The Essential Guide to Tax Invoice Template Form

Understanding tax invoices

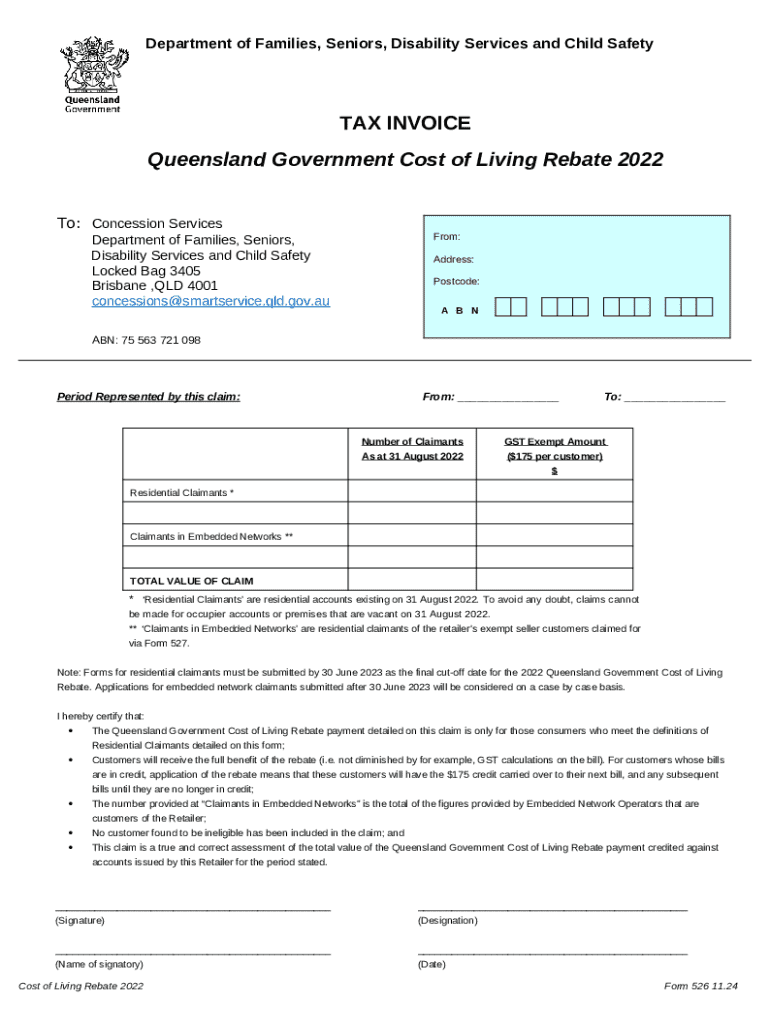

A tax invoice is a critical document in the business transaction ecosystem, serving as a formal request for payment and documentation of a sale. It outlines goods or services provided, detailing their cost and applicable taxes, thus playing a vital role in accounting and regulatory compliance. For businesses, maintaining proper records of tax invoices is crucial for tax reporting and audits.

Tax invoices provide a clear representation of financial transactions, making them indispensable for both buyers and sellers. They facilitate easy tracking of expenses and revenues while ensuring transparency between parties. Moreover, tax invoices are often required by law to allow buyers to claim input tax credits.

It acts as proof of a transaction, consolidating trust in business dealings.

Essential for tax purposes, allowing businesses to provide evidence of VAT/GST charged.

Legal requirements

Legal requirements for tax invoices can vary greatly depending on the jurisdiction. However, certain elements are universally essential. These elements typically include the seller’s and buyer’s names and addresses, the tax identification numbers (TINs), a unique invoice number, and the date of issue. Additionally, the details of each item sold, including prices and tax rates, must be clearly listed.

In many regions, businesses are mandated to issue tax invoices for sales above a particular amount, and failing to comply can lead to penalties. Understanding these requirements ensures that businesses operate within the law and maintain their eligibility for tax credits.

Tax invoice template overview

Using a tax invoice template can significantly enhance efficiency in generating invoices. Templates eliminate the repetitive task of formatting invoices from scratch, allowing individuals and teams to create professional documents in mere minutes. This time-saving aspect is particularly beneficial for small businesses and freelancers who often juggle multiple roles.

A consistent template supports brand visibility and professional communication with clients. It fosters recognition and instills trust, making clients more likely to pay their invoices promptly. An effective tax invoice template should contain customizable fields that reflect the specifics of each transaction while adhering to legal standards.

Editable fields for customization.

Dedicated sections for listing services/products, tax rates, and total amounts.

Utilizing pdfFiller's tax invoice template

pdfFiller offers an accessible tax invoice template that users can easily customize according to their specific needs. To access the template, you simply navigate to the pdfFiller website and search for the tax invoice template within their vast library of document forms. This user-friendly interface guides you throughout the selection process.

Filling out the template

Entering company information, such as your logo, name, address, and contact details, is the first step in customizing the template. Next, adding client information is crucial, collecting the recipient's details along with any unique identifiers necessary for proper record-keeping and payment tracking.

The template includes sections for itemizing the services or products provided, ensuring clear communication of what's being charged. When adding services/products, be mindful of tax rate applications; different products or services may attract varying rates. Calculating totals accurately and outlining any discounts or special notes is vital to convey all necessary information to your client.

Customizing your tax invoice

The ability to incorporate branding elements into your tax invoice is essential for reinforcing your business identity. pdfFiller enables users to upload logos and customize design aspects such as color schemes and fonts to match their brand aesthetics. This degree of customization leads to a more personalized presentation that resonates with clients.

Adjusting the layout and dimensions of the tax invoice template allows businesses to cater the document to their specific needs. Additionally, selecting the preferred currency for transactions enhances the invoice’s relevance, especially for businesses operating cross-border. This capability can also help in maintaining clarity for clients who may expect invoices to reflect their local currency.

Managing your tax invoice

Once you've created your tax invoice, managing it efficiently is crucial. pdfFiller allows you to edit and update invoices even after they have been issued, providing flexibility in case adjustments are needed. This feature ensures accuracy and keeps both parties informed of any changes in invoicing details.

Signing and sending invoices

Integrating eSignature options further streamlines the process by allowing clients to sign documents electronically. This not only speeds up approval but also reduces the friction that can arise from traditional paper-based methods. Sending invoices directly through pdfFiller simplifies the process, offering various methods for distribution, such as email or cloud storage sharing.

Additionally, effective document management ensures that all invoices are saved, tracked, and monitored. Users can easily access sent invoices and follow their payment status, providing invaluable insights to manage cash flow.

Industry-specific tax invoice templates

Different industries may require specific information on tax invoices due to varied regulatory standards. For instance, construction businesses might require more detailed breakdowns of labor and materials, while freelancers may opt for templates with more concise pricing structures. Utilizing tailored tax invoice templates allows businesses to present the most pertinent information efficiently.

Moreover, tax laws vary internationally, and adapting templates for different countries ensures compliance with local tax regulations. Businesses operating in multiple regions should consider localized templates that adhere to jurisdiction-specific requirements, providing legal protection and ensuring they do not miss out on valuable tax credits.

Additional tools and features on pdfFiller

pdfFiller's platform encompasses a plethora of additional tools that enhance the functionality of tax invoice management. Teams can collaborate on invoices in real-time, facilitating collective input and ensuring no detail goes overlooked. This feature is particularly advantageous for larger teams or businesses with multiple stakeholders.

Furthermore, pdfFiller integrates payment solutions directly within invoices, enabling clients to make payments seamlessly upon receipt. This not only simplifies the payment process but also enhances the likelihood of prompt payments, ultimately benefiting cash flow.

Comprehensive document management through pdfFiller allows users to handle an array of document types, making it a versatile tool in any business's toolkit. From documents like contracts to HR forms, pdfFiller supports various sizes and types, streamlining an organization's overall documentation needs.

Troubleshooting common issues

Even with the best tools, mistakes can happen while filling out tax invoices. Common errors include inaccurate calculations, failure to include mandatory information, or mismanagement of client details. Identifying these common pitfalls early on can save time and prevent costly mistakes.

To address any questions concerning the tax invoice template, pdfFiller provides various support resources, including detailed guides and customer service assistance, ensuring users have access to the help they need.

Creating a free account

Registering for a free account with pdfFiller unlocks a suite of benefits, including access to unlimited document templates and the ability to store and manage documents securely in the cloud. This enhances users' capabilities to create, edit, and maintain professional tax invoices with ease.

The registration process is straightforward: users simply need to provide basic personal information and agree to the terms. By completing this step, users can integrate document management into their workflow and maximize productivity, gaining valuable tools to cater to their invoicing requirements.