Get the free Monthly Cash Flow Plan

Get, Create, Make and Sign monthly cash flow plan

Editing monthly cash flow plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly cash flow plan

How to fill out monthly cash flow plan

Who needs monthly cash flow plan?

Monthly Cash Flow Plan Form: Your Ultimate Guide to Financial Health

Understanding monthly cash flow: foundation for financial success

Monthly cash flow is the net amount of cash coming in and going out of your finances within a specific month. It is crucial for budgeting and financial planning, enabling individuals and businesses to monitor their financial health closely. Regularly assessing cash flow helps identify patterns and manage resources effectively.

Common cash flow challenges include unforeseen expenses that disrupt planned budgets, inconsistent income streams, and debts that can lead to cash shortages. Addressing these challenges with a structured cash flow plan can enhance financial stability.

What is a monthly cash flow plan?

A monthly cash flow plan is a financial document designed to chart all expected income and expenses for an upcoming month. Its primary purpose is to provide a clear overview of where your money comes from and where it goes, aiding in better financial decision-making.

Key components of a cash flow plan include income sources (like salaries and investments), expense categories (fixed and variable), and a summary of cash inflows and outflows. Unlike a budget, which allocates funds for various expenses, a cash flow plan focuses purely on tracking actual cash movement.

Benefits of using a monthly cash flow plan

Using a monthly cash flow plan fosters better financial awareness, allowing you to visualize your spending habits and pinpoint areas for improvement. This awareness helps in making informed financial decisions, such as when to cut unnecessary expenses or increase savings.

Moreover, a cash flow plan encourages enhanced savings strategies by establishing clearer financial goals. By understanding your cash flow, you can devise tailored management practices that align with your individual or family lifestyle.

Key features of the monthly cash flow template

A user-friendly cash flow template provides easy access to critical financial information. The sections are customizable, enabling users to modify them according to their unique needs and circumstances.

Additionally, the template can integrate with other financial documents, such as budgets and expense reports, allowing for comprehensive financial oversight. Specialized digital features from pdfFiller, such as seamless editing and signing capabilities, enhance user experience.

Essential elements of a monthly cash flow plan form

An effective monthly cash flow plan includes a detailed breakdown of income sources, categorized as follows:

Expenses are categorized to include:

A thorough plan will also calculate total cash inflows and outflows, analyze the net cash flow, and outline actionable points to improve financial stability.

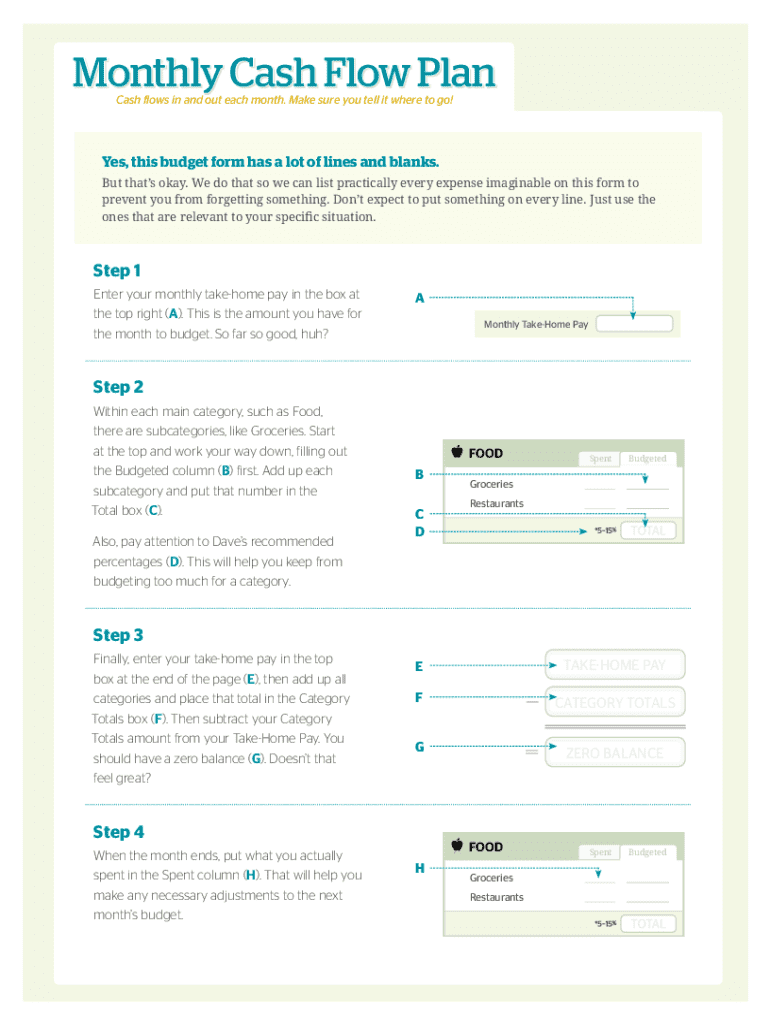

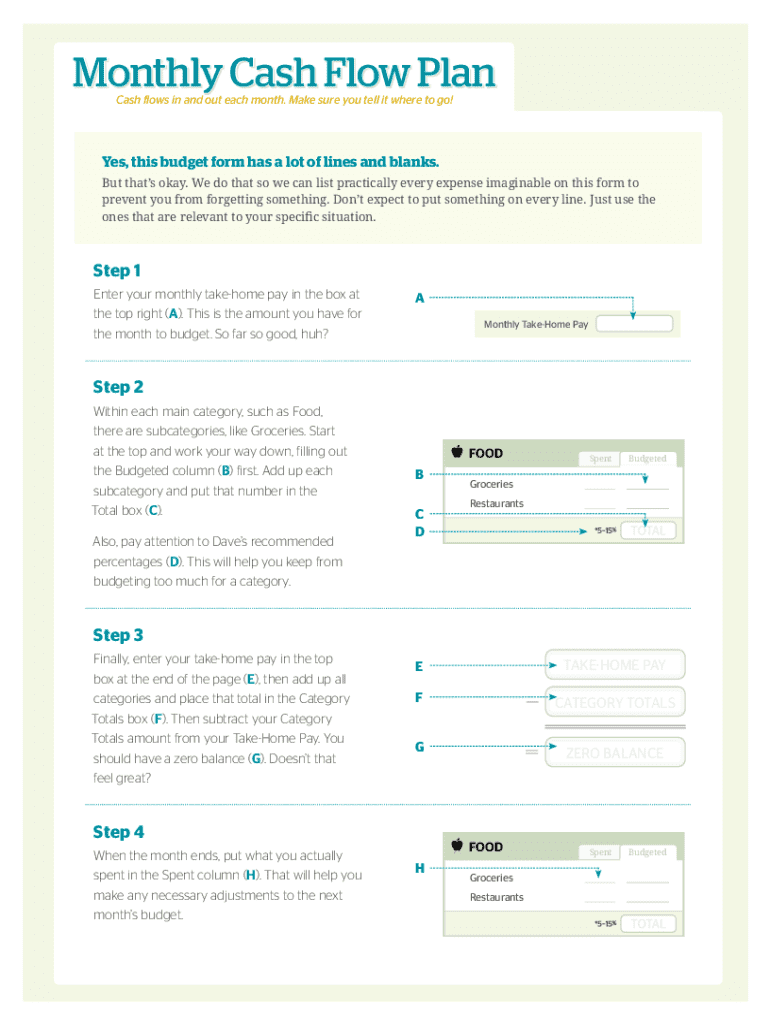

Step-by-step guide to filling out the monthly cash flow plan form

Filling out the monthly cash flow plan requires careful preparation. Begin by gathering the necessary financial documents, including pay stubs, bank statements, and bills, to ensure complete accuracy.

Next, identify and list all income sources. When estimating irregular income, consider your highest and lowest earnings over the past several months to achieve a more accurate average.

Moving on, categorize your monthly expenses. Group fixed expenses together (like rent) and separate variable expenses (like food). This makes it easier to allocate funds effectively.

Finally, review your net cash flow and interpret any surplus or deficit to inform your future financial goals.

How to edit and customize your monthly cash flow plan with pdfFiller

Editing your monthly cash flow plan is a breeze with pdfFiller’s suite of tools designed for user-friendly customization. Users can modify design elements, input detailed financial data, and adjust the layout as needed.

pdfFiller also offers interactive features promoting real-time collaboration, making it easy for individuals and teams to work together on the document. You can securely sign and share your cash flow document with stakeholders to ensure all parties are informed and engaged.

Advanced strategies for managing your cash flow

Using your monthly cash flow plan as a forecasting tool can significantly enhance your financial strategy. Consider incorporating the '50/30/20 Rule', which divides your income into needs, wants, and savings to help prioritize expenditures.

Additionally, look for strategies to reduce expenses (like cutting unnecessary subscriptions) and increase cash inflow (like seeking side gigs or promotions). Leveraging cash flow management tools and resources ensures you stay on top of your financial game.

Real-life applications of the monthly cash flow plan

Success stories abound for individuals and businesses that embraced cash flow planning. One case involved a freelancer who, with the help of their cash flow plan, identified peaks and troughs in income and adjusted their spending accordingly, leading to lower stress during lean months.

Another example features a small business that utilized its cash flow plan to recognize unnecessary expenses, ultimately reallocating those funds towards growth initiatives resulting in increased profitability.

FAQs about the monthly cash flow plan form

Many misconceptions exist about cash flow planning. For example, some believe it’s only for those in financial distress, when, in fact, it’s a proactive measure beneficial for anyone. Troubleshooting tips include revisiting your income estimates if you encounter discrepancies.

Furthermore, clarifying financial jargon within your plan is vital for understanding. Regular reviews of terms and conditions associated with income sources and expense categories can enhance overall comprehension and financial literacy.

Additional templates related to cash flow management

In addition to the monthly cash flow plan, other useful templates include variations like the weekly cash flow tracker for shorter periods, and an annual cash flow overview that provides a broader perspective over the year.

Furthermore, pdfFiller offers a selection of financial planning documents that can be directly integrated with your cash flow plan to streamline your financial management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get monthly cash flow plan?

How do I complete monthly cash flow plan online?

How do I complete monthly cash flow plan on an Android device?

What is monthly cash flow plan?

Who is required to file monthly cash flow plan?

How to fill out monthly cash flow plan?

What is the purpose of monthly cash flow plan?

What information must be reported on monthly cash flow plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.