Get the free Income-driven Repayment (idr) Plan Request

Get, Create, Make and Sign income-driven repayment idr plan

Editing income-driven repayment idr plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income-driven repayment idr plan

How to fill out income-driven repayment idr plan

Who needs income-driven repayment idr plan?

A comprehensive guide to the Income-Driven Repayment IDR plan form

Understanding income-driven repayment plans

An Income-Driven Repayment (IDR) plan offers a lifeline for borrowers struggling to repay federal student loans. These plans adjust your monthly payments based on your income and family size, ensuring they remain affordable even as your financial situation changes. The core idea is to link your monthly payment to your Adjusted Gross Income (AGI), which means that for many borrowers, these payments can be reduced significantly during challenging financial periods.

The benefits of applying for an IDR plan are substantial. For one, should you qualify, you may see your payments capped at a percentage of your discretionary income, which is calculated based on the federal poverty line relative to your family size. There’s also the potential for loan forgiveness after a certain period of consistent payments, which could be as few as 20 or 25 years depending on the specific plan chosen. These aspects provide not just immediate relief but long-term financial planning opportunities.

Who should apply for the IDR plan?

Anyone facing financial hardship or struggling to meet standard repayment terms should consider applying for an IDR plan. The main eligibility criteria include holding federal student loans and demonstrating a need for financial assistance based on your income and family size. This especially applies to individuals with fluctuating incomes or those who may have lost a job, as the IDR plans are designed to adapt to varying income levels.

To assess your current situation, compile information regarding your income sources, including any part-time or freelance work. It’s crucial to recognize that even if your income seems steady, if it's low compared to your debt, applying for an IDR plan can significantly lighten your financial load. Additionally, be mindful that timely submission of your IDR Plan application is vital. Delays may lead to increased payments that can strain your financial health.

Key documents needed for the IDR plan application

Preparing your application for the IDR plan requires certain essential documents to validate your income and family size. Crucial materials include your most recent Tax Returns to verify your income claims, detailed Income Information for all jobs and sources, and Family Size Documentation to determine household size that influences the affordability of your payments.

Gathering these documents can seem daunting. Here’s a quick overview of the essentials: 1) your most recent tax return forms, 2) pay stubs or proof of any additional income, and 3) documentation such as a government-issued ID or birth certificates for family members. Keeping your financial records organized will accelerate the application process and ensure accuracy.

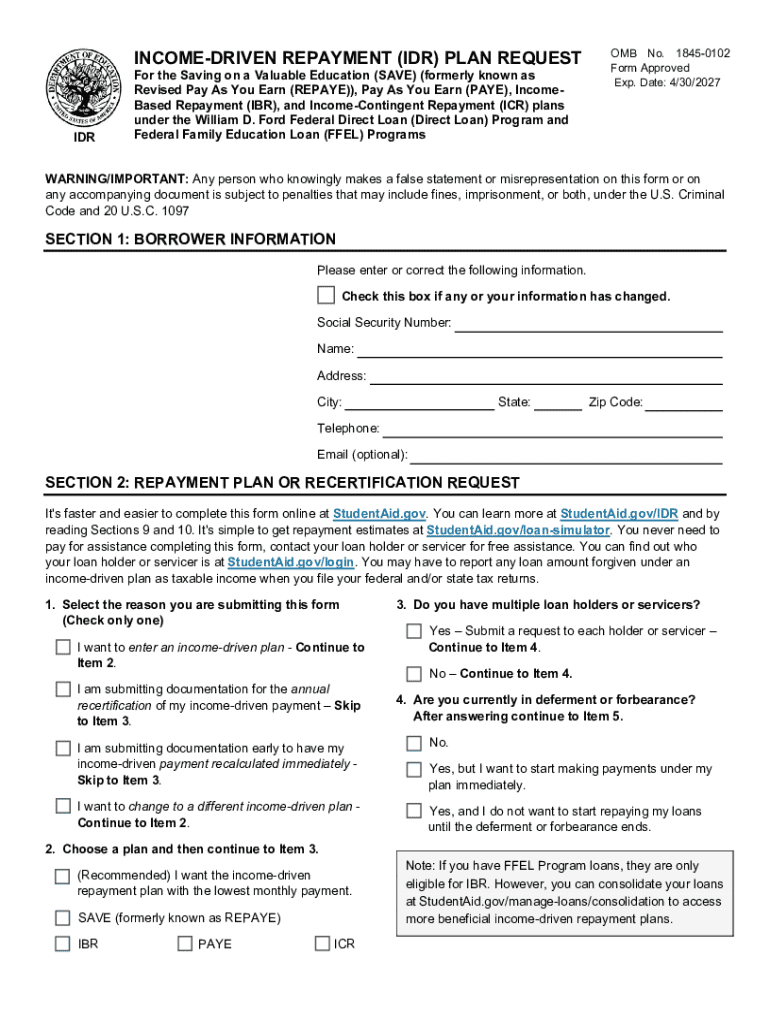

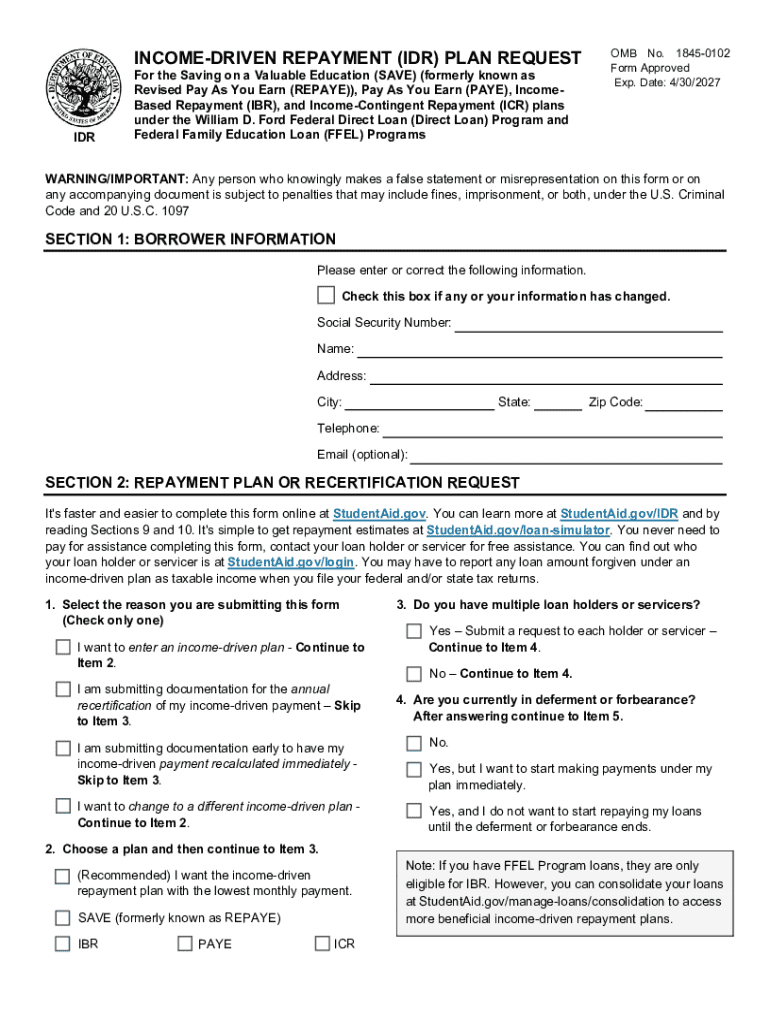

Detailed steps to fill out the IDR plan form

Accessing the IDR application form online via pdfFiller enhances the experience by providing ease of use. Begin by navigating to pdfFiller’s website, where the IDR plan form is readily available. Completing the form involves several straightforward steps: input your personal information accurately, including your Social Security number and contact details, since these are crucial for the loan servicer to identify your account.

Next, meticulously report your income. This step is crucial as it directly impacts the payment calculation. Include all sources of income and ensure your figures reflect your current financial status. Indicating your family size is equally important, as this will adjust your payment cap according to federal poverty guidelines. Avoid common mistakes, like overlooking or misreporting income details, failing to sign and date the form, or neglecting to attach necessary documentation, which could delay the review process.

Submitting your IDR application

Once you have accurately completed your IDR application form using pdfFiller, it’s time to submit. You can do so online via pdfFiller for a quick and hassle-free process. Alternatively, if you prefer a physical copy, paper submission is acceptable as well, but keep in mind the potential delays in processing. Ensure you're aware of the correct mailing address for your loan servicer to avoid mishaps.

After submission, consider following up by tracking your application status. Many servicers provide online portals, allowing you to check where your application stands. This proactive approach keeps you informed about any additional information required or the timeline expected for processing your request.

What happens after you apply?

After your IDR application is submitted, it enters a review process conducted by your loan servicer. This step typically involves verifying your provided documentation against your application data. Expect a delay of anywhere from a few weeks to a couple of months before you receive a determination on your application. It is advisable during this time to stay proactive, continuing to make bimonthly or monthly payments based on your previous terms to avoid falling behind.

In the event your application is denied, don't lose hope. You can request a reconsideration or appeal the decision, providing additional documentation or clarifying your financial situation. Understanding the reasoning behind your denial will also help you tailor a stronger application next time, ensuring you take advantage of the IDR options available to you.

Annual recertification process

Recertification is essential for all borrowers under IDR plans. This requirement is necessary to ensure your payment amount accurately reflects your current financial situation. Typically, this process should occur annually, with your servicer notifying you when to complete the recertification. The main steps include submitting updated income information and family size details, along with any necessary financial documents from the previous year.

Failing to recertify on time can result in reverting to a higher payment based on the standard repayment plan, which could significantly strain your budget. This lapse can also affect any eligibility for loan forgiveness outcomes, emphasizing the importance of punctuality in this annual commitment.

Troubleshooting common issues

If you encounter issues during the application process, don’t hesitate to reach out to your loan servicer for clarification and troubleshooting support. They can provide detailed explanations for any difficulties you face and help you navigate the requirements. Additionally, maintain a log of communication with your servicer, including the dates and topics discussed, as this may assist you in further interactions.

One tip for keeping your IDR status in good standing is to set reminders for both your application submission deadlines and recertification timelines. Staying organized and proactive can mitigate many issues borrowers face, helping maintain peace of mind as you manage your student loans.

Utilizing pdfFiller for a seamless document experience

pdfFiller simplifies the process of handling your IDR Plan applications with its user-friendly tools designed for document management. Essential features include the ability to edit PDFs directly, ensuring that your IDR application form is perfectly filled out before submission. The e-signing option enables quick completion of any necessary forms, while collaboration features allow family members or co-signers to review and sign documents effortlessly.

Security is a central focus for pdfFiller, ensuring that your personal and financial information is kept confidential and secure throughout the application process. The platform leverages advanced document management capabilities, keeping your applications organized and easily accessible for future reference.

Frequently asked questions about IDR plans

Prospective applicants often have questions regarding IDR plans. A frequently asked question is whether a borrower's employment status affects eligibility for these plans — the answer is yes. Unemployment or drastic decreases in income can indeed qualify you for lower payments. Another common inquiry revolves around the impact of deferment; while you may defer payments, it's essential to remember this does not equate to forgiveness and could extend overall loan length.

Many misconceptions also surround IDR plans, such as the belief that all federal loans qualify. It's vital to check your specific loans' eligibility, as not all federal loans can be included, especially older loan types. Understanding these nuances ensures a clearer application process and enhances overall satisfaction with the repayment plan chosen.

Real experiences: User testimonials

Hearing from individuals who successfully navigated the IDR application process provides valuable insights. One user shared how the Pay As You Earn plan allowed them to significantly reduce their payments while unfurling a path toward loan forgiveness. This individual learned the importance of accurate income reporting and how timely documentation plays a pivotal role in expediting approvals.

Similarly, another testimonial highlighted how financial literacy helped them plan their IDR recertifications effectively, optimizing their benefits and avoiding pitfalls. These user stories underscore not only the potential impact of IDR plans but also the essential lessons learned in the diligence required throughout the process.

Additional tips for maximizing your IDR benefits

To maximize your IDR benefits, it's crucial to stay informed about all available repayment options. Regularly reviewing your financial situation and understanding how changes in income might affect your IDR plan can prove beneficial. Knowing when to switch plans can ensure you are at a lower payment rate and extending calculations for forgiveness timelines.

Further, gaining skills in financial literacy can empower you to navigate your student loans more adeptly. Use available resources to explore budgeting tools, attend workshops, or consult with financial advisors. These efforts can enhance your capability in managing your student loans efficiently, reducing fiscal stress and insecurity in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in income-driven repayment idr plan without leaving Chrome?

How do I fill out the income-driven repayment idr plan form on my smartphone?

How do I edit income-driven repayment idr plan on an iOS device?

What is income-driven repayment idr plan?

Who is required to file income-driven repayment idr plan?

How to fill out income-driven repayment idr plan?

What is the purpose of income-driven repayment idr plan?

What information must be reported on income-driven repayment idr plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.