Get the free Certificate of Exemption

Get, Create, Make and Sign certificate of exemption

Editing certificate of exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption

How to fill out certificate of exemption

Who needs certificate of exemption?

Understanding the Certificate of Exemption Form

Understanding the certificate of exemption form

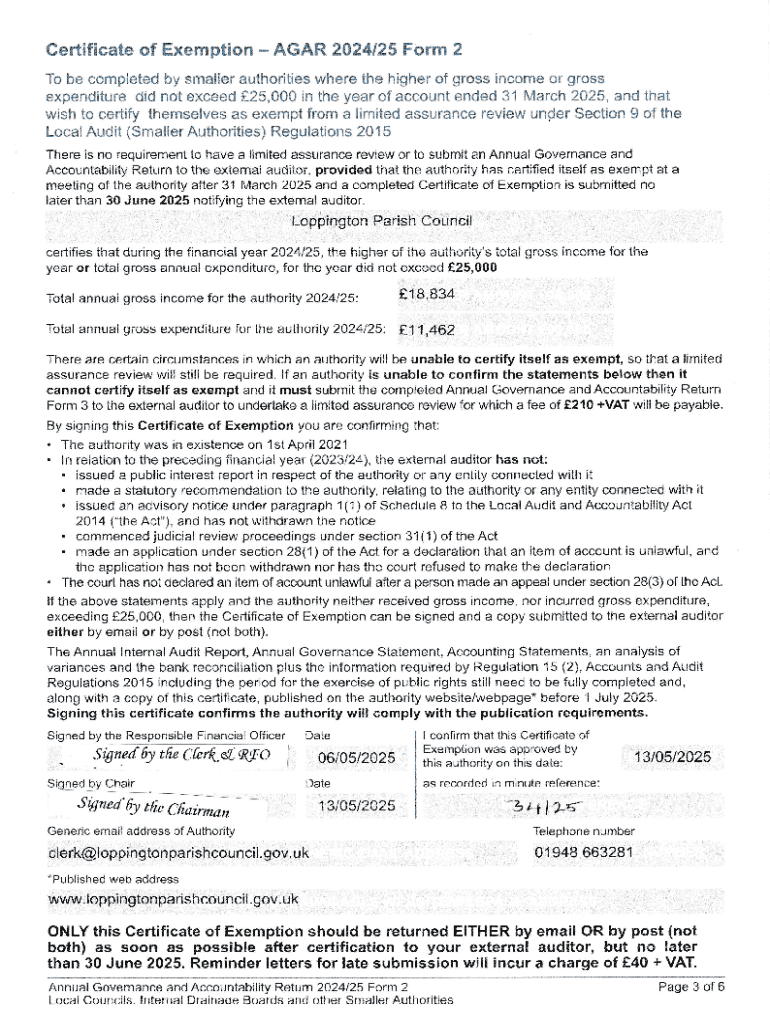

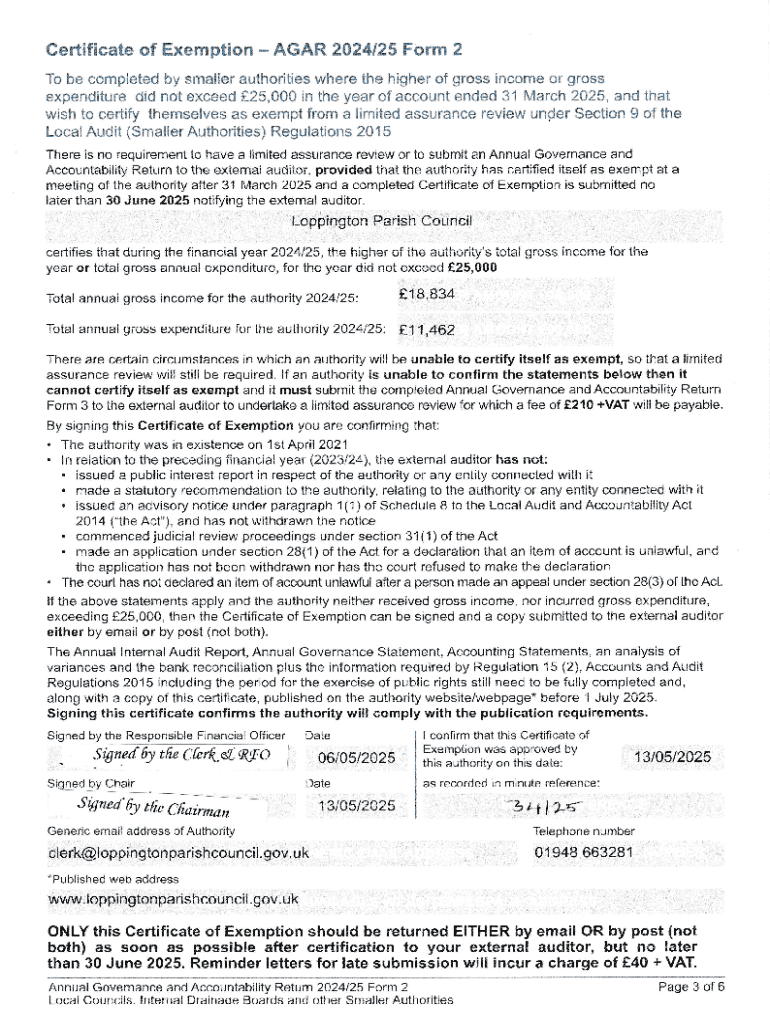

A certificate of exemption form is a crucial document that allows individuals and organizations to claim certain tax exemptions. The primary purpose of this form is to provide a means for eligible entities to exempt their purchases from sales tax or to qualify for other tax benefits. By filling out and submitting this form, taxpayers can legally avoid paying taxes on qualifying transactions, making it a vital component in tax planning and compliance.

Understanding the role of the certificate of exemption is essential, especially in jurisdictions where sales tax regulations vary significantly. Organizations such as non-profits, educational institutions, and certain types of businesses may be eligible to use this form, allowing them to operate more efficiently and reinvest their savings into their missions.

Importance of the certificate of exemption in tax regulations

The certificate of exemption plays a pivotal role in the tax landscape. It serves as proof that a purchaser is entitled to claim an exemption from sales tax. This not only helps in reducing the financial burden on eligible organizations but also promotes compliance with tax laws. Moreover, by providing clarity on who can claim these exemptions, it aids tax authorities in enforcing regulations fairly and efficiently.

In this way, the certificate acts as a protective mechanism for those who qualify, ensuring that tax regulations do not unfairly disadvantage certain sectors or individuals. For example, a non-profit organization that provides educational materials can use a certificate of exemption to purchase these resources without incurring additional costs, thereby maximizing their budget.

Who is eligible to use a certificate of exemption?

Eligibility for utilizing a certificate of exemption encompasses a diverse range of entities and scenarios. Commonly, this includes:

Key features of the certificate of exemption form

The certificate of exemption form comprises several critical components that ensure the effective capture of exemption qualifications. Understanding these features is essential for anyone looking to utilize this form successfully. Key elements include:

Another important consideration is that variations in exemption certificates exist across different states, each potentially having unique requirements. States often dictate specific forms or additional documentation to validate exemption claims effectively.

This variation means that for organizations operating in multiple states, it’s crucial to be aware of and comply with local regulations concerning the certificate of exemption.

How to obtain and fill out the certificate of exemption form

Obtaining a certificate of exemption form is typically straightforward and can be completed through several methods. The most common steps include:

Once obtained, filling out the form accurately is crucial to avoid delays or rejections. The form will typically require detailed information, including the purchaser’s name, address, and tax identification number, along with a description of the items being purchased and the exemption type.

A step-by-step guide for completing this document is as follows:

Avoid common mistakes such as leaving out fields or submitting incomplete documentation, as these issues can lead to unnecessary delays.

Utilizing pdfFiller for the certificate of exemption form

pdfFiller offers a powerful platform that streamlines the process of managing the certificate of exemption form. Users can take advantage of features like easy PDF editing and collaboration, which simplify the process of customization:

pdfFiller also provides interactive tools that serve to optimize the document experience. Templates and customization options enable users to create forms tailored to their specific requirements, while cloud-based management ensures that forms can be accessed anytime, anywhere.

Additionally, security and compliance features integrated into pdfFiller offer protection for sensitive information, ensuring compliance with tax regulations and providing peace of mind to users. With various security measures in place, documents remain safe and confidential throughout the process.

Submitting the certificate of exemption form

Once the form is filled out correctly, submission is the final key step. Understanding submission methods is essential for ensuring that the form reaches the correct department in a timely manner. Users can typically choose between:

After submission, keep track of your form’s status to ensure everything is processed properly. Various states may offer online tracking options, allowing users to verify the receipt and status of their submissions effortlessly.

In the event your submission is rejected, prompt action is crucial. Review the provided reasons for rejection, and make necessary corrections before resubmitting to avoid further issues.

Frequently asked questions about the certificate of exemption form

Clarifying common misconceptions and addressing frequently asked questions can help individuals navigate the certificate of exemption process more effectively.

For instance, the validity period of a certificate may vary by state, and it’s crucial to check specific state guidelines to ensure compliance. Additionally, while the certificate is primarily designed for businesses and organizations, certain individual scenarios do apply, often tied to specific regulations.

On the technical side, users may have questions about recovering submitted forms or editing them after submission. pdfFiller allows users to manage these concerns easily, making document handling smooth and hassle-free.

Tips for managing your certificate of exemption form efficiently

Managing the certificate of exemption form effectively can save users time and resources. Implementing best practices for document management will enhance your filing process. Key strategies include:

These tips ensure that individuals and teams are well-prepared and organized when handling tax exemption forms. By proactively managing this document, users can focus more on their core activities rather than getting bogged down by compliance details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit certificate of exemption from Google Drive?

How do I edit certificate of exemption straight from my smartphone?

How do I edit certificate of exemption on an iOS device?

What is certificate of exemption?

Who is required to file certificate of exemption?

How to fill out certificate of exemption?

What is the purpose of certificate of exemption?

What information must be reported on certificate of exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.