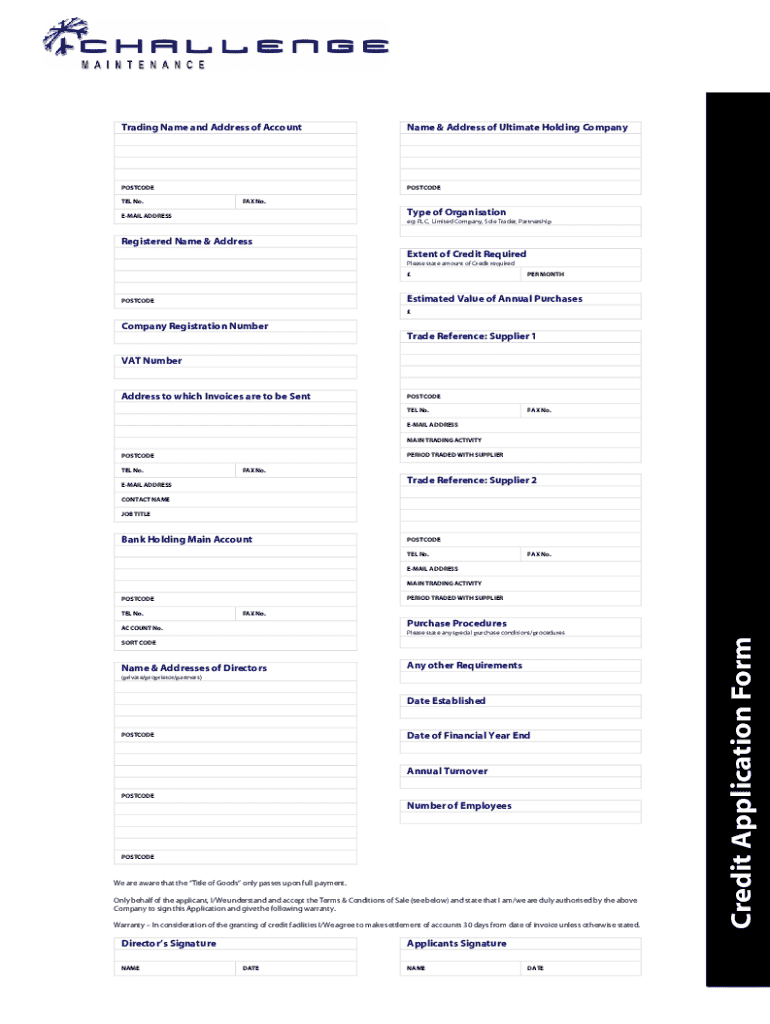

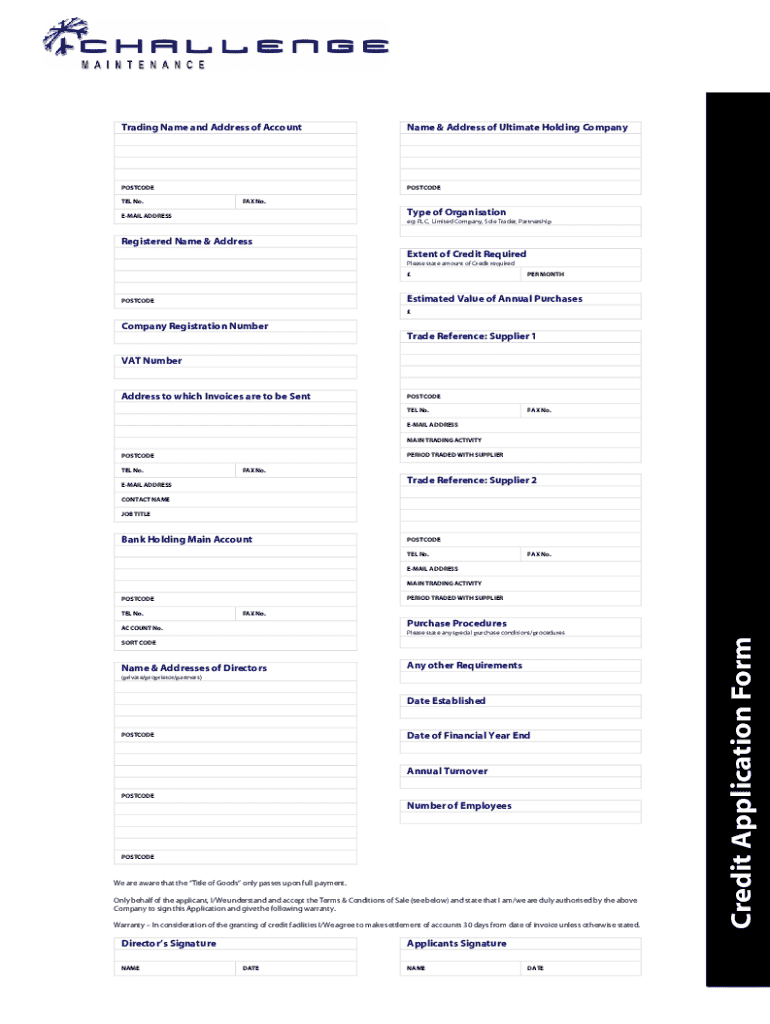

Get the free Credit Application Form

Get, Create, Make and Sign credit application form

Editing credit application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application form

How to fill out credit application form

Who needs credit application form?

Credit Application Form: A Comprehensive How-to Guide

Overview of credit application forms

A credit application form is a critical document used by businesses and individuals to apply for credit. This form collects essential information that helps lenders evaluate the creditworthiness of the applicant. Whether you are applying for a personal loan, a business line of credit, or a credit card, the credit application form serves as the first step in securing the funds you need. Businesses, on their end, also utilize these forms to assess potential customers before extending credit terms.

The importance of credit application forms extends beyond mere paperwork. They facilitate the decision-making process for lenders by providing a structured way to compare different applicants based on their financial standing. By carefully analyzing the data submitted, lenders can identify their risk levels and make informed decisions. For individuals, understanding how to fill out credit application forms can bolster approval chances, ensuring access to necessary financial resources.

Types of credit application forms

Credit application forms can be broadly categorized into two types: B2B (business-to-business) and B2C (business-to-consumer). Each type has specific requirements and components tailored to its audience.

B2B credit application

B2B credit applications typically require detailed information about the business applying for credit. Key components include the company's legal name, business structure, tax identification number, annual revenue, and sometimes trade references from suppliers. The B2B applications differ from B2C applications, which are more focused on personal financial data, such as income and credit history.

B2C credit application

B2C credit applications revolve around personal financial information, including the applicant's full name, address, income, and social security number. They may also require bank account details and information about other debts. These forms are commonly used by individuals applying for mortgages, auto loans, or credit cards.

Key elements to include in a credit application form

When creating a credit application form, it’s essential to include several key elements that provide lenders with necessary insight into the applicant’s financial condition.

Step-by-step process to complete a credit application form

Filling out a credit application form does not have to be a daunting task. Following a structured approach ensures that you cover all necessary areas without missing critical details.

Step 1: Gathering necessary information

Before you even start filling out the application, gather key documentation such as proof of income, tax returns, and bank statements. Create a checklist of all required documents to ensure you don’t overlook anything. It's also helpful to familiarize yourself with terms and definitions related to credit applications, as this will make the completion process smoother.

Step 2: Filling out the application

As you fill out the credit application form, pay close attention to accuracy and completeness. Thoroughly check sections where numerical data, such as income and debts, are requested. A common pitfall is providing inconsistent information or failing to disclose required details, which can lead to application denial.

Step 3: Reviewing the application

Once you have filled out the application, take the time to carefully review it for any errors or omissions. Mistakes can draw unnecessary scrutiny and delay the approval process. If needed, don’t hesitate to seek assistance from someone familiar with credit applications.

Common challenges in the credit application process

Filling a credit application form can be straightforward, but there are common challenges that applicants often face.

The role of automation in credit application processing

Automated systems for credit application processing have revolutionized the way lenders manage these documents. The benefits are substantial, enabling faster processing times and reducing the likelihood of human error.

When considering automation for credit application processing, several software options can streamline your workflow. pdfFiller, for instance, enhances the credit application experience by providing a cloud-based platform for filling out, signing, and managing forms. Its features are designed to improve collaboration and minimize the administrative burden associated with processing credit applications.

Tips for assessing creditworthiness

When evaluating the information provided in a credit application form, several key metrics can offer insight into an applicant’s financial stability and repayment capacity.

Developing a thorough evaluation strategy can increase the likelihood of making sound lending decisions while minimizing risk.

Best practices for submitting a credit application

Submitting a well-prepared credit application form is crucial for increasing approval odds. There are a couple of best practices applicants should adhere to.

Timelines for submission

Timing can significantly affect the approval chances of your application. Aim to submit your application when lenders are actively seeking new clients, often at the beginning of the month or after promotional offers. This awareness can improve your chances of quick acceptance.

Follow-up protocols

After submitting your credit application, have a plan in place for following up. Wait a few days, then reach out to check the status of your application. An appropriate follow-up can show you're engaged and invested in the process.

FAQs about credit application forms

Many individuals and businesses have questions regarding the credit application process. Here are a few frequent inquiries.

Enhancing your credit application with pdfFiller

pdfFiller provides a host of features that streamline the process of filling out and managing credit application forms. Its cloud-based platform allows users to edit PDFs, eSign documents, and collaborate in real-time with team members, making it easier to manage credit applications effectively.

Many businesses have successfully implemented pdfFiller to improve their credit application processes, resulting in quicker turnaround times and improved accuracy. These case studies highlight how adopting digital solutions can yield significant benefits.

Related document management solutions

In addition to credit application forms, several other documents might be required during the credit assessment process. This can include financial statements, personal guarantees, or collateral documentation. Understanding these documents and having effective management tools in place is essential.

Continuing your learning journey

Educating yourself about the ins and outs of credit applications is essential for both individuals and businesses. Various resources, including templates, webinars, and in-depth guides, can assist you in mastering this subject.

Keeping your credit application secure

Handling sensitive information must be a priority when completing a credit application form. Understanding the necessary measures to protect this data will ensure compliance with data privacy laws.

Conclusion and next steps

Navigating the credit application process can significantly impact your financial future, whether as an individual seeking a personal loan or a business applying for a line of credit. pdfFiller is positioned to provide you with the tools and resources necessary to manage credit applications efficiently.

By harnessing the capabilities of pdfFiller, users can streamline their credit applications, ensuring they are well-prepared and informed every step of the way. Engaging with the community can also provide ongoing support and advice to further enhance your understanding of credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application form in Gmail?

How can I modify credit application form without leaving Google Drive?

How do I fill out the credit application form form on my smartphone?

What is credit application form?

Who is required to file credit application form?

How to fill out credit application form?

What is the purpose of credit application form?

What information must be reported on credit application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.