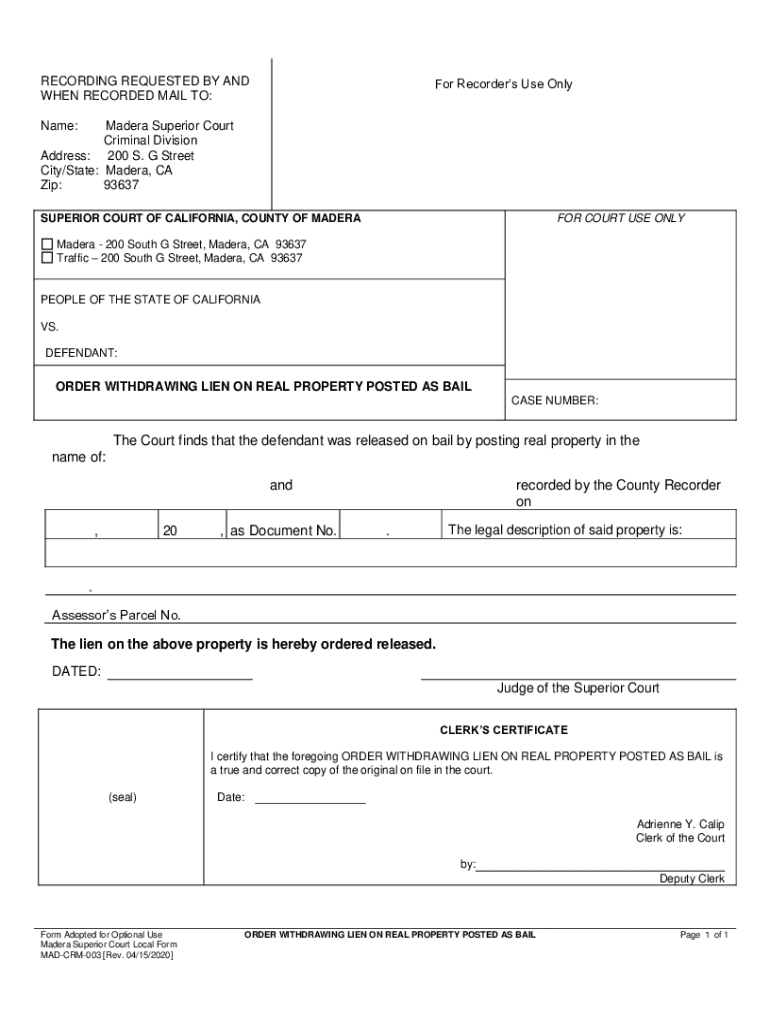

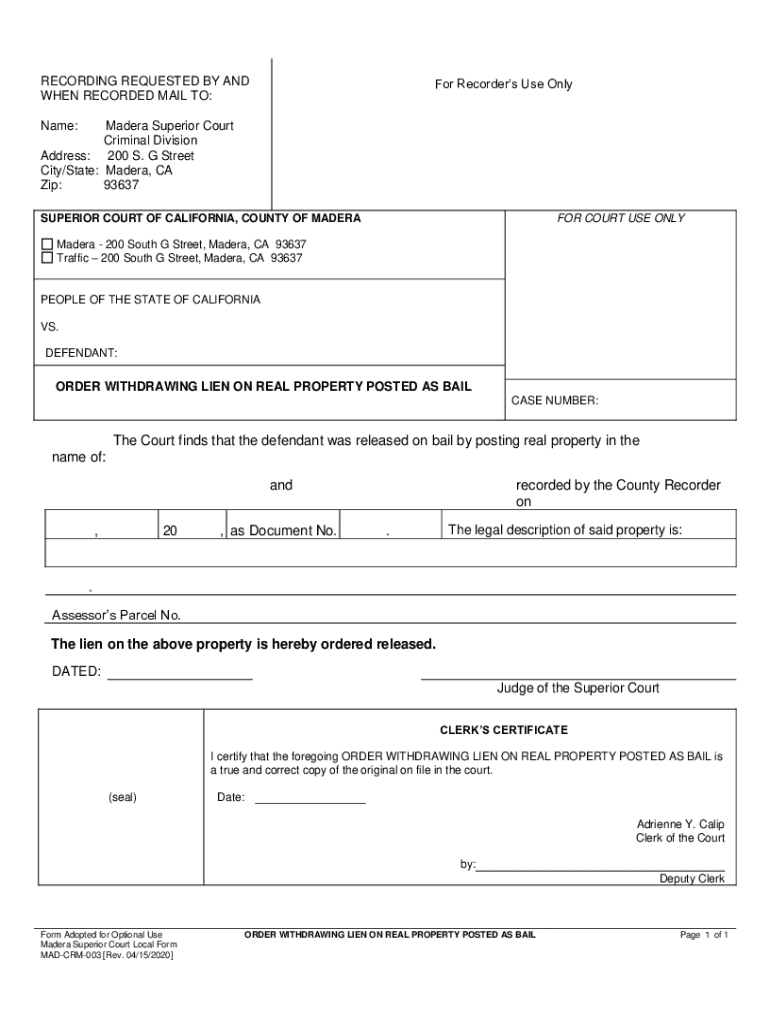

CA MAD-CRM-003 - Madera County 2020-2026 free printable template

Get, Create, Make and Sign CA MAD-CRM-003 - Madera County

How to edit CA MAD-CRM-003 - Madera County online

Uncompromising security for your PDF editing and eSignature needs

How to fill out CA MAD-CRM-003 - Madera County

How to fill out order withdrawing lien on

Who needs order withdrawing lien on?

Order withdrawing lien on form: A comprehensive how-to guide

Understanding liens: What you need to know

A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. Liens can arise from mortgages, tax debts, mechanics’ claims, and more. Their primary purpose is to secure the lender’s position, ensuring they can recover what they are owed by placing a claim against the debtor's property.

There are several types of liens, including consensual liens created with the debtor’s consent, judicial liens imposed by court judgment, and statutory liens established by statutes. Understanding the nature of the lien affecting your property is crucial when considering a withdrawal.

Withdrawing a lien generally involves a formal request to the appropriate authority, signaling that the debt has been settled or that other conditions for withdrawal have been met. Knowing the procedures can alleviate confusion and ensure a smoother process.

Why would you want to withdraw a lien?

Liens can have significant implications for your financial standing and property ownership. For instance, a lien can affect your credit score and create difficulties when trying to sell your property or refinancing it. It is essential to address these issues to regain financial flexibility.

The withdrawal of a lien can yield several immediate benefits, such as improving your credit score, ensuring the marketability of your property, and making it easier to obtain new loans. Common scenarios where withdrawing a lien is necessary include finalizing late payments, reaching a settlement, or addressing a dispute over the claimed debt.

Eligibility for withdrawing a lien

Determining eligibility for withdrawing a lien often hinges on who holds the lien and the circumstances surrounding it. Generally, the property owner, or an authorized representative, can file a request for withdrawal if they can demonstrate that the conditions for withdrawal have been satisfied.

Necessary preconditions typically involve showing proof of payment or resolution of the underlying debt associated with the lien. Additionally, any request for withdrawal needs to adhere to specific local laws and regulations governing lien management.

Step-by-step guide to ordering a lien withdrawal

To successfully withdraw a lien, follow these structured steps. Each phase is critical in ensuring that your request is processed without undue complications.

Gather necessary documents

Your first step is to gather all relevant documents. This typically includes:

Filling out the proper form

When filling out the lien withdrawal form, specificity is key. Ensure to provide accurate information regarding your identity, property details, and the lien itself. Additionally, check the applicable laws for your area as regulations may vary significantly by state or locality.

Common errors to avoid include misspellings in property addresses, failing to include required attachments, or providing incorrect identification. Each of these mistakes could delay your request.

Submitting your request

You have several options for submitting your lien withdrawal request. Depending on your local jurisdiction, you may be able to file online, via mail, or in person. Each method has its advantages; electronic submissions are typically faster, while mailed submissions may provide a physical record.

Regardless of your submission method, be sure to keep copies of everything you send. Tracking your submission is essential if issues arise post-filing.

Key considerations after submission

After you've submitted your request to withdraw a lien, it’s essential to understand that processing times can vary widely. Many jurisdictions provide estimated timelines for processing, so be sure to check those to set your expectations.

If you face delays, whether due to incomplete information or required additional documentation, prompt action is advisable. Common issues can include lost paperwork or missing signatures—addressing these proactively can save significant time.

Impact of withdrawal on your financial status

Once a lien is successfully withdrawn, you may notice a significant improvement in your financial standing. This can positively affect your credit score, opening doors for future loans and credit opportunities. Moreover, dealing with existing financial goals becomes more manageable without the weight of the lien affecting your assets.

However, it's essential to recognize that while the withdrawal alleviates immediate challenges, the underlying reasons for the lien and how they impacted your finances must still be addressed. Developing a plan to manage your finances effectively post-withdrawal, such as settling debts and adhering to budgets, is fundamental.

Legal and financial resources

Navigating legal processes can be daunting, but several resources are available to assist with lien withdrawals. Understanding where to seek help can streamline the path to resolution. Many local government agencies provide assistance for filing procedures, while numerous online platforms offer guides and templates for required documents.

When in doubt, seeking professional assistance from attorneys specializing in property law can provide clarity and direction. They can help navigate complex situations or disputes surrounding lien issues.

Tips for avoiding future liens

Preventing liens is often easier than resolving them. Key proactive measures include diligently managing payments on existing loans, maintaining open communications with creditors, and staying informed about any potential tax obligations.

Setting up payment plans or automating regular payments can mitigate the risk of missing deadlines. Additionally, visiting reputable financial education resources can help enhance your understanding of debt management and personal finance.

Frequently asked questions (FAQs)

As you navigate the process of withdrawing a lien, questions may arise regarding eligibility, submission procedures, and next steps. Addressing common concerns can provide clarity.

Expert insights

Learning from real-world experiences can illuminate best practices and common pitfalls in the lien withdrawal process. Analyzing case studies of successful lien withdrawals showcases effective strategies and highlights the importance of thorough preparation before filing.

Additionally, separating facts from myths related to liens can empower you with the knowledge necessary for sound financial decision-making. Often, misconceptions stem from a lack of understanding, which can lead to missteps during the withdrawal process.

Interactive tools

To assist you in managing the lien withdrawal process, utilize interactive tools such as checklists or calculators tailored to assess the financial implications of liens. These tools can provide guidance as you prepare documentation or work through step-by-step processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA MAD-CRM-003 - Madera County on a smartphone?

How do I fill out the CA MAD-CRM-003 - Madera County form on my smartphone?

How do I fill out CA MAD-CRM-003 - Madera County on an Android device?

What is order withdrawing lien on?

Who is required to file order withdrawing lien on?

How to fill out order withdrawing lien on?

What is the purpose of order withdrawing lien on?

What information must be reported on order withdrawing lien on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.