Get the free P-15.01 Reg 4

Get, Create, Make and Sign p-1501 reg 4

Editing p-1501 reg 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p-1501 reg 4

How to fill out p-1501 reg 4

Who needs p-1501 reg 4?

Comprehensive Guide to the p-1501 Reg 4 Form

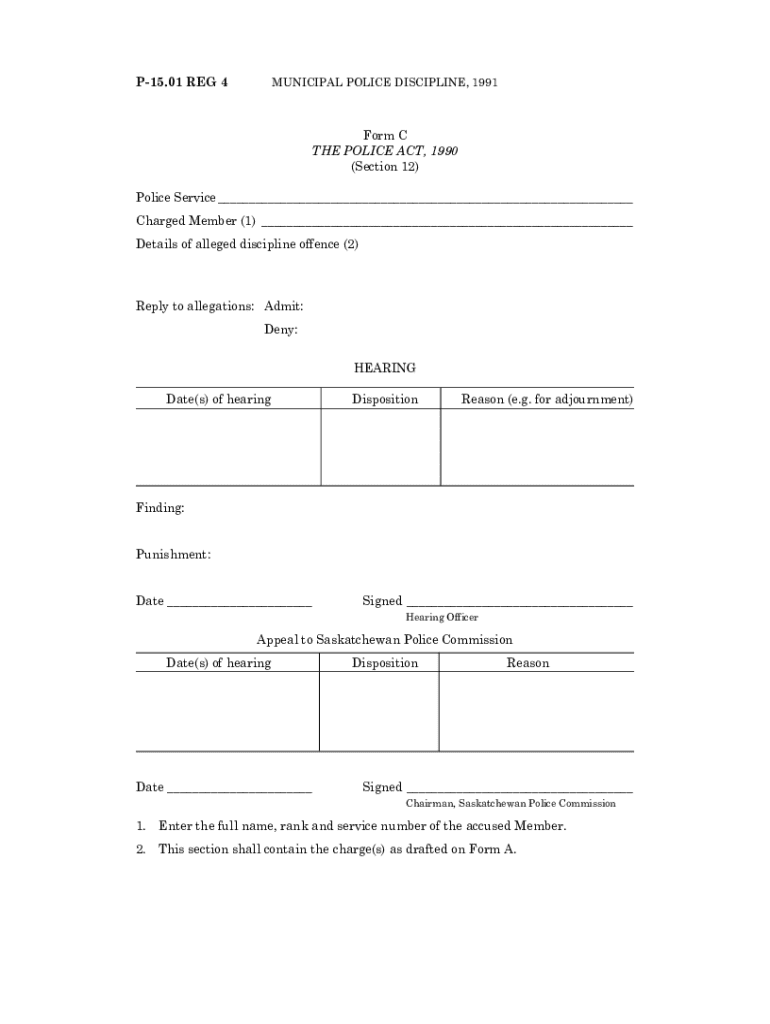

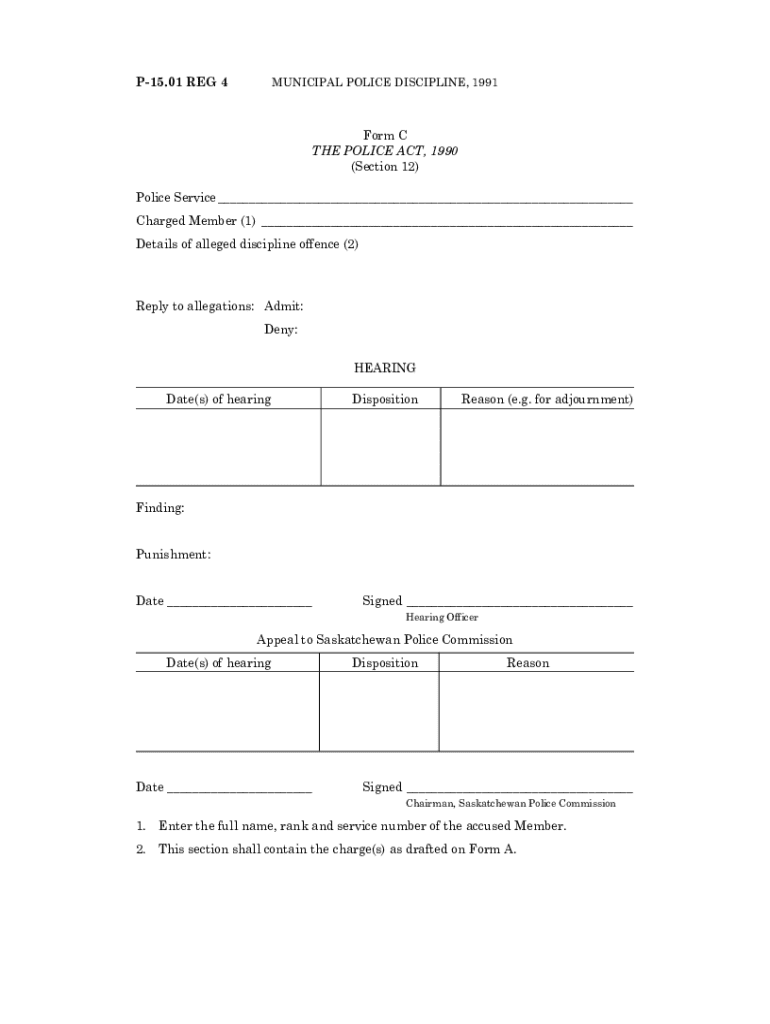

Overview of the p-1501 Reg 4 Form

The p-1501 Reg 4 Form is an essential document utilized in various sectors for regulatory compliance and documentation. It primarily serves as a means for individuals and businesses to report specific information to relevant authorities, thereby ensuring adherence to regulations set forth by governing bodies. As such, its importance in regulatory compliance cannot be overstated, as submitting this form helps prevent legal issues and maintains a controlled approach to documentation.

Key features of the p-1501 Reg 4 Form include its structured format, allowing for the clear presentation of necessary information. By using this form, businesses and individuals benefit from a standardized method for reporting data, which facilitates easy review by regulatory authorities. Additionally, it provides a template that supports thorough documentation needs, simplifying the process of compliance reporting.

Key components of the p-1501 Reg 4 Form

Understanding the components of the p-1501 Reg 4 Form is vital for accurate completion. This form typically includes several sections designed to capture relevant information systematically. The key sections of the form generally consist of Identifying Information, Tax Information, and a Signature Section.

In the Identifying Information section, users are required to furnish personal details such as name, address, and contact information. The Tax Information section captures identifiers related to tax obligations, providing authorities with insight into the individual or business's tax status. Finally, the Signature Section often requires a formal endorsement to affirm the accuracy and authenticity of the provided information.

To accompany the p-1501 Reg 4 Form, users must typically provide supporting documents such as proof of identity and any relevant financial records. Verification of these documents is crucial, as failing to provide appropriate supporting evidence may lead to delays or rejections of the submission.

Step-by-step instructions for completing the form

Before filling out the p-1501 Reg 4 Form, it's important to gather necessary tools and resources. This includes access to a computer with an internet connection and software, such as pdfFiller, which allows for easy editing and filling of PDF forms.

To fill out the form, follow these steps: First, in Step 1, enter your Personal Information accurately. Make sure to double-check all data for correctness. In Step 2, complete the Tax Information section, ensuring all financial identifiers are included. In Step 3, review the entire document for accuracy before submission. This review process is critical to prevent any mistakes that could hinder the compliance process.

Common pitfalls include neglecting to provide complete information or miswriting important details. To avoid these errors, it's advisable to read through each section patiently and consider having a second pair of eyes review the form before submission.

Editing and managing the p-1501 Reg 4 Form with pdfFiller

pdfFiller makes editing and managing the p-1501 Reg 4 Form straightforward. Users can easily upload and open the form in pdfFiller, where they can utilize advanced editing features to fill in or revise the necessary fields. This platform supports annotations, enabling users to highlight specific areas that may require attention or further collaboration.

eSigning the form is also a critical feature provided by pdfFiller. Users can electronically sign the document with just a few clicks. This electronic signature is secure and recognized in various regulatory contexts, ensuring that users can complete their submissions without physical paperwork. Furthermore, pdfFiller allows for collaboration by enabling team members to share the form for reviews and edits, making it easier to track changes and maintain version control.

Submitting the p-1501 Reg 4 Form

After completing the p-1501 Reg 4 Form, users have multiple submission methods available. Online submission is typically the most efficient method, provided that the relevant governing body allows for digital submissions. For those who prefer or are required to submit via postal mail, guidelines for addressing and sending the completed form should be strictly followed to ensure it reaches the appropriate office.

It’s imperative to be aware of deadlines related to the p-1501 Reg 4 Form submission. Missed deadlines can lead to penalties or eroded compliance status, which can significantly affect individuals and businesses. Thus, it's advisable to mark important dates on your calendar and plan submissions ahead of time to accommodate any unforeseen delays.

Frequently asked questions (FAQs)

Many individuals have common queries regarding the p-1501 Reg 4 Form. For instance, if a mistake is identified after submission, the correct course of action typically involves contacting the relevant authority to seek guidance on how to rectify the issue. Additionally, users often inquire about how to track the status of their submission, which can usually be done through the authority's designated online portal.

For further assistance, especially with technical questions about using pdfFiller or the form itself, users are encouraged to reach out to dedicated help desks or customer support teams. This can aid in resolving specific issues and providing prompt assistance.

Advanced tips for efficient document management

Proper archiving and storage of the p-1501 Reg 4 Form are crucial for future reference and compliance needs. Storing the document in recommended digital formats, such as PDF, ensures that the integrity of the form remains intact. Moreover, utilizing cloud-based solutions for storage allows for easy retrieval and sharing when necessary.

pdfFiller also offers features that can be leveraged for future use. Users can save templates of the p-1501 Reg 4 Form to streamline the process for similar forms in the future. Furthermore, automated workflows within the platform aid in increasing efficiency, making repetitive tasks much simpler and faster.

Conclusion and encouragement to use pdfFiller

The p-1501 Reg 4 Form plays a vital role in ensuring compliance for both individuals and businesses. It is crucial to approach filling and submitting this form thoroughly to avoid complications. Utilizing pdfFiller enhances this process, making it seamless and efficient. Its comprehensive platform not only facilitates editing and signing but also encourages collaboration and document management with ease.

By embracing pdfFiller, users can simplify their experience with the p-1501 Reg 4 Form and many others. The platform’s flexibility and robustness enable users to navigate their document needs with confidence, ultimately enhancing compliance and streamlining operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my p-1501 reg 4 directly from Gmail?

Can I edit p-1501 reg 4 on an iOS device?

How can I fill out p-1501 reg 4 on an iOS device?

What is p-1501 reg 4?

Who is required to file p-1501 reg 4?

How to fill out p-1501 reg 4?

What is the purpose of p-1501 reg 4?

What information must be reported on p-1501 reg 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.