Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out florida lady bird deed

Who needs florida lady bird deed?

Florida Lady Bird Deed Form: A Comprehensive Guide

Understanding the Florida Lady Bird Deed

A Florida Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. This unique legal document facilitates home transfers without the often cumbersome process of probate. The term 'Lady Bird' is attributed to former First Lady Lady Bird Johnson, who advocated for property rights and is associated with the accessibility and benefits of this type of deed.

Unlike traditional life estate deeds, which limit the property owner's ability to make changes, a Lady Bird Deed allows the original owner to change beneficiaries, sell, or even mortgage the property without needing consent from the beneficiaries. This flexibility is a significant draw for many Florida homeowners.

Advantages of a Florida Lady Bird Deed

There are several compelling advantages to utilizing a Florida Lady Bird Deed. For instance, one of its primary benefits is the avoidance of probate. When property is transferred through this deed, it passes directly to the beneficiaries upon the owner’s death, bypassing the often lengthy and expensive probate process.

Cost-effectiveness is another significant advantage. Compared to establishing revocable living trusts, which can incur substantial legal fees, Lady Bird Deeds tend to be more affordable. Moreover, owners maintain continuous control over the property, unlike standard life estate deeds, where control is limited post-transfer.

Additionally, the flexibility to change beneficiaries at any point is a valuable feature. Tax benefits are also noteworthy, as transferring property through a Lady Bird Deed can allow for the stepped-up basis, minimizing capital gains taxes for heirs.

Requirements for creating a Florida Lady Bird Deed

Creating a Florida Lady Bird Deed involves specific requirements that property owners must fulfill. Firstly, eligibility criteria stipulate that the property must be owned by one or more individuals and not held jointly with right of survivorship. The property must be real estate, such as a house or land, rather than personal property.

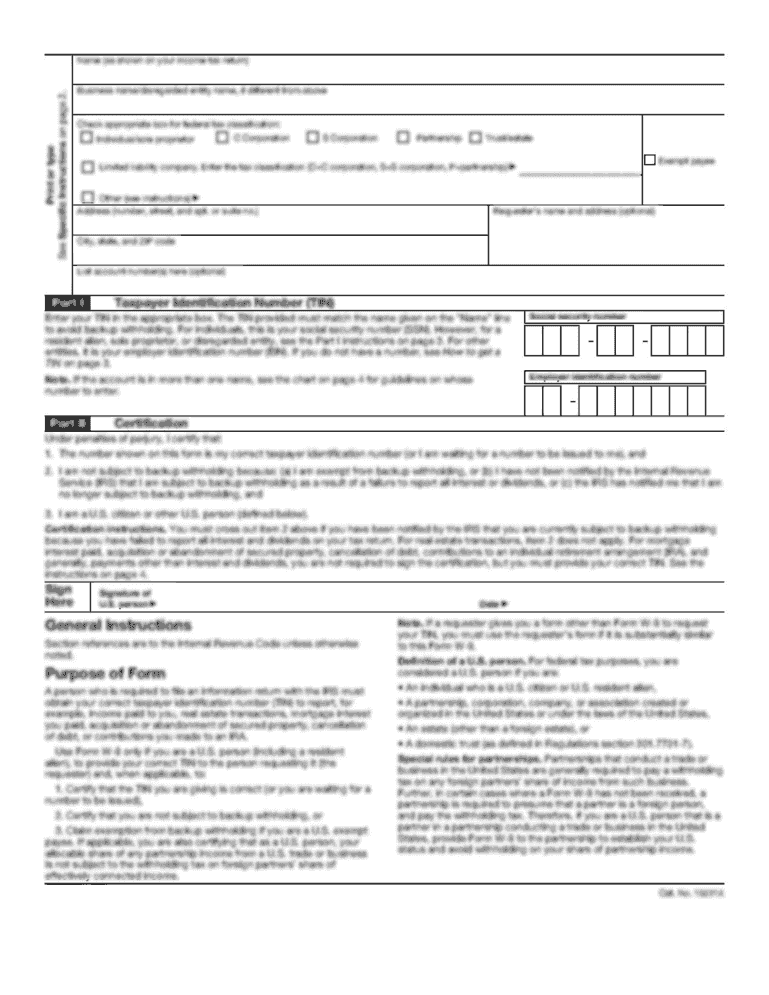

Necessary documentation typically includes the deed itself, which must be filled out correctly with information such as the names of the grantors (property owners), the names of the beneficiaries, and a legal description of the property. Additionally, a witness and notarization are required for the deed to be valid.

Steps to fill out the Florida Lady Bird Deed form

When filling out the Florida Lady Bird Deed Form, it's crucial to follow specific steps to ensure accuracy. Begin by entering the names of the grantors and the beneficiaries at the designated spaces. It is essential to include the legal description of the property, which can be found in the original deed or tax documents. Double-check the spelling of names and the accuracy of property details to avoid any issues later on.

One common mistake to avoid is neglecting to have the document notarized. Notarization is a critical component that validates the deed. Additionally, consider utilizing tools like pdfFiller, which offers editing capabilities for customizing the form. This ensures the document is not only accurate but also adheres to any specific requirements or preferences you may have.

Recording your Lady Bird Deed

Once filled out, recording your Florida Lady Bird Deed is crucial for its effectiveness. Filing with the appropriate county clerk's office is a mandatory step as the deed must be public record to take effect. Before heading to the office, you may want to check online for specific recording fees and any additional documents that may be required.

The importance of filing cannot be overstated. Without proper recording, the deed may not hold legal standing. For those who prefer convenience, consider eRecording solutions which allow you to submit the deed electronically, streamlining the process and saving time.

Relationship of Lady Bird Deeds to Florida homestead law

Florida's homestead law plays a significant role in the operation of Lady Bird Deeds. Properties designated as homestead have certain protections from creditors and are eligible for property tax exemptions. These protections can extend even when a Lady Bird Deed is utilized, allowing property owners to benefit from these legal protections while still implementing their estate planning strategies.

Moreover, for individuals concerned about Medicaid estate recovery, understanding how Lady Bird Deeds interact with these regulations is vital. Properties transferred through a Lady Bird Deed may not be subject to estate recovery, unlike properties included in a person's estate. This aspect is particularly important for seniors who may need assistance with long-term care.

Frequently asked questions about Florida Lady Bird Deeds

Potential users of a Florida Lady Bird Deed often have questions regarding its operation. For instance, many inquire, 'Can a Lady Bird Deed be revoked or changed?' The answer is yes; property owners maintain the right to revoke or change the beneficiaries as desired at any point during their lifetime.

Another common question is, 'What happens if the beneficiary dies before the grantor?' In such cases, the property can be transferred to alternate beneficiaries named in the deed. If none are designated, the property will revert to the grantor's estate unless specified otherwise.

Practical usage of the Florida Lady Bird Deed

Florida Lady Bird Deeds serve a pivotal role in various estate planning strategies. Their ease of use makes them particularly appealing for individuals looking to avoid the complexities of probate. By directly transferring property upon the death of the owner, these deeds simplify the transition of assets to heirs, providing a smooth way to ensure that desired individuals inherit property without delays.

Moreover, with the increasing emphasis on Medicaid considerations, utilizing a Lady Bird Deed is an effective tool for asset protection. Property owners can safeguard their homes from being counted as assets for Medicaid eligibility while still retaining the right to live in their property. This dual benefit makes the Lady Bird Deed a versatile approach to estate planning in Florida.

Comparing Florida Lady Bird Deeds with other Florida deed forms

When evaluating your estate planning options in Florida, it’s essential to distinguish between the various types of deeds available. For instance, while quitclaim deeds can transfer property, they do not confer the same protections or benefits as a Lady Bird Deed. Quitclaim deeds simply transfer whatever interest the grantor has in the property without guarantees, which can lead to potential issues down the road.

In contrast, a Lady Bird Deed provides enhanced protections and allows the grantor to retain control during their lifetime. This type of deed can be particularly advantageous in situations involving family properties or real estate intended for direct transfer upon death. Understanding the unique traits of each deed type helps owners make informed decisions about which option best suits their needs.

Client testimonials and reviews of Florida Lady Bird Deeds

Feedback from clients illustrates the practical advantages of utilizing a Florida Lady Bird Deed. Many users report significant peace of mind upon executing this deed, appreciating the seamless transition of property upon death without the burden of probate proceedings. These testimonials often highlight the flexibility allowed for making changes, granting property owners the confidence to manage their estates more effectively.

However, it’s essential to note that some reviews point out potential challenges, such as misunderstanding the implications of Medicaid recovery or the nuances of Florida's homestead laws impacting property values. Consulting with a knowledgeable attorney can often mitigate these concerns and enhance the effectiveness of using a Lady Bird Deed.

Additional considerations for using Florida Lady Bird Deeds

Beyond the basics, several additional considerations come into play when deciding to use a Florida Lady Bird Deed. For example, understanding how civil judgments may affect the property after a transfer is critical. If a grantor has existing judgments, they could encumber the property, complicating the transfer to beneficiaries after death.

Furthermore, post-transfer property insurance considerations are essential. After executing a Lady Bird Deed, it is important for beneficiaries to ensure that the property remains adequately insured to prevent financial loss. Seeking legal guidance to navigate these complexities is advisable to ensure that all bases are covered effectively.

Getting started with pdfFiller for your Florida Lady Bird Deed

To create your Florida Lady Bird Deed Form, accessing pdfFiller is an excellent first step. By utilizing their platform, you can easily locate the Lady Bird Deed form, fill it out, and customize it according to your needs. Not only does pdfFiller simplify the process, but it also enhances document management by allowing users to electronically sign and collaborate on documents from anywhere.

Additionally, pdfFiller offers various estate planning templates, ensuring users have the resources necessary for comprehensive estate management. Embracing the robust capabilities of pdfFiller empowers individuals to navigate the complexities of property transfers confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form in Chrome?

How do I complete pdffiller form on an iOS device?

How do I edit pdffiller form on an Android device?

What is Florida lady bird deed?

Who is required to file Florida lady bird deed?

How to fill out Florida lady bird deed?

What is the purpose of Florida lady bird deed?

What information must be reported on Florida lady bird deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.