Comprehensive Guide to Small Business Subcontracting Plan Form

Understanding small business subcontracting plans

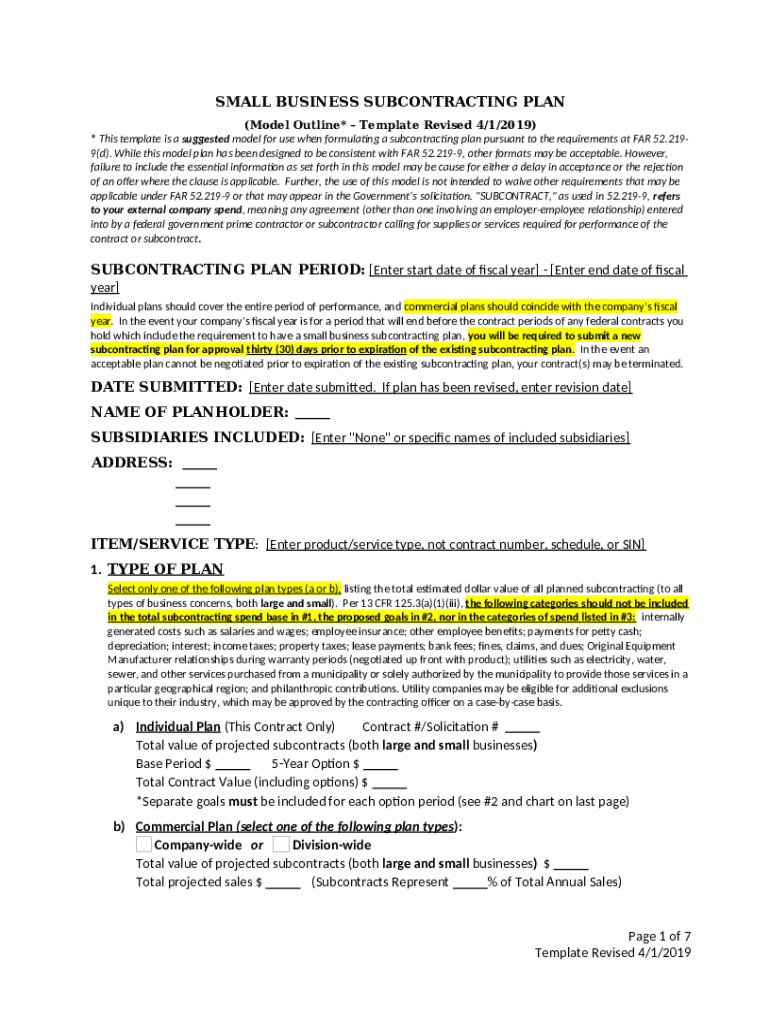

A small business subcontracting plan is a document that outlines how a prime contractor will provide opportunities for small businesses to participate in contract work. This plan is essential in federal contracting and is often a requirement to ensure that small businesses can compete for and win contracts alongside larger firms.

Subcontracting serves multiple benefits for small businesses. By partnering with larger contractors, small firms can gain access to more extensive projects that would be challenging for them to handle independently. Additionally, subcontracting allows small businesses to build their capabilities and experience while also ensuring a steady stream of income as ancillary support to larger contracts.

Expanded network: Collaborating with larger contractors provides small businesses with valuable industry connections.

Access to resources: Small businesses can leverage existing processes and resources from larger firms to enhance their operational capacity.

Financial stability: Regular subcontracted work can provide a more stable income stream, aiding business sustainability.

Types of small business subcontracting plans

Understanding the different types of small business subcontracting plans is essential for ensuring compliance and maximizing opportunities. The plans can be broadly categorized into three types.

Individual subcontracting plans

Individual subcontracting plans are tailored for specific agreements and are most commonly used when the prime contractor finds it necessary to delineate how small businesses will participate in larger contracts. These plans should detail the commitment to small business participation and should articulate clear recruitment strategies.

Key components to include are measurable goals for the percentage of work awarded to small businesses, methodologies for tracking performance, and identification of specific small business entities engaged.

Commercial subcontracting plans

Commercial subcontracting plans differ in that they cater specifically to commercial contracts rather than federal contracts. They need to showcase how the prime contractor can provide substantial opportunities for small businesses while meeting their overall commercial objectives.

Unlike individual plans, commercial plans are not typically mandated by government agencies but can enhance a company's reputation and facilitate business growth.

Tailored plans by industry

Different industries possess unique challenges and requirements when structuring subcontracting plans. For instance, technology companies might focus more on IT-related small businesses, while construction firms might look at trades and skilled labor. Tailoring plans to fit the industry's specific landscape is crucial.

Healthcare: Business plans might prioritize minority-owned healthcare providers for consultation services.

Construction: Plans in this industry often emphasize partnering with local contractors specializing in specific trades.

Information Technology: These can include partnerships with small firms who offer niche software solutions.

Essential requirements for establishing a subcontracting plan

Creating a robust subcontracting plan involves understanding essential regulatory compliance factors. The Federal Acquisition Regulation (FAR) provides the framework within which all government contracting operates. Companies must familiarize themselves with particular clauses regarding small business engagement.

In addition to meeting compliance standards, establishing clear goals and objectives is crucial. This part entails developing realistic outreach strategies while assessing business performance metrics to develop achievable targets that correspond with overall business goals.

Understand FAR regulations: Assess applicable sections relevant to small business subcontracting.

Define specific goals: Articulate numerical targets for subcontracted work assigned to small businesses.

Outreach strategies: Formulate methods for identifying and engaging potential subcontractors to meet goals.

Step-by-step guide to creating your small business subcontracting plan form

Creating an effective small business subcontracting plan form requires diligence and focus. Below is a step-by-step guide to streamline this process.

Gather necessary information

Begin by compiling all essential data, which includes financial performance metrics pertinent to your business, any past subcontracting experiences, and potential subcontractors. Information about the supply chain can significantly influence decisions on which contracts to pursue.

Outline plan structure

Structuring your subcontracting plan document involves a clear layout with easily identifiable sections. Implement essential headings and subheadings that will guide the reader through the document seamlessly. Consider using templates provided by platforms like pdfFiller to simplify this phase.

Writing the plan

When composing your plan, ensure detailed guidelines are available for each section. Maintain clarity and compliance by using straightforward language that can be easily understood. Avoid jargon whenever possible to ensure that all stakeholders can easily digest the plan.

Review and edit

Revising your purchase plan is crucial. Consult with key stakeholders and consider using feedback tools available on platforms like pdfFiller to allow real-time comments and collaboration.

Submitting your plan

Pay attention to the submission methods specified by the authority requiring the plan. Thoroughly check submission requirements to avoid common pitfalls that can result in rejection.

Tools for filling out and managing your subcontracting plan

Managing and filling out your subcontracting plan is made easier with the right tools. pdfFiller offers an array of features to assist users in this process.

pdfFiller’s interactive features

The interactive features offered by pdfFiller allow users to easily edit PDF documents. This capability ensures that necessary revisions can be made directly within the document, preserving the integrity of the original formatting while simplifying collaboration efforts.

Collaboration tools

pdfFiller provides users with robust sharing capacities, enabling documents to be viewed and edited by multiple stakeholders. This collaborative environment aids in refining the plan and addressing any concerns in real time.

Common mistakes in small business subcontracting plans

Even seasoned enterprises can fall into traps when drafting subcontracting plans. Recognizing these pitfalls can lead contractors toward a more successful approach.

Underestimating subcontractor roles: Not providing proper resources or expectations can hinder small businesses’ ability to meet goals.

Failing to adhere to compliance requirements: Overlooking federal requirements can lead to contract forfeiture.

Incomplete or vague goal definitions: Clearly defined objectives are crucial for measuring progress and success.

Insights into subcontractor compliance and reporting

Compliance reviews are an integral part of maintaining a successful small business subcontracting plan. These reviews serve the purpose of assessing whether the established goals are being met and ensuring that all regulations are being adhered to.

Reporting requirements vary but generally involve regular intervals where contractors must submit documentation detailing their progress toward the established goals set forth in the subcontracting plan. This information is crucial for stakeholders to evaluate the subcontractor's performance and for federal agencies to ensure compliance.

Purpose of reviews: Assess performance against goals to ensure compliance.

Regular reporting: Establish intervals for consistent updates to stakeholders.

Information disclosure: Clearly define what data needs to be included in the reports.

Navigating challenges in small business subcontracting

Contractors face several challenges while navigating subcontracting in the small business space. Understanding these limitations and developing strategies to overcome them is essential for success.

Limitations on subcontracting

Legal restrictions can sometimes limit the scope of subcontracting relationships. These can include regulations based on the type of contract or the nature of the work. Familiarity with these provisions is vital for compliance.

Strategies for overcoming obstacles

Developing strategic partnerships and networking within the industry can greatly aid in overcoming these challenges. Connecting with other firms often opens doors that would remain closed within isolated operational environments.

Building partnerships: Create strong alliances that can enhance project capabilities.

Leveraging technology: Use digital tools to streamline subcontracting processes and improve efficiency.

Finding resources and support

Small businesses should consider available resources and support mechanisms for their subcontracting plans. pdfFiller offers a wide range of tools and templates that provide essential frameworks for your documentation needs.

Educational platforms for training and development

There are a variety of training programs and workshops designed to enhance understanding of subcontracting requirements and expectations. Many organizations within certain sectors often provide meaningful resources to small businesses aimed at supporting compliance.

Networking opportunities within industry circles

Building connections with industry professionals can be a great way to gain insights and discover best practices for effective subcontracting. Engage actively in local business events, seminars, and trade shows to foster valuable relationships.

Frequently asked questions about small business subcontracting plans

Prospective contractors often have common queries regarding subcontracting plans. Below are some frequently asked questions that can help clarify various uncertainties.

What is the best way to begin a subcontracting plan? Start by researching industry regulations and gathering necessary data.

How do I calculate subcontracting goals? Use historical data to inform your goal-setting, ensuring they are realistic and measurable.

What happens if I fail to comply with market requirements? Non-compliance can result in the loss of contracts and legal penalties, emphasizing the need for stringent adherence.

Additional support options

For businesses seeking further assistance, pdfFiller provides excellent customer service to guide you through creating your subcontracting plan. Engaging with partner resources and organizations in your field can offer additional insights and understanding of legal constraints.

Accessing legal advice may prove invaluable, particularly regarding compliance matters. Partnering with legal experts can help safeguard against potential infractions and foster a robust subcontracting strategy.