Get the free New Account Application

Get, Create, Make and Sign new account application

How to edit new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

Your Comprehensive Guide to the New Account Application Form

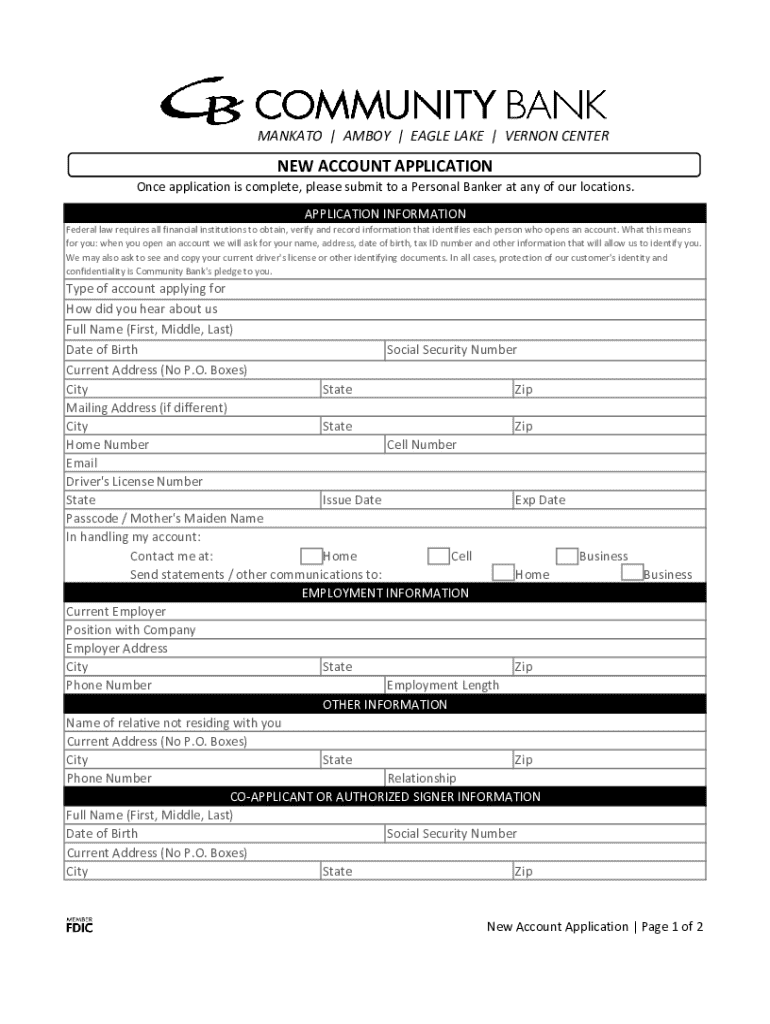

Overview of the new account application form

The new account application form serves as a vital gateway for individuals and teams looking to engage with financial institutions or investment platforms. This document streamlines the process of account registration, ensuring that all necessary information is captured efficiently. Without it, setting up financial accounts could lead to miscommunication, delays, and even lost opportunities.

Common uses of the new account application form include opening checking or savings accounts, investment accounts, and even retirement accounts. By utilizing this form, users benefit from a clear structure that guides them through the required information and legalities associated with managing their finances.

Navigating the new account application form

Understanding the structure of the new account application form can seem daunting, yet the organization of the document simplifies the process significantly. Typically, the form is divided into several sections, each addressing different aspects of your financial history and personal information.

Key sections often include personal information, financial information, and a section dedicated to investment objectives. Familiarizing yourself with these sections can make the filling process much smoother and less stressful.

Step-by-step instructions for filling out the form

Completing the new account application form entails a methodical approach. Ensuring you are well-prepared with all necessary information and documents before sitting down to fill out the form can save you time and hassle.

Step 1: Gathering required information

Before you start, gather essential documents such as identification, proof of address, and any relevant financial statements that may be required. These will simplify the process.

Common pitfalls include forgetting to sign the form or omitting crucial details, both of which can lead to delays or denials.

Step 2: Completing the personal information section

Accurate data entry is paramount in this section. Ensure that your name and address match what’s on your official identification documents. Small discrepancies can lead to complications down the line.

Step 3: Financial overview submission

This section typically requests an overview of your current financial standing, including annual income and net worth. Be prepared to submit supporting documentation that verifies your claims, such as tax returns or pay stubs.

Step 4: Selecting investment goals and preferences

Understanding your investment objectives is critical. Do you aim for growth, income, or capital preservation? Assess your risk tolerance level, as this will significantly influence the types of investments you can pursue.

Editing and customizing your new account application form

One of the advantages of using pdfFiller to manage your new account application form is the ability to edit and customize it seamlessly. You can modify any part of the form to tailor it to your specific needs.

Utilizing pdfFiller's tools for form customization

With pdfFiller, you can easily incorporate your own text, select options, and even add electronic signatures. This is particularly useful if you’re collaborating with team members or financial advisors.

Furthermore, you can share the form with colleagues for feedback, utilizing annotations for further clarity when necessary.

Understanding eSignature integration

eSigning your new account application form through pdfFiller enhances both security and efficiency. eSignatures are legally binding, ensuring that your application process adheres to regulatory standards.

It is essential to know how to incorporate eSignatures properly into your application. The process typically includes sending the form for signature, and once completed, confirming the receipt of the eSignature.

Managing your application after submission

Once you've submitted your application, it's crucial to stay proactive. You may encounter common scenarios such as tracking your application status or fulfilling additional documentation requests.

pdfFiller ensures that all your documents are stored securely in the cloud, providing easy access whenever needed. This storage solution comes with robust privacy and security features to protect your sensitive information.

Troubleshooting common issues with the new account application form

Despite the best preparations, errors can still occur during the application process. Common issues include providing incorrect information, failing to sign, or submitting incomplete forms. These can lead to application delays or denials.

To alleviate these concerns, review the application carefully before submission. In case of any mistakes after submission, promptly contact the financial institution to discuss options for correction.

Frequently asked questions can provide additional insights on the application process, helping to clear up any confusion.

Additional forms and documentation

Various related forms are often necessary for different account types. Whether it's specific forms for retirement accounts or investment adjustments, understanding what additional documentation may be required is essential.

Consider exploring financial planning guides and investment strategy resources to support informed decisions and enhance your understanding of financial products.

Engaging with the new account application form community

The community around new account applications is robust, offering valuable user testimonials and shared experiences. Engaging with this community can provide insights that may improve your process.

Various webinars and tutorials are available to educate users on effectively utilizing tools like pdfFiller for form management. Signing up for newsletters can keep you updated on best practices and new developments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new account application to be eSigned by others?

Can I create an electronic signature for the new account application in Chrome?

Can I create an electronic signature for signing my new account application in Gmail?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.