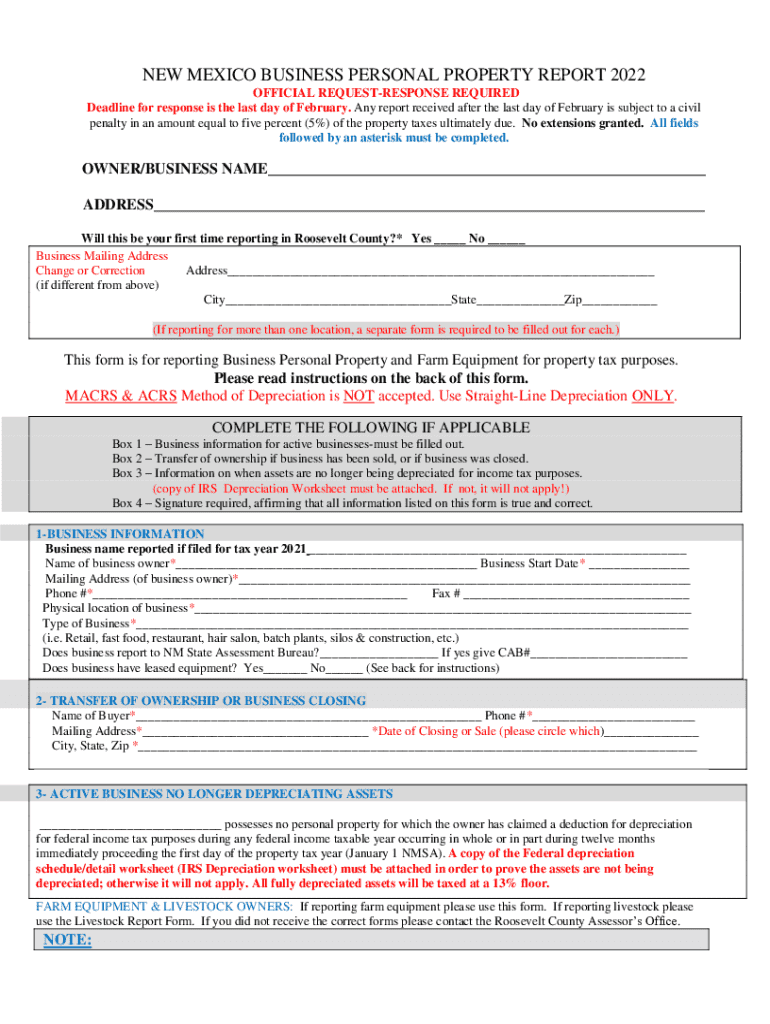

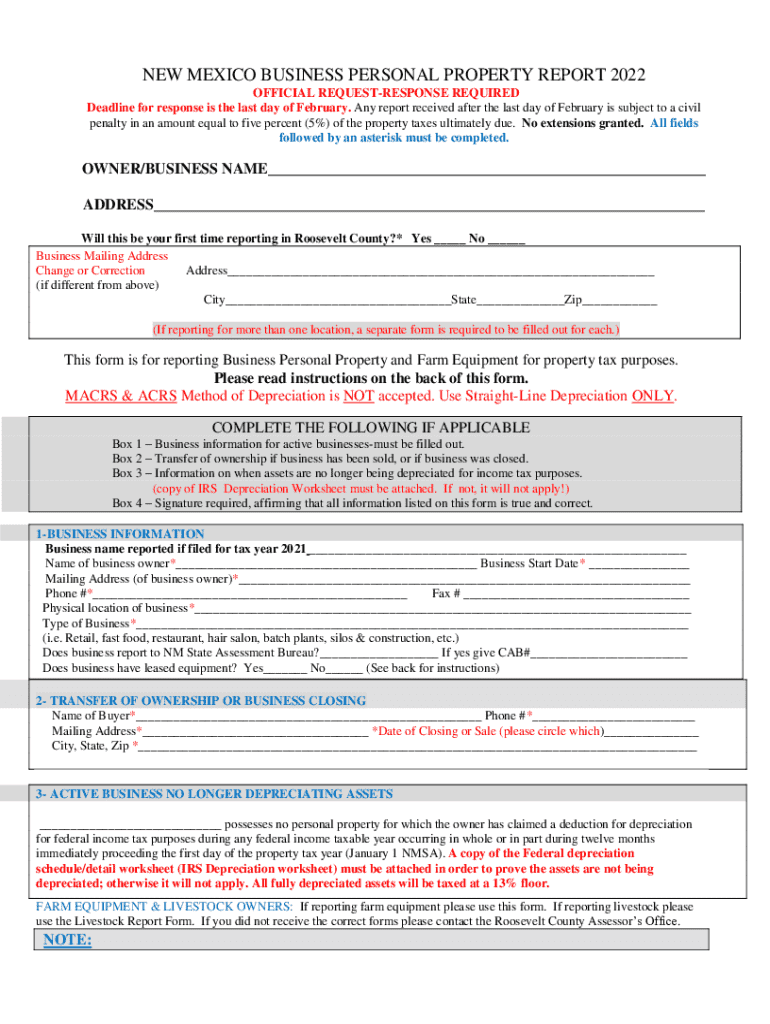

The New Mexico Business Personal Form is a crucial document designed for business owners in the state to declare personal property used in their business operations. This form catalogues various assets, including machinery, equipment, and inventory, all of which can significantly impact tax assessments. By accurately completing this form, business owners ensure compliance with state regulations and provide the necessary information for property tax calculations.

Key features of the New Mexico Business Personal Form include categorization of assets, an area for providing detailed valuations, and space designated for supporting documentation. This structure helps streamline the reporting process, making it easier for business owners to present their information clearly and accurately. Moreover, this form is essential for keeping the state's tax authorities informed about the business's property, thereby avoiding potential audit issues.

For business owners in New Mexico, understanding and utilizing the Business Personal Form is paramount. It's not just about compliance; accurately reporting personal property can lead to appropriate tax assessments, ensuring that businesses are not overpaying on assessments.

Who needs the New Mexico Business Personal Form?

The target audience for the New Mexico Business Personal Form includes individuals and teams managing businesses within the state. This encompasses a variety of business types, from sole proprietors to large corporations, as long as they possess personal property utilized for business operations. Startups, retail shops, service providers, and any organization that maintains tangible personal property must file this form to ensure compliance with local tax regulations.

Specific situations that require the New Mexico Business Personal Form include asset declarations during annual tax filings or if the business undergoes significant changes, such as acquiring new equipment or expanding operations. Keeping the form updated is crucial for reflecting the current value and scope of the business's assets.

Detailed steps on how to fill out the New Mexico Business Personal Form

Filling out the New Mexico Business Personal Form requires careful attention to detail. The following steps will guide you through successfully completing this essential document.

Interactive tools and features offered by pdfFiller

pdfFiller provides a suite of interactive tools designed to enhance your experience while filling out the New Mexico Business Personal Form. With live editing capabilities, users can collaborate in real-time, making it easier for teams to input necessary information swiftly.

The eSignature functionality allows business owners to sign off on the form electronically, thus streamlining the submission process whether you are filing online or printing for paper submission. Additionally, pdfFiller's robust document management solutions facilitate the storage, retrieval, and tracking of your business documents, ensuring that important forms like the Business Personal Form are easily accessible whenever needed.

Filing and submission options for the New Mexico Business Personal Form

Understanding the submission options for the New Mexico Business Personal Form is crucial for timely compliance. The filing deadline typically aligns with April 15 annually, although it’s advisable to check for any specific local changes. This deadline is critical, as late submissions can incur penalties.

Business owners have two primary submission methods: online or paper filing. Online submissions can be more efficient, examples including using pdfFiller for electronic submission that ensures timely filing with an organized, manageable format. Alternatively, for those preferring a traditional route, paper filings require printing, signing, and mailing to your local taxation office, which also necessitates a review of signature requirements to prevent any processing delays.

Understanding the impact of errors on your submission

Accurate completion of the New Mexico Business Personal Form is essential, as errors can lead to significant consequences. Common mistakes include misreporting asset values, forgetting to include all necessary assets, or failing to provide appropriate documentation. Any inaccuracies can trigger audits, fines, or increased tax burdens.

By utilizing pdfFiller, you can mitigate these risks. The platform’s editing features allow you to correct entries before submission, and its guidance on common mistakes ensures that you are well-informed about what to avoid. This not only helps to reduce stress regarding potential errors but also enhances confidence in the submission process.

Frequently asked questions about the New Mexico Business Personal Form

The New Mexico Business Personal Form may raise several questions for new and experienced business owners alike. Here are some commonly asked questions and answers to guide you further.

Best practices for managing your business documents

Effective document management is crucial for any business owner. The first step is to organize your documentation for quick access. Utilizing cloud-based solutions, such as pdfFiller, allows for easy retrieval of essential forms, including the New Mexico Business Personal Form.

Regularly updating personal forms and other associated documents ensures that all information remains current and compliant with any regulatory changes, thereby minimizing risks associated with outdated documentation. Moreover, pdfFiller offers comprehensive document management tools, allowing users to maintain up-to-date records and streamline processes further.

Exploring additional services related to business in New Mexico

In addition to the New Mexico Business Personal Form, pdfFiller provides access to a myriad of other forms and resources necessary for businesses operating in the state. This includes tax forms, compliance documentation, and various templates tailored to meet a range of business needs.

Business owners can benefit significantly from these resources as they navigate through legal and regulatory obligations. Furthermore, making use of online services and publications can provide valuable insight into requirements that evolve over time, ensuring that businesses remain compliant and informed.

Latest news relevant to business taxation and regulations in New Mexico

Staying updated on the latest changes in taxation laws and regulations in New Mexico is integral for business owners. Recent adjustments may include modified reporting requirements or changes in deadlines, influencing how businesses should approach their filings.

According to the New Mexico Taxation and Revenue Department, updates on filing guidelines and resources are frequently announced. Business owners should regularly check official channels or relevant finance news for pertinent updates, ensuring compliance with the current laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new mexico business personal without leaving Google Drive?

How do I make edits in new mexico business personal without leaving Chrome?

How can I fill out new mexico business personal on an iOS device?

What is new mexico business personal?

Who is required to file new mexico business personal?

How to fill out new mexico business personal?

What is the purpose of new mexico business personal?

What information must be reported on new mexico business personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.