Get the free Mortgage of Water Share(s)

Get, Create, Make and Sign mortgage of water shares

How to edit mortgage of water shares online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage of water shares

How to fill out mortgage of water shares

Who needs mortgage of water shares?

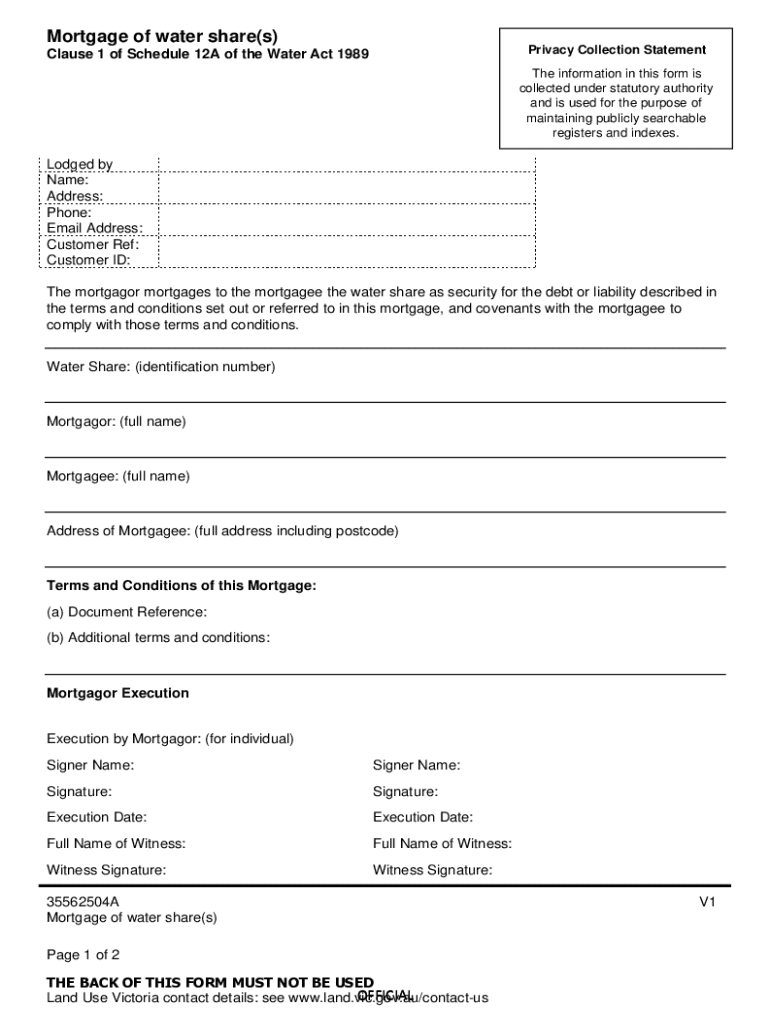

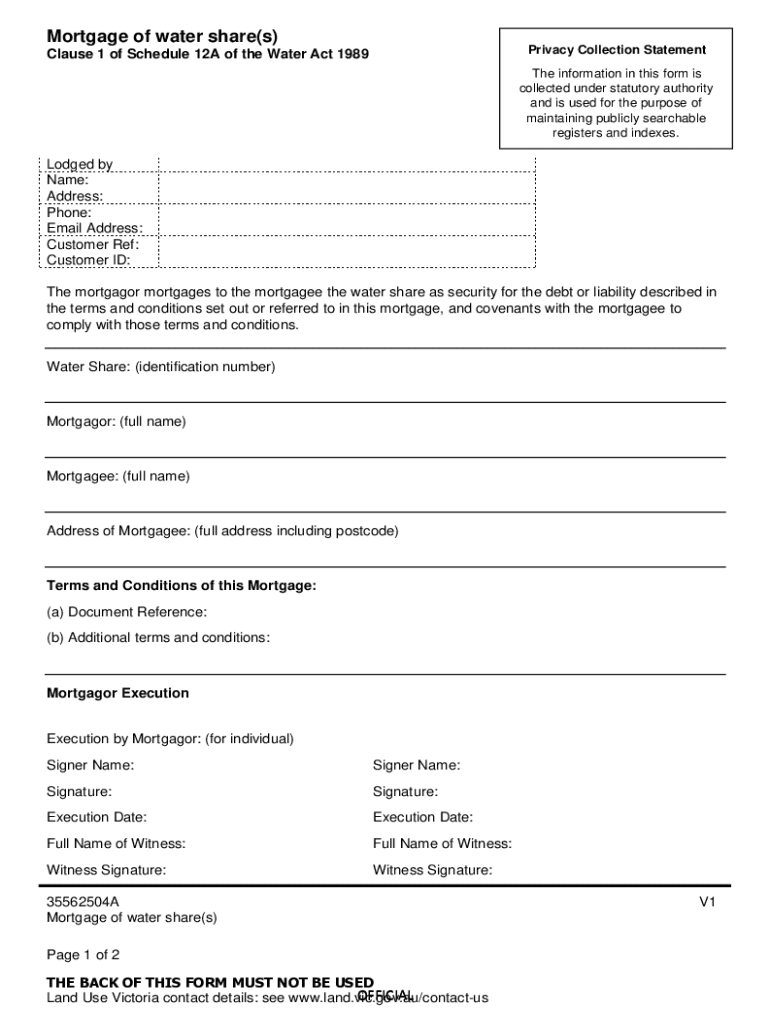

Understanding the Mortgage of Water Shares Form

Understanding water shares and mortgage basics

Water shares are a vital asset in regions where water resources are limited, serving both agricultural and residential communities. A water share represents a legal entitlement to access a specified quantity of water, typically allocated from rivers, lakes, or aquifers to support irrigation and other uses. In agricultural contexts, securing water shares can mean the difference between a successful crop yield and agricultural failure. For residents, particularly in arid regions, owning water shares is crucial for maintaining gardens, swimming pools, and other water-dependent facilities.

Mortgaging water shares emerges as a practical financing solution for individuals or businesses looking to leverage their water assets. Mortgaging involves using water shares as collateral to secure a loan, allowing debtors to access funds without divesting their ownership. Understanding the legal implications surrounding this practice is crucial, as terms of these agreements can affect water rights and ownership significance.

The mortgage of water shares process

Navigating the mortgage of water shares involves several key steps, starting with the evaluation of your water share value. Various factors influence this valuation, including the reliability of the water source, historical data on water usage, and the demand for water shares in your area. It is advisable to seek professional appraisals to ascertain the true worth of your water shares before moving forward.

Key considerations for mortgaging water shares

When seeking a mortgage on water shares, it's essential to understand the typical interest rates and terms associated with these loans. Interest rates may vary depending on the lender and local market conditions, but knowing the average rates will help you assess whether the mortgage is a financially sound decision. Standard mortgage terms often include repayment durations and clauses related to your water rights.

Mortgaging your water shares can impact your rights. While you retain ownership, the lender may hold some rights until the mortgage is fully paid. Therefore, it's critical to maintain compliance with mortgage terms, which may include regular financial assessments and maintaining the requisite documentation showcasing the shares' value.

Comparative analysis of water shares mortgage vs other financing options

Mortgaging water shares differs significantly from traditional land mortgages. While both involve borrowing against an asset, land mortgages often come with more stringent requirements and longer-term commitments. In contrast, water share mortgages allow more flexibility for businesses and individuals seeking quick access to funds against an essential, yet less tangible, resource.

Fee structure related to mortgaging water shares

Understanding the fee structure associated with the mortgage of water shares is critical for budgeting purposes. Application fees are often required upfront, alongside legal fees that may accrue during the drafting of contracts or agreements. Appraisal fees for assessing the value of your water shares also factor into the overall cost. These expenses can accumulate, so being aware of them beforehand can prevent surprises later on.

Ongoing costs post-mortgage approval should also be factored in, such as maintaining your water shares (irrigation systems, etc.) and adequate insurance coverage, which may be required by lenders. These costs, while manageable, should be included in your financial projections when considering a mortgage against your water shares.

Interactive tools and resources

pdfFiller provides several interactive tools specifically designed to streamline the process of managing the mortgage of water shares form. Users can access calculators for precise water share valuation and mortgage cost calculations, facilitating informed decisions. Additionally, customizable document templates are available on pdfFiller to assist users in preparing required mortgage documentation.

Case studies and real-world examples

Learning from real-world case studies can provide valuable insights into the mortgage of water shares. There are numerous accounts of successful transactions where individuals or farms have leveraged their water shares to fund expansions, invest in better irrigation technology, or stabilize cash flow during drought periods. Each scenario highlights the strategic advantages water share mortgages can present.

However, not all stories are filled with success. Some individuals encountered challenges due to undervaluation of their water shares or misunderstanding the implications of their agreements. It is crucial to approach the decision to mortgage water shares with thorough research and consultation to navigate potential risks effectively.

Legal aspects and compliance

When considering a mortgage of water shares, understanding your legal responsibilities is paramount. Local regulations often govern the forfeiture and transfer of water rights, meaning any mortgage agreement should not violate these laws. Borrowers must maintain compliance with both state and local guidelines to protect their rights and avoid potential penalties.

Failure to comply with the terms set forth in the mortgage agreement can lead to severe consequences, including foreclosure on the shares. Keeping up with any changes in local regulations and ensuring adherence to contractual obligations lays the groundwork for a successful lending arrangement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my mortgage of water shares in Gmail?

How do I complete mortgage of water shares on an iOS device?

How do I fill out mortgage of water shares on an Android device?

What is mortgage of water shares?

Who is required to file mortgage of water shares?

How to fill out mortgage of water shares?

What is the purpose of mortgage of water shares?

What information must be reported on mortgage of water shares?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.